South Carolina Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

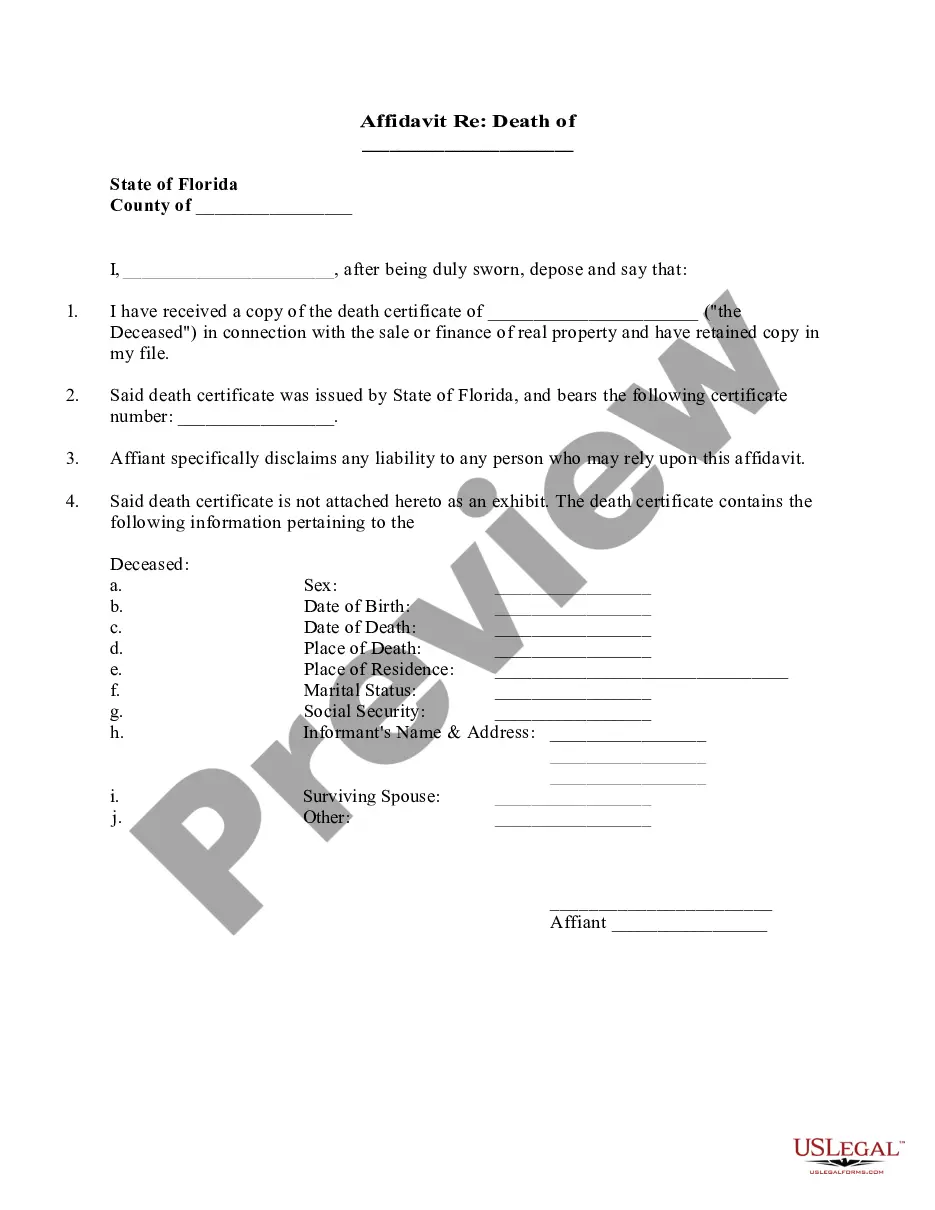

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

Are you currently within a position the place you will need documents for sometimes company or individual functions just about every day? There are a lot of legitimate record templates available on the net, but locating ones you can depend on isn`t easy. US Legal Forms offers a large number of kind templates, just like the South Carolina Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, that happen to be written in order to meet state and federal demands.

When you are already informed about US Legal Forms site and get an account, just log in. Afterward, you can acquire the South Carolina Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights web template.

Unless you provide an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the kind you need and ensure it is to the correct town/area.

- Make use of the Preview button to analyze the form.

- Look at the information to actually have selected the proper kind.

- In case the kind isn`t what you are looking for, take advantage of the Research area to obtain the kind that suits you and demands.

- Whenever you obtain the correct kind, simply click Acquire now.

- Opt for the rates strategy you desire, fill out the specified info to make your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper formatting and acquire your copy.

Get every one of the record templates you have bought in the My Forms menu. You can obtain a additional copy of South Carolina Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights any time, if required. Just select the required kind to acquire or print out the record web template.

Use US Legal Forms, by far the most substantial variety of legitimate kinds, in order to save time and prevent mistakes. The service offers skillfully produced legitimate record templates that you can use for a selection of functions. Produce an account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Non-statutory stock options are also known as a non-qualified stock options. These are a stock option for employees, but also for vendors, the board of directors, contractors, and anyone else the company issues them to. They are named as such because the will not qualify within the strict guidelines of ISOs.

Nonstatutory stock options are a type of stock option granted by an employer to an employee that allows the employee to buy the company's stock at a preset price at a later date. Unlike statutory stock options, nonstatutory stock options are not part of an employee stock purchase plan or incentive stock option plan.

What would cause a nonstatutory stock option to be taxable upon grant? Nonstatutory stock options are never taxable upon grant. If the value of the stock option was readily determinable at the time of grant. If the stock option was fully vested at the time of the grant.

Options that exceed the $200,000 threshold are ?non-qualified securities? and thus do not qualify for the Stock Option Deduction.

Non-statutory stock options are also known as a non-qualified stock options. These are a stock option for employees, but also for vendors, the board of directors, contractors, and anyone else the company issues them to. They are named as such because the will not qualify within the strict guidelines of ISOs.

If this amount is not included in Box 1 of Form W-2, add it as "Other Income" on your Form 1040. Report the sale on your 2023 Schedule D, Part I as a short-term sale. The sale is short-term because not more than one year passed between the date you acquired the actual stock and the date you sold it.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.