South Carolina Consulting Contract Questionnaire — Self-Employed is a comprehensive document used by self-employed consultants in South Carolina to ensure clarity and agreement between the consultant and the client. It serves as a legally binding contract that outlines the terms, obligations, and expectations of both parties involved in the consulting project. The questionnaire covers various aspects related to the consultancy work and enables both parties to have a clear understanding of the scope, deliverables, timelines, and payment terms. Below are some relevant keywords and key areas covered in the South Carolina Consulting Contract Questionnaire — Self-Employed: 1. Scope of Work: The questionnaire includes a detailed description of the specific services the consultant will provide, such as research, analysis, strategy development, training, project management, or any other relevant expertise. 2. Project Deliverables: It outlines the tangible or intangible outcomes that the consultant agrees to produce by the end of the project. This can include reports, presentations, training materials, or any other agreed-upon deliverables. 3. Timelines: The questionnaire includes specific dates and milestones for project completion. It ensures that both the consultant and the client are aligned on the project duration and any important deadlines. 4. Fees and Payment Terms: This section covers the compensation structure, including the fees charged, payment deadlines, and invoicing procedures. It may include information on any deposits, retainers, or installment payments required. 5. Confidentiality and Intellectual Property: The questionnaire addresses the protection of confidential information shared during the project and the ownership of any intellectual property created during the consultancy. 6. Termination and Dispute Resolution: It outlines the conditions under which either party can terminate the contract and the steps involved in resolving any potential disputes or disagreements. 7. Independent Contractor Relationship: Clarifies that the consultant is an independent contractor and not an employee of the client, highlighting the responsibilities and liabilities for each party. Apart from the general South Carolina Consulting Contract Questionnaire — Self-Employed, there may be variations depending on the specific type of consulting services being provided. Examples of specialized consulting contracts could include IT consulting contract questionnaire, marketing consulting contract questionnaire, financial consulting contract questionnaire, or legal consulting contract questionnaire. Each specialized contract may have additional sections tailored to the specific nature of the consultancy. In conclusion, South Carolina Consulting Contract Questionnaire — Self-Employed is a comprehensive document that serves as a foundation for establishing a clear consulting agreement between self-employed consultants and clients. By addressing various crucial aspects of the consultancy engagement, it ensures transparency, mitigates risks, and protects the interests of both parties involved.

South Carolina Consulting Contract Questionnaire - Self-Employed

Description

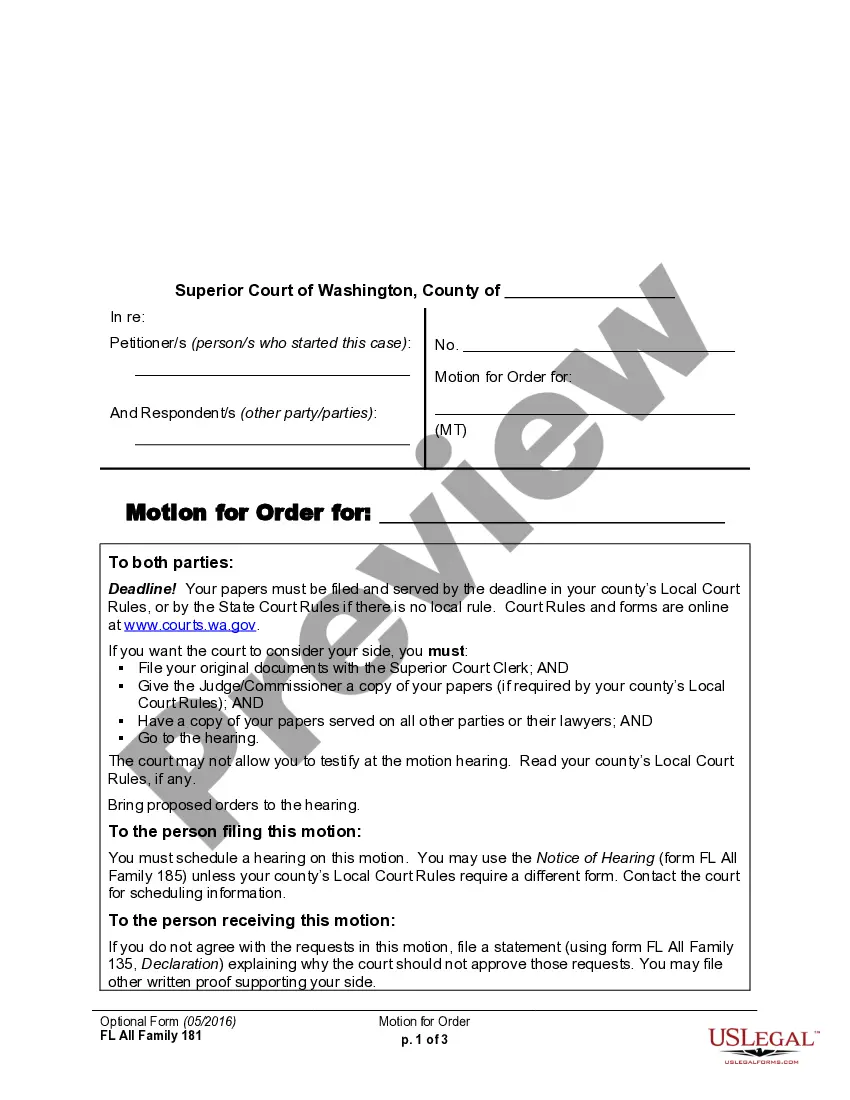

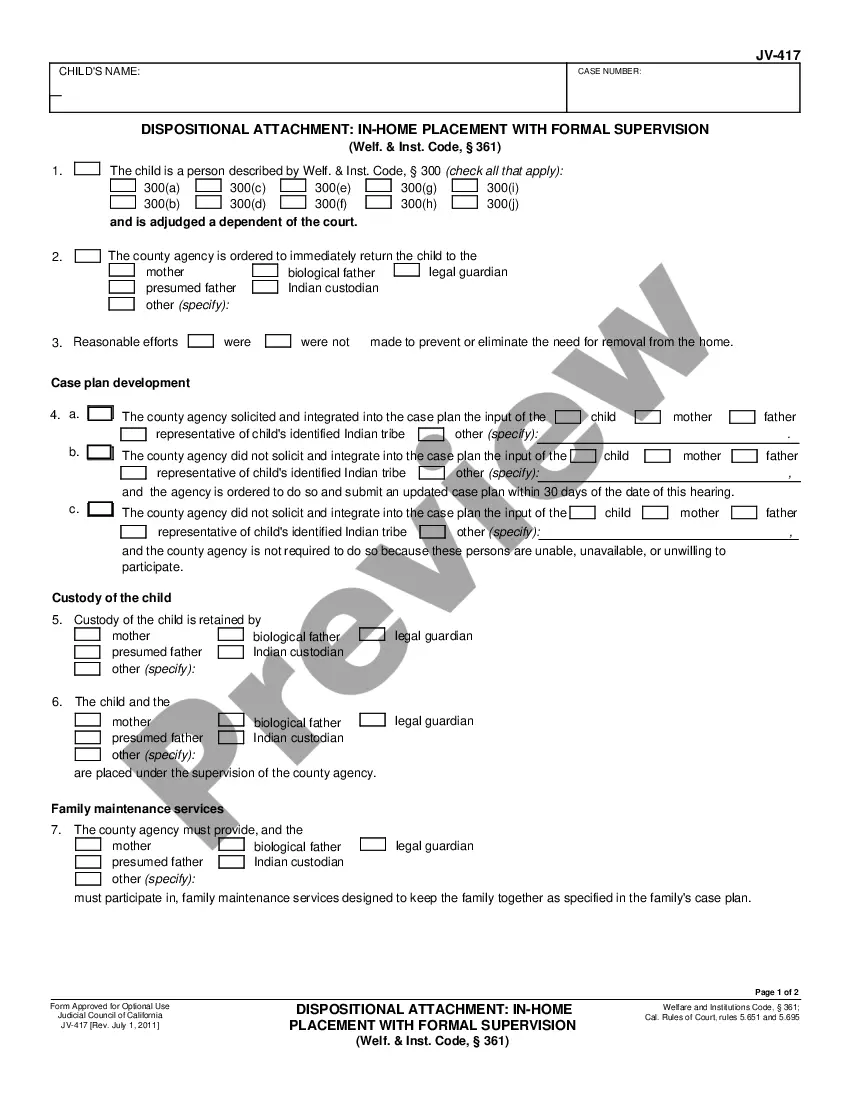

How to fill out South Carolina Consulting Contract Questionnaire - Self-Employed?

Are you within a situation in which you need to have paperwork for possibly company or specific reasons nearly every day? There are tons of legitimate record layouts available on the Internet, but getting ones you can rely on is not simple. US Legal Forms provides a huge number of form layouts, much like the South Carolina Consulting Contract Questionnaire - Self-Employed, which are written to meet state and federal needs.

If you are already knowledgeable about US Legal Forms internet site and get a merchant account, just log in. Following that, it is possible to download the South Carolina Consulting Contract Questionnaire - Self-Employed design.

Should you not provide an accounts and want to begin to use US Legal Forms, adopt these measures:

- Get the form you will need and ensure it is to the correct city/area.

- Make use of the Preview option to review the shape.

- Look at the explanation to ensure that you have selected the correct form.

- When the form is not what you`re looking for, make use of the Look for discipline to get the form that meets your requirements and needs.

- Whenever you obtain the correct form, simply click Purchase now.

- Pick the costs plan you would like, fill out the required details to create your bank account, and buy your order utilizing your PayPal or credit card.

- Pick a hassle-free document formatting and download your version.

Locate all the record layouts you have purchased in the My Forms food list. You can aquire a extra version of South Carolina Consulting Contract Questionnaire - Self-Employed whenever, if necessary. Just click the required form to download or print the record design.

Use US Legal Forms, the most extensive collection of legitimate varieties, to save some time and avoid mistakes. The support provides expertly created legitimate record layouts that you can use for a variety of reasons. Make a merchant account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).