South Carolina Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

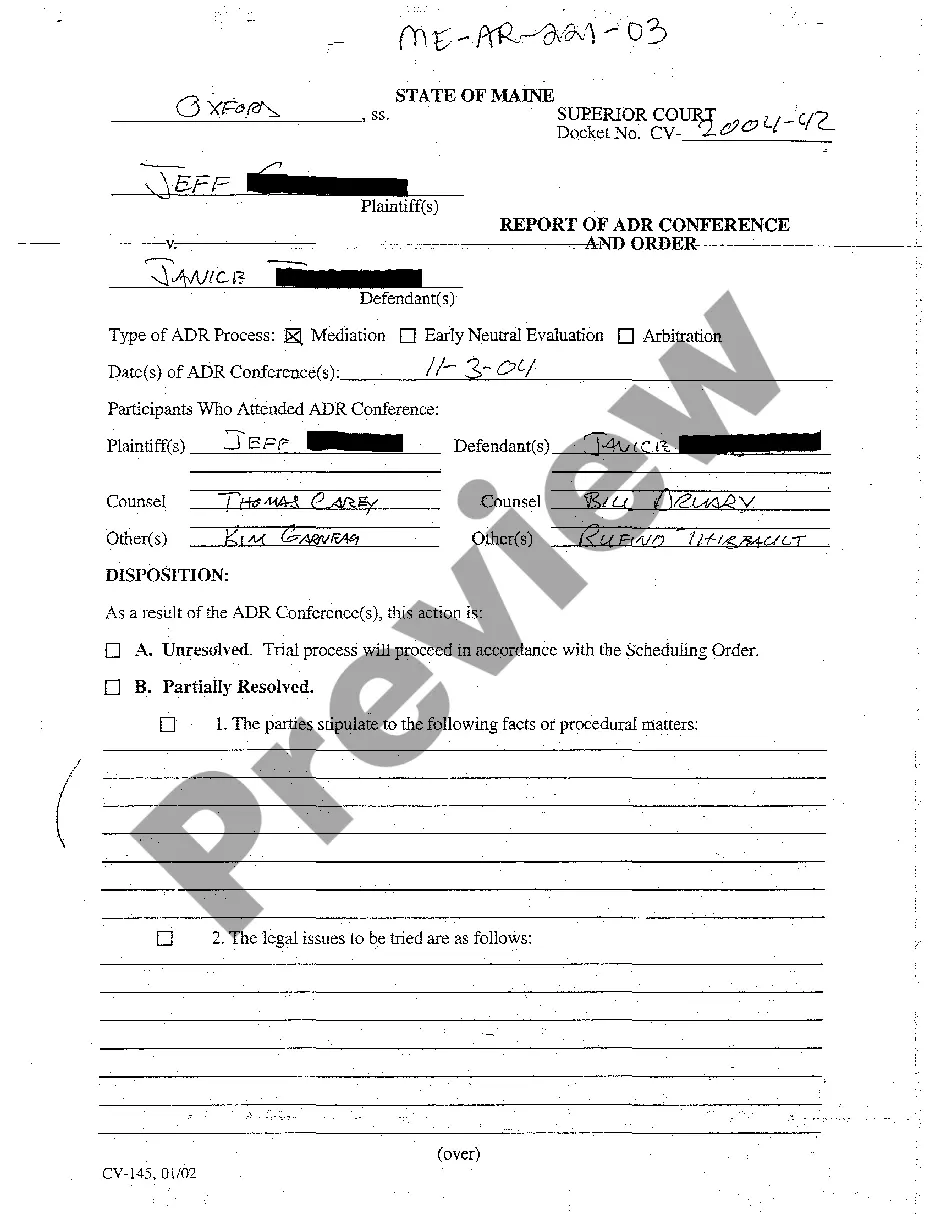

How to fill out Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

If you need to complete, acquire, or printing lawful record layouts, use US Legal Forms, the greatest collection of lawful varieties, that can be found online. Utilize the site`s simple and practical search to find the documents you will need. Different layouts for company and individual functions are categorized by types and states, or keywords. Use US Legal Forms to find the South Carolina Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co in just a number of click throughs.

Should you be already a US Legal Forms customer, log in to the profile and click the Acquire key to obtain the South Carolina Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co. You can also entry varieties you previously downloaded within the My Forms tab of the profile.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that right area/nation.

- Step 2. Use the Review option to check out the form`s information. Never neglect to learn the outline.

- Step 3. Should you be not satisfied with all the type, use the Search area on top of the display to locate other variations of your lawful type format.

- Step 4. When you have located the form you will need, go through the Buy now key. Choose the prices prepare you choose and include your references to sign up to have an profile.

- Step 5. Method the purchase. You can utilize your credit card or PayPal profile to finish the purchase.

- Step 6. Select the format of your lawful type and acquire it on the system.

- Step 7. Total, change and printing or sign the South Carolina Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co.

Each lawful record format you acquire is your own property forever. You may have acces to each and every type you downloaded with your acccount. Click the My Forms area and choose a type to printing or acquire yet again.

Contend and acquire, and printing the South Carolina Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co with US Legal Forms. There are thousands of expert and state-specific varieties you can use for your company or individual demands.

Form popularity

FAQ

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

12.2 Merger Clause. This Agreement and the other agreements, documents or instruments contemplated hereby shall constitute the entire agreement between the Parties, and shall supersede all prior agreements, understandings and negotiations between the Parties with respect to the subject matter hereof.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Questions to Ask During a Merger or Acquisition Company. ? What is the timeframe for change? When can customers expect to see changes to the company or products? ... People. ? What will happen to the current leadership team? ... Products. ? Are there any plans to sunset the brand of one of the companies?