South Carolina Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

Are you inside a situation that you require paperwork for either business or specific purposes almost every day time? There are plenty of lawful papers web templates available online, but discovering versions you can rely on is not easy. US Legal Forms delivers 1000s of form web templates, much like the South Carolina Deferred Compensation Investment Account Plan, which are created to fulfill federal and state requirements.

In case you are previously familiar with US Legal Forms web site and have a free account, simply log in. Next, you are able to down load the South Carolina Deferred Compensation Investment Account Plan format.

Unless you come with an account and want to begin using US Legal Forms, abide by these steps:

- Get the form you require and make sure it is for that right city/region.

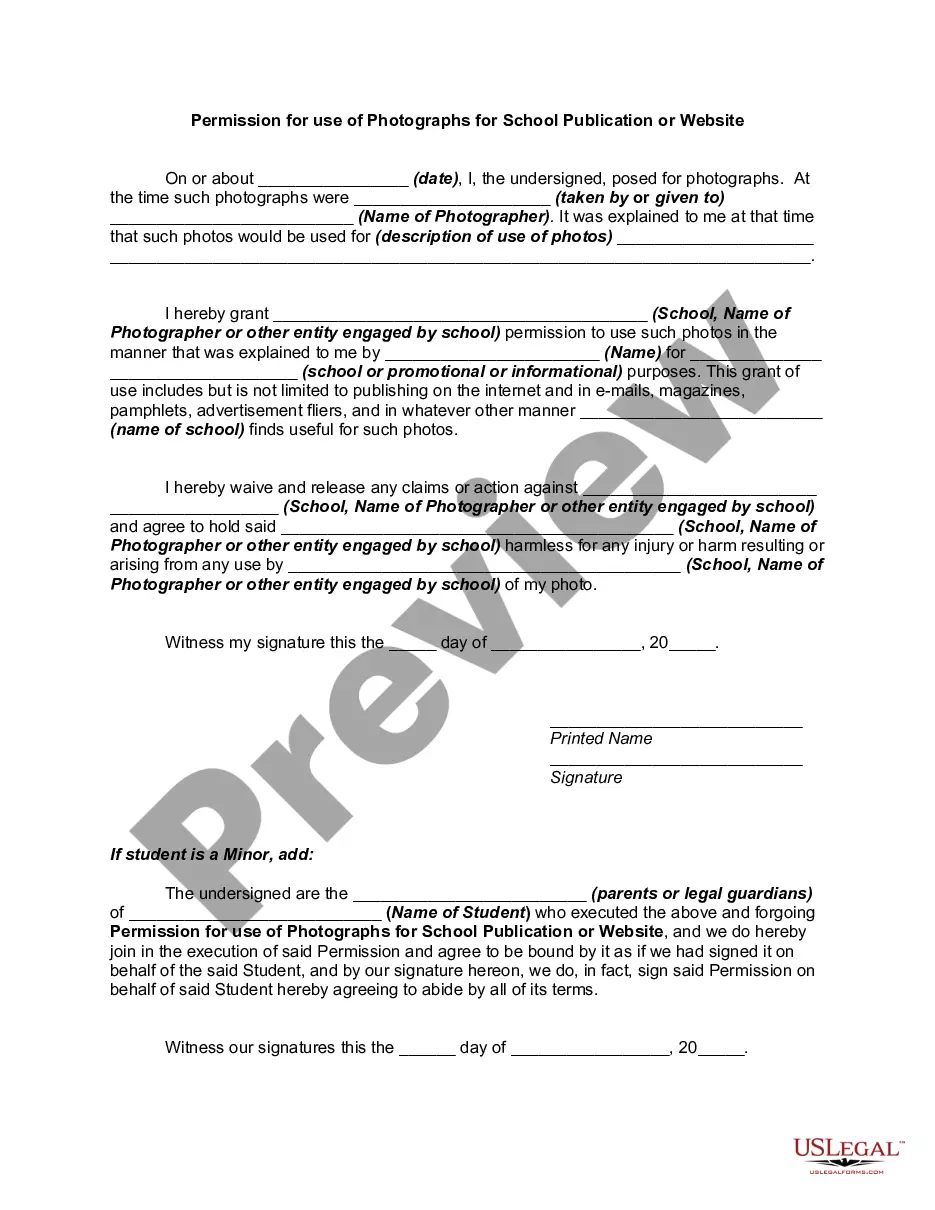

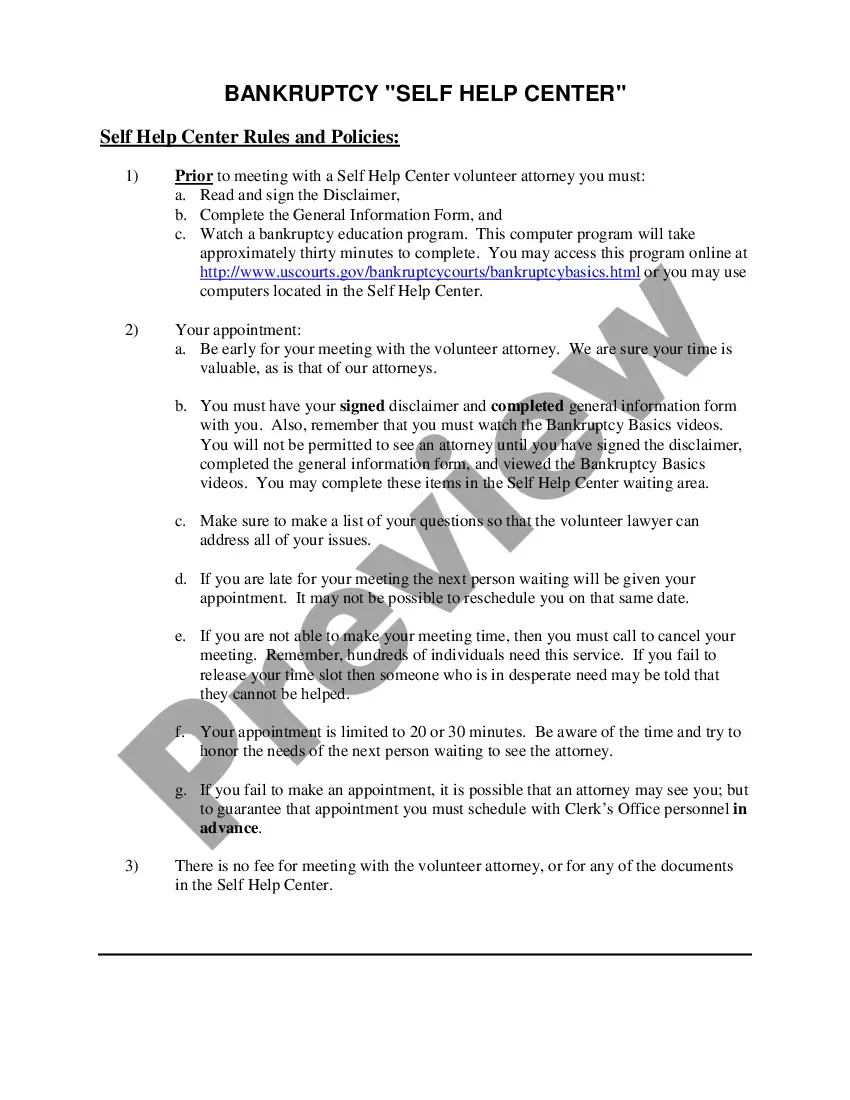

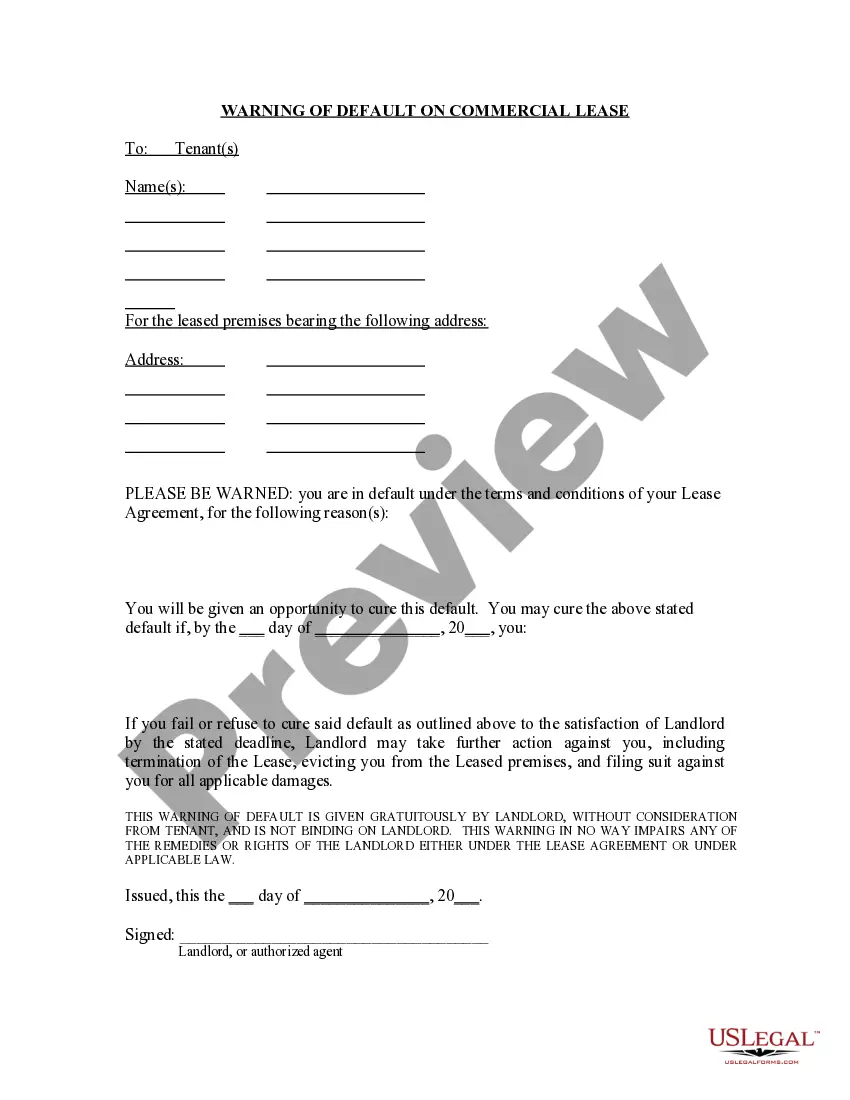

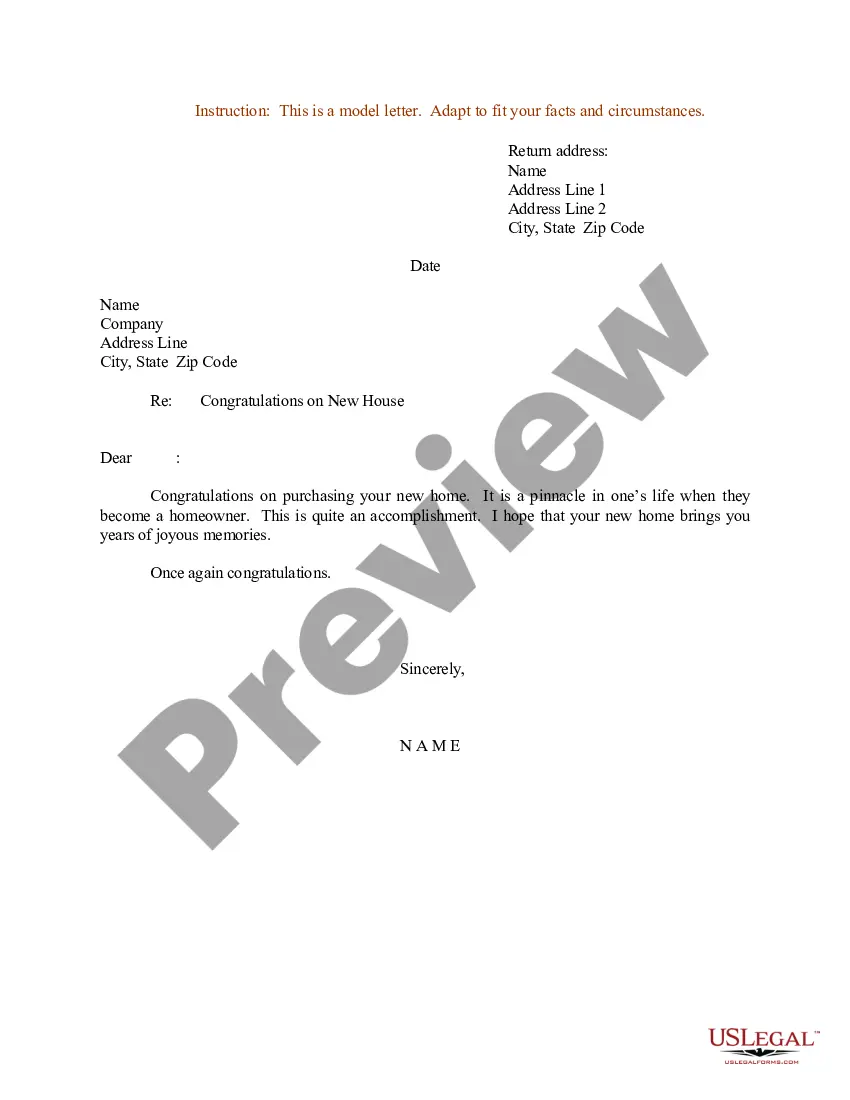

- Use the Preview option to check the form.

- Look at the description to actually have selected the right form.

- In the event the form is not what you`re looking for, take advantage of the Research industry to get the form that meets your needs and requirements.

- Once you discover the right form, just click Buy now.

- Select the prices plan you want, fill in the required information to produce your money, and pay for your order using your PayPal or Visa or Mastercard.

- Pick a hassle-free file structure and down load your backup.

Get all of the papers web templates you have bought in the My Forms food selection. You may get a further backup of South Carolina Deferred Compensation Investment Account Plan whenever, if possible. Just select the required form to down load or produce the papers format.

Use US Legal Forms, the most extensive assortment of lawful forms, to save time and prevent mistakes. The support delivers skillfully manufactured lawful papers web templates that can be used for a range of purposes. Create a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Note: Your deferred compensation is not placed directly into an investment, but you designate investment choices for bookkeeping purposes. Your employer uses your choices as a benchmark to calculate the appropriate investment returns owed during the deferral period.

The South Carolina Deferred Compensation Program (Program) is a voluntary program that gives you a tool to save and invest extra money for retirement through before-tax and after-tax contributions.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

If people are not comfortable leaving deferred compensation in the hands of their employer, pre-retirement distributions allow them to protect their money by withdrawing it from the plan, paying tax on it, and investing it elsewhere.

One potential exception is performance based compensation (PBC). If a deferral qualifies as PBC under Section 409A rules, deferral elections can be changed or cancelled as long as that change occurs with at least six months remaining in the performance period.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.