South Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

How to fill out Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

Have you been in a position the place you require files for sometimes business or individual purposes nearly every day time? There are a lot of authorized papers web templates available on the Internet, but finding ones you can rely on isn`t easy. US Legal Forms offers 1000s of form web templates, just like the South Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation, that happen to be composed to meet state and federal needs.

If you are currently familiar with US Legal Forms website and get your account, just log in. After that, you may down load the South Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation web template.

Unless you provide an bank account and would like to begin using US Legal Forms, abide by these steps:

- Find the form you want and make sure it is for your appropriate city/area.

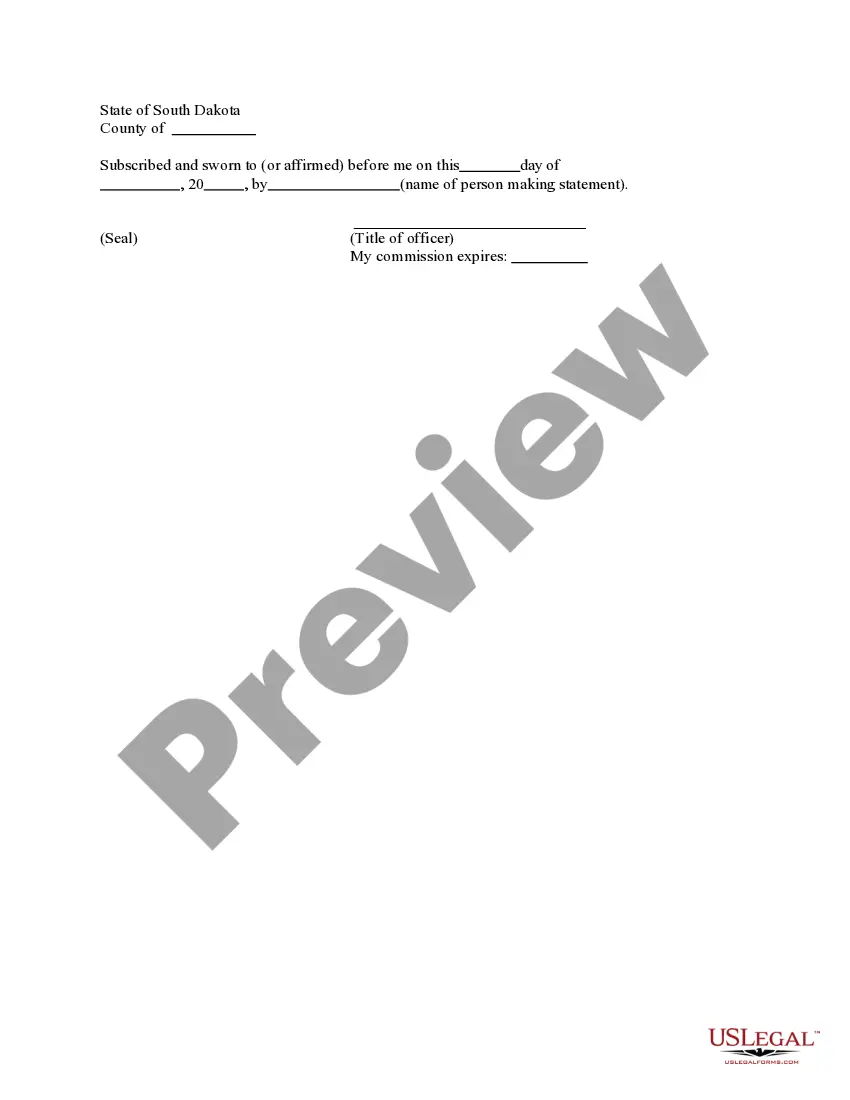

- Make use of the Review switch to analyze the form.

- Look at the information to ensure that you have chosen the appropriate form.

- In the event the form isn`t what you`re trying to find, make use of the Research industry to discover the form that meets your needs and needs.

- If you obtain the appropriate form, click Acquire now.

- Opt for the pricing plan you would like, submit the required info to generate your money, and pay for your order with your PayPal or charge card.

- Pick a handy file format and down load your version.

Find all of the papers web templates you possess bought in the My Forms food list. You can obtain a additional version of South Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation anytime, if necessary. Just click on the required form to down load or print out the papers web template.

Use US Legal Forms, the most extensive selection of authorized kinds, to save lots of some time and steer clear of faults. The assistance offers appropriately created authorized papers web templates which you can use for a selection of purposes. Create your account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

Merger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

?parties? means Parent, Merger Sub and the Company.

Merger: A contractual and statutory process by which one corporation (the surviving corporation) acquires all of the assets and liabilities of another corporation (the merged corporation), causing the merged corporation to become defunct.