South Carolina Stock Purchase - Letter of Intent

Description

How to fill out Stock Purchase - Letter Of Intent?

It is possible to commit hrs on the Internet trying to find the legitimate document template that meets the state and federal specifications you want. US Legal Forms provides a large number of legitimate forms which are evaluated by experts. It is simple to download or produce the South Carolina Stock Purchase - Letter of Intent from our assistance.

If you already have a US Legal Forms accounts, you can log in and click the Obtain switch. Afterward, you can full, revise, produce, or indicator the South Carolina Stock Purchase - Letter of Intent. Every single legitimate document template you acquire is your own for a long time. To get an additional version for any bought form, proceed to the My Forms tab and click the related switch.

Should you use the US Legal Forms web site for the first time, adhere to the straightforward recommendations beneath:

- First, be sure that you have selected the proper document template for your county/town of your liking. Read the form outline to make sure you have picked out the right form. If readily available, utilize the Review switch to appear from the document template also.

- If you wish to find an additional variation in the form, utilize the Lookup industry to discover the template that meets your requirements and specifications.

- Upon having found the template you desire, simply click Buy now to move forward.

- Find the rates program you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal accounts to fund the legitimate form.

- Find the file format in the document and download it for your product.

- Make alterations for your document if possible. It is possible to full, revise and indicator and produce South Carolina Stock Purchase - Letter of Intent.

Obtain and produce a large number of document web templates using the US Legal Forms website, that provides the most important variety of legitimate forms. Use expert and express-distinct web templates to handle your organization or person requires.

Form popularity

FAQ

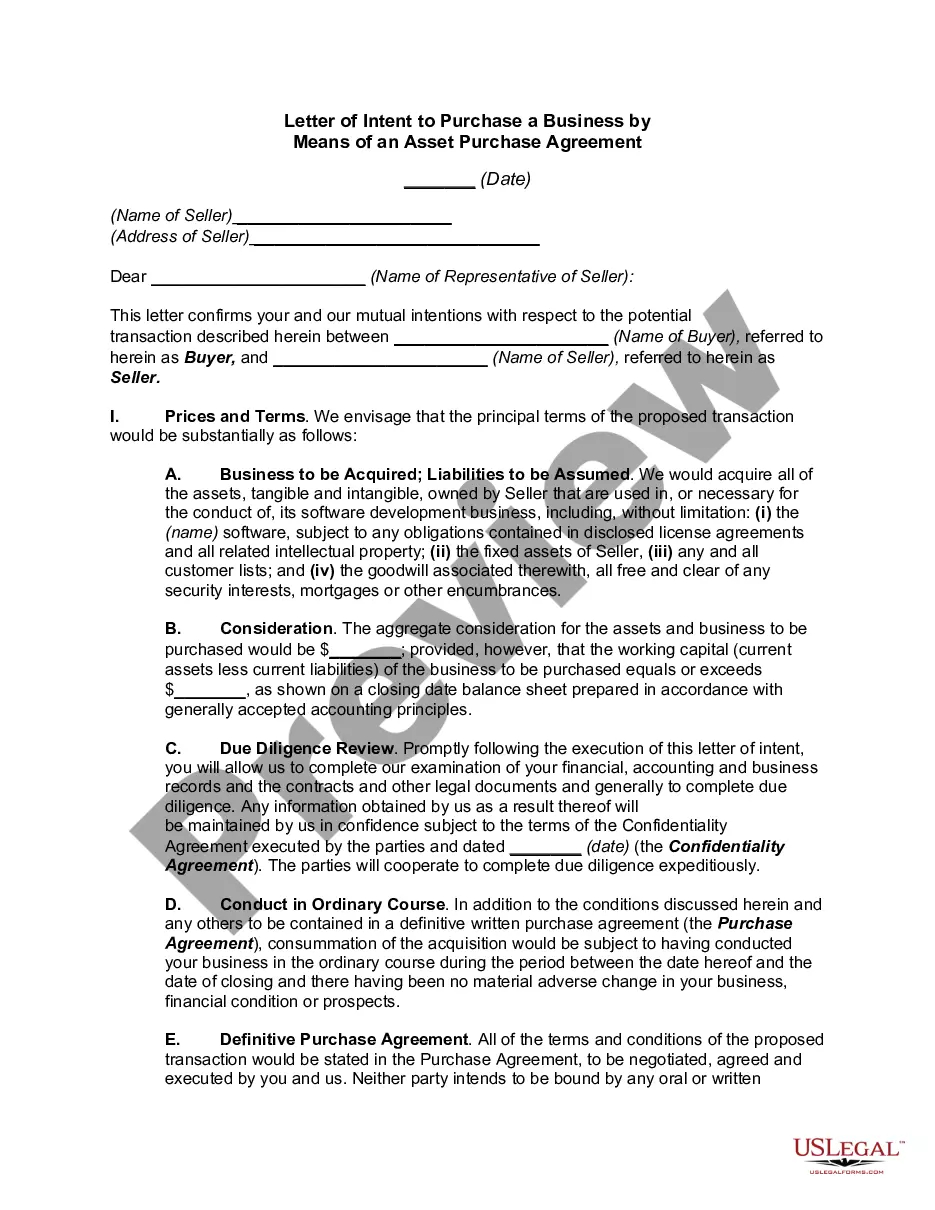

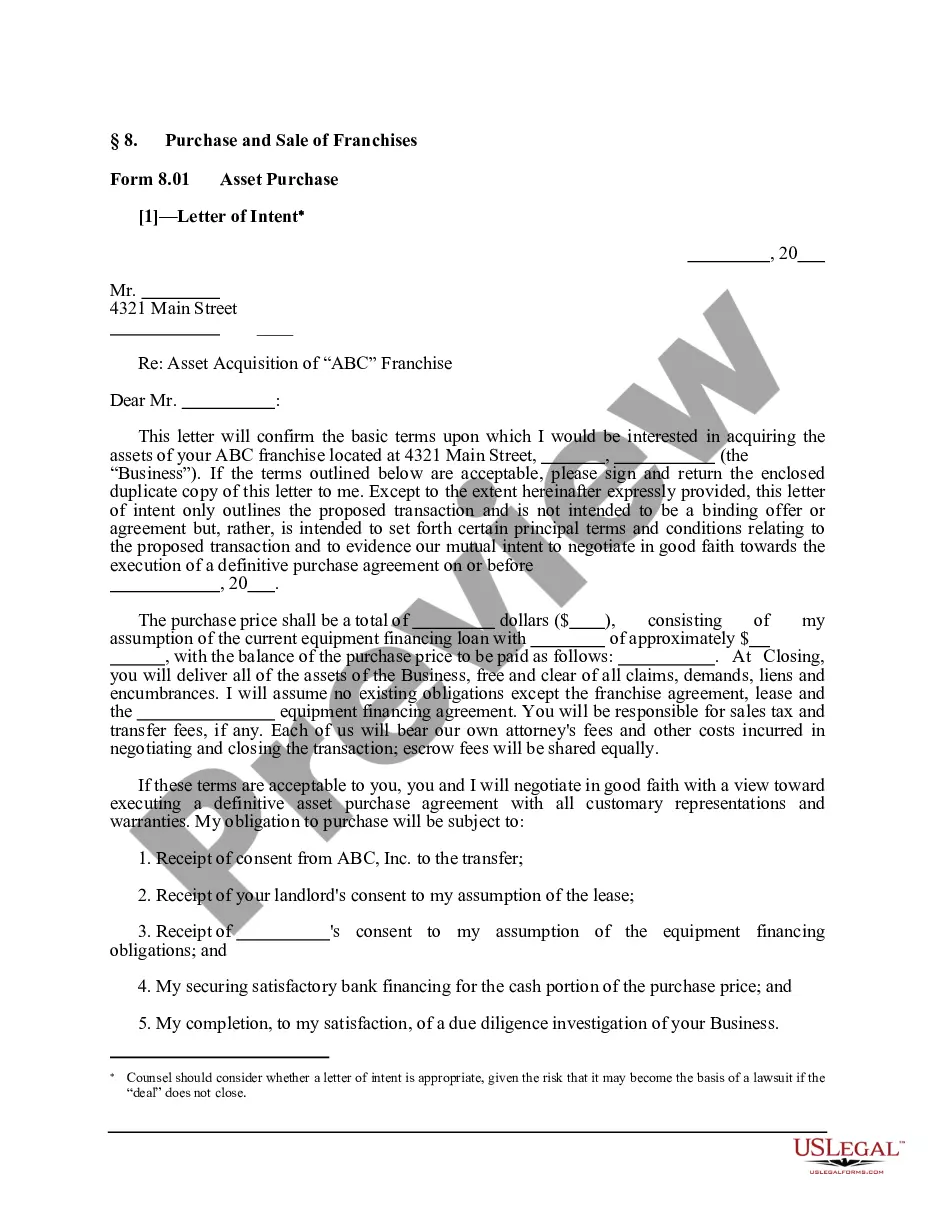

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

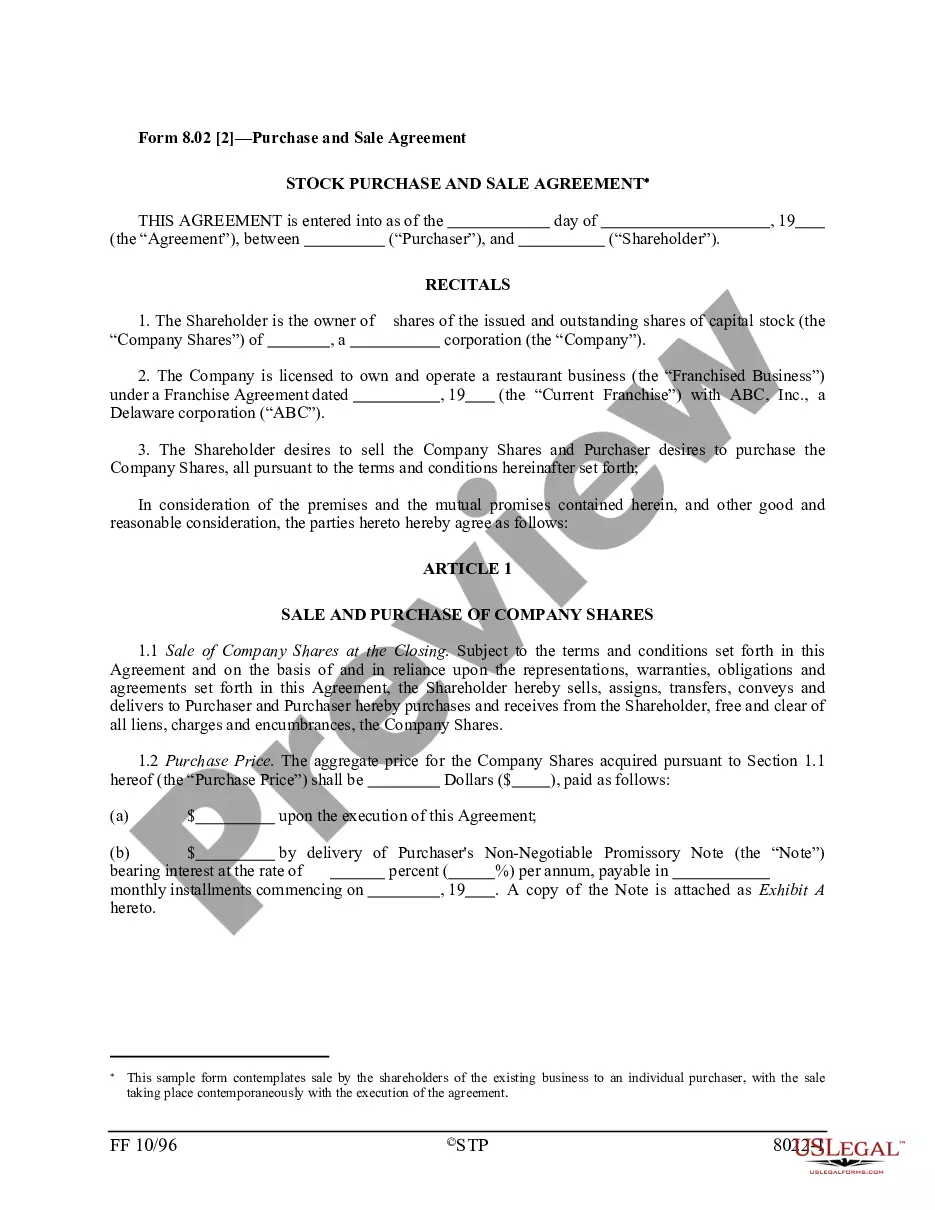

To file a share purchase agreement, it is necessary to review it once and then get the signature done by both the parties as well as the signatures of the witnesses. Copies of the agreement shall be made for a company, purchaser, and seller. The issue of certificate only after the payment.

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

What to include in letters of intent to purchase. Name and contact information of the buyer. Name and contact information of the seller. Detailed description of the items or property being sold. Any relevant disclaimers or liabilities. The total purchase price. Method of payment and other payment terms, including dates.

The agreement is exchanged and signed by both parties, payment completed and share ownership is transferred to the buyer. However, delays to completion may occur if either party has to meet certain obligations, such as: Consent of other shareholders to the transaction.

An investment letter of intent (LOI) is used to express interest in purchasing partial ownership in a company or real estate. The letter presents the basic terms of the investor's proposal and acts as a mark of their commitment to proceed through negotiations to reach a formal agreement.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

At exchange, the parties sign or execute the formal documentation, including the share purchase agreement. At completion, the requisite formalities to complete and implement the transaction are undertaken.