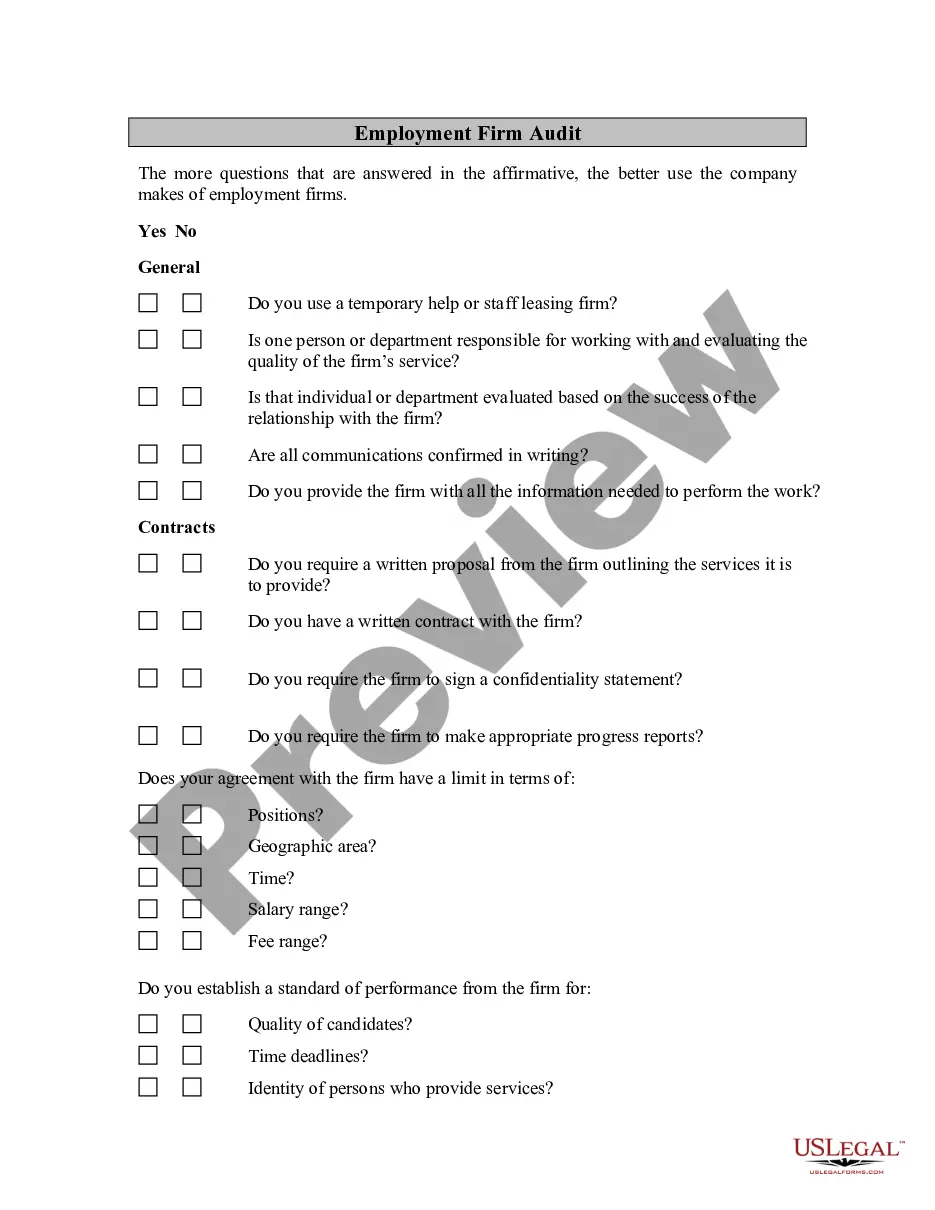

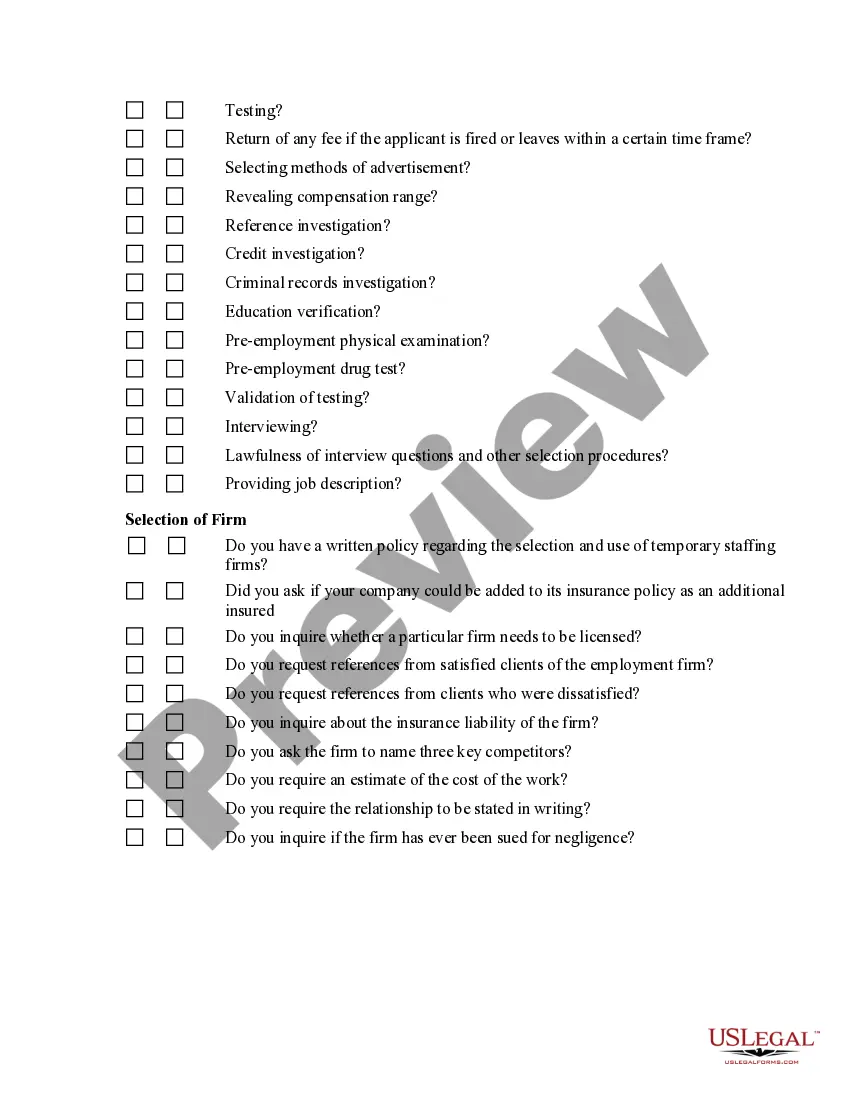

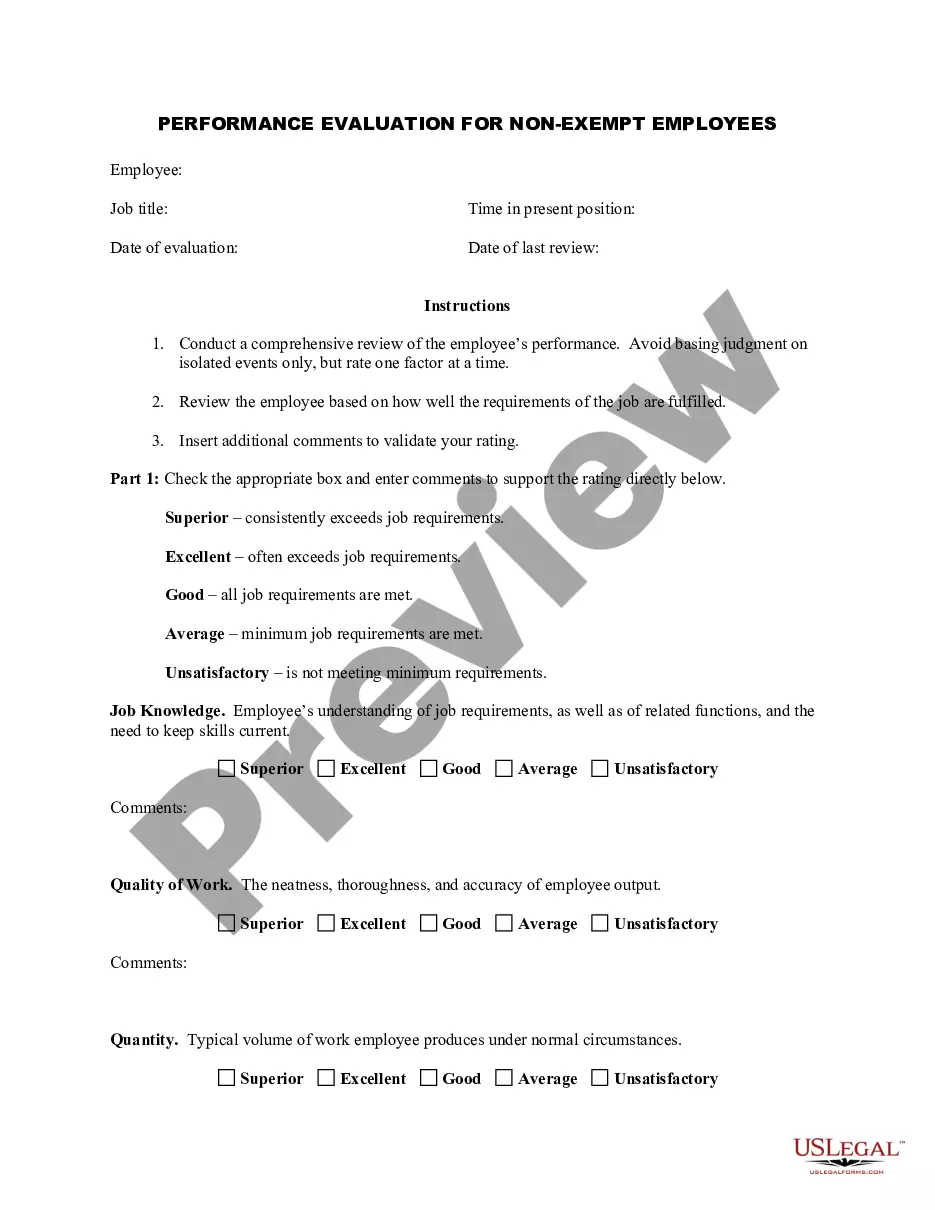

South Carolina Employment Firm Audit is a systematic examination and evaluation of the financial records, processes, and compliance measures of an employment firm operating in South Carolina. This audit aims to ensure that the firm adheres to the state's labor laws, regulations, and industry standards. The South Carolina Employment Firm Audit involves a comprehensive review of various aspects related to the firm's employment practices, financial transactions, employee classification, payroll processing, tax compliance, worker's compensation, and other relevant areas. By conducting this audit, the firm can identify any potential violations, non-compliance issues, or areas for improvement in its employment operations. Keywords: South Carolina, employment firm, audit, financial records, compliance, labor laws, regulations, industry standards, employment practices, employee classification, payroll processing, tax compliance, worker's compensation, non-compliance issues. Different types of South Carolina Employment Firm Audits may include: 1. Financial Audit: This type of audit focuses primarily on the financial records and transactions of the employment firm. It examines the accuracy, completeness, and validity of financial statements, including income statements, balance sheets, and cash flow statements. 2. Compliance Audit: A compliance audit ensures that the employment firm adheres to the relevant labor laws, regulations, and industry-specific standards of South Carolina. It assesses the firm's compliance with wage and hour laws, discrimination and harassment laws, worker classification, and other employment-related regulations. 3. Payroll Audit: A payroll audit specifically focuses on the accuracy of the firm's payroll processes, ensuring that all employee wages, benefits, deductions, and tax withholding are correctly calculated and recorded. This audit helps identify any potential errors or discrepancies in the payroll system. 4. Tax Audit: This type of audit evaluates the employment firm's compliance with state and federal tax requirements. It reviews the accuracy of tax filings, timely payment of taxes, proper classification of workers for tax purposes, and adherence to relevant tax regulations. 5. Worker's Compensation Audit: A worker's compensation audit concentrates on the firm's compliance with South Carolina's worker's compensation laws and insurance requirements. It verifies the accuracy of records related to workforce classification, payroll data, coverage, and payments made to worker's compensation insurance providers. By conducting these various types of audits, a South Carolina Employment Firm can ensure transparency, accuracy, and compliance in its financial and employment processes, thereby enhancing its reputation and minimizing legal and financial risks.

South Carolina Employment Firm Audit

Description

How to fill out South Carolina Employment Firm Audit?

Are you within a situation where you need to have papers for both enterprise or person purposes just about every day time? There are a lot of lawful record web templates accessible on the Internet, but getting kinds you can rely is not straightforward. US Legal Forms provides a huge number of type web templates, like the South Carolina Employment Firm Audit, which can be composed to satisfy state and federal demands.

When you are already informed about US Legal Forms web site and also have your account, simply log in. Following that, you are able to down load the South Carolina Employment Firm Audit design.

Should you not have an bank account and want to start using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for your correct town/area.

- Use the Preview switch to examine the form.

- Look at the information to ensure that you have chosen the proper type.

- In the event the type is not what you are seeking, take advantage of the Search area to find the type that meets your needs and demands.

- If you get the correct type, click on Buy now.

- Opt for the pricing program you need, submit the specified information to generate your bank account, and pay money for an order utilizing your PayPal or charge card.

- Decide on a handy document format and down load your backup.

Find each of the record web templates you might have bought in the My Forms menus. You can get a additional backup of South Carolina Employment Firm Audit anytime, if required. Just click on the necessary type to down load or printing the record design.

Use US Legal Forms, the most considerable selection of lawful varieties, to save efforts and stay away from blunders. The service provides skillfully made lawful record web templates that can be used for a selection of purposes. Make your account on US Legal Forms and commence making your lifestyle easier.