South Carolina Proposal to Approve Restricted Stock Plan: A Comprehensive Overview Introduction: In South Carolina, a proposal is underway to approve a restricted stock plan, aimed at providing companies with a strategic mechanism for rewarding and retaining key employees. This proposal seeks to outline the key provisions and guidelines for implementing such a plan, ensuring fair and equitable distribution of restricted stock among eligible participants. This description will delve into the intricate details of the South Carolina Proposal to Approve Restricted Stock Plan, highlighting its various types and emphasizing relevant keywords for easy comprehension. Types of South Carolina Proposal to Approve Restricted Stock Plan: 1. Employee Stock Ownership Plan (ESOP): One type of restricted stock plan gaining popularity in South Carolina is the Employee Stock Ownership Plan. This plan allows eligible employees to acquire a certain percentage of company stocks, which are held in a trust until a predetermined vesting period or specific conditions are met. Sops foster a greater sense of ownership and loyalty among employees, aligning their interests with that of the company's growth and success. 2. Performance-Based Restricted Stock Plan: Another variant of the South Carolina Proposal to Approve Restricted Stock Plan is the Performance-Based Restricted Stock Plan. Under this arrangement, stock grants are awarded based on predefined performance goals and objectives. Participants must achieve specific milestones and targets to unlock the granted shares fully. This type of plan incentivizes employees to drive results, boosting productivity, and nurturing a performance-driven culture within organizations. Key Provisions of the South Carolina Proposal: 1. Eligibility Criteria: The proposal will outline the criteria that determine who can participate in the restricted stock plan. Typically, eligibility is based on an employee's tenure, level of responsibility, and contribution to the company's growth and success. 2. Vesting Schedule: A vesting schedule determines when an employee gains full ownership/control over the granted shares. The South Carolina Proposal will define a suitable vesting period, which could be determined by years of service, achievement of specific performance goals, or a combination of both. 3. Transferability: The proposal will provide clarity on whether participants can sell, transfer, or pledge their restricted stock, if allowed at all. Restrictions on transferability aim to prevent stock dilution and retain the intended benefits within the organization. 4. Dividend Rights: The South Carolina Proposal will specify the treatment of dividend rights concerning restricted stock. This provision determines whether participants are entitled to receive dividends during the vesting period or only after complete ownership is attained. 5. Termination and Forfeiture: The proposal outlines the circumstances that lead to the termination of the restricted stock plan. It will detail the consequences should an employee voluntarily leave the company or be terminated before the shares fully vest. This provision protects the organization's interests and ensures that the plan fulfills its intended purpose. Conclusion: The South Carolina Proposal to Approve Restricted Stock Plan aims to introduce a transparent and efficient mechanism for incentivizing employees while promoting long-term commitment and loyalty. By carefully delineating the types of plans available, along with their key provisions, the proposal aims to provide clarity, fairness, and legal structure to the implementation of restricted stock plans within South Carolina companies. Embracing such plans fosters employee engagement, helps attract top talent, and contributes to the overall growth and stability of organizations.

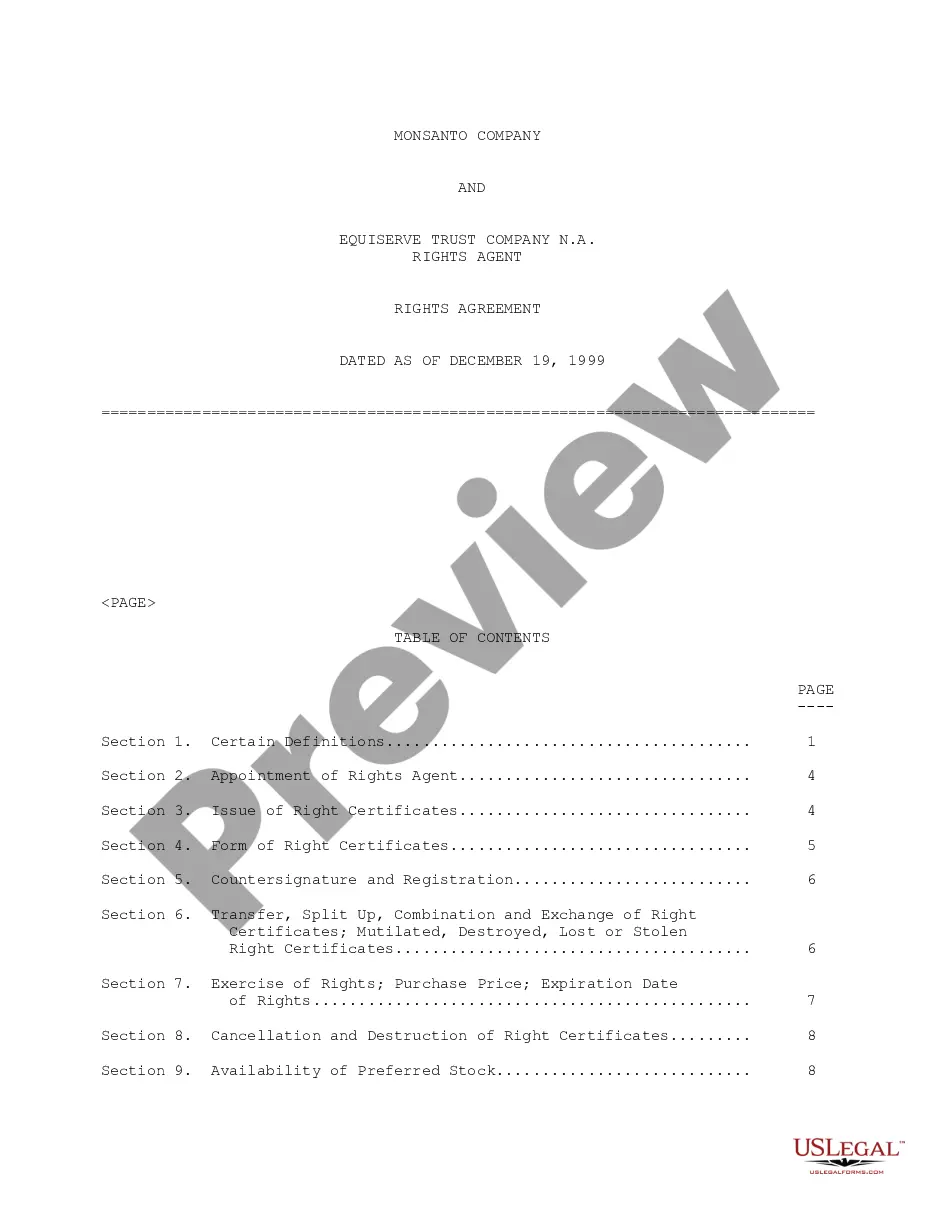

South Carolina Proposal to approve restricted stock plan

Description

How to fill out South Carolina Proposal To Approve Restricted Stock Plan?

Are you presently in a placement the place you will need papers for sometimes company or personal functions just about every time? There are a variety of legitimate papers layouts accessible on the Internet, but getting types you can rely on isn`t effortless. US Legal Forms offers thousands of develop layouts, just like the South Carolina Proposal to approve restricted stock plan, which can be composed to fulfill federal and state needs.

In case you are currently familiar with US Legal Forms site and also have a free account, merely log in. Next, it is possible to obtain the South Carolina Proposal to approve restricted stock plan design.

If you do not come with an profile and wish to start using US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is to the right town/area.

- Utilize the Review key to check the form.

- Read the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re searching for, use the Research discipline to find the develop that fits your needs and needs.

- When you get the right develop, just click Buy now.

- Opt for the pricing strategy you desire, fill out the desired information to make your bank account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free data file structure and obtain your backup.

Locate each of the papers layouts you possess purchased in the My Forms menus. You can obtain a extra backup of South Carolina Proposal to approve restricted stock plan any time, if needed. Just select the essential develop to obtain or print out the papers design.

Use US Legal Forms, by far the most comprehensive selection of legitimate forms, to save some time and prevent faults. The service offers expertly produced legitimate papers layouts which can be used for an array of functions. Make a free account on US Legal Forms and initiate producing your daily life easier.