A South Carolina Stock Option Agreement is a legally binding contract that outlines the terms and conditions under which Shore wood Packaging Corp. and Jefferson Capital Group, Ltd engages in a stock option arrangement. The agreement is a strategic collaboration between these two entities in the state of South Carolina, allowing Shore wood Packaging Corp. to grant stock options to Jefferson Capital Group, Ltd. This agreement provides Jefferson Capital Group, Ltd with the opportunity to purchase a specific number of shares in the company at a predetermined price within a specified timeframe. The South Carolina Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd ensures a mutually beneficial relationship. The primary purpose is to incentivize Jefferson Capital Group, Ltd employees or stakeholders by granting them the right to purchase the company's stock at a discounted price. This agreement thus acts as a motivating factor and aligns the interests of both parties. Keywords: South Carolina, Stock Option Agreement, Shore wood Packaging Corp., Jefferson Capital Group, Ltd, collaboration, strategic, legally binding, terms and conditions, stock options, purchase, shares, predetermined price, timeframe, incentivize, stakeholders, employees, discounted price, motivating factor, interests. Several types of South Carolina Stock Option Agreements can be established between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd, namely: 1. Employee Stock Option Agreement: This type of agreement is designed to provide stock options to employees of Jefferson Capital Group, Ltd. It acts as an incentive to attract and retain talented individuals within the organization. 2. Contractor Stock Option Agreement: This agreement is established for contractors or consultants working with Jefferson Capital Group, Ltd. It grants them the opportunity to own company stock, motivating them to provide high-quality services and actively contribute to the company's growth. 3. Investor Stock Option Agreement: In situations where Jefferson Capital Group, Ltd invests in Shore wood Packaging Corp., this agreement is put in place. It allows Jefferson Capital Group, Ltd to purchase company stock at a predetermined price, providing them with ownership benefits. 4. Board of Directors Stock Option Agreement: This agreement is established specifically for members of the board of directors of Jefferson Capital Group, Ltd. It serves as a means to incentivize and align the interests of directors with the company's overall success. Each type of South Carolina Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd serves a unique purpose, but all of them share the goal of promoting collaboration and fostering a mutually beneficial relationship.

South Carolina Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd

Description

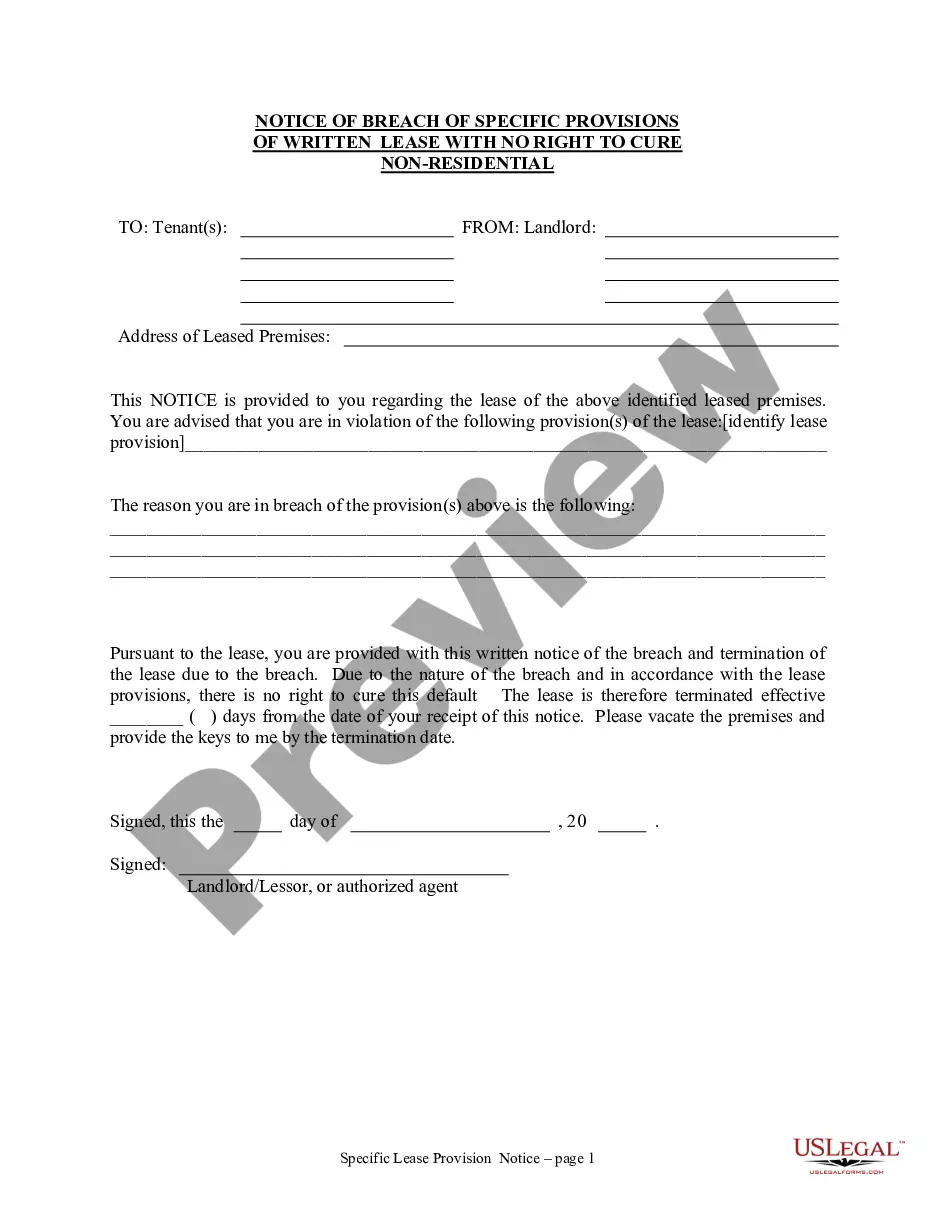

How to fill out South Carolina Stock Option Agreement Between Shorewood Packaging Corp. And Jefferson Capital Group, Ltd?

US Legal Forms - one of several greatest libraries of lawful kinds in America - gives a wide array of lawful record layouts you are able to obtain or printing. Utilizing the internet site, you may get 1000s of kinds for business and person uses, categorized by groups, claims, or keywords.You can find the most up-to-date types of kinds like the South Carolina Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd in seconds.

If you already have a membership, log in and obtain South Carolina Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd from your US Legal Forms library. The Download option can look on each and every form you look at. You have access to all formerly saved kinds within the My Forms tab of your profile.

If you would like use US Legal Forms initially, allow me to share easy directions to obtain began:

- Be sure you have picked out the right form to your metropolis/area. Click on the Review option to examine the form`s articles. Browse the form information to actually have selected the correct form.

- If the form doesn`t satisfy your requirements, make use of the Lookup industry towards the top of the monitor to obtain the one who does.

- Should you be content with the shape, verify your decision by visiting the Get now option. Then, choose the pricing program you favor and give your accreditations to sign up to have an profile.

- Approach the purchase. Make use of your Visa or Mastercard or PayPal profile to complete the purchase.

- Find the formatting and obtain the shape on your own device.

- Make changes. Load, revise and printing and sign the saved South Carolina Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd.

Every single format you included in your bank account lacks an expiration time and is also yours permanently. So, if you would like obtain or printing one more backup, just check out the My Forms area and then click about the form you will need.

Get access to the South Carolina Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd with US Legal Forms, one of the most extensive library of lawful record layouts. Use 1000s of expert and express-specific layouts that meet up with your business or person requirements and requirements.