Title: South Carolina Authorizes Sale of Fractional Shares: A Comprehensive Overview Introduction: In a significant move aimed at enhancing accessibility and flexibility in the world of investing, South Carolina has recently authorized the sale of fractional shares. This breakthrough development allows investors to purchase and trade fractional shares of various assets, revolutionizing investment opportunities in the state. This article provides a detailed description of South Carolina's authorization of fractional shares, its implications, benefits, and potential types. 1. Understanding Fractional Shares: Fractional shares, also known as partial shares, are units of stocks or other assets that represent less than one whole share. Investors can purchase or sell these fractionally divided portions of a single share, providing an avenue for even small-scale investors to diversify their portfolios. 2. South Carolina's Authorization: The South Carolina legislature has recognized the increasing demand for fractional shares and has approved their sale within the state. This decision allows investors to engage in fractional share trading without limitations, promoting financial inclusion and access to investment opportunities for everyone. 3. Benefits of Fractional Shares: a) Accessibility: Fractional shares make it possible for investors with limited capital to enter the market and invest in high-value stocks that they may not be able to afford in whole share amounts. b) Diversification: Investors can derive greater portfolio diversification by trading fractional shares across various sectors, including technology, healthcare, and real estate. c) Dividend Earnings: Fractional share owners are entitled to receive proportional dividends, enabling them to earn income based on their invested capital. d) Market Participation: Fractional shares enable investors to participate actively in the stock market, providing an opportunity to engage with their favorite companies and brands. 4. Potential Types of South Carolina's Authorize Sale of Fractional Shares: a) Common Stocks: Investors can buy or sell fractional shares of popular stocks like Apple, Google, or Amazon. b) Exchange-Traded Funds (ETFs): Fractional ETF shares allow investors to gain exposure to a diversified portfolio of assets, such as indices, sectors, or commodities. c) Real Estate Investment Trusts (Rests): Fractional shares of Rests provide investors with an opportunity to invest in the real estate market, generating income through rental properties and property value appreciation. d) Mutual Funds: Investors can purchase fractional shares of mutual funds, offering a diversified pool of securities managed by professional fund managers. Conclusion: South Carolina's decision to authorize the sale of fractional shares opens up new avenues for investors in the state, promoting financial inclusion and flexibility. Fractional shares provide numerous benefits, such as accessibility, diversification, dividend earnings, and active market participation. This authorization encompasses various asset classes, including common stocks, ETFs, Rests, and mutual funds. With these opportunities, both seasoned and novice investors can now explore and participate in the investment market, leveraging fractional shares to build their portfolios.

South Carolina Authorize Sale of fractional shares

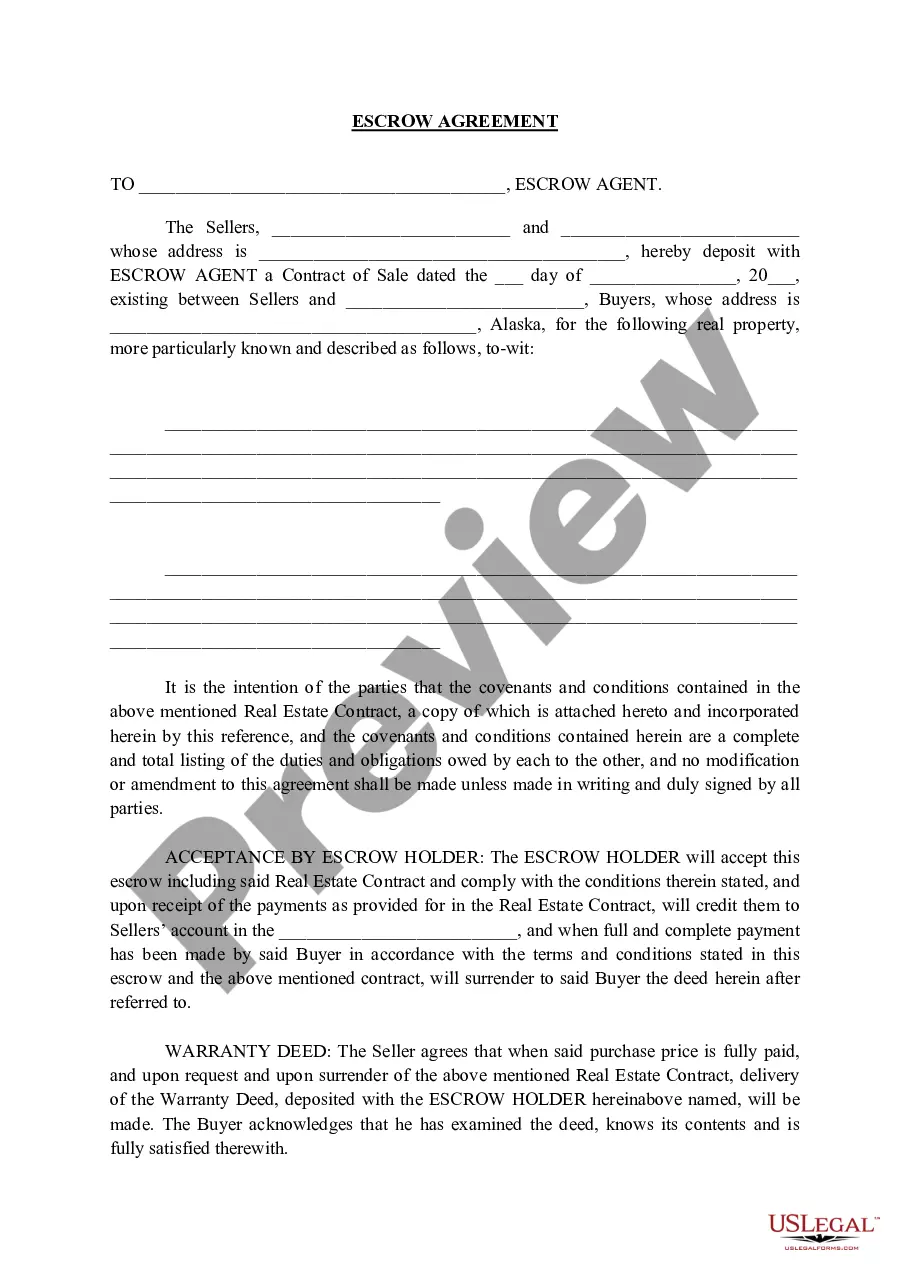

Description

How to fill out South Carolina Authorize Sale Of Fractional Shares?

If you want to full, acquire, or print lawful file web templates, use US Legal Forms, the greatest assortment of lawful kinds, which can be found on-line. Use the site`s basic and convenient research to find the papers you require. A variety of web templates for organization and specific uses are sorted by classes and suggests, or keywords. Use US Legal Forms to find the South Carolina Authorize Sale of fractional shares in just a handful of mouse clicks.

Should you be currently a US Legal Forms client, log in to your account and click the Obtain key to have the South Carolina Authorize Sale of fractional shares. You can also gain access to kinds you earlier downloaded in the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for your right metropolis/region.

- Step 2. Make use of the Review option to look through the form`s articles. Don`t forget to learn the outline.

- Step 3. Should you be not satisfied using the develop, take advantage of the Look for area on top of the display screen to discover other models in the lawful develop template.

- Step 4. Upon having located the form you require, select the Acquire now key. Pick the rates plan you choose and add your credentials to sign up for an account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Select the format in the lawful develop and acquire it on your system.

- Step 7. Comprehensive, change and print or signal the South Carolina Authorize Sale of fractional shares.

Every lawful file template you buy is your own forever. You might have acces to each develop you downloaded with your acccount. Click the My Forms section and select a develop to print or acquire yet again.

Remain competitive and acquire, and print the South Carolina Authorize Sale of fractional shares with US Legal Forms. There are many expert and condition-particular kinds you may use for the organization or specific needs.

Form popularity

FAQ

In order to form a professional corporation, the shareholders must be licensed professionals in their respective fields. This requirement does not apply to a regular corporation. A corporation is taxed as a separate entity, with the potential for double taxation if dividends are paid out to shareholders.

A South Carolina professional corporation (PC) is a business formed by one or more licensed professionals to offer services related to their profession. The business is taxed as a single corporate entity and, in most cases, it shoulders the burden of liability instead of the individual owners (shareholders).

South Carolina Business Corporation Act of 1988 defines a Corporation or Domestic Corporation as a corporation incorporated for profit and not a foreign corporation. Any person may act as the incorporator of a corporation by delivering articles of incorporation to the Secretary of State for filing.

A California Professional Corporation may be a C-Corporation or an S-Corporation, and is organized to provide services in professions that require a state license in order to practice.

: a corporation organized by one or more licensed individuals (such as a doctor or lawyer) especially for the purpose of providing professional services and obtaining tax advantages.

If your business meets the qualifications, S corporation status allows you to avoid double taxation, thus increasing your net profits. In many states, licensed professionals are not permitted to operate as regular corporations. However, a professional corporation is an alternative that provides limited liability.