South Carolina Resolution of Meeting of LLC Members to Make Specific Loan is a legal document that outlines the decision-making process of an LLC (Limited Liability Company) in South Carolina to provide a specific loan. This resolution serves as formal approval from the LLC's members, authorizing the loan process and specifying its terms and conditions. Keywords: South Carolina, Resolution of Meeting, LLC Members, Specific Loan There are different types of South Carolina Resolution of Meeting of LLC Members to Make Specific Loan based on the nature and purpose of the loan: 1. Expansion Loan Resolution: This type of resolution is used when an LLC intends to obtain a loan to expand its operations, purchase new assets, or hire additional staff. The members authorize the loan, including the loan amount, interest rate, repayment terms, and any collateral or personal guarantees involved. 2. Working Capital Loan Resolution: This resolution is employed when an LLC requires funds for day-to-day operations, such as paying suppliers, covering payroll expenses, or managing cash flow. The members discuss and approve the loan details, ensuring the company's ongoing financial stability. 3. Investment Loan Resolution: When an LLC decides to invest in another business or venture, this type of resolution is used to secure the necessary funds. The members deliberate on the investment opportunity, conduct due diligence, and determine the loan specifics to protect the LLC's interests. 4. Bridge Loan Resolution: In situations where an LLC needs immediate financing while awaiting a future funding source, a bridge loan resolution may be adopted. The resolution allows the members to agree upon short-term borrowing to bridge the financial gap until the anticipated funds are received. 5. Emergency Loan Resolution: This type of resolution is applicable when an LLC faces unexpected financial emergencies, such as natural disasters, lawsuit settlements, or sudden market downturns. The members collectively decide on the loan details to address the urgent financial needs of the company. 6. Acquisition Loan Resolution: When an LLC intends to acquire another company, this resolution is necessary to facilitate the loan required for the acquisition. The members discuss and authorize the loan terms, collateral, and other aspects necessary to complete the acquisition process successfully. In conclusion, a South Carolina Resolution of Meeting of LLC Members to Make Specific Loan is a critical legal document that formalizes the decision-making process, approval, and terms of providing a loan by an LLC. The various types of resolutions named above demonstrate how this document can be tailored to suit different loan purposes within an LLC in South Carolina.

South Carolina Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out South Carolina Resolution Of Meeting Of LLC Members To Make Specific Loan?

If you want to complete, down load, or produce lawful file web templates, use US Legal Forms, the biggest selection of lawful varieties, which can be found on the Internet. Make use of the site`s simple and easy hassle-free research to get the paperwork you will need. Various web templates for organization and individual purposes are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to get the South Carolina Resolution of Meeting of LLC Members to Make Specific Loan in a number of click throughs.

When you are previously a US Legal Forms buyer, log in to your profile and click on the Down load key to find the South Carolina Resolution of Meeting of LLC Members to Make Specific Loan. You can also gain access to varieties you previously saved from the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

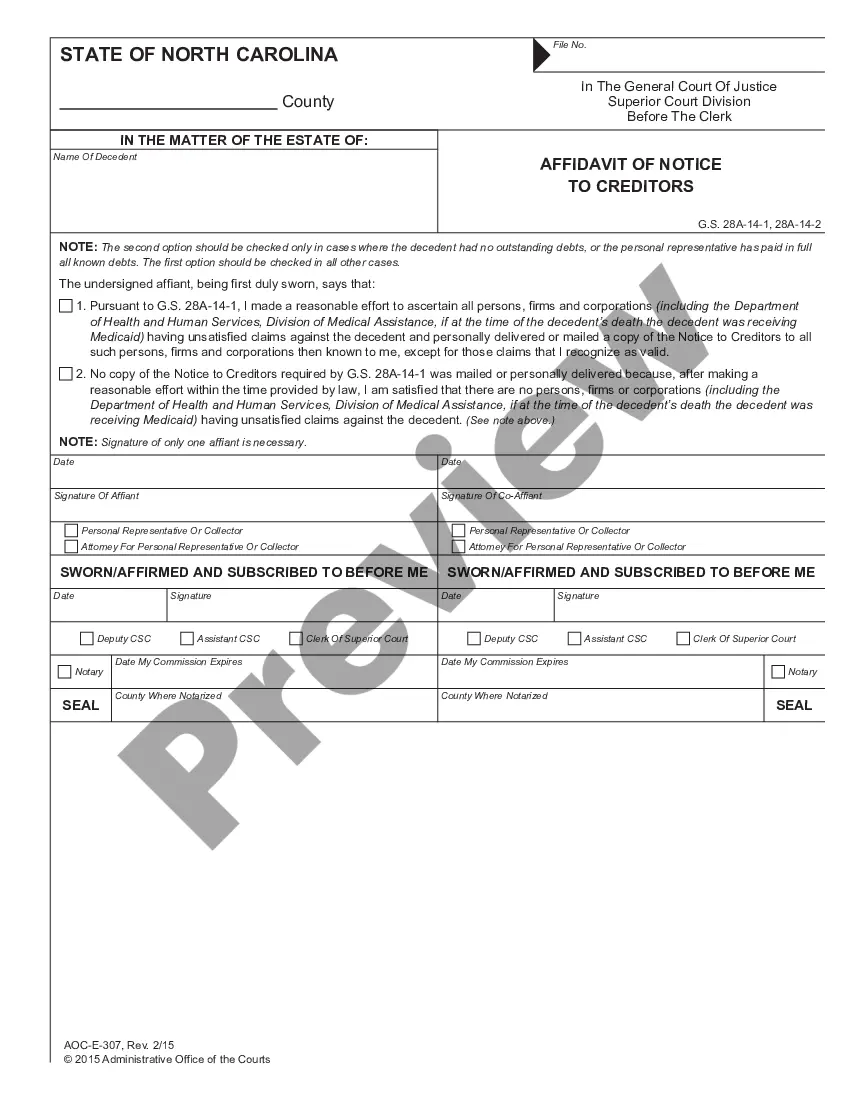

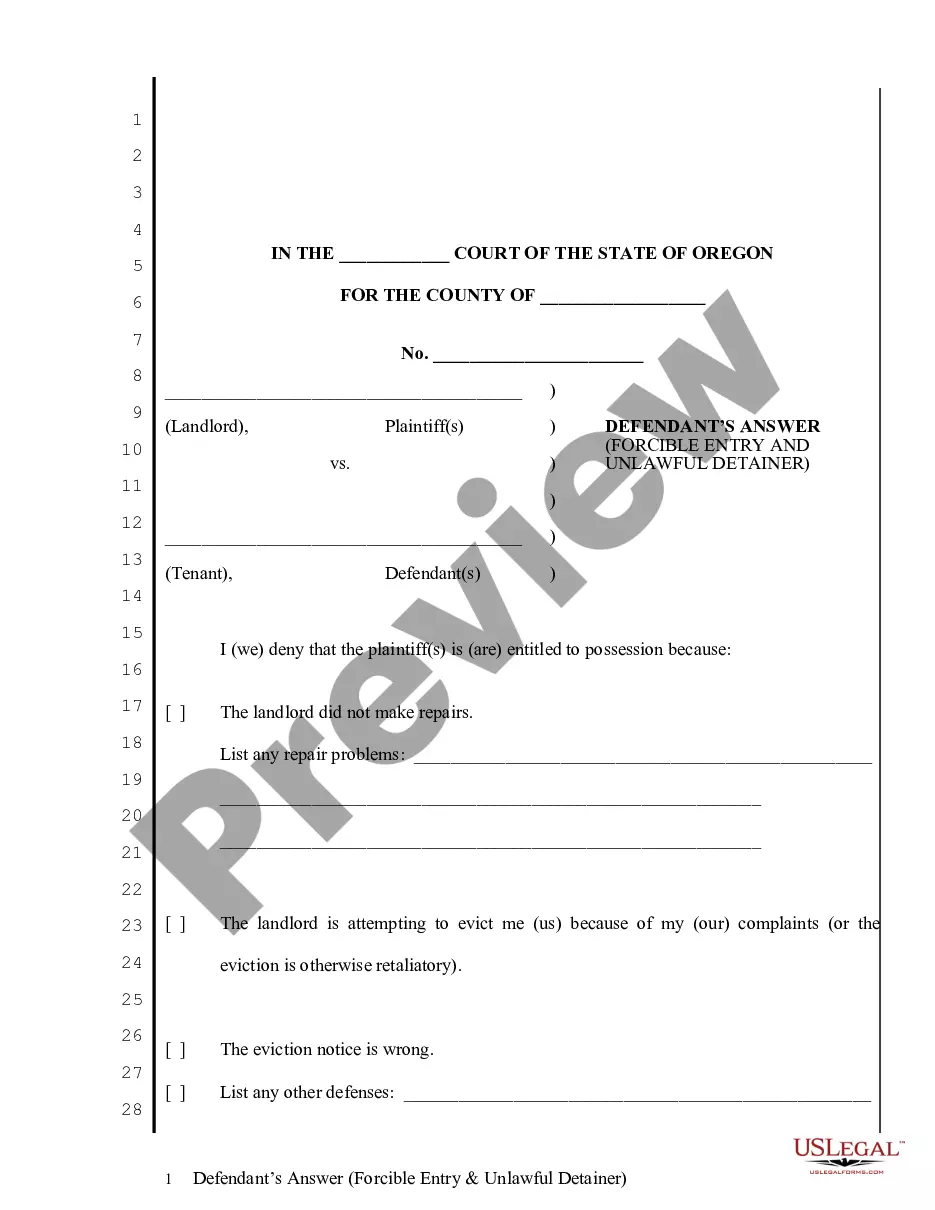

- Step 1. Be sure you have selected the shape to the right town/land.

- Step 2. Use the Review choice to look over the form`s content. Don`t overlook to read through the explanation.

- Step 3. When you are unsatisfied using the form, utilize the Look for discipline on top of the screen to discover other variations of the lawful form web template.

- Step 4. Once you have discovered the shape you will need, select the Purchase now key. Select the rates prepare you like and include your accreditations to sign up on an profile.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Select the format of the lawful form and down load it on your own gadget.

- Step 7. Total, edit and produce or indicator the South Carolina Resolution of Meeting of LLC Members to Make Specific Loan.

Every single lawful file web template you purchase is your own property for a long time. You have acces to every form you saved inside your acccount. Select the My Forms area and select a form to produce or down load once more.

Be competitive and down load, and produce the South Carolina Resolution of Meeting of LLC Members to Make Specific Loan with US Legal Forms. There are many professional and express-distinct varieties you can utilize for your personal organization or individual requirements.

Form popularity

FAQ

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

An LLC operating agreement is not required in South Carolina, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...