The South Carolina Supplemental Employee Stock Ownership Plan (ESOP) of SIX Corporations is a retirement benefit program offered to eligible employees of SIX Corporations based in South Carolina. As an ESOP, this plan enables employees to become partial owners of the company by allocating shares of SIX Corporations stock to their retirement accounts. The program serves as an additional retirement savings option, providing employees with the opportunity to build wealth and benefit from the company's success. The South Carolina Supplemental ESOP is designed to supplement the primary retirement plan offered by SIX Corporations, enhancing the retirement benefits package for eligible employees. It allows participants to accumulate shares of SIX Corporations stock over time, ensuring that their financial future is closely aligned with the company's performance and long-term growth. This ESOP is a tax-advantaged plan, meaning it offers certain tax benefits to participants. Contributions made by the company towards the ESOP are tax-deductible, while participants can defer taxes on the accumulated stock until they decide to sell or distribute their shares. Participation in the South Carolina Supplemental ESOP is typically voluntary and requires employees to meet certain eligibility criteria, such as a minimum period of service and/or hours worked. Eligible participants can contribute a portion of their salary towards the ESOP, with the company potentially providing matching contributions based on preset formulas or criteria. Participants in the South Carolina Supplemental ESOP may have the ability to diversify their investments by allocating their contributions into different investment funds or options based on their risk tolerance and long-term financial goals. While specific variations or types of the South Carolina Supplemental ESOP of SIX Corporations may exist, such as differing contribution formulas or vesting schedules, this detailed description provides a general overview of the plan's purpose, benefits, and essential features.

South Carolina Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

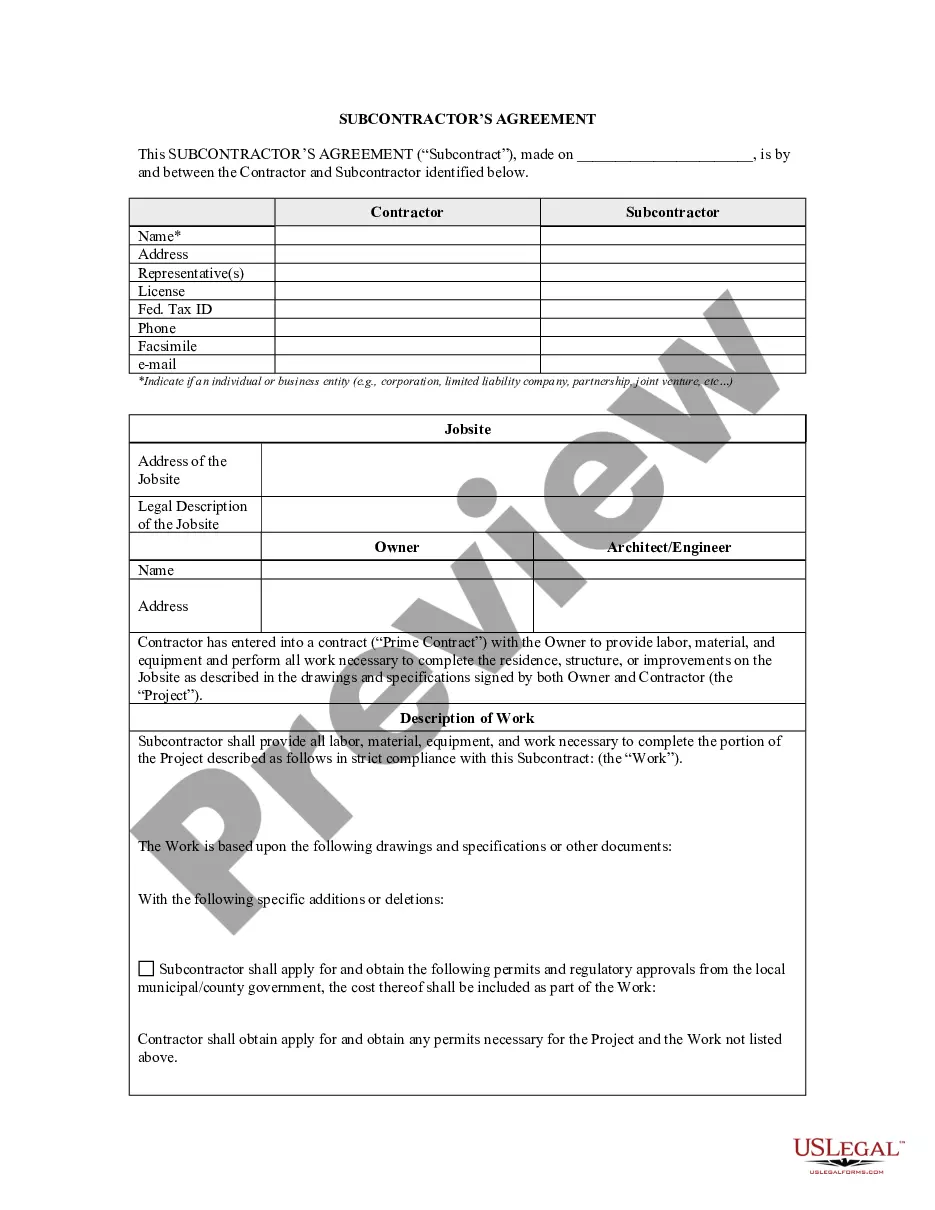

How to fill out South Carolina Supplemental Employee Stock Ownership Plan Of SPX Corporation?

Choosing the best legal record design can be quite a have difficulties. Obviously, there are tons of web templates available on the Internet, but how can you obtain the legal develop you will need? Take advantage of the US Legal Forms site. The assistance offers thousands of web templates, such as the South Carolina Supplemental Employee Stock Ownership Plan of SPX Corporation, which can be used for company and personal requires. Every one of the types are checked out by pros and satisfy federal and state requirements.

Should you be presently signed up, log in for your accounts and click the Acquire key to obtain the South Carolina Supplemental Employee Stock Ownership Plan of SPX Corporation. Use your accounts to search throughout the legal types you have ordered previously. Go to the My Forms tab of your accounts and have another backup in the record you will need.

Should you be a new customer of US Legal Forms, listed here are simple directions for you to comply with:

- First, make sure you have chosen the appropriate develop for your personal town/area. It is possible to check out the form using the Review key and browse the form outline to make sure it will be the best for you.

- When the develop will not satisfy your needs, take advantage of the Seach industry to obtain the proper develop.

- Once you are sure that the form is acceptable, select the Buy now key to obtain the develop.

- Choose the pricing prepare you desire and enter in the needed details. Build your accounts and pay for the transaction making use of your PayPal accounts or bank card.

- Select the document structure and download the legal record design for your device.

- Complete, revise and print out and sign the acquired South Carolina Supplemental Employee Stock Ownership Plan of SPX Corporation.

US Legal Forms is the biggest local library of legal types in which you can see a variety of record web templates. Take advantage of the company to download expertly-manufactured paperwork that comply with state requirements.