Title: Understanding South Carolina's Proposal to Adopt Plan of Dissolution and Liquidation Introduction: South Carolina, like many other jurisdictions, has a well-defined legal framework in place for the dissolution and liquidation of businesses. This detailed description aims to provide an insight into South Carolina's proposal to adopt a plan of dissolution and liquidation, along with explaining relevant keywords associated with this process. 1. South Carolina Proposal for Dissolution: A South Carolina Proposal for Dissolution refers to the formal process undertaken by a business entity to wind up its affairs and cease its operations legally. This proposal marks the start of the dissolution process. It involves adopting a plan outlining how the company will distribute its remaining assets, settle outstanding debts, and resolve any pending legal matters. 2. Plan of Dissolution: The plan of dissolution is an essential component of the proposal. It lays out the detailed strategy and steps the entity will undertake during the liquidation process. This plan typically includes provisions related to asset appraisal, creditor notifications, sale of assets, settlement of debts, tax obligations, the appointment of a liquidator, and any other necessary actions. 3. Liquidation: Liquidation, also commonly known as winding up, is the systematic process of converting a company's assets into cash, settling its liabilities, and ultimately dissolving the company. Liquidation can occur voluntarily, following the approval of the plan of dissolution, or involuntarily through a court-ordered process. 4. Voluntary Dissolution: Voluntary dissolution refers to the dissolution of a company initiated by its owners or shareholders in accordance with the provisions set forth in the company's governing documents. The South Carolina Proposal to adopt a plan of dissolution and liquidation can be voluntarily filed by the company's management or authorized shareholders once it is determined that continued operations are no longer feasible or desired. 5. Involuntary Dissolution: Involuntary dissolution occurs when a company is dissolved by court order due to various reasons, typically when it has failed to comply with legal requirements such as timely filing of annual reports, paying taxes, maintaining a registered agent, or fulfilling other statutory obligations. In such cases, the court may initiate the plan of dissolution and liquidation. 6. Dissolution and Liquidation Process: The South Carolina dissolution and liquidation process involves several crucial steps, including: a) Approval of the Proposal: The company's board of directors or shareholders must approve the proposal to adopt a plan of dissolution and liquidation. b) Formal Filing: Once approved, the plan must be submitted to the appropriate state authorities, usually the South Carolina Secretary of State or another designated office, by filing the necessary dissolution documents. c) Notice to Creditors and Stakeholders: The dissolved entity is required to provide notice to its creditors and other stakeholders, informing them of the pending dissolution and setting deadlines for the submission of claims. d) Asset Liquidation: The company must initiate the sale or distribution of its assets, generating funds that will be used for debt settlement and possibly returning any remaining value to shareholders. e) Debt Settlement and Obligations: Outstanding debts and liabilities must be settled, ensuring all legal requirements are met before the final dissolution. f) Distribution of Remaining Assets: After satisfying all financial obligations, the remaining assets are allocated among shareholders or other entitled parties as per the plan of dissolution. Conclusion: Navigating the dissolution and liquidation process is a significant decision for any South Carolina company. Understanding the proposal to adopt a plan of dissolution and liquidation, along with its associated keywords, empowers businesses to follow the required legal procedures smoothly and responsibly. Seeking legal counsel or consulting the South Carolina statutes governing dissolution is advisable to ensure compliance and efficient execution of the process.

South Carolina Proposal to adopt plan of dissolution and liquidation

Description

How to fill out South Carolina Proposal To Adopt Plan Of Dissolution And Liquidation?

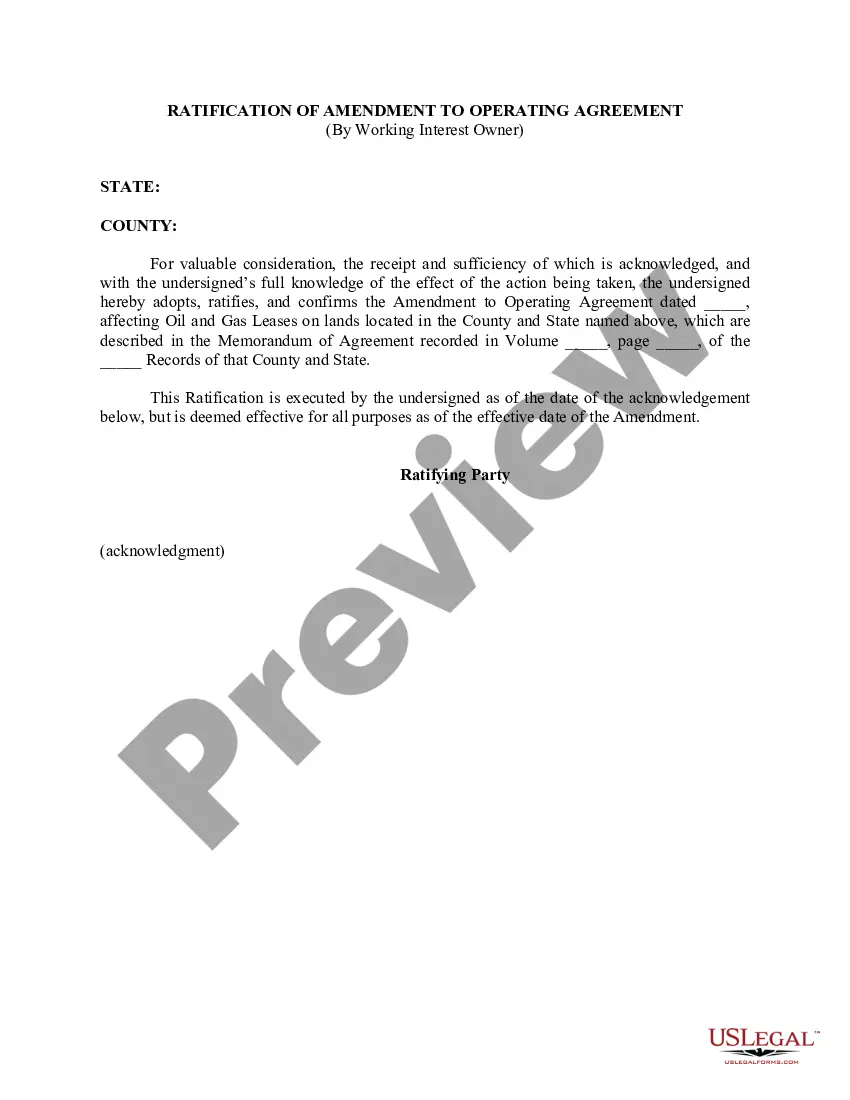

Discovering the right legal document design can be a have difficulties. Obviously, there are a lot of themes available online, but how do you get the legal type you will need? Utilize the US Legal Forms site. The assistance provides thousands of themes, including the South Carolina Proposal to adopt plan of dissolution and liquidation, which can be used for company and personal requirements. All of the varieties are checked out by professionals and meet state and federal needs.

Should you be currently listed, log in in your account and click on the Download switch to get the South Carolina Proposal to adopt plan of dissolution and liquidation. Utilize your account to search from the legal varieties you might have acquired in the past. Go to the My Forms tab of your account and obtain yet another duplicate of your document you will need.

Should you be a fresh customer of US Legal Forms, listed below are simple directions so that you can comply with:

- Initial, make certain you have chosen the right type for the metropolis/state. You may look over the shape making use of the Review switch and read the shape outline to make certain it is the right one for you.

- When the type will not meet your expectations, make use of the Seach discipline to discover the right type.

- Once you are certain that the shape is proper, click on the Buy now switch to get the type.

- Opt for the costs prepare you desire and enter the required information. Create your account and pay for the order utilizing your PayPal account or credit card.

- Select the document structure and down load the legal document design in your product.

- Complete, change and produce and sign the attained South Carolina Proposal to adopt plan of dissolution and liquidation.

US Legal Forms will be the greatest collection of legal varieties where you can see a variety of document themes. Utilize the company to down load expertly-manufactured documents that comply with express needs.