South Carolina Vehicle Policy refers to the set of regulations, laws, and guidelines implemented by the state government to ensure safe, lawful, and responsible use of vehicles within the state. These policies aim to safeguard the interests of both vehicle owners and the public, promoting vehicle safety, insurance coverage, and compliance with registration and licensing requirements. 1. Minimum Liability Insurance: One crucial aspect of South Carolina Vehicle Policy is the requirement for vehicle owners to maintain a minimum level of liability insurance coverage. This policy ensures that drivers have sufficient protection to cover damages caused to others in case of an accident. 2. Vehicle Registration: South Carolina mandates all vehicle owners to register their vehicles with the state's Department of Motor Vehicles (DMV) within 45 days of acquiring the vehicle or moving into the state. This policy ensures that all vehicles on the road are properly documented, allowing effective enforcement of other regulations such as tax collection, safety inspections, and identification. 3. Motor Vehicle Title: The policy requires South Carolina residents to obtain a title for their vehicles, which serves as legal proof of ownership. This policy prevents vehicle theft, facilitates easy transfer of ownership, and protects the interests of buyers and sellers in vehicle transactions. 4. Vehicle Inspections: South Carolina conducts periodic safety inspections for certain vehicles. These inspections aim to ensure that vehicles meet the required safety standards by examining components such as tires, brakes, lights, and emissions. Compliance with the inspection policy contributes to enhancing road safety and reducing accidents caused by faulty vehicles. 5. License Plates: South Carolina Vehicle Policy mandates the issuance and proper display of license plates on all registered vehicles. The policy ensures that vehicles can be easily identified for law enforcement purposes and facilitates effective tax collection. 6. Uninsured Motorist Coverage: South Carolina law also requires vehicle owners to carry uninsured motorist coverage, providing protection in case of an accident involving a driver who does not have adequate insurance coverage. This policy helps mitigate financial burdens for innocent parties involved in accidents with uninsured or under insured motorists. 7. Commercial Vehicle Policies: South Carolina also has specific policies for commercial vehicles, including trucks, buses, and taxis, to regulate their operations within the state. These policies generally include requirements for licensing, safety inspections, and additional insurance coverage due to the potential risks associated with commercial vehicles. It is important for South Carolina residents to familiarize themselves with these vehicle policies to ensure compliance and understand their rights and responsibilities as vehicle owners or drivers within the state. Following these policies helps maintain road safety, protect against financial burdens, and contribute to the overall well-being of the community.

South Carolina Vehicle Policy

Description

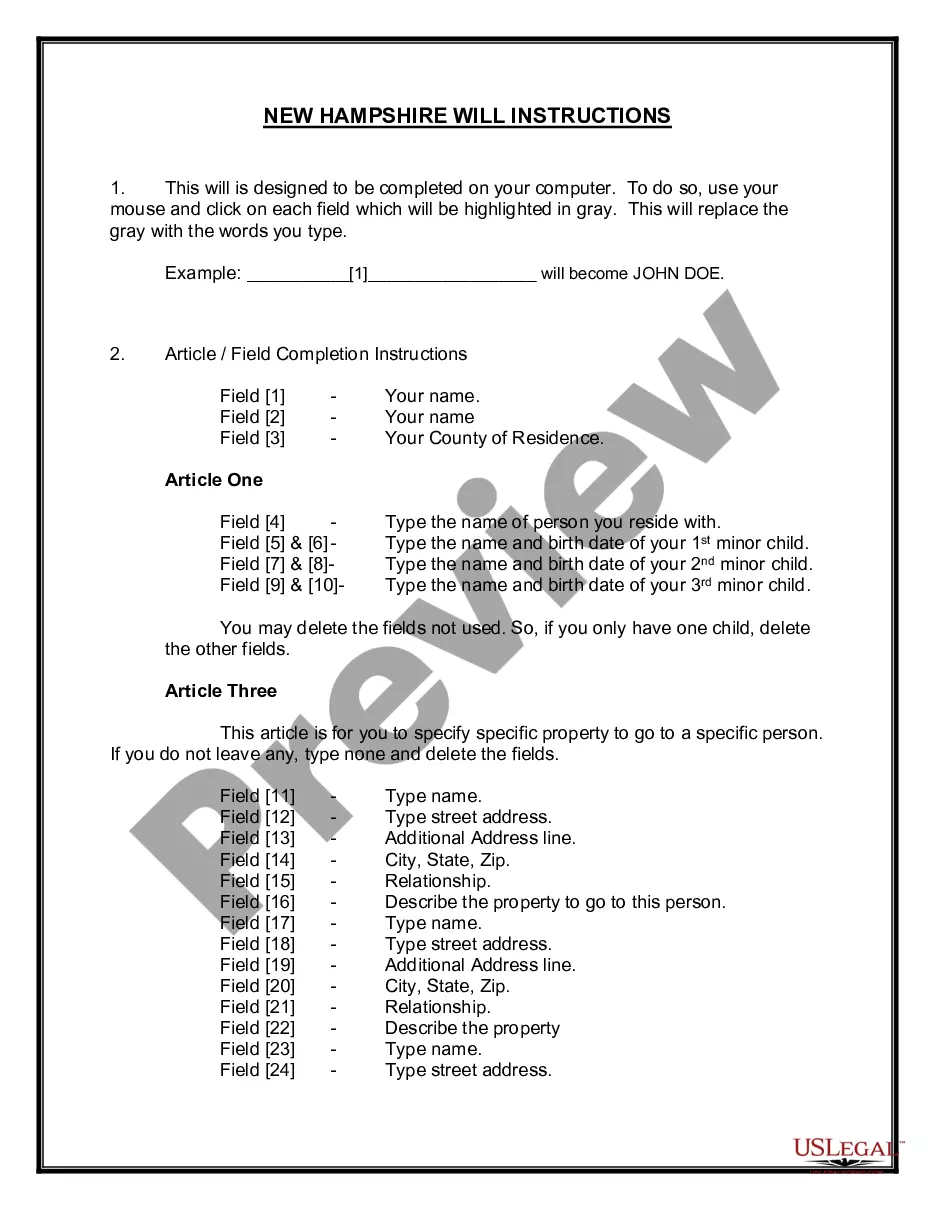

How to fill out South Carolina Vehicle Policy?

If you have to comprehensive, acquire, or print lawful file themes, use US Legal Forms, the biggest selection of lawful types, which can be found online. Use the site`s basic and convenient research to discover the paperwork you require. A variety of themes for organization and personal reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to discover the South Carolina Vehicle Policy in a few click throughs.

In case you are currently a US Legal Forms customer, log in to your bank account and click the Download switch to find the South Carolina Vehicle Policy. You can even gain access to types you formerly downloaded inside the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your proper town/nation.

- Step 2. Take advantage of the Review method to check out the form`s content material. Don`t overlook to learn the information.

- Step 3. In case you are not satisfied with all the type, take advantage of the Lookup discipline at the top of the screen to find other models of the lawful type template.

- Step 4. When you have discovered the form you require, select the Get now switch. Select the prices program you choose and add your qualifications to register on an bank account.

- Step 5. Procedure the deal. You may use your bank card or PayPal bank account to complete the deal.

- Step 6. Choose the formatting of the lawful type and acquire it in your device.

- Step 7. Total, edit and print or indicator the South Carolina Vehicle Policy.

Every single lawful file template you buy is your own forever. You may have acces to every type you downloaded within your acccount. Click the My Forms portion and choose a type to print or acquire again.

Contend and acquire, and print the South Carolina Vehicle Policy with US Legal Forms. There are millions of expert and state-specific types you can utilize for the organization or personal demands.

Form popularity

FAQ

Compared to national averages, South Carolina is just a bit cheaper at $1,512 per year for full coverage and $558 per year for minimum coverage. However, the cost of your car insurance will typically vary based on rate factors like your motor vehicle record, age or ZIP code, among other variables.

For example, collision coverage (optional in South Carolina, though might be required under the terms of a vehicle lease or financing agreement) can pay for repairs to (or replacement of) your damaged vehicle after a car accident.

While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured/underinsured motorist.

Minimum Bodily Injury Liability Limits$15,000 for the death or injury of any one person. If one person is injured in the accident, your coverage pays up to $15,000. A total of $30,000 for the death or injury of more than one person in any one accident. If 2 or more people are injured, the coverage pays up to $30,000.

Full coverage insurance in South Carolina is usually defined as a policy that provides more than the state's minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage.

Minimum SC Car Insurance Coverage RequirementsProperty damage: $25,000 per accident. Bodily injury: $25,000 per person and $50,000 per accident. Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident.

Unlike so-called no-fault states, South Carolina uses a fault-based system for dealing with car accidents, meaning the at-fault driver themselves can be held legally liable for any costs you incur.

South Carolina law requires that you purchase liability and uninsured motorist coverage to drive legally in the state. Auto insurance is divided into two basic coverages: liability and physical damage.

No, South Carolina does not have the no-fault law in effect. Instead, it follows an at fault model with comparative negligence. This means that so long as you are under 50% responsible for your accident, you can file a claim against the driver that caused your accident.

Report the accident to the police. In South Carolina, you must report the accident to the police if a crash results in injury or death. With that said, even if the vehicle damage and/or injuries appear to be minor, you should still call the police. Doing so will create a record.