South Carolina Employee Evaluation Form for Accountant

Description

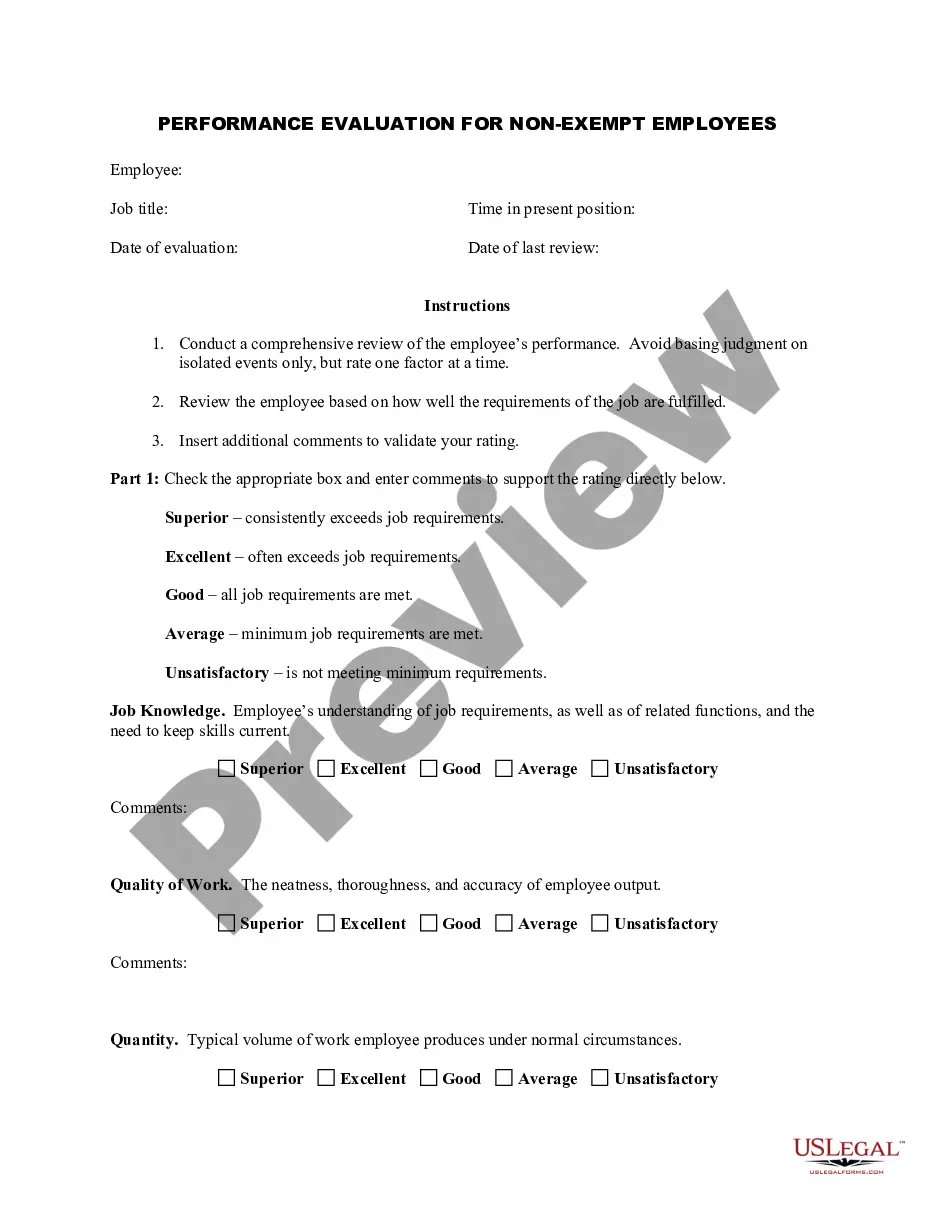

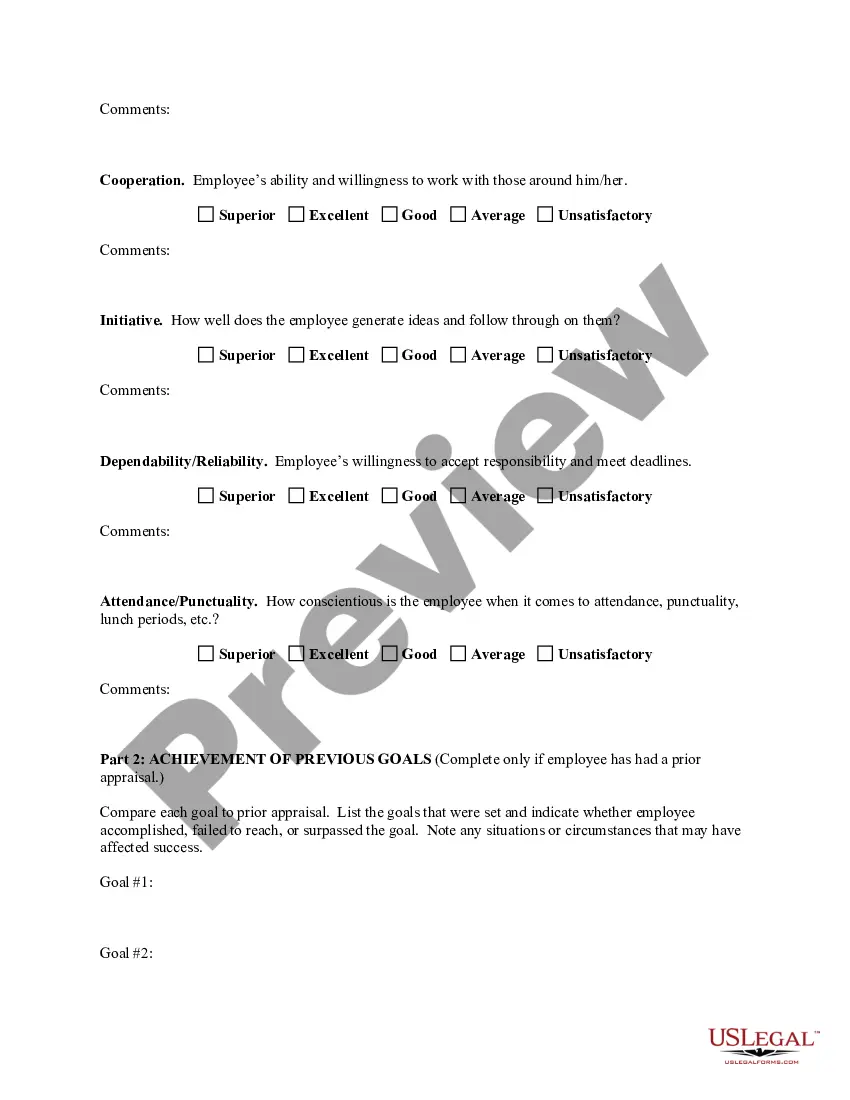

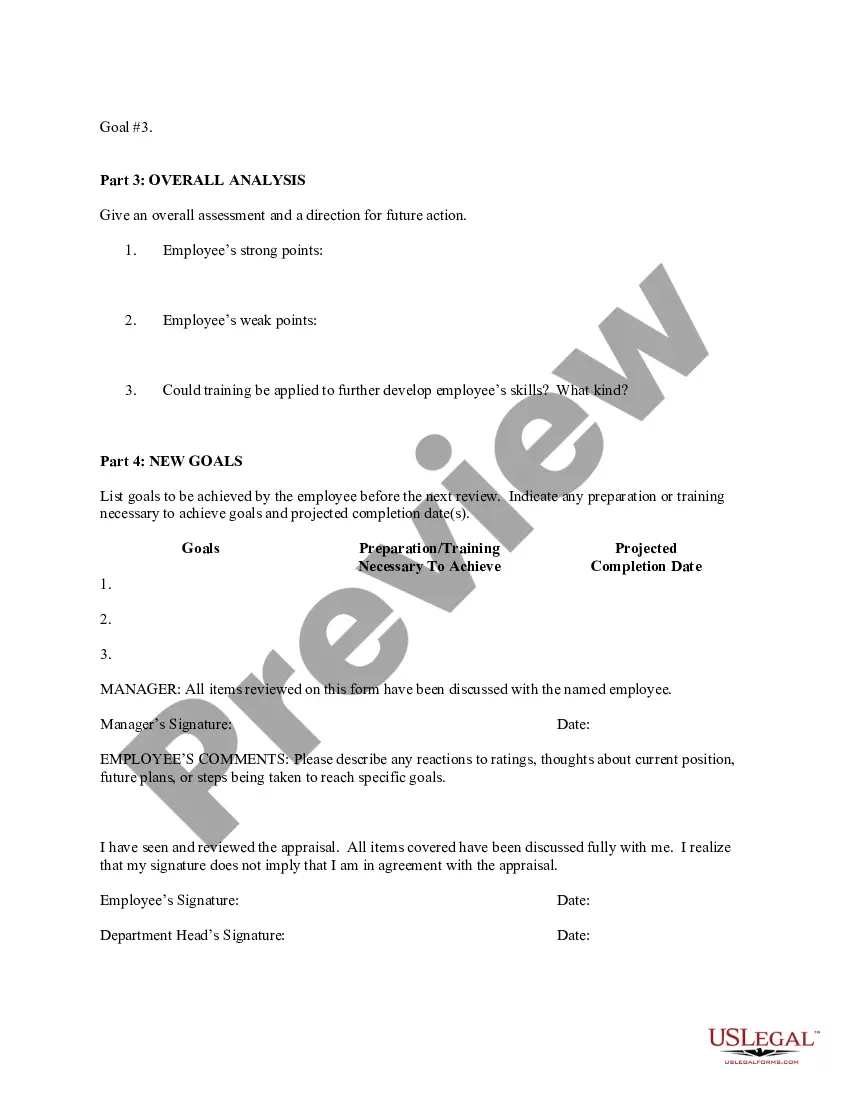

How to fill out South Carolina Employee Evaluation Form For Accountant?

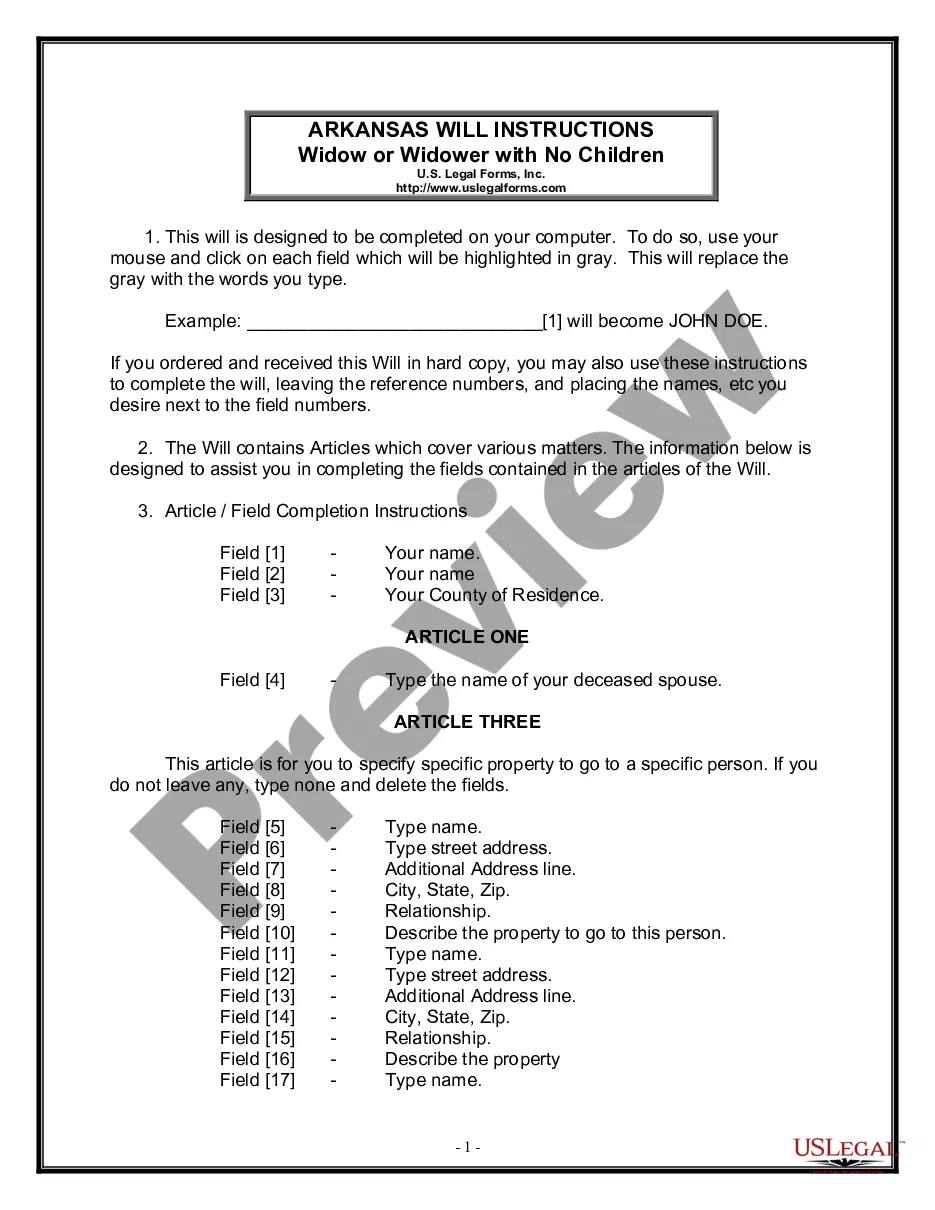

Discovering the right legal file format could be a have difficulties. Needless to say, there are a variety of templates accessible on the Internet, but how do you get the legal form you want? Utilize the US Legal Forms site. The service offers thousands of templates, for example the South Carolina Employee Evaluation Form for Accountant, which can be used for enterprise and private requires. Each of the varieties are checked by professionals and fulfill federal and state requirements.

In case you are already listed, log in for your profile and then click the Obtain option to find the South Carolina Employee Evaluation Form for Accountant. Utilize your profile to check through the legal varieties you may have ordered earlier. Proceed to the My Forms tab of your own profile and have yet another backup of your file you want.

In case you are a whole new consumer of US Legal Forms, listed below are easy directions that you should comply with:

- First, be sure you have selected the correct form for the metropolis/county. You may examine the form using the Preview option and read the form explanation to ensure it is the best for you.

- If the form does not fulfill your requirements, use the Seach discipline to obtain the appropriate form.

- Once you are certain the form is suitable, click on the Purchase now option to find the form.

- Opt for the pricing prepare you want and enter the required information. Design your profile and pay money for the order utilizing your PayPal profile or credit card.

- Opt for the document formatting and acquire the legal file format for your product.

- Total, revise and print and indication the acquired South Carolina Employee Evaluation Form for Accountant.

US Legal Forms is definitely the largest library of legal varieties where you will find numerous file templates. Utilize the company to acquire expertly-produced paperwork that comply with state requirements.

Form popularity

FAQ

For a 3-year B.COM degree, you get 90 credit hours. In the past, a CA certificate gave you an additional around 40 credit hours. With 90+40=130 credit hours, you can get qualified for a few states.

Steps to Become a CPA in South CarolinaComplete 150 semester hours of acceptable college-level coursework in accounting.Accumulate the required hours of experience.Complete the AICPA ethics course and exam.Pass the Uniform CPA Examination.Apply for a license.Receive a license.

The South Carolina Leadership, Effectiveness, Advancement ,and Development (SCLead.org) data management system facilitates special area educator, teacher, and principal professional growth and development in schools and districts across the state.

In general, it takes four years of study to earn a degree in accounting.

New Jersey, Pennsylvania, Connecticut, Massachusettsevery state in the Union except for New York and Hawaiiallow non-CPAs to hold a minority ownership stake in a CPA firm. The sky hasn't fallen. CPA firms are still CPA firms, even with non-CPAs contributing to their growth.

Yes. Your firm can have non-CPA owners, but the majority of the firm's ownership (at least 51%) must be held by CPAs who are currently licensed in some state. All owners must be active individual participants in the firm. Investors, LLPs, LLCs, and commercial interests are not permitted to be firm owners.

Most agencies have a turnaround time of 2 weeks but can also vary from 5 business days to 8+ weeks.

The Foreign Academic Credentials Service assists people educated outside the United States in determining the equivalency of their international credentials in terms of an education in the U.S. FACS was established in 1982 at the request of the American Institute of Certified Public Accountants (AICPA) and the National

Students often report that Financial Accounting and Reporting (FAR) is the most difficult part of the CPA Exam to pass, because it is the most comprehensive section.

Check with the CA State Board of Accountancy to ensure your CPA doesn't have outstanding complaints against them (do this when looking for a new CPA firm, as well). Assess Your Situation. Think about whether you need an Enrolled Agent (EA), a CPA or a tax lawyer.