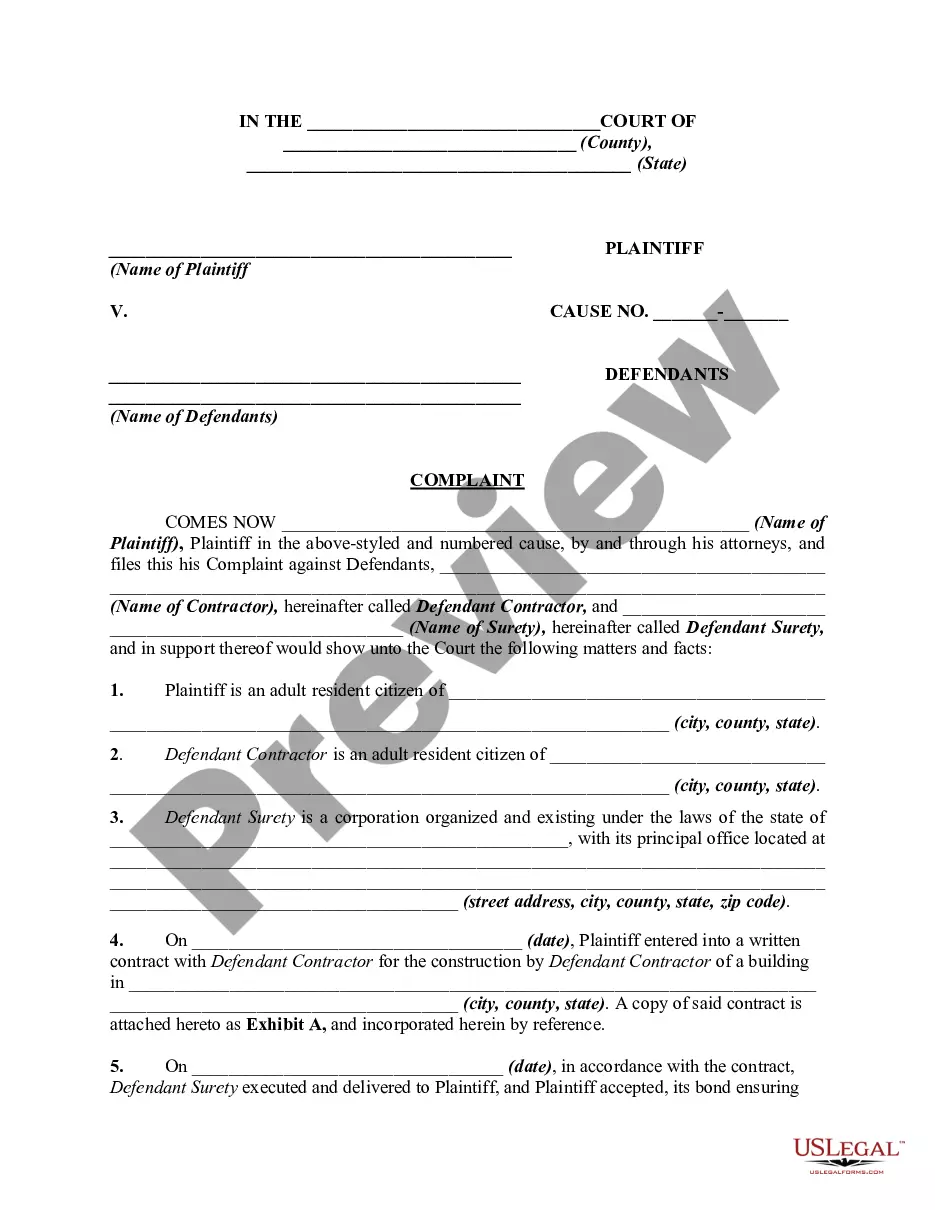

South Carolina Expense Reimbursement Request

Description

How to fill out Expense Reimbursement Request?

US Legal Forms - among the largest repositories of legal forms in the USA - offers a range of legal document templates that you can download or print.

By utilizing the website, you can access numerous forms for professional and personal use, organized by categories, states, or keywords. You can find the most recent templates like the South Carolina Expense Reimbursement Request in moments.

If you already have a subscription, Log In and retrieve the South Carolina Expense Reimbursement Request from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms under the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded South Carolina Expense Reimbursement Request. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and select the form you desire. Access the South Carolina Expense Reimbursement Request using US Legal Forms, the most extensive library of legal document templates. Utilize countless professional and state-specific templates that meet your business or personal needs.

- Verify that you have selected the correct form for your city/state.

- Click the Review button to evaluate the content of the form.

- Examine the form details to ensure it is the correct one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking on the Get now button.

- Next, choose your preferred payment plan and provide your information to create an account.

Form popularity

FAQ

While employers must reimburse employees for business-related mileage in some states, neither South Carolina nor North Carolina has such a mandate. But most employers offer reimbursement anyway, usually for recruitment and retention purposes or for a general sense of fairness.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

$71.00. FY 2021 Per Diem Rates apply from October 2020 - September 2021.

If you are traveling to a city in South Carolina that does not have a specific per diem rate the standard per-diem rates of $96.00 per night for lodging and $59.00 per day for meals and incidentals apply.

New Mileage Reimbursement Rate Effective January 1, 2021 Beginning on January 1, 2021, the Internal Revenue Service rate will be 56 cents per mile (IRS Revenue IR 2020-279). Effective January 1, 2021, the new mileage reimbursement rate to claimants to and from a place of medical attention is 56 cents per mile.

As of October 1, 2020, the special meals and incidental expenses (M&IE) per diem rates for taxpayers in the transportation industry are $66 for any locality of travel in the continental United States and $71 for any locality of travel outside the continental United States; those rates are the same as they were last

Beginning October 1, 2021, the high-low per diem rate that can be used for lodging, meals, and incidental expenses increases to $296 (from $292) for travel to high-cost locations and increases to $202 (from $198) for travel to other locations.

Although California law requires employees to pay employees for mileage driven for reasons associated with work, their daily commutes don't count. This means that you should not expect your employer to compensate you for the mileage you drive to work and from it when you're done for the day.

Mileage Reimbursement a. General Rules - Employees shall be reimbursed for use of a personal vehicle on official business per mile at the rate provided by current IRS rulings as directed by the State Comptroller General's Office when such reimbursement is the most economical, available method.