South Carolina Results of voting for directors at three previous stockholders meetings

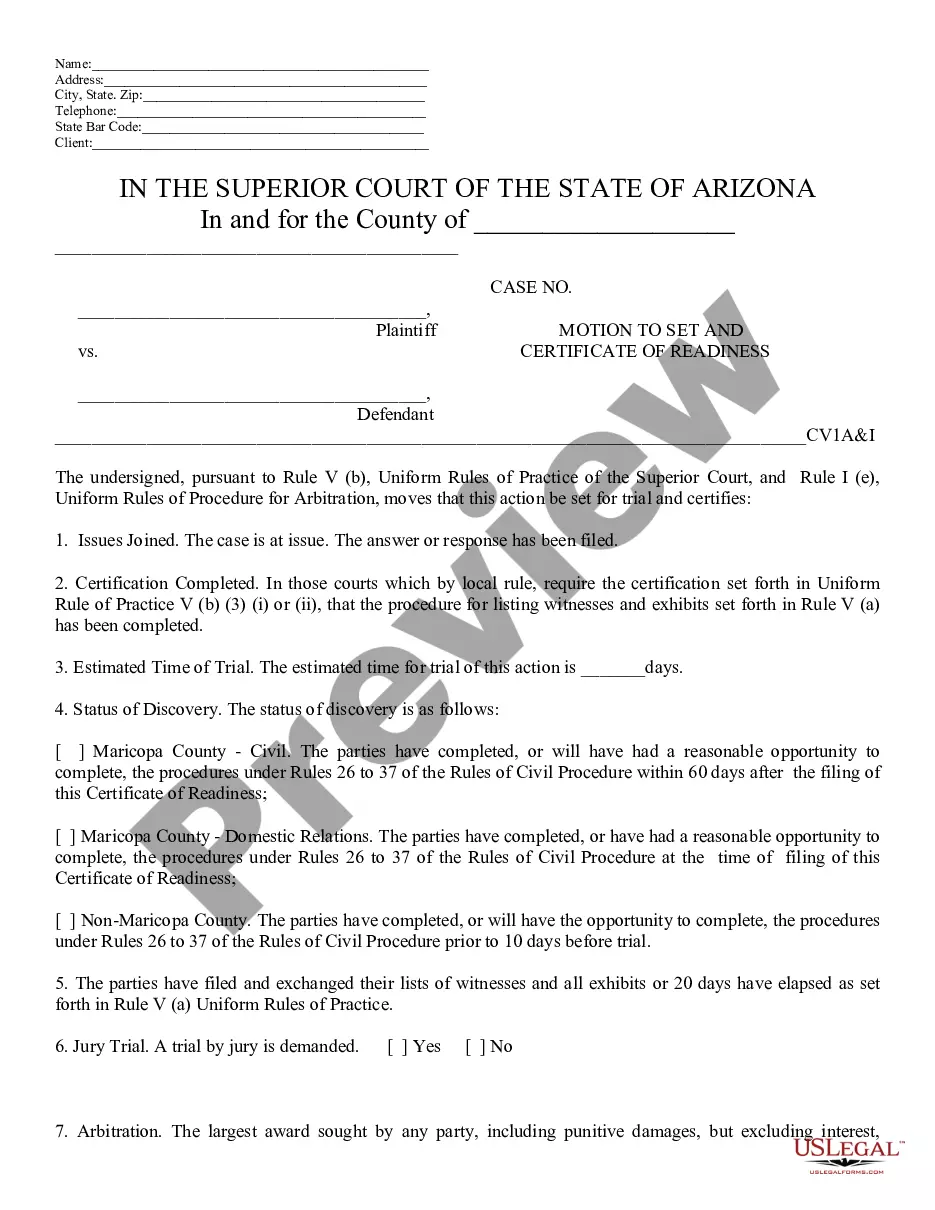

Description

How to fill out Results Of Voting For Directors At Three Previous Stockholders Meetings?

You are able to devote hrs online searching for the legal document template that meets the federal and state requirements you will need. US Legal Forms supplies a large number of legal forms that are examined by experts. You can easily download or print out the South Carolina Results of voting for directors at three previous stockholders meetings from my assistance.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Download button. After that, it is possible to total, change, print out, or indicator the South Carolina Results of voting for directors at three previous stockholders meetings. Every legal document template you buy is your own permanently. To get yet another version of any acquired form, visit the My Forms tab and click on the related button.

If you work with the US Legal Forms website initially, follow the basic directions under:

- Very first, ensure that you have selected the proper document template for that region/city of your choosing. Look at the form description to ensure you have selected the correct form. If accessible, make use of the Review button to check from the document template as well.

- If you would like find yet another version in the form, make use of the Research area to obtain the template that suits you and requirements.

- After you have located the template you want, simply click Get now to proceed.

- Choose the costs program you want, key in your credentials, and register for a free account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal profile to purchase the legal form.

- Choose the formatting in the document and download it for your device.

- Make alterations for your document if required. You are able to total, change and indicator and print out South Carolina Results of voting for directors at three previous stockholders meetings.

Download and print out a large number of document web templates utilizing the US Legal Forms Internet site, that provides the greatest selection of legal forms. Use specialist and condition-particular web templates to handle your organization or person needs.

Form popularity

FAQ

Registered shareholders, their proxies, directors and the auditors are entitled to speak at the meeting. The majority can determine who else is entitled to speak. Beneficial shareholders do not have a right to speak, but are typically afforded this privilege unless they are disruptive.

(1) The board of a company, or any other person specified in the company's Memorandum of Incorporation or rules, may call a shareholders meeting at any time.

A Shareholders' Consent to Action Without Meeting, or a consent resolution, is a written statement that describes and validates a course of action taken by the shareholders of a particular corporation without a meeting having to take place between directors and/or shareholders.

A general meeting can be called (ie initiated) either by the company directors or requested by the company shareholders. Different periods of notice are required depending on how a general meeting is being called, the type of company calling it, and whether or not the meeting is an AGM.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders. The bylaws or CoI needs to specify this, though.

The typical lower threshold is 10% of the shares, while most others require either 25% of the shares (Microsoft's level) or 50% or 51% of the shares. Most companies that allow shareholders to call a special shareholder meeting use one of these standards.

A general meeting can be called (ie initiated) either by the company directors or requested by the company shareholders. Different periods of notice are required depending on how a general meeting is being called, the type of company calling it, and whether or not the meeting is an AGM.