South Carolina Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 is a legal document used in bankruptcy cases to list creditors who have unsecured priority claims in the state of South Carolina. It is an important component of the bankruptcy process, as it helps ensure that all creditors are properly accounted for and given the opportunity to collect the debts owed to them. Unsecured priority claims refer to debts that are not secured by collateral but hold higher priority in the repayment hierarchy outlined in bankruptcy laws. These claims take precedence over other unsecured claims and are typically associated with certain types of debts that are considered critically important or legally mandated. Some examples of South Carolina Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 may include: 1. Tax Authorities: This category encompasses federal, state, and local tax agencies that are owed unpaid taxes. These could include income taxes, sales taxes, property taxes, or any other tax obligations. 2. Child and Spousal Support: Debts relating to court-ordered child support or spousal support payments fall under this category. These are considered essential obligations that hold a higher priority to ensure the welfare and financial support of dependents. 3. Wage Claims: Employees who are owed unpaid wages, including salary, bonuses, commissions, or vacation pay, may file a claim under this category. This ensures that workers are prioritized in receiving their owed compensation. 4. Contributions to Employee Benefit Plans: Unpaid contributions to employee benefit plans, such as pension funds or health insurance coverage, may be listed as unsecured priority claims. These are crucial for protecting the rights and benefits of employees. 5. Court Fines and Penalties: Debts resulting from court-ordered fines, penalties, or restitution may be included in this category. These claims serve as a means to enforce legal compliance and deter future violations. South Carolina Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 provides a comprehensive and organized way to document these priority claims, ensuring that both creditors and debtors have a clear understanding of the outstanding debts and their respective priorities. The completion of this form enables the bankruptcy court to distribute available assets in a fair and equitable manner, while prioritizing important creditors with valid claims.

South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

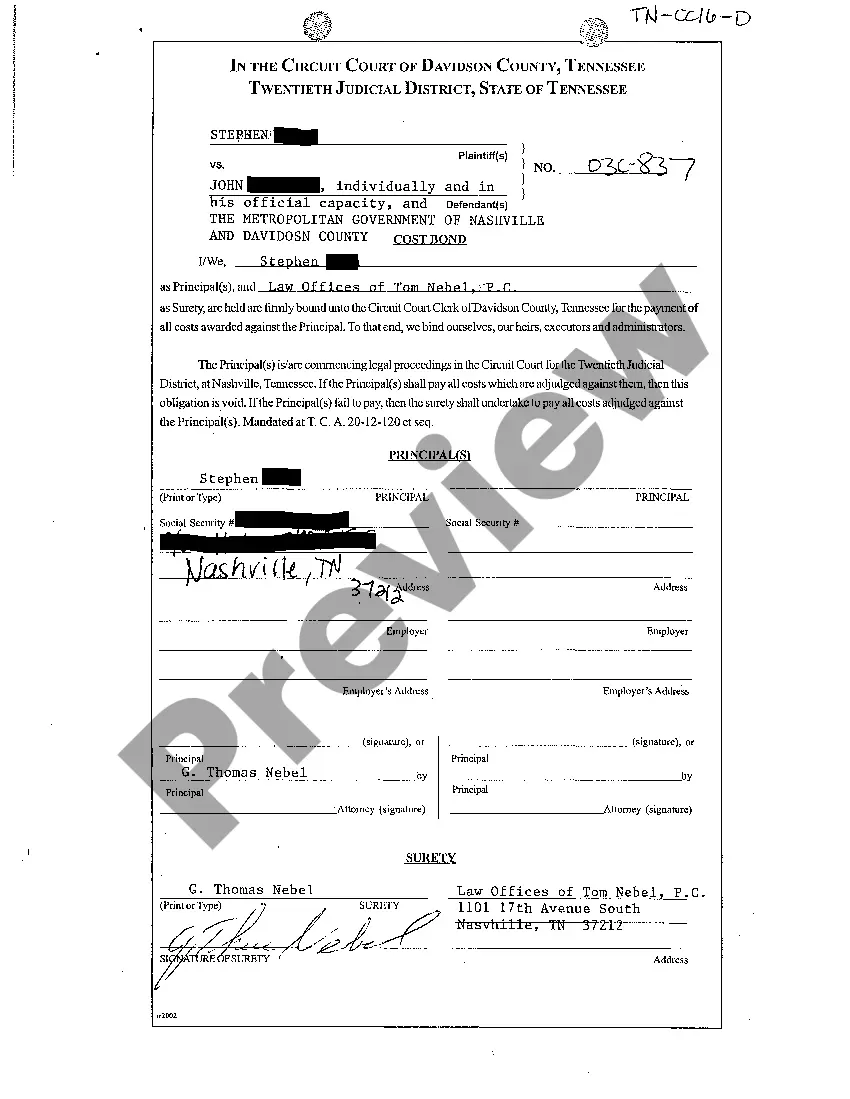

How to fill out South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

US Legal Forms - one of the greatest libraries of legal forms in the USA - offers a wide array of legal papers layouts it is possible to down load or printing. Utilizing the internet site, you may get a large number of forms for company and personal purposes, sorted by groups, says, or search phrases.You can get the newest types of forms such as the South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 within minutes.

If you already possess a subscription, log in and down load South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 from your US Legal Forms catalogue. The Down load option will show up on each and every develop you view. You get access to all previously saved forms within the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, listed below are straightforward recommendations to obtain started off:

- Ensure you have picked the best develop for your city/state. Click on the Preview option to check the form`s content. Browse the develop explanation to actually have chosen the proper develop.

- In case the develop does not match your specifications, utilize the Search field towards the top of the display to find the one that does.

- Should you be pleased with the form, validate your decision by simply clicking the Get now option. Then, opt for the prices program you prefer and give your credentials to sign up for an bank account.

- Approach the deal. Make use of charge card or PayPal bank account to complete the deal.

- Find the format and down load the form on the gadget.

- Make alterations. Complete, change and printing and signal the saved South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Each and every format you added to your money does not have an expiration date and is yours eternally. So, if you would like down load or printing an additional backup, just go to the My Forms segment and click about the develop you need.

Gain access to the South Carolina Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms, the most extensive catalogue of legal papers layouts. Use a large number of specialist and condition-particular layouts that satisfy your company or personal requires and specifications.

Form popularity

FAQ

An unsecured creditor is an individual or institution that lends money without obtaining specified assets as collateral. This poses a higher risk to the creditor because it will have nothing to fall back on should the borrower default on the loan.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

General unsecured claims have the lowest priority of all claims. After the bankruptcy estate pays administrative expenses, priority unsecured claims, and secured claims, general unsecured creditors will receive a pro rata (equal percentage) distribution of the remaining funds.

?Is the claim subject to Offset?? Asks if you have to pay back the whole debt. For example, if you owe the creditor $1,000 but the creditor owes you $200, then the claim can be ?offset?.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

Examples of unsecured debts include credit cards, medical expenses, utility bills, most taxes, and personal loans.

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.