South Carolina Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits to Employees with Company Stock Description: The South Carolina Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits to Employees with Company Stock is a legal provision that enables employers to establish a plan to compensate their employees for unused vacation time in the form of company stock. This plan allows employees to enjoy the benefits of stock ownership while rewarding them for their dedication and loyalty to the company. Keywords: South Carolina, authorization, adopt, plan, payment, accrued vacation benefits, employees, company stock, copy of plan Types of South Carolina Authorization to Adopt a Plan for Payment of Accrued Vacation Benefits to Employees with Company Stock: 1. Voluntary Stock Compensation Plan: This type of authorization allows employers to offer their employees the option to receive company stock as payment for their accrued vacation benefits. It provides a flexible and enticing incentive for employees to accumulate and utilize their vacation time. By giving employees a choice, employers can cater to their individual preferences and encourage long-term commitment to the organization. 2. Mandatory Stock Compensation Plan: In this scenario, employers are required by South Carolina law to establish a plan whereby accrued vacation benefits must be paid to employees in the form of company stock. This mandatory plan ensures that employees are provided with the opportunity to accumulate assets while utilizing their vacation benefits. It creates a standard practice across organizations within the state and promotes equity among employees. 3. Partial Stock Compensation Plan: With a partial stock compensation plan, employers have the option to offer a combination of cash and company stock as payment for accrued vacation benefits. This allows employees to receive a portion of their benefits in the form of stock while providing them with immediate financial liquidity through cash compensation. The choice of receiving a combination of cash and stock can be based on employees' personal preferences and financial needs. 4. Vesting Stock Compensation Plan: A vesting stock compensation plan is designed to reward long-term employee commitment by granting them ownership of company stock over a pre-determined period. Under this plan, employees receive a certain percentage of their accrued vacation benefits as stock based on their years of service. This approach incentivizes employees to stay with the company for an extended duration, ensuring continuity and loyalty. Employers interested in implementing these types of plans should consult legal counsel to ensure compliance with South Carolina labor laws and to obtain a formal plan document. The plan document should specify the terms, conditions, and eligibility criteria for employees to participate in the stock compensation plan, ensuring transparency and fairness.

South Carolina Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

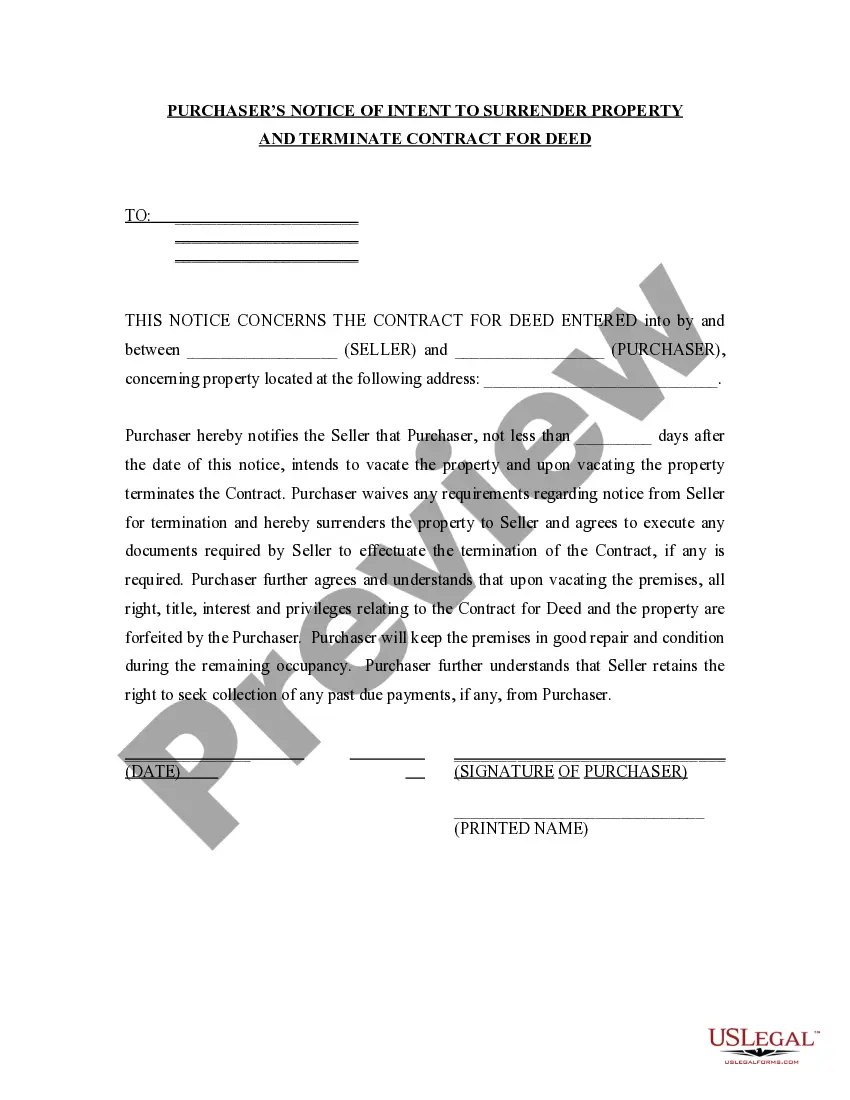

How to fill out South Carolina Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Have you been in a position in which you will need papers for sometimes organization or personal uses just about every day time? There are tons of lawful document templates available on the net, but getting kinds you can depend on is not effortless. US Legal Forms offers a huge number of form templates, just like the South Carolina Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, which are created to fulfill state and federal specifications.

Should you be currently informed about US Legal Forms site and get your account, simply log in. Afterward, you can acquire the South Carolina Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan design.

Should you not come with an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the form you need and ensure it is for that appropriate town/area.

- Use the Preview key to examine the form.

- See the explanation to actually have selected the proper form.

- In case the form is not what you`re looking for, take advantage of the Look for field to discover the form that fits your needs and specifications.

- Whenever you get the appropriate form, click on Get now.

- Select the pricing plan you would like, fill in the desired info to create your account, and purchase an order utilizing your PayPal or bank card.

- Select a practical document structure and acquire your version.

Find every one of the document templates you may have purchased in the My Forms menu. You may get a more version of South Carolina Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan any time, if necessary. Just select the needed form to acquire or printing the document design.

Use US Legal Forms, one of the most comprehensive selection of lawful kinds, to save efforts and stay away from faults. The services offers skillfully made lawful document templates which can be used for a selection of uses. Create your account on US Legal Forms and commence creating your lifestyle easier.