South Carolina Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

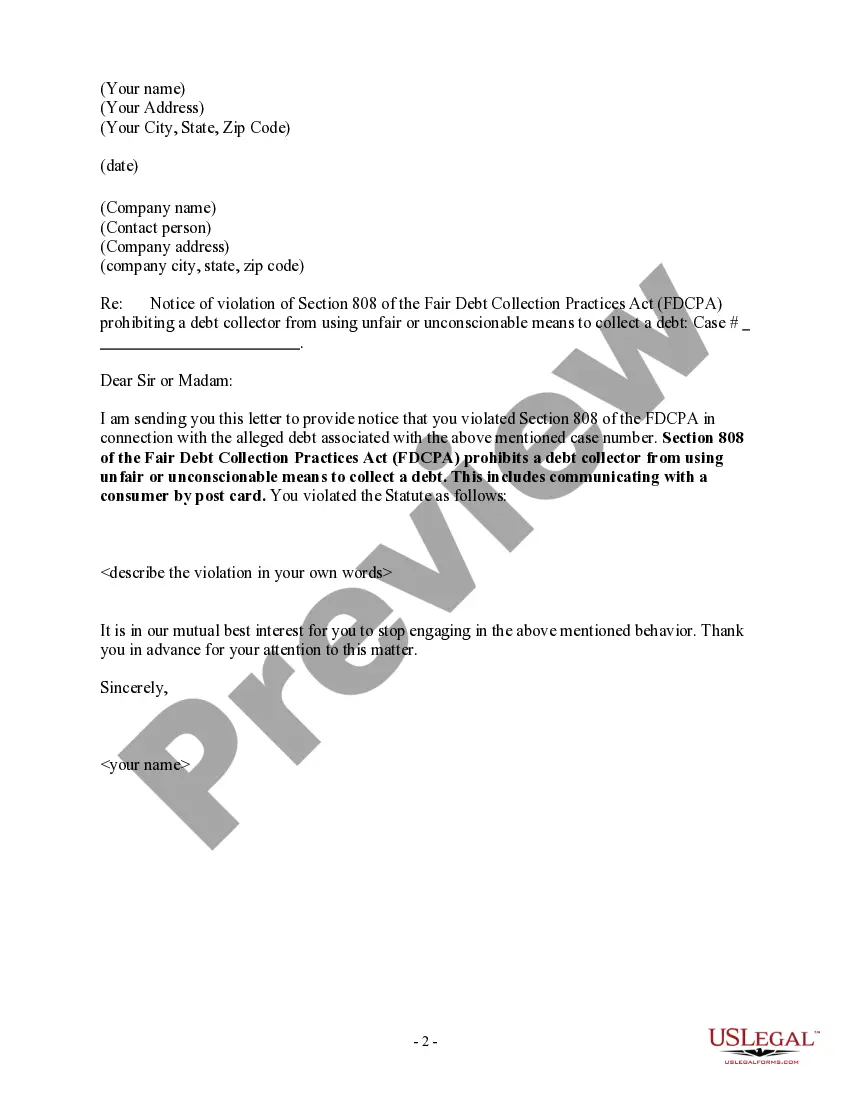

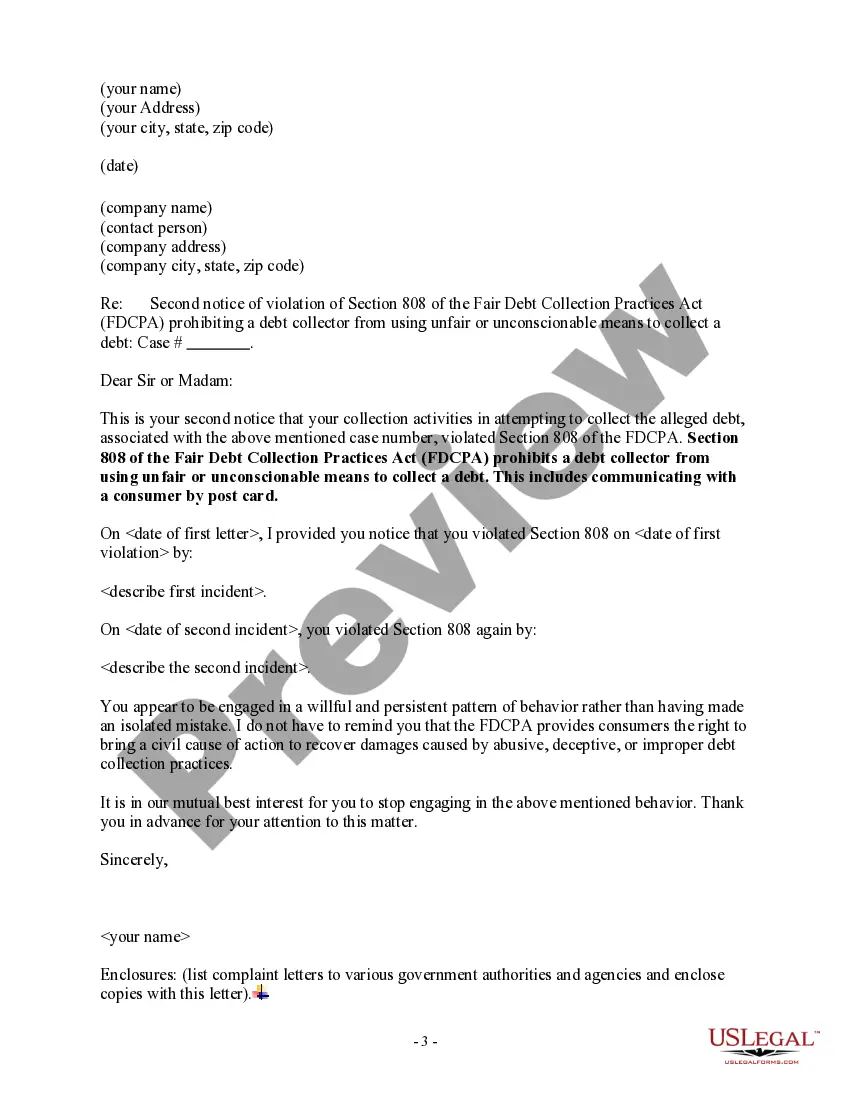

How to fill out South Carolina Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

US Legal Forms - among the biggest libraries of authorized types in the United States - delivers a wide array of authorized file themes you are able to download or print out. Utilizing the site, you can find a large number of types for organization and person uses, sorted by groups, states, or key phrases.You can find the most up-to-date versions of types just like the South Carolina Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard within minutes.

If you already possess a monthly subscription, log in and download South Carolina Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard from the US Legal Forms catalogue. The Obtain switch will appear on each and every kind you perspective. You have access to all in the past saved types in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, here are straightforward recommendations to obtain began:

- Be sure to have selected the correct kind for the city/region. Go through the Preview switch to analyze the form`s articles. See the kind explanation to ensure that you have chosen the correct kind.

- If the kind does not suit your specifications, use the Research discipline near the top of the screen to get the one which does.

- If you are satisfied with the shape, verify your decision by simply clicking the Get now switch. Then, opt for the prices prepare you like and offer your qualifications to register to have an accounts.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal accounts to accomplish the transaction.

- Select the format and download the shape on your own device.

- Make modifications. Load, revise and print out and indicator the saved South Carolina Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Each format you included in your bank account does not have an expiry day and is also the one you have forever. So, if you would like download or print out yet another backup, just check out the My Forms segment and then click about the kind you need.

Get access to the South Carolina Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard with US Legal Forms, one of the most considerable catalogue of authorized file themes. Use a large number of professional and status-particular themes that satisfy your organization or person needs and specifications.

Form popularity

FAQ

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.