South Carolina Supplemental Retirement Plan

Description

How to fill out Supplemental Retirement Plan?

If you have to comprehensive, obtain, or print legitimate file themes, use US Legal Forms, the largest collection of legitimate varieties, that can be found on-line. Utilize the site`s basic and hassle-free search to find the documents you need. Different themes for business and individual functions are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to find the South Carolina Supplemental Retirement Plan with a couple of clicks.

When you are presently a US Legal Forms buyer, log in to the bank account and then click the Down load switch to obtain the South Carolina Supplemental Retirement Plan. You can also access varieties you formerly delivered electronically in the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper city/country.

- Step 2. Take advantage of the Preview option to look through the form`s information. Do not overlook to learn the explanation.

- Step 3. When you are not satisfied using the develop, utilize the Research industry towards the top of the display screen to discover other versions of your legitimate develop template.

- Step 4. When you have located the shape you need, go through the Buy now switch. Choose the pricing program you favor and add your qualifications to register for the bank account.

- Step 5. Approach the deal. You may use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Pick the structure of your legitimate develop and obtain it on your device.

- Step 7. Total, revise and print or indication the South Carolina Supplemental Retirement Plan.

Every legitimate file template you buy is your own property eternally. You possess acces to every develop you delivered electronically within your acccount. Click on the My Forms section and select a develop to print or obtain yet again.

Contend and obtain, and print the South Carolina Supplemental Retirement Plan with US Legal Forms. There are thousands of professional and condition-distinct varieties you can use for the business or individual needs.

Form popularity

FAQ

You have immediate rights to your entire account State ORP balance, including employee and employer contributions, when you terminate employment or reach age 59 ½.

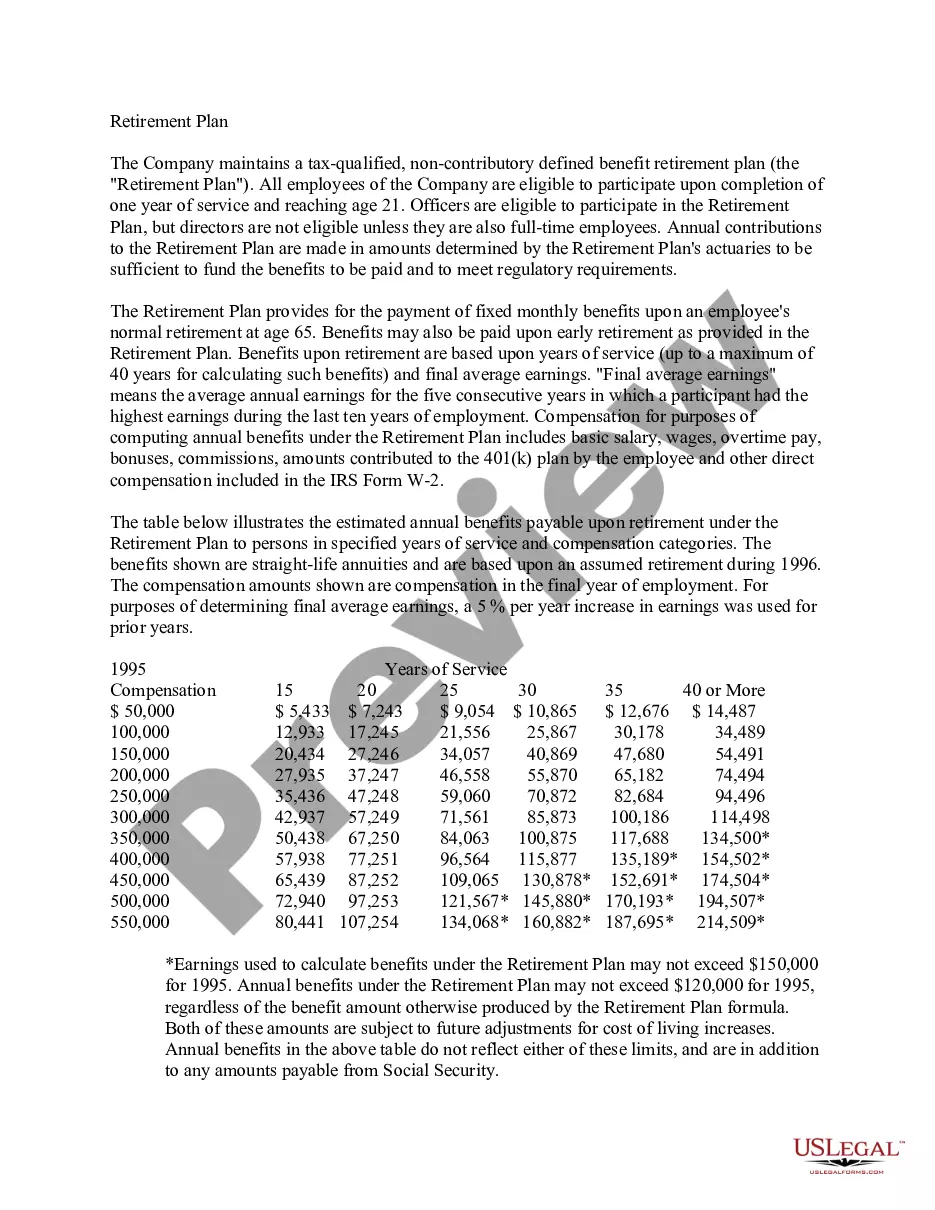

Monthly retirement benefit is based on a formula (1.82% of average final compensation multiplied by years of service), not on your account balance at retirement. Current state law provides for an annual benefit adjustment of 1% of your annual benefit up to a maximum of $500 per year.

Under SCRS, you are eligible to retire with an unreduced benefit if you have at least eight years of earned service credit and: Met the Rule of 90 requirement; or ? Reached age 65. The Rule of 90 means your age and your years of service total 90.

An employee is vested in the System after eight (8) years of full-time service and may draw an annuity upon eligibility.

SCRS provides a fixed monthly benefit based on a formula that includes your average final compensation, years of service credit and a benefit multiplier, not on your account balance at retirement. The plan assumes life expectancy and investment risk.

For most people, that amounts to at least five years of CalPERS-credited service. But there are a few other factors involved. To be vested, you must actually meet two requirements: age and service credit.

A supplemental retirement plan gives your top employees a chance to save more once they've maxed out their contribution to a qualified plan, which can increase engagement and retention.

SC Retirement System Traditional Pension Plan (SCRS) You must have a minimum of 5 years of earned service (Class II members) or 8 years of earned service (Class III members) to be eligible to receive a retirement annuity. Learn more about the SCRS Plan.