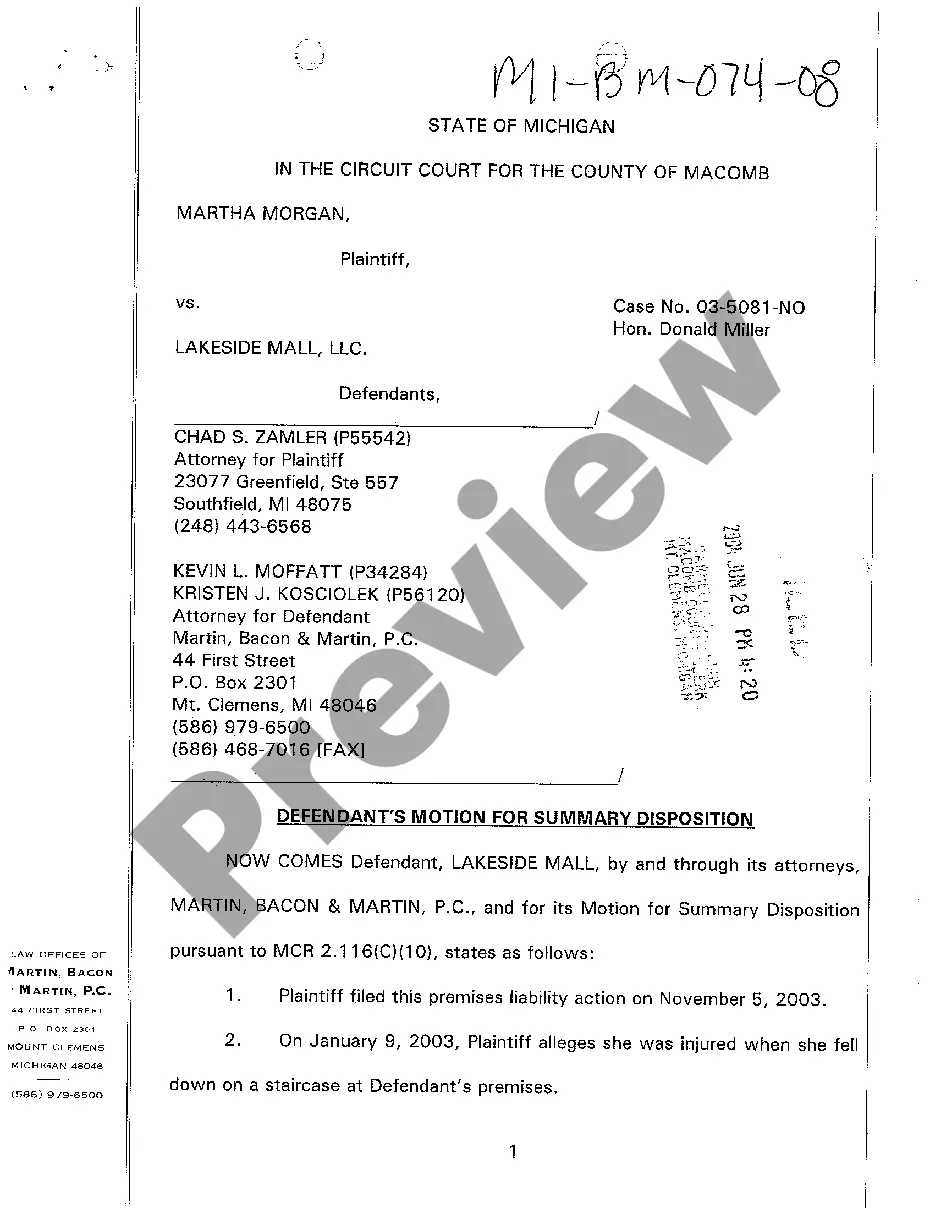

South Carolina Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.

Description

How to fill out Sample Stock Purchase Agreement Regarding Acquisition By Finova Capital Corp. Of All Outstanding Shares Of Fremont Financial Corp.?

US Legal Forms - one of many most significant libraries of legal kinds in the States - gives a variety of legal document layouts you may obtain or print. Making use of the website, you may get thousands of kinds for enterprise and individual uses, sorted by groups, suggests, or search phrases.You can find the newest types of kinds just like the South Carolina Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. within minutes.

If you have a membership, log in and obtain South Carolina Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. in the US Legal Forms local library. The Obtain switch will appear on every single kind you perspective. You gain access to all earlier downloaded kinds within the My Forms tab of the bank account.

In order to use US Legal Forms the first time, allow me to share simple directions to obtain began:

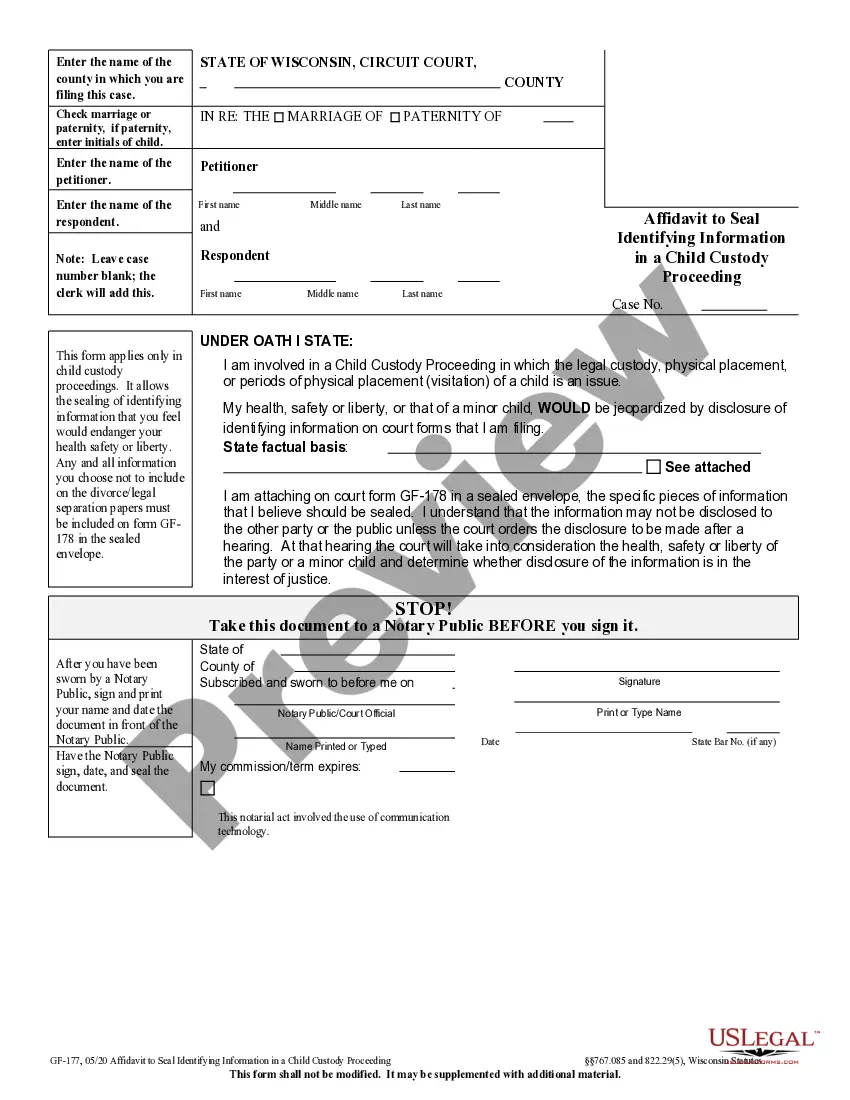

- Ensure you have chosen the right kind for your metropolis/region. Click on the Review switch to examine the form`s content. Browse the kind explanation to actually have chosen the proper kind.

- If the kind does not satisfy your requirements, take advantage of the Research discipline at the top of the screen to find the the one that does.

- Should you be happy with the shape, verify your option by visiting the Acquire now switch. Then, pick the pricing program you want and provide your references to register for the bank account.

- Process the transaction. Use your charge card or PayPal bank account to accomplish the transaction.

- Choose the file format and obtain the shape on your device.

- Make changes. Complete, modify and print and sign the downloaded South Carolina Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp..

Every web template you added to your account lacks an expiry time and is the one you have forever. So, if you wish to obtain or print an additional duplicate, just proceed to the My Forms segment and click on the kind you will need.

Gain access to the South Carolina Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. with US Legal Forms, probably the most comprehensive local library of legal document layouts. Use thousands of specialist and condition-distinct layouts that satisfy your small business or individual needs and requirements.

Form popularity

FAQ

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

In an asset acquisition, the buyer is able to specify the liabilities it is willing to assume, while leaving other liabilities behind. In a stock purchase, on the other hand, the buyer purchases stock in a company that may have unknown or uncertain liabilities.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.