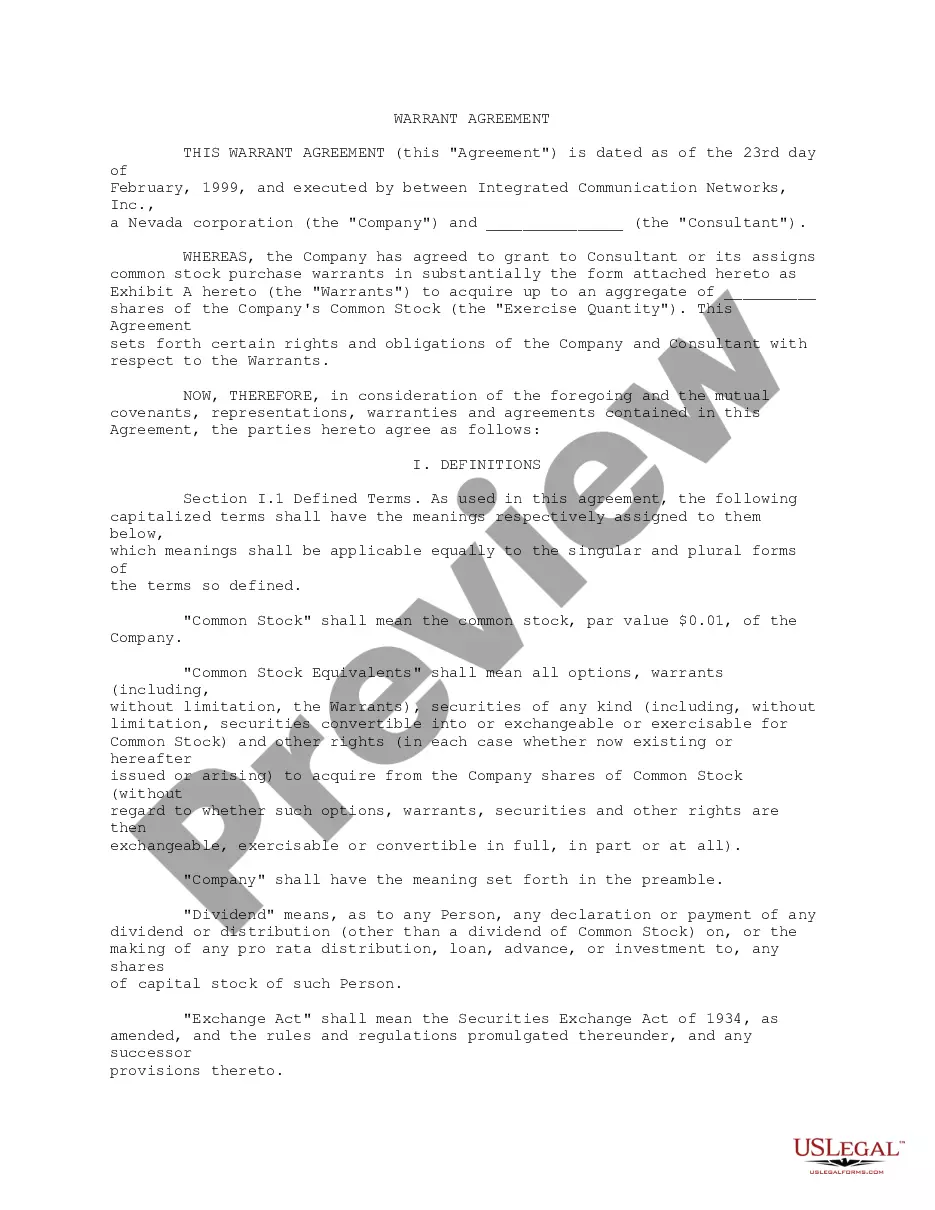

This is a form of Warrant to purchase shares of common stock in a corporation. It is a type of security issued by a corporation (usually together with a bond or preferred stock) that gives the holder the right to purchase a certain amount of common stock at a stated price.

South Carolina Common Stock Purchase Warrant

Description

How to fill out Common Stock Purchase Warrant?

Are you presently in a position where you will need files for sometimes company or individual reasons nearly every day? There are a lot of legitimate papers web templates available on the net, but finding kinds you can trust isn`t simple. US Legal Forms offers a large number of form web templates, much like the South Carolina Common Stock Purchase Warrant, which are created to fulfill federal and state demands.

If you are already knowledgeable about US Legal Forms internet site and have your account, simply log in. Following that, you may down load the South Carolina Common Stock Purchase Warrant format.

Should you not offer an account and want to begin using US Legal Forms, follow these steps:

- Get the form you need and ensure it is for that appropriate city/area.

- Take advantage of the Review key to analyze the shape.

- Read the outline to ensure that you have chosen the right form.

- If the form isn`t what you are seeking, use the Research discipline to find the form that fits your needs and demands.

- Once you find the appropriate form, simply click Purchase now.

- Pick the pricing strategy you desire, submit the required information and facts to produce your bank account, and pay for the transaction using your PayPal or bank card.

- Decide on a hassle-free document file format and down load your copy.

Get every one of the papers web templates you have purchased in the My Forms food list. You may get a additional copy of South Carolina Common Stock Purchase Warrant whenever, if necessary. Just select the necessary form to down load or produce the papers format.

Use US Legal Forms, the most extensive collection of legitimate forms, to save lots of time as well as avoid faults. The assistance offers professionally manufactured legitimate papers web templates that can be used for a selection of reasons. Generate your account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

The benefit corporation law allows for the creation of a new and voluntary corporate entity that will allow businesses to consider profit as well as society and the environment. This form of incorporation allows a business to balance fiduciary duty between its shareholders and stakeholders.

(a) Unless prohibited or limited by the articles or bylaws, any action that may be taken at any annual, regular, or special meeting of members may be taken without a meeting if the corporation delivers a written or electronic ballot to every member entitled to vote on the matter.

South Carolina Business Corporation Act of 1988 defines a Corporation or Domestic Corporation as a corporation incorporated for profit and not a foreign corporation. Any person may act as the incorporator of a corporation by delivering articles of incorporation to the Secretary of State for filing.

Rule 701, adopted pursuant to Section 3(b) of the Securities Act of 1933, as amended (the ?Securities Act?),1 provides an exemption from the registration requirements of the Securities Act for certain offers and sales of securities made pursuant to the terms of compensatory benefit plans or written contracts relating ...

SECTION 33-44-202. Organization. (a) One or more persons may organize a limited liability company, consisting of one or more members, by delivering articles of organization to the office of the Secretary of State for filing.

South Carolina Code of Laws Sections 33-44-108 through 33-44-111 contain the state law governing registered agents for limited liability companies. This includes the need to have an agent and office for service of process, the procedures for changing the agent or office, and what an agent must do to resign.