South Carolina Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

How to fill out Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

Choosing the right legal file web template might be a struggle. Of course, there are tons of templates available on the Internet, but how do you discover the legal kind you want? Utilize the US Legal Forms web site. The services provides thousands of templates, like the South Carolina Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank, which can be used for enterprise and private requires. All the kinds are checked out by specialists and fulfill state and federal specifications.

When you are previously authorized, log in to your account and then click the Download button to get the South Carolina Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank. Use your account to look from the legal kinds you have purchased previously. Proceed to the My Forms tab of your respective account and get another duplicate in the file you want.

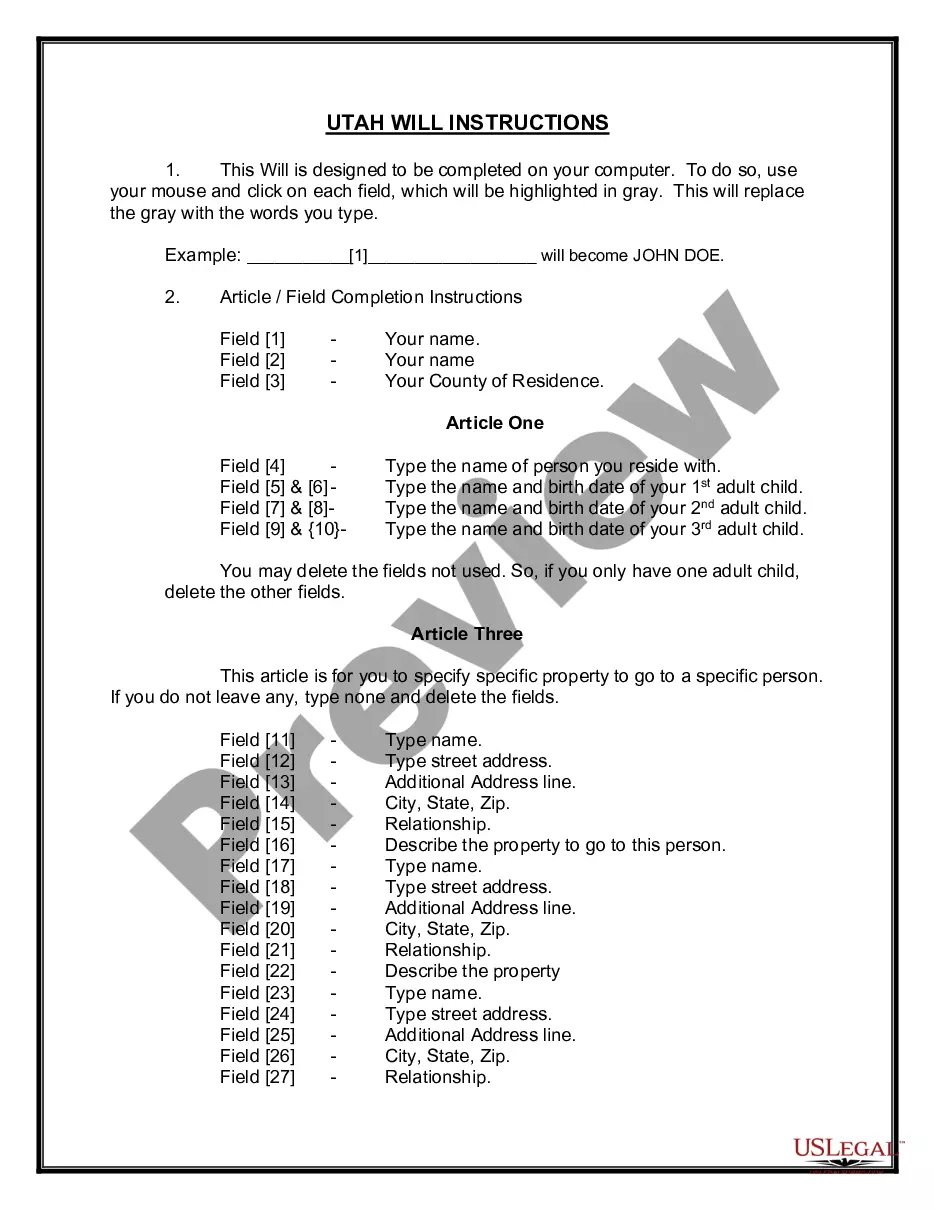

When you are a fresh consumer of US Legal Forms, allow me to share easy recommendations that you should stick to:

- First, make sure you have chosen the right kind to your city/county. It is possible to examine the form using the Preview button and browse the form description to make sure it will be the best for you.

- When the kind is not going to fulfill your needs, make use of the Seach industry to obtain the right kind.

- When you are sure that the form is suitable, go through the Buy now button to get the kind.

- Select the rates program you want and enter the required information and facts. Design your account and pay money for the order utilizing your PayPal account or credit card.

- Select the submit file format and obtain the legal file web template to your device.

- Comprehensive, revise and print out and sign the received South Carolina Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

US Legal Forms is the largest collection of legal kinds where you can find numerous file templates. Utilize the service to obtain skillfully-created documents that stick to condition specifications.