The South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities (JSA) is an essential document required for retirement plans in South Carolina. This form specifically addresses the provisions related to JSA, which is a type of annuity that provides lifetime income for both the participant and their spouse. The JSA ensures that the surviving spouse continues to receive a portion of the annuity payments after the participant's death. This consent form highlights the parameters and options available for beneficiaries under the JSA plan. It outlines the terms and conditions in which the surviving spouse's rights are secured in the event of the participant's death. Key terms and keywords associated with the South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities JSASA include: 1. Qualified Joint and Survivor Annuities (JSA): It refers to a retirement plan arrangement that guarantees income payments for the participant's lifetime, with a survivor benefit for the spouse. 2. South Carolina Specific Consent Form: This is a standardized document required by retirement plans in South Carolina to ensure compliance with state regulations regarding JSA arrangements. 3. Spousal Consent: The participant's spouse must provide written consent to waive their right to lifetime annuity payments or to alter the terms of the JSA plan. 4. Beneficiary Options: The form may outline various beneficiary options, such as ensuring the spouse receives a certain percentage of the annuity payment or the option to choose between a lump-sum distribution or monthly payments. 5. Death Benefit Provisions: The form may include sections that explain the options available to the surviving spouse upon the participant's death, such as continuing to receive the annuity payments or selecting an alternative distribution method. Types of South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities JSASA may vary depending on the retirement plan or provider. Some variations include: 1. Basic JSA Consent Form: This form outlines the standard provisions and requirements of the JSA in accordance with South Carolina retirement plan regulations. 2. Customized JSA Consent Form: Some retirement plans may include additional optional features or variations to the JSA, and thus, require a specialized consent form specific to those plan provisions. In conclusion, the South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities (JSA) is a crucial document in retirement planning. It ensures compliance with state regulations and serves as a means to secure the rights of the participant and their spouse concerning annuity payments and survivor benefits.

South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

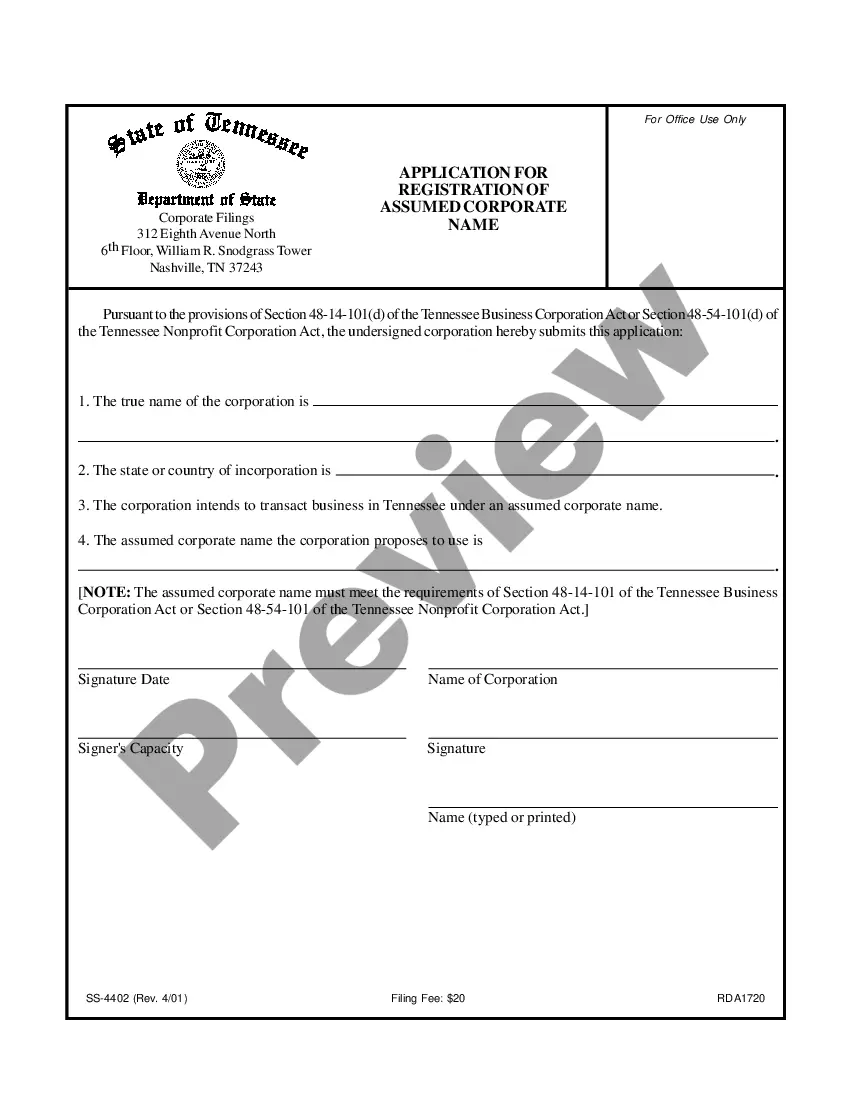

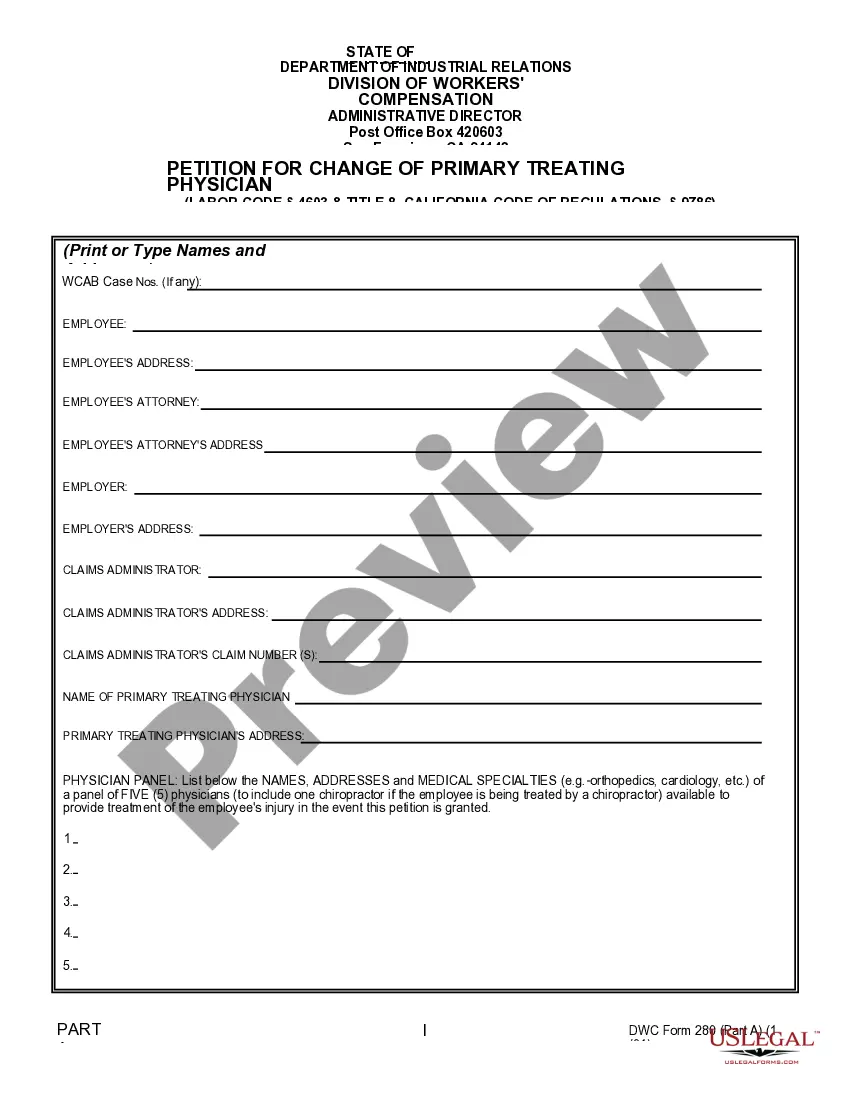

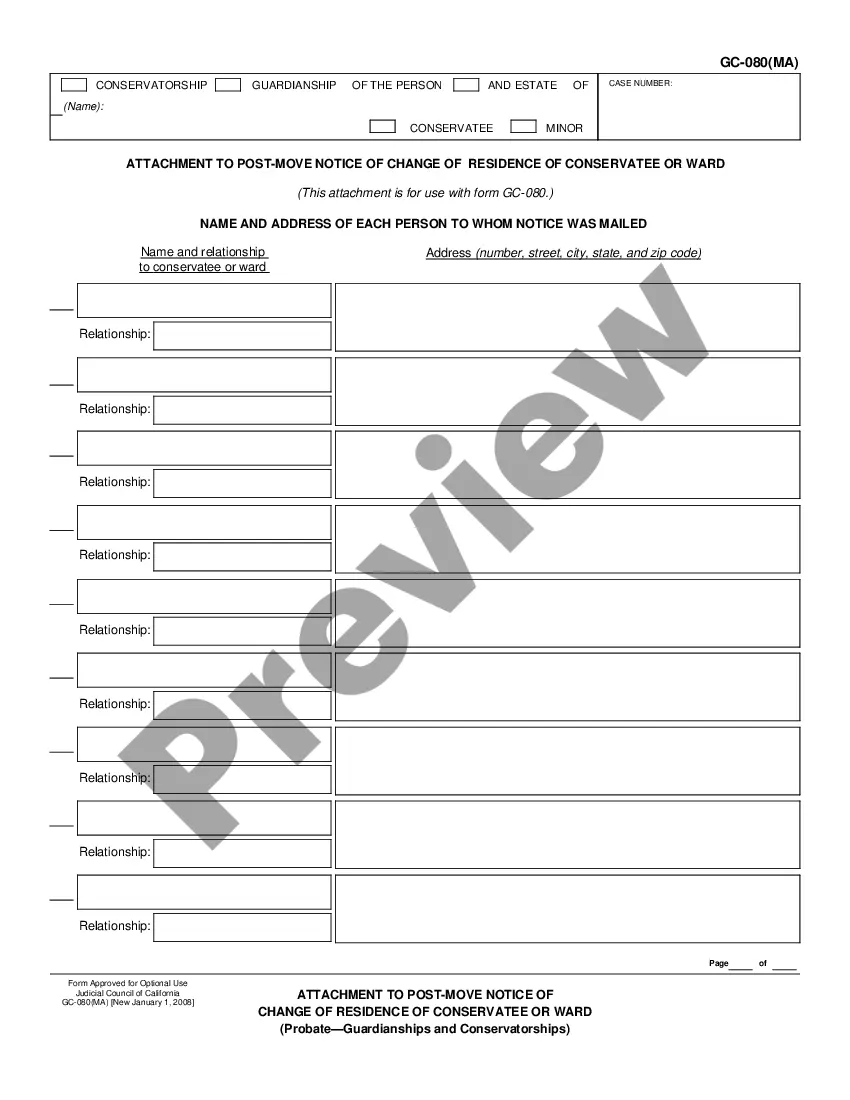

How to fill out South Carolina Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

Have you been in the situation where you will need documents for sometimes enterprise or personal purposes nearly every day time? There are tons of legitimate record themes available online, but finding ones you can trust is not straightforward. US Legal Forms offers a large number of type themes, just like the South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA, that are composed to meet state and federal demands.

When you are already familiar with US Legal Forms web site and have a free account, just log in. Next, you are able to acquire the South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA web template.

If you do not offer an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for the right town/region.

- Take advantage of the Review option to analyze the form.

- Browse the outline to actually have selected the correct type.

- If the type is not what you are looking for, utilize the Search discipline to discover the type that meets your requirements and demands.

- When you discover the right type, click Acquire now.

- Select the rates strategy you need, fill out the necessary information to generate your bank account, and buy the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file structure and acquire your copy.

Discover every one of the record themes you possess bought in the My Forms menus. You may get a further copy of South Carolina Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA at any time, if necessary. Just go through the necessary type to acquire or printing the record web template.

Use US Legal Forms, by far the most extensive collection of legitimate forms, to save time as well as avoid mistakes. The assistance offers skillfully made legitimate record themes which can be used for a variety of purposes. Create a free account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

life annuity provides the largest monthly payment but pays only during your lifetime. It's a poor choice if your spouse will need income from your pension to pay routine expenses. A jointandsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary.

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.