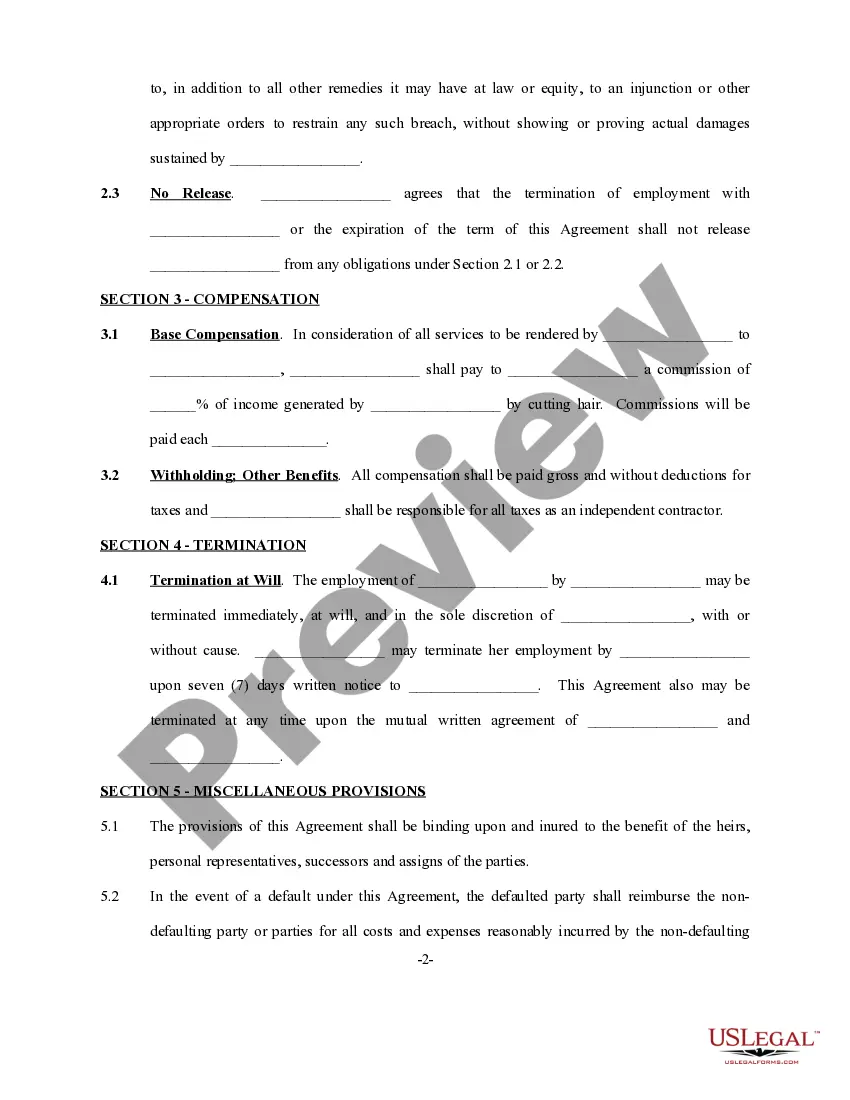

South Carolina Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

You may spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a wide array of legal forms that have been reviewed by professionals.

You can easily download or print the South Carolina Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop from our service.

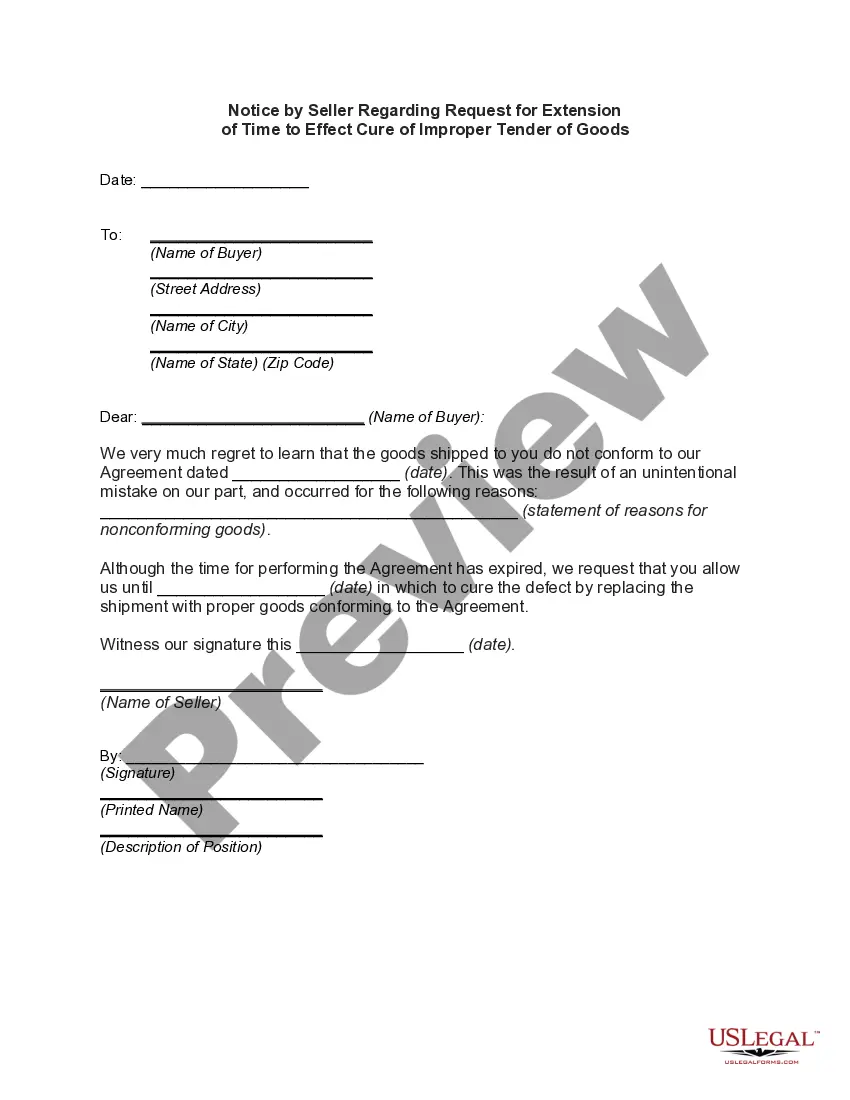

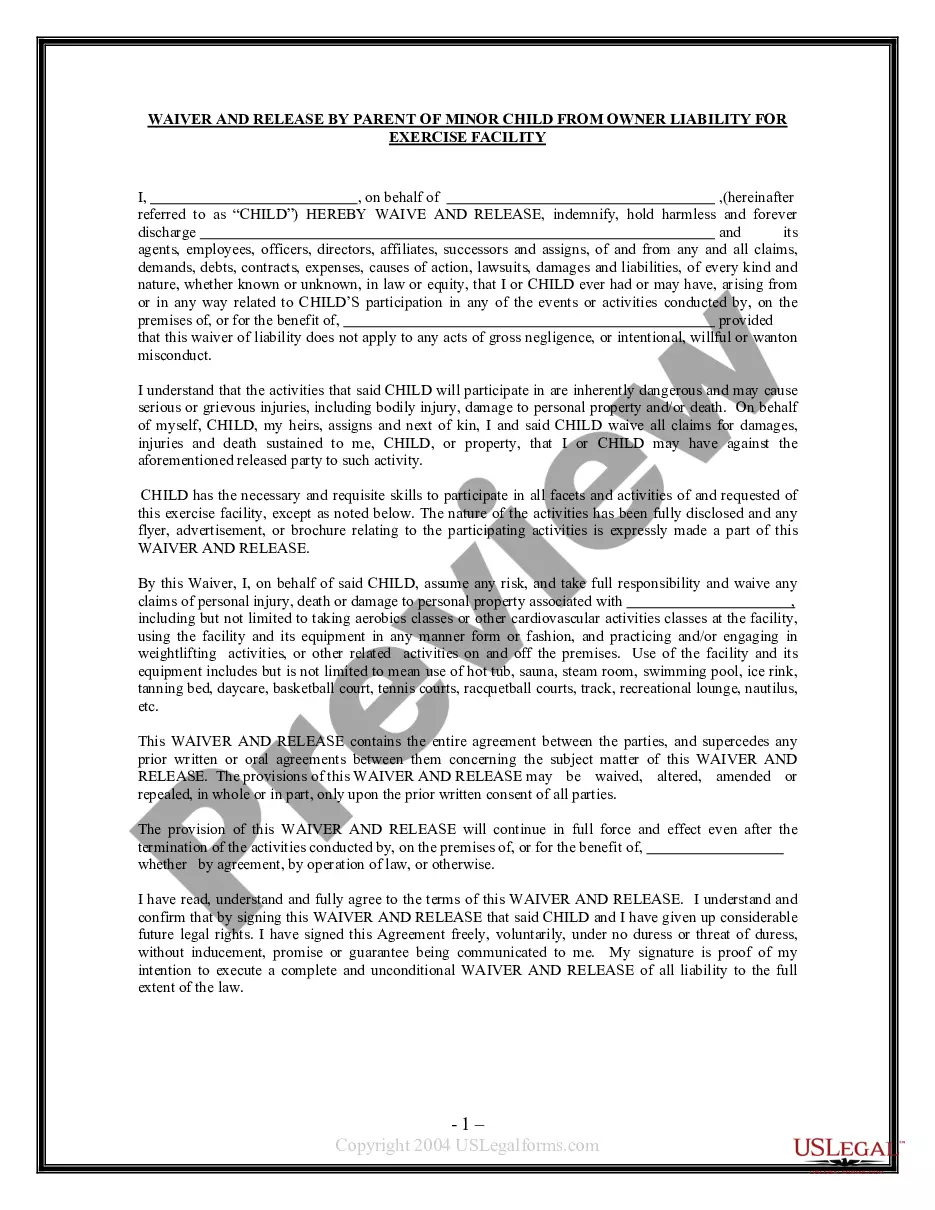

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you may fill out, modify, print, or sign the South Carolina Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents section and click the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, make sure you have selected the correct document template for the region/area you choose. Check the form description to verify you have selected the right form.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

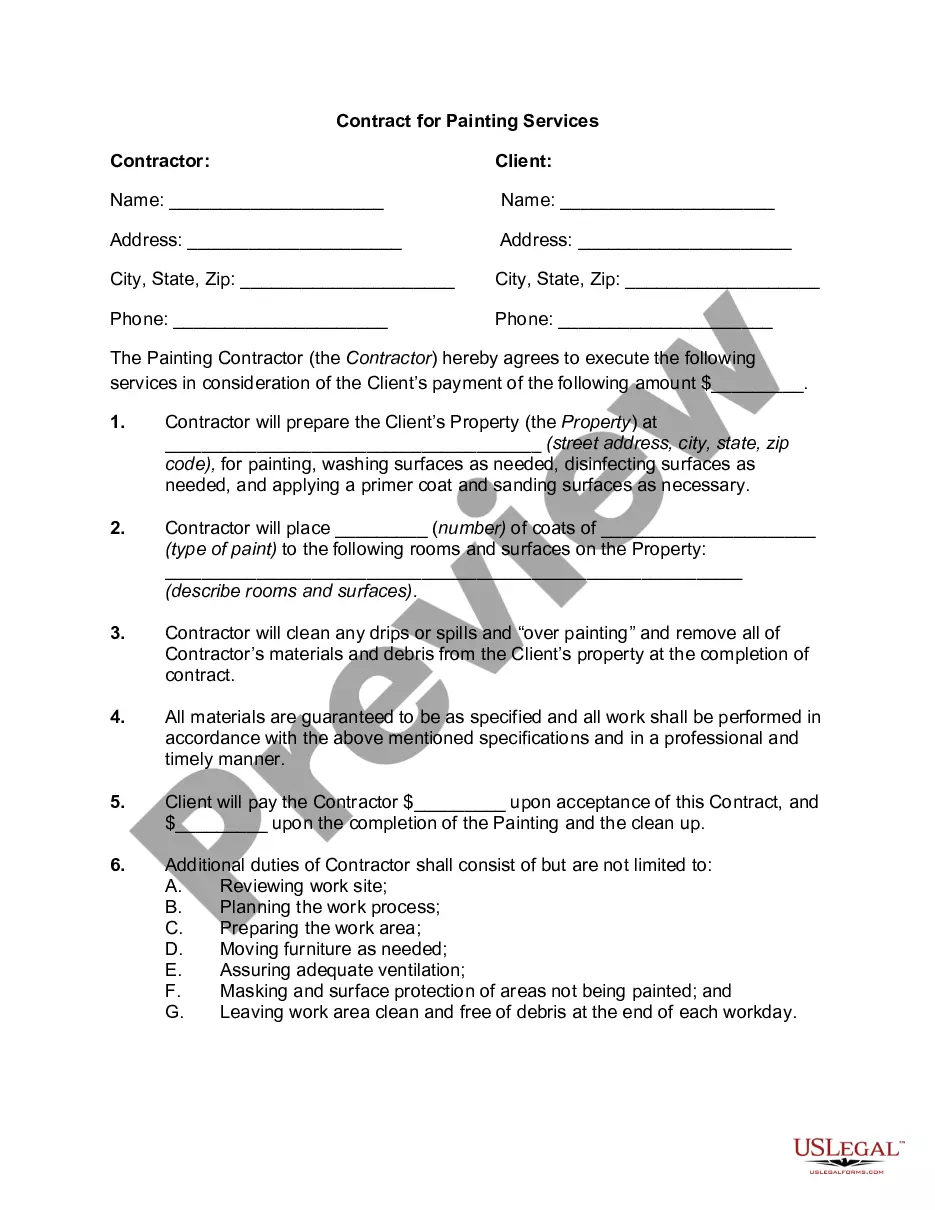

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

I am self employed as a hairdresser and pay rental booth at a salon but i dont actually own a business how do i need to file that. If you're self-employed then you're a sole proprietor and your business is a sole proprietorship. Sole proprietorships: Owned by one personyou don't have any partners.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

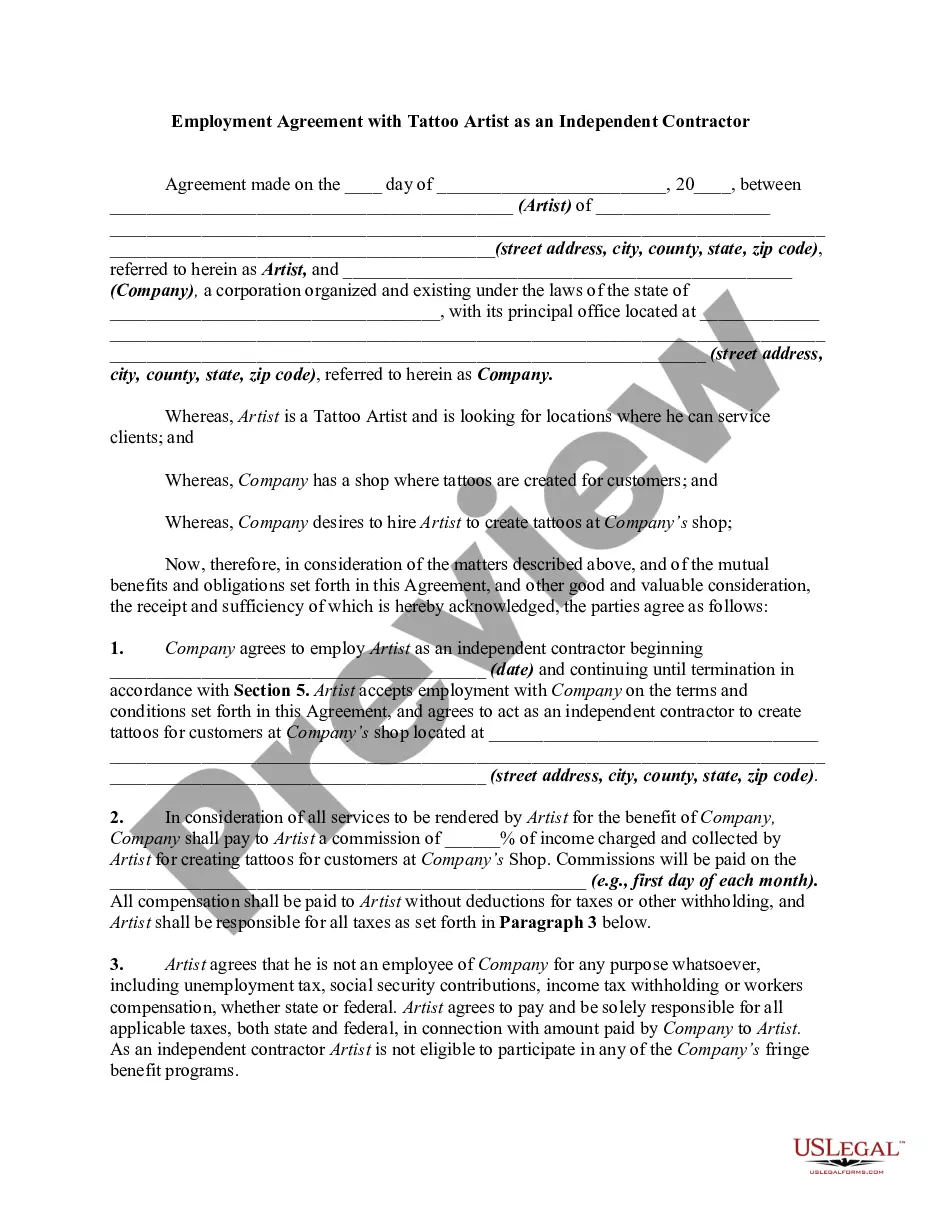

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.