South Carolina Waiver of the Right to be Spouse's Beneficiary

Description

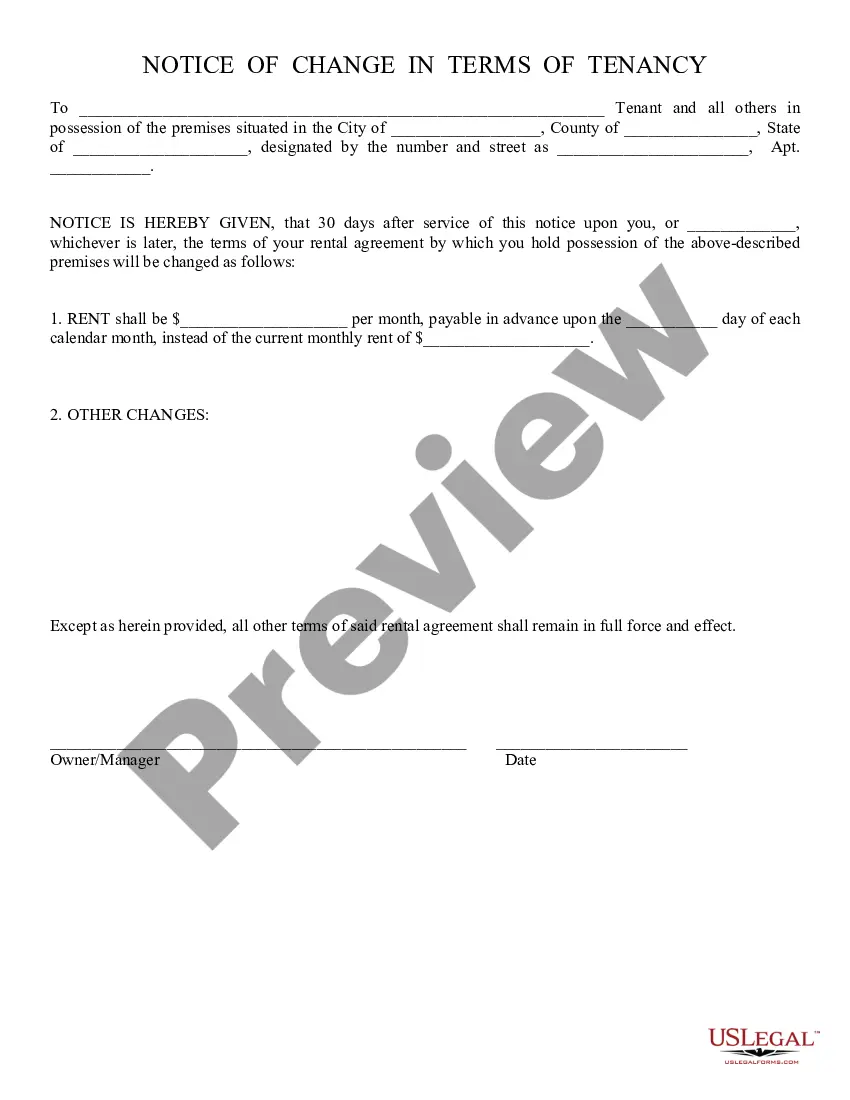

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Are you in the position in which you need documents for possibly business or specific functions just about every working day? There are tons of legal papers templates available on the net, but finding types you can rely is not effortless. US Legal Forms provides thousands of kind templates, such as the South Carolina Waiver of the Right to be Spouse's Beneficiary, which are written to meet federal and state requirements.

In case you are currently acquainted with US Legal Forms website and also have a free account, simply log in. After that, you are able to download the South Carolina Waiver of the Right to be Spouse's Beneficiary template.

Unless you offer an accounts and would like to start using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for that proper city/area.

- Take advantage of the Preview button to analyze the form.

- See the information to ensure that you have chosen the appropriate kind.

- If the kind is not what you are searching for, use the Lookup industry to find the kind that meets your needs and requirements.

- Once you find the proper kind, click on Buy now.

- Choose the costs plan you need, submit the necessary information and facts to produce your account, and buy the transaction making use of your PayPal or bank card.

- Choose a handy data file structure and download your backup.

Get all of the papers templates you have bought in the My Forms food selection. You may get a extra backup of South Carolina Waiver of the Right to be Spouse's Beneficiary at any time, if possible. Just click on the necessary kind to download or printing the papers template.

Use US Legal Forms, by far the most extensive variety of legal varieties, to conserve time and steer clear of blunders. The assistance provides professionally manufactured legal papers templates which you can use for a variety of functions. Generate a free account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Regardless of whether you are engaged or how long your relationship may have been, they would not be considered your spouse legally and therefore would only inherit if you named them in a will.

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

Family members, including spouses, are generally not responsible for paying off the debts of their deceased relatives. That includes credit card debts, student loans, car loans, mortgages and business loans. Instead, any outstanding debts would be paid out from the deceased person's estate.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In most cases you will not be responsible to pay off your deceased spouse's debts. As a general rule, no one else is obligated to pay the debt of a person who has died. There are some exceptions and the exceptions vary by state.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

While you can disinherit your children, in South Carolina you cannot completely disinherit your spouse. This is to protect the surviving spouse from being left destitute and a burden on the state.

When real estate is not held jointly, and someone dies, it must generally pass through their estate. If the deceased had a will, the will would dictate the distribution of their estate to beneficiaries (presumably your mother, in your father's case).

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

Spousal Inheritance Laws in South Carolina A surviving spouse is entitled to the elective share, or one-third of the decedent's estate by law.