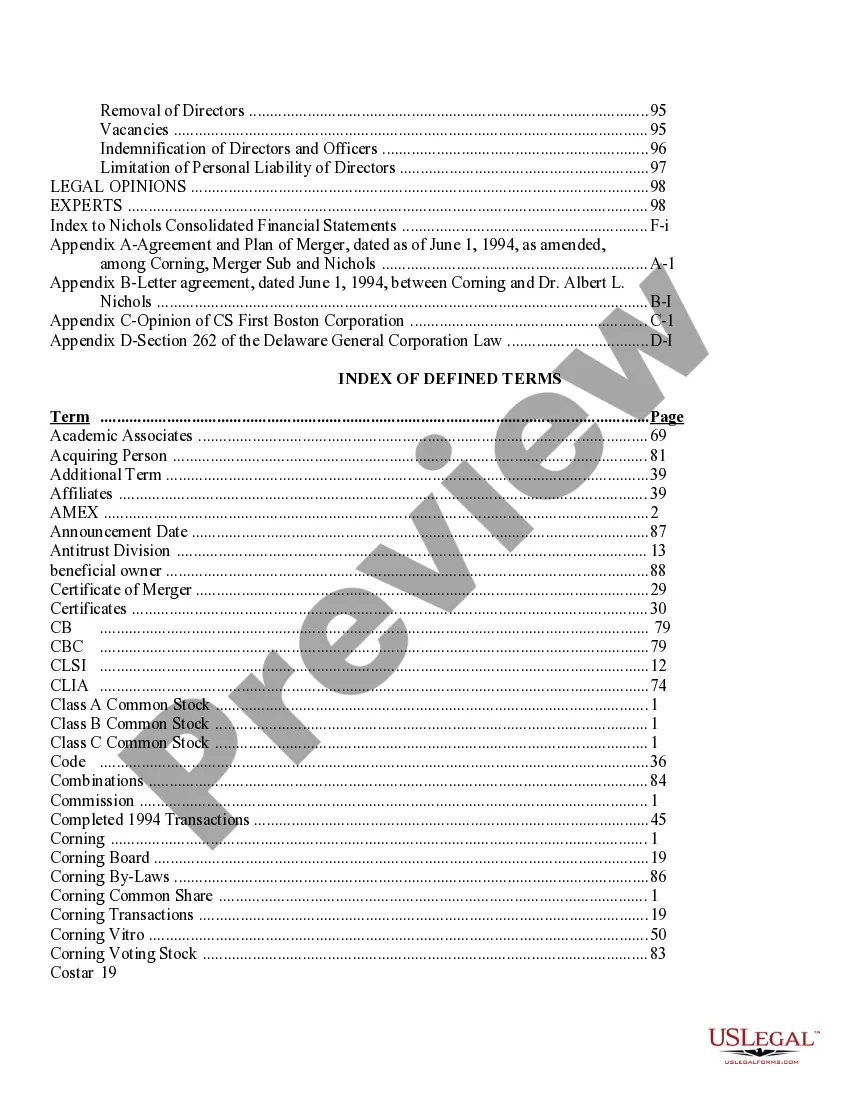

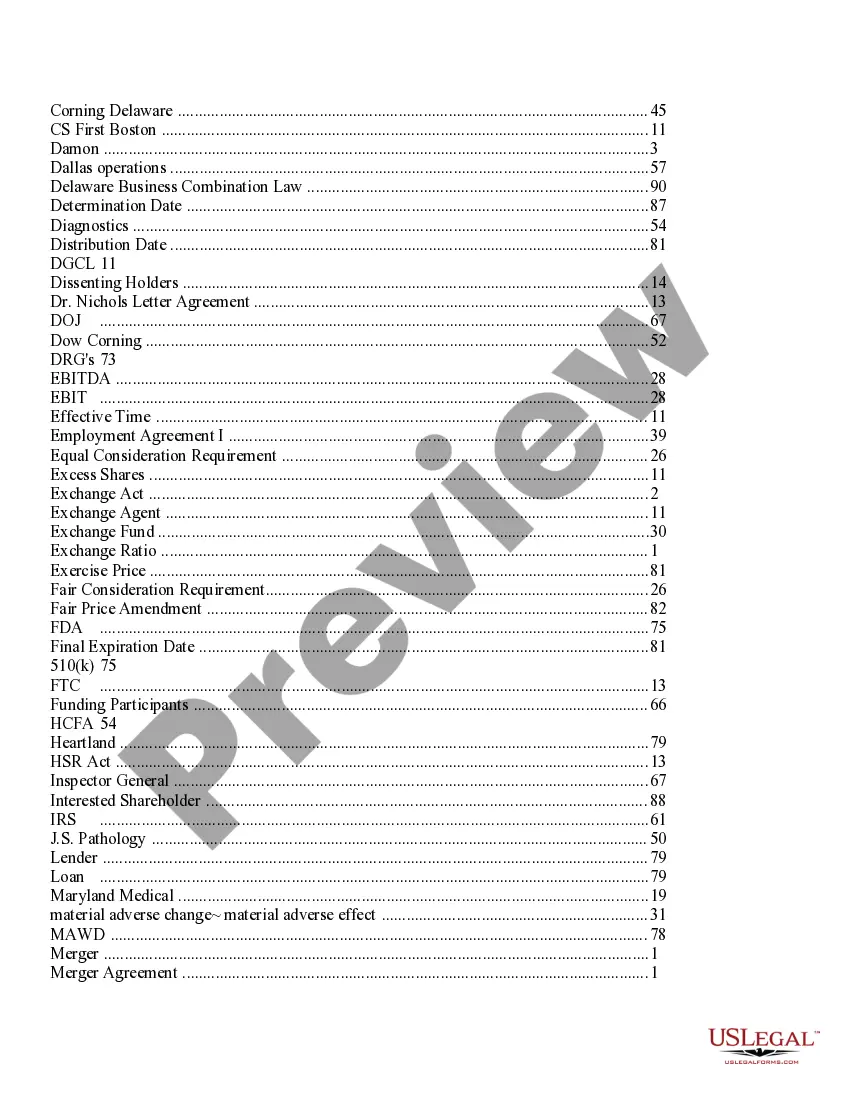

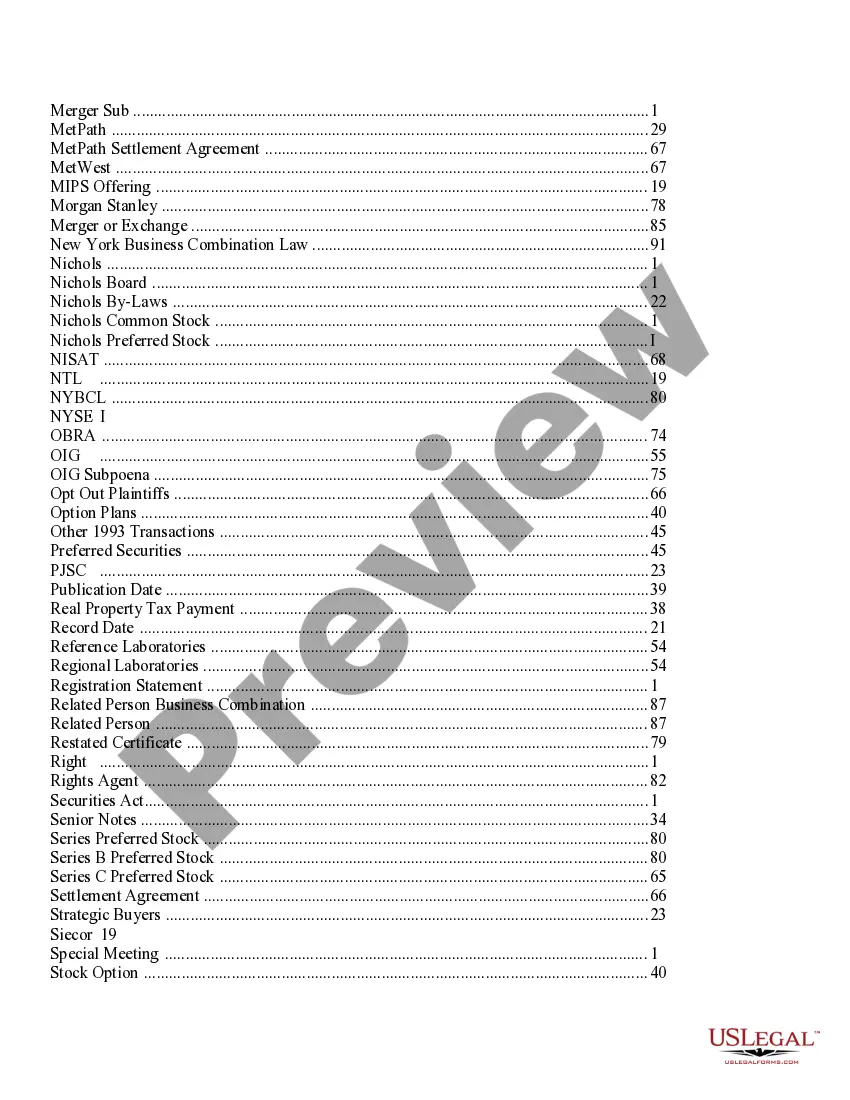

A South Carolina Proxy Statement — Prospectus is a legal document that provides shareholders of Corning Incorporated with important information regarding corporate governance matters and financial details. It serves as a communication tool between the company and its shareholders. The document is filed with the U.S. Securities and Exchange Commission (SEC) and must comply with specific regulations. The Proxy Statement section of the South Carolina Proxy Statement — Prospectus covers a wide range of topics. It includes information about the upcoming annual or special shareholder meeting, where important matters, such as the election of directors and voting on significant proposals, will be discussed and decided upon. The document discloses details about the meeting date, time, and location as well. This Proxy Statement — Prospectus also covers essential financial information. It provides historical financial statements, including balance sheets, income statements, and cash flow statements, which depict the company's financial performance over a specific period. This information helps investors and shareholders gain insight into Corning Incorporated's profitability, liquidity, and overall financial health. The Proxy Statement also outlines the compensation packages of Corning Incorporated's executives and directors. This section sheds light on the salary, bonuses, stock options, and other elements of compensation that these individuals receive. Details about long-term incentive plans and retirement benefits are often presented as well. This information assists shareholders in evaluating the alignment of executive compensation with company performance and shareholders' interests. The document may also include information about Corning Incorporated's corporate governance structure, such as the composition and independence of the board of directors, the existence of specialized committees (e.g., audit, compensation, and governance committees), and the company's code of ethics. These sections demonstrate the company's commitment to transparency, accountability, and ethical practices, which are essential factors for shareholders and potential investors. Different versions of the South Carolina Proxy Statement — Prospectus of Corning Incorporated without appendices may exist, tailored for specific purposes or audiences. For example, there might be separate proxy statements for different shareholder meetings (annual vs. special meetings). There could also be proxy statements specific to certain proposals or extraordinary events, such as mergers, acquisitions, or major capital restructuring initiatives. In conclusion, the South Carolina Proxy Statement — Prospectus of Corning Incorporated without appendices is a crucial document that provides shareholders with important information about the company's corporate governance structure, financial performance, executive compensation, and more. It is designed to ensure transparency and help shareholders make informed decisions during the shareholder meeting.

South Carolina Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out South Carolina Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

If you need to total, acquire, or print out legal papers web templates, use US Legal Forms, the most important selection of legal types, which can be found online. Use the site`s basic and convenient lookup to obtain the papers you require. Different web templates for enterprise and specific reasons are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the South Carolina Proxy Statement - Prospectus of Corning Incorporated without appendices with a few click throughs.

Should you be currently a US Legal Forms customer, log in in your profile and click the Download button to obtain the South Carolina Proxy Statement - Prospectus of Corning Incorporated without appendices. You can even entry types you in the past delivered electronically within the My Forms tab of your own profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for that correct town/region.

- Step 2. Take advantage of the Preview method to examine the form`s articles. Do not neglect to read the description.

- Step 3. Should you be unsatisfied using the form, take advantage of the Look for field on top of the display to find other versions from the legal form design.

- Step 4. Once you have discovered the form you require, click on the Get now button. Select the rates strategy you favor and include your accreditations to sign up on an profile.

- Step 5. Approach the transaction. You may use your charge card or PayPal profile to perform the transaction.

- Step 6. Pick the structure from the legal form and acquire it on the gadget.

- Step 7. Comprehensive, edit and print out or signal the South Carolina Proxy Statement - Prospectus of Corning Incorporated without appendices.

Every single legal papers design you purchase is your own property forever. You possess acces to every single form you delivered electronically inside your acccount. Click on the My Forms portion and select a form to print out or acquire once more.

Remain competitive and acquire, and print out the South Carolina Proxy Statement - Prospectus of Corning Incorporated without appendices with US Legal Forms. There are thousands of professional and condition-distinct types you can utilize for your personal enterprise or specific requirements.