South Carolina Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out South Carolina Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

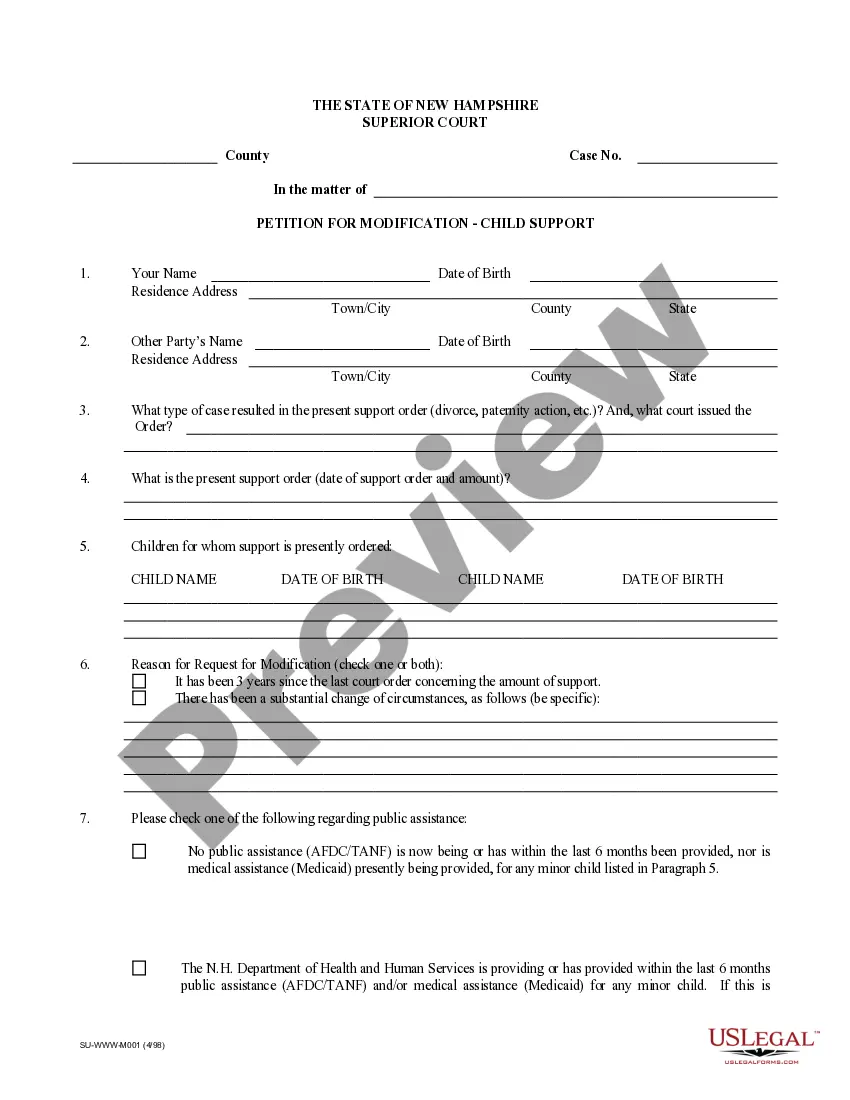

Are you inside a place the place you will need documents for sometimes enterprise or individual functions nearly every working day? There are a variety of lawful papers layouts accessible on the Internet, but finding types you can depend on isn`t effortless. US Legal Forms gives 1000s of form layouts, such as the South Carolina Notice of Violation of Fair Debt Act - Improper Contact at Work, that happen to be published to meet federal and state needs.

When you are currently knowledgeable about US Legal Forms site and possess a merchant account, merely log in. After that, you are able to acquire the South Carolina Notice of Violation of Fair Debt Act - Improper Contact at Work format.

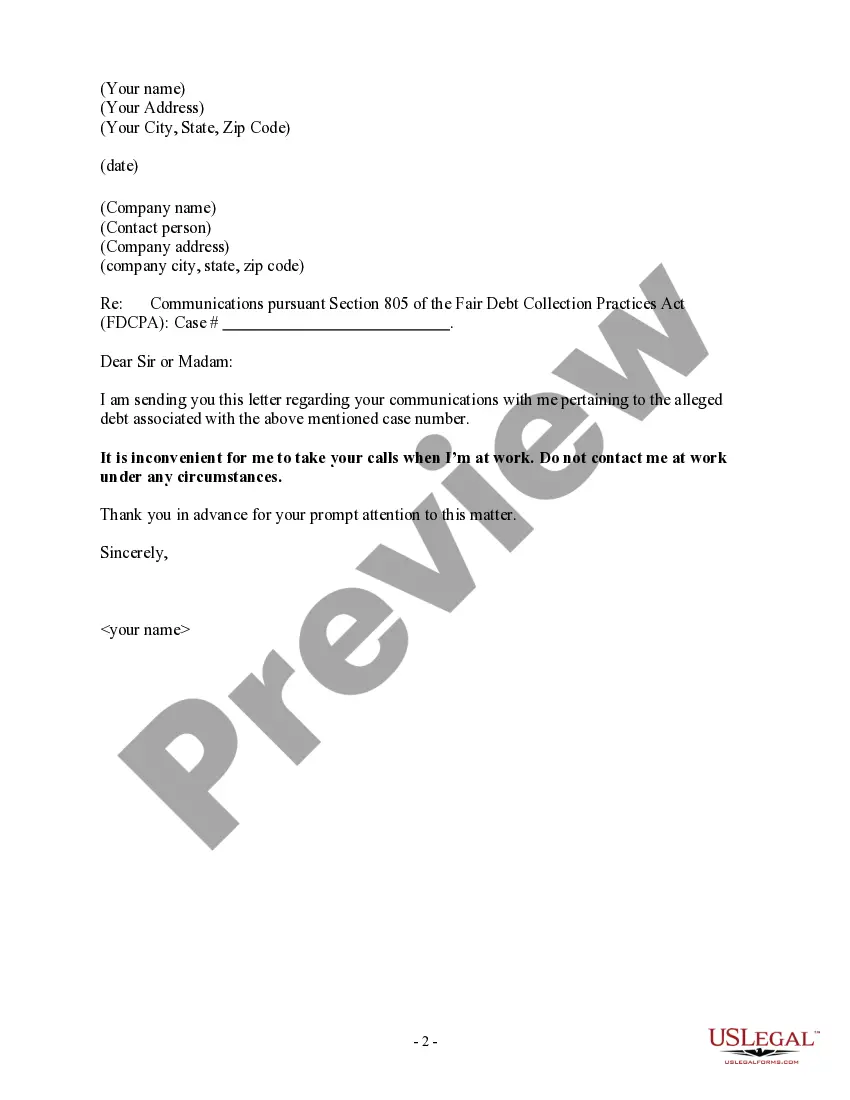

Unless you come with an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the form you require and make sure it is for that right metropolis/area.

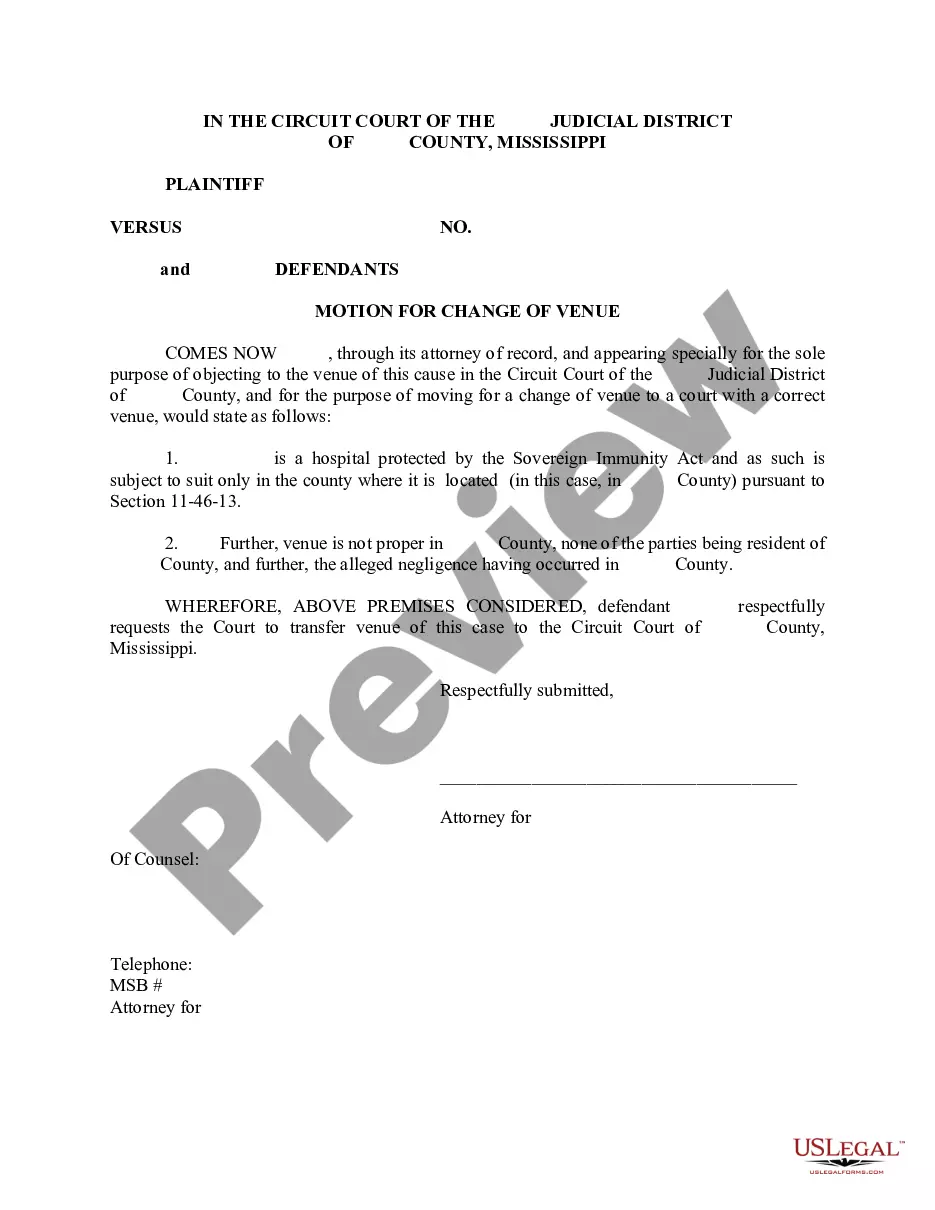

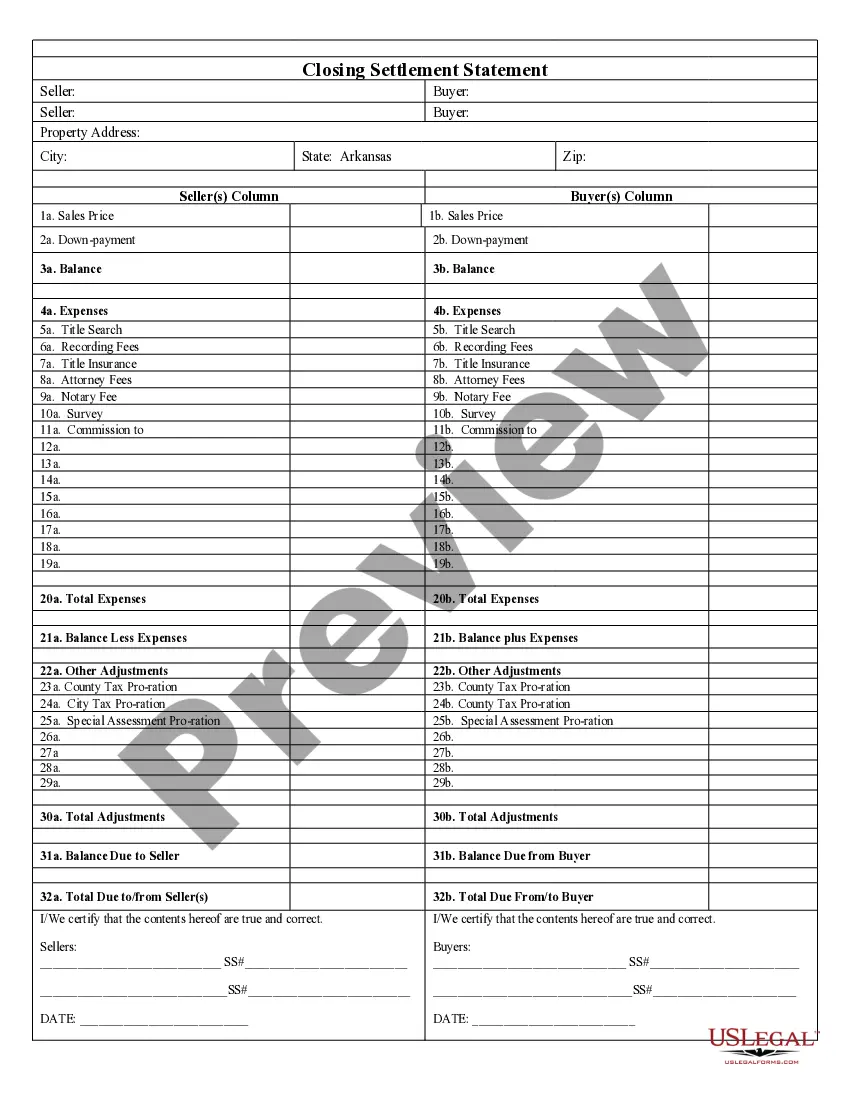

- Use the Preview key to check the form.

- Read the outline to actually have chosen the correct form.

- In the event the form isn`t what you are searching for, make use of the Search area to get the form that meets your requirements and needs.

- Whenever you get the right form, simply click Acquire now.

- Choose the rates strategy you want, complete the required information and facts to make your money, and purchase an order using your PayPal or charge card.

- Decide on a convenient paper file format and acquire your duplicate.

Find all the papers layouts you possess bought in the My Forms menus. You can aquire a more duplicate of South Carolina Notice of Violation of Fair Debt Act - Improper Contact at Work whenever, if possible. Just select the necessary form to acquire or print out the papers format.

Use US Legal Forms, one of the most considerable selection of lawful kinds, to save lots of time as well as prevent mistakes. The support gives skillfully produced lawful papers layouts which you can use for a selection of functions. Generate a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

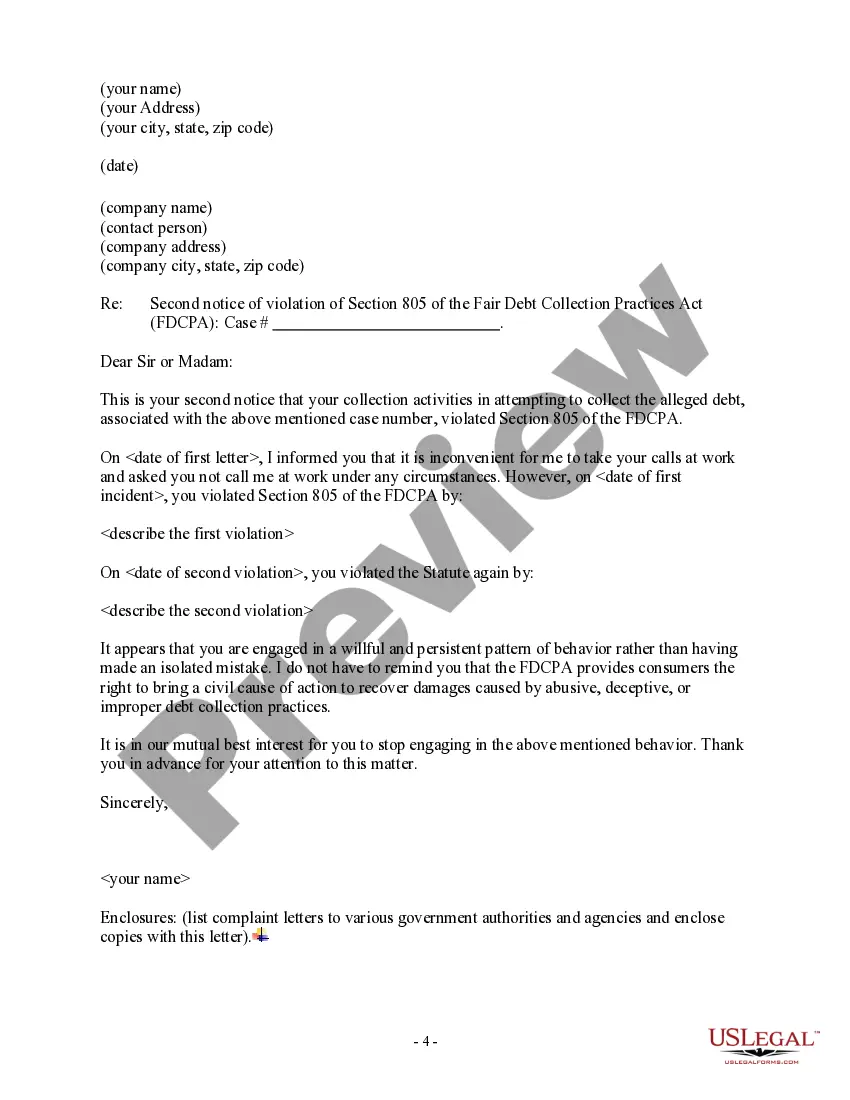

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

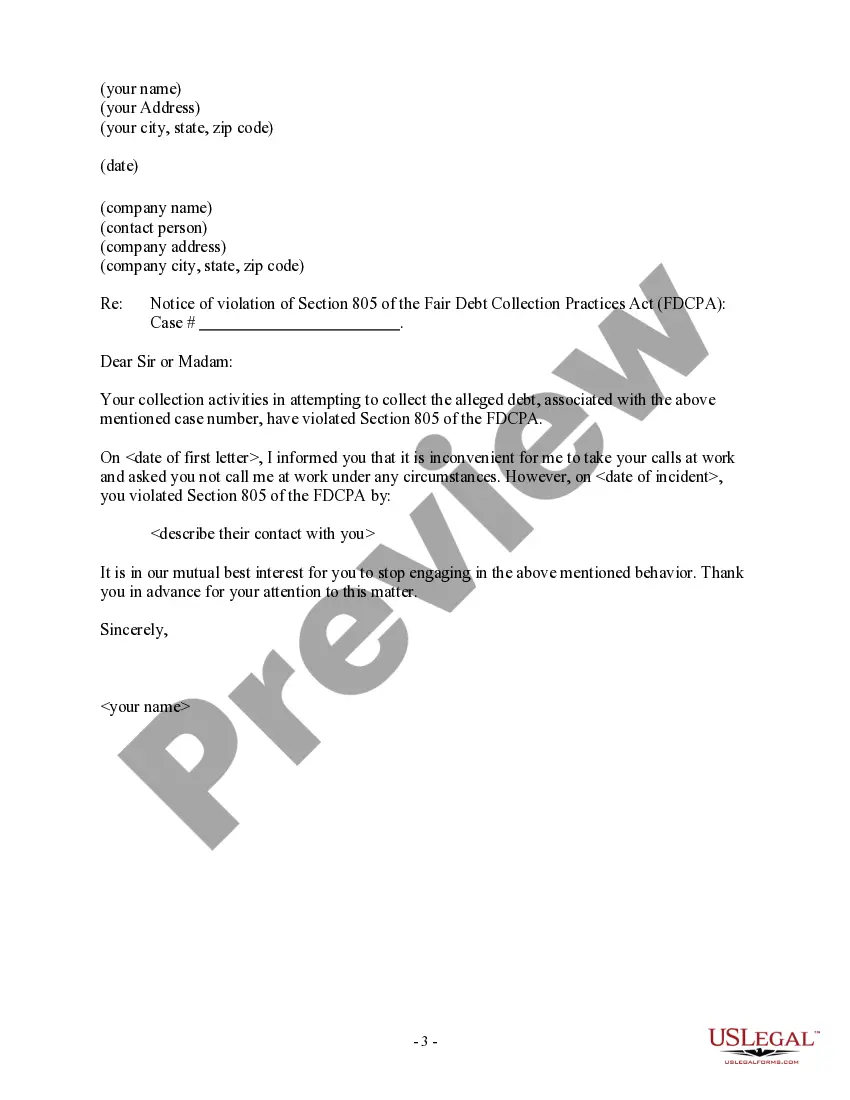

However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You can stop debt collectors from calling you at work fairly easily. Simply tell the debt collector that your employer doesn't want them calling your job or that you're not allowed to receive personal calls at work.

It's not necessarily illegal for a debt collector to call you at work, but the FDCPA prohibits debt collection calls to your job if the debt collector "has reason to know" that your employer forbids those calls.