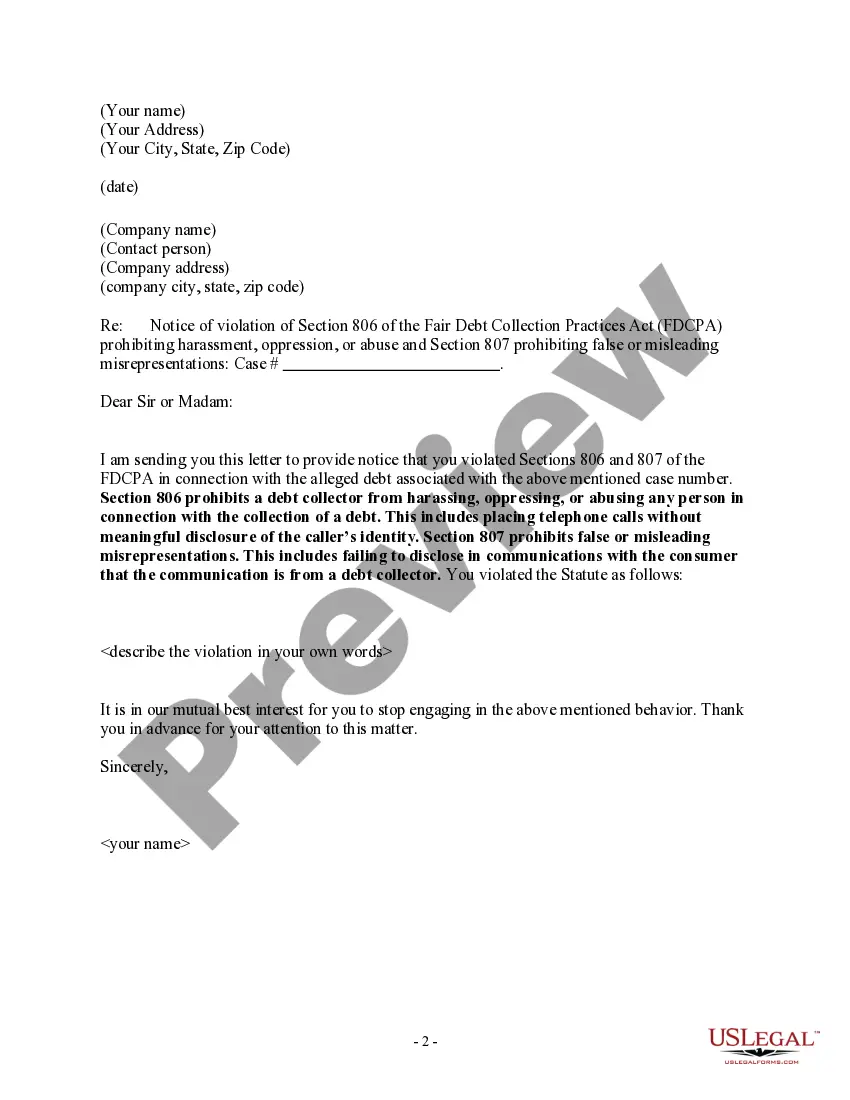

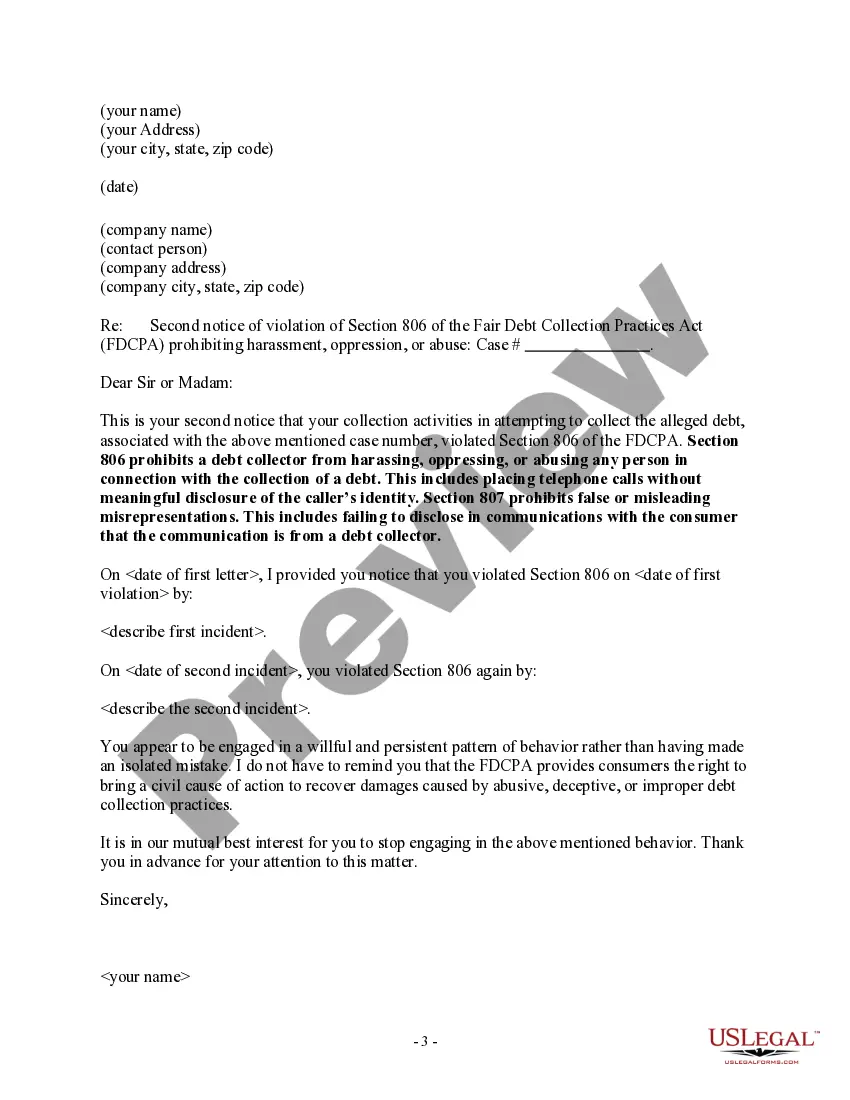

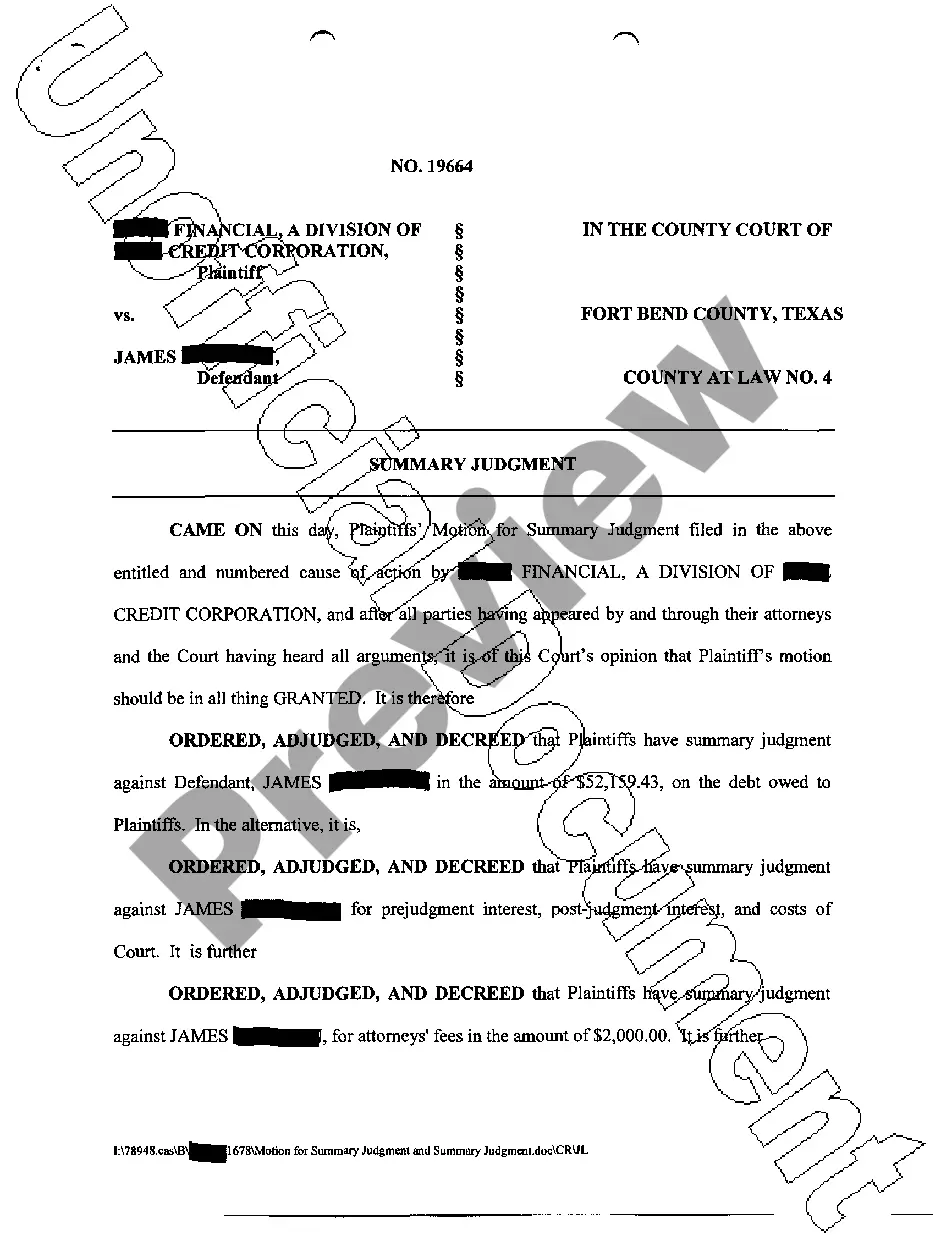

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

South Carolina Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

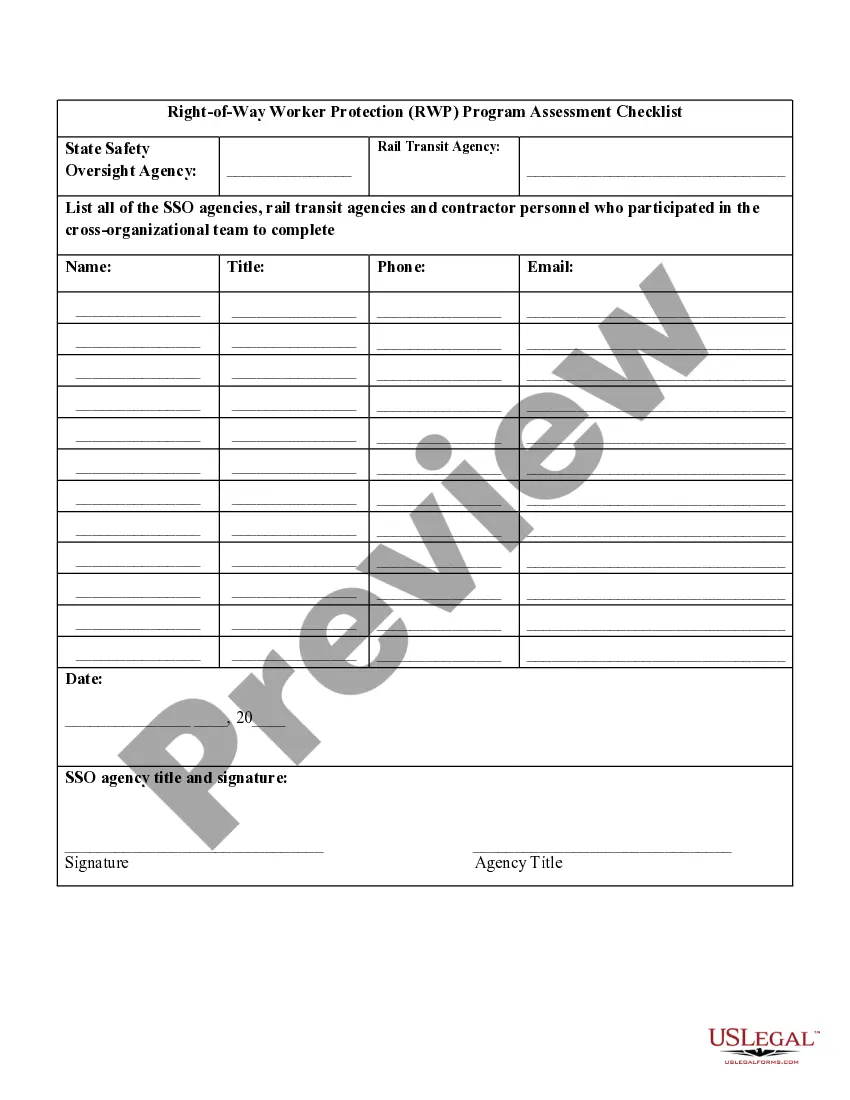

How to fill out South Carolina Notice To Debt Collector - Not Disclosing The Caller's Identity?

You may spend several hours on the Internet searching for the legal document template that suits the federal and state specifications you will need. US Legal Forms gives 1000s of legal types that happen to be examined by professionals. You can easily obtain or print the South Carolina Notice to Debt Collector - Not Disclosing the Caller's Identity from my service.

If you currently have a US Legal Forms accounts, you can log in and click the Download key. Afterward, you can comprehensive, change, print, or sign the South Carolina Notice to Debt Collector - Not Disclosing the Caller's Identity. Every legal document template you acquire is yours for a long time. To acquire an additional backup associated with a obtained type, proceed to the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site the very first time, keep to the simple recommendations under:

- Initial, be sure that you have chosen the proper document template for your area/town of your choosing. Read the type outline to ensure you have picked out the proper type. If accessible, take advantage of the Review key to appear from the document template at the same time.

- If you would like get an additional edition from the type, take advantage of the Search discipline to discover the template that suits you and specifications.

- When you have identified the template you desire, click Acquire now to continue.

- Find the rates prepare you desire, type your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal accounts to purchase the legal type.

- Find the formatting from the document and obtain it in your product.

- Make changes in your document if needed. You may comprehensive, change and sign and print South Carolina Notice to Debt Collector - Not Disclosing the Caller's Identity.

Download and print 1000s of document templates utilizing the US Legal Forms Internet site, that provides the greatest variety of legal types. Use expert and state-particular templates to deal with your small business or personal requires.

Form popularity

FAQ

Generally, a debt collector can't discuss your debt with anyone other than: You. Your spouse. Your parents (if you are a minor)

Debt collectors often ask for Social Security numbers, birth dates or other personal information to ensure they have reached the correct debtor.

For a debt collector to have the legal right to pull your credit report without your consent, you must owe the company a legitimate debt and it must stem from a voluntary credit transaction.

The Fair Debt Collection Practices Act (FDCPA) It is always your choice whether to provide any information to a debt collector, even a legitimate one, including whether to verify your identity.

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.

Under the FDCPA, any communication from a debt collector is required to disclose their identity. This means they must state their name, the name of the collection company and their phone number. Additionally, they must state that the communication is being done to collect a debt.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.