South Carolina Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Are you in a situation that you require files for both organization or specific reasons virtually every day time? There are tons of legitimate record themes available online, but locating kinds you can depend on is not effortless. US Legal Forms delivers 1000s of kind themes, such as the South Carolina Retirement Benefits Plan, which can be written to satisfy federal and state requirements.

If you are currently knowledgeable about US Legal Forms site and get a merchant account, just log in. Afterward, it is possible to acquire the South Carolina Retirement Benefits Plan design.

If you do not provide an bank account and need to start using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for your appropriate town/state.

- Take advantage of the Preview switch to analyze the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- In the event the kind is not what you are searching for, utilize the Look for discipline to get the kind that fits your needs and requirements.

- When you discover the appropriate kind, simply click Acquire now.

- Opt for the rates strategy you would like, fill in the desired information and facts to make your money, and purchase an order using your PayPal or bank card.

- Select a hassle-free file file format and acquire your duplicate.

Get each of the record themes you might have bought in the My Forms menu. You can obtain a additional duplicate of South Carolina Retirement Benefits Plan anytime, if possible. Just select the required kind to acquire or print the record design.

Use US Legal Forms, by far the most extensive selection of legitimate kinds, in order to save time and steer clear of errors. The services delivers professionally manufactured legitimate record themes which you can use for a selection of reasons. Produce a merchant account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

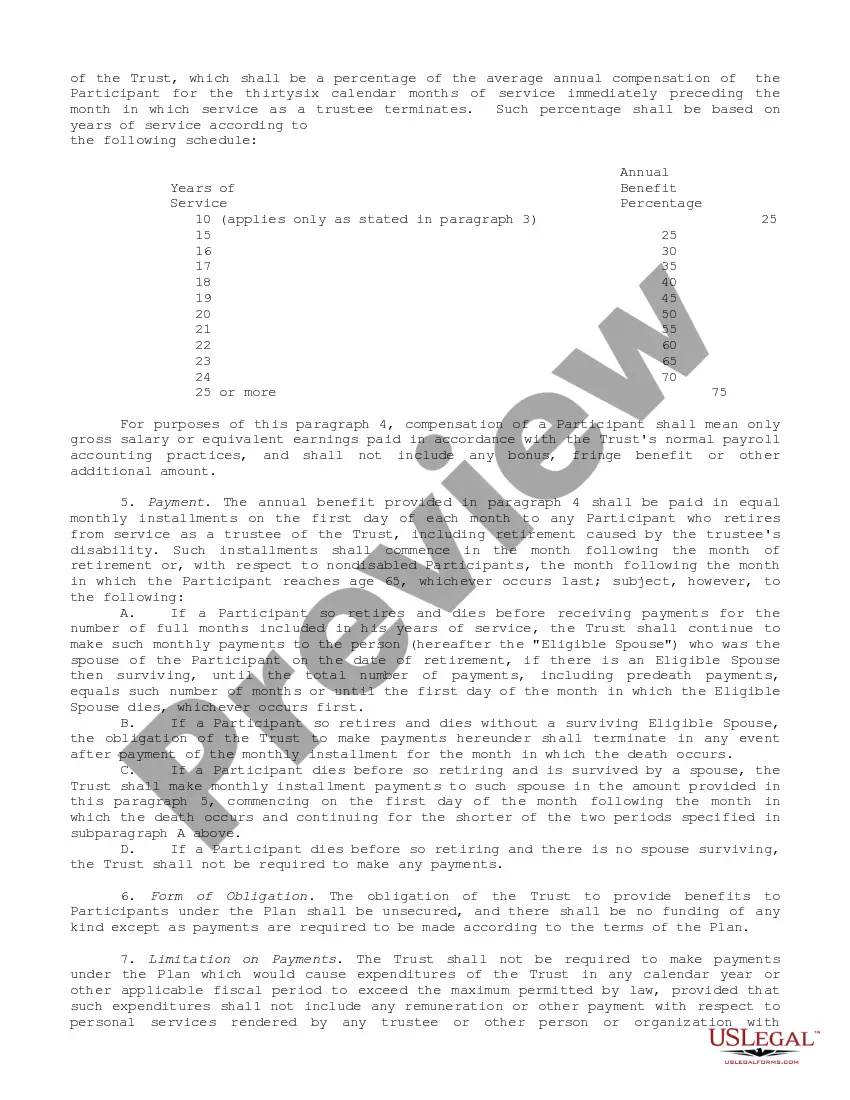

Monthly retirement benefit is based on a formula (1.82% of average final compensation multiplied by years of service), not on your account balance at retirement. Current state law provides for an annual benefit adjustment of 1% of your annual benefit up to a maximum of $500 per year.

South Carolina does not tax Social Security benefits. Plus, it offers a retirement income deduction of up to $15,000 for individuals over the age of 65. This is a great advantage to stretch that retirement income as far as possible.

SC Retirement System Traditional Pension Plan (SCRS) You must have a minimum of 5 years of earned service (Class II members) or 8 years of earned service (Class III members) to be eligible to receive a retirement annuity. Learn more about the SCRS Plan.

If you leave your job and terminate all covered employment before you are eligible to retire, you have two options concerning your contributions: request a refund of your contributions plus interest earned on your account or leave your funds in your retirement account with PEBA.

For most people, that amounts to at least five years of CalPERS-credited service. But there are a few other factors involved. To be vested, you must actually meet two requirements: age and service credit.

Each year purchased cannot cost less than 16% of career- highest salary. Member must have: Active PORS account; and ? Non-concurrent SCRS service, meaning the SCRS service is for a period of time not already covered by PORS service.

An employee is vested in the System after eight (8) years of full-time service and may draw an annuity upon eligibility.