South Carolina Proposal to amend the restated articles of incorporation to create a second class of common stock

Description

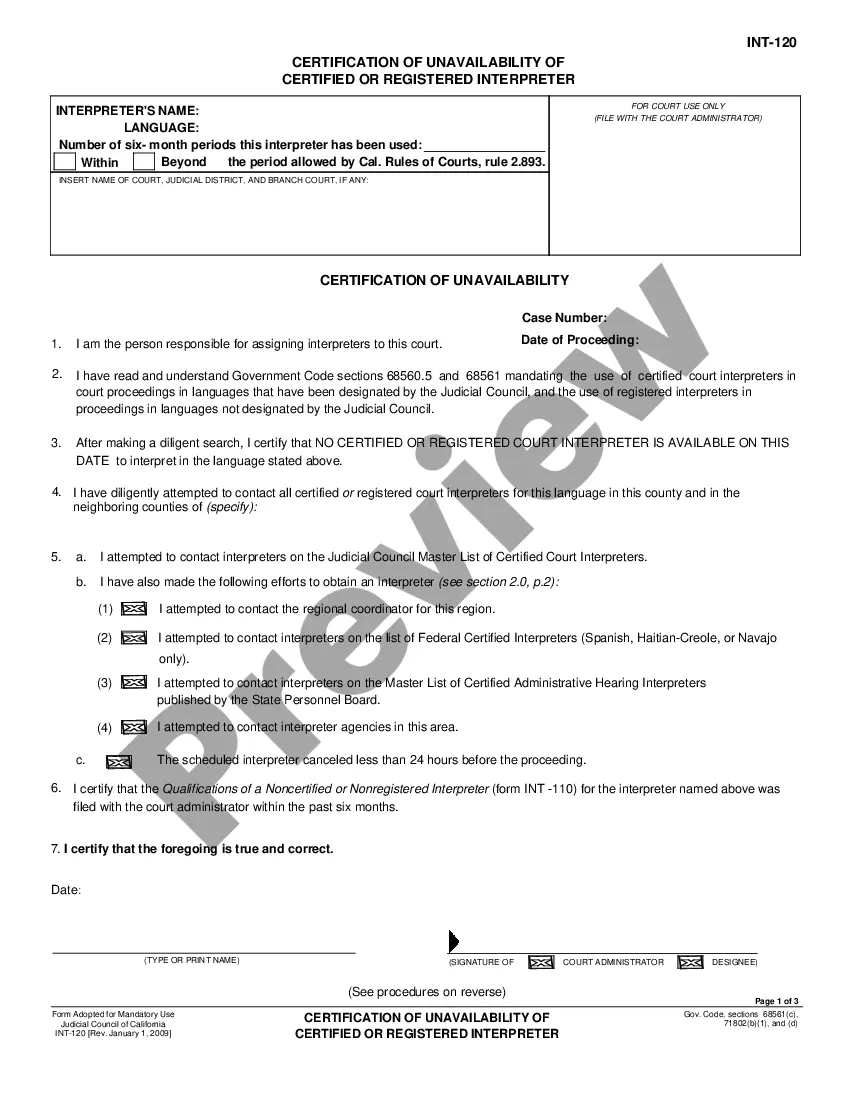

How to fill out Proposal To Amend The Restated Articles Of Incorporation To Create A Second Class Of Common Stock?

US Legal Forms - among the most significant libraries of lawful varieties in the USA - offers a wide array of lawful record templates you may download or print out. Making use of the web site, you can get a huge number of varieties for enterprise and individual purposes, categorized by categories, states, or keywords.You can get the most up-to-date versions of varieties such as the South Carolina Proposal to amend the restated articles of incorporation to create a second class of common stock in seconds.

If you have a registration, log in and download South Carolina Proposal to amend the restated articles of incorporation to create a second class of common stock in the US Legal Forms collection. The Download switch can look on each kind you view. You get access to all earlier delivered electronically varieties within the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed below are simple instructions to obtain started off:

- Be sure you have picked the best kind to your metropolis/state. Select the Review switch to examine the form`s articles. Read the kind information to ensure that you have chosen the correct kind.

- In the event the kind does not satisfy your needs, use the Search area on top of the monitor to get the one that does.

- Should you be pleased with the shape, verify your selection by clicking the Get now switch. Then, pick the costs program you favor and supply your qualifications to sign up for an profile.

- Procedure the deal. Utilize your bank card or PayPal profile to perform the deal.

- Find the structure and download the shape on your gadget.

- Make modifications. Load, revise and print out and signal the delivered electronically South Carolina Proposal to amend the restated articles of incorporation to create a second class of common stock.

Every template you included in your bank account does not have an expiration day and it is your own permanently. So, if you want to download or print out yet another duplicate, just visit the My Forms section and click in the kind you will need.

Obtain access to the South Carolina Proposal to amend the restated articles of incorporation to create a second class of common stock with US Legal Forms, probably the most substantial collection of lawful record templates. Use a huge number of professional and express-distinct templates that meet up with your company or individual demands and needs.

Form popularity

FAQ

Here's a quick overview of the main steps to dissolve and wind up a 501(c)(3) nonprofit corporation under South Carolina law. Authorizing Dissolution. ... Initial Notice to Attorney General. ... Articles of Dissolution. ... "Winding Up" ... Notice to Creditors and Other Claimants. ... Final Notice to Attorney General. ... Federal Tax Note.

Notices to the Attorney General. (a) A nonprofit organization shall give the Attorney General written notice that it intends to dissolve at or before the time it delivers articles of dissolution to the Secretary of State. The notice shall include a copy or summary of the plan of dissolution.

In South Carolina, you must have a minimum of three directors. Most nonprofits will have more depending on the size and structure of the organization. South Carolina also requires that board members be naturalized persons. There are no residency or membership requirements in the state.

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

Section 33-31-1402 - Dissolution by directors, members, and third persons. (3) in writing by any person whose approval is required by a provision of the articles authorized by Section 33-31-1030 for an amendment to the articles or bylaws.

File two copies of the Amended Articles of Organization with the South Carolina Secretary of State, Division of Business Filings (SOS). The form is on the SOS website (see link below) or in your online account when you sign up for registered agent service with Northwest.

(a) Unless prohibited or limited by the articles or bylaws, any action that may be taken at any annual, regular, or special meeting of members may be taken without a meeting if the corporation delivers a written or electronic ballot to every member entitled to vote on the matter.