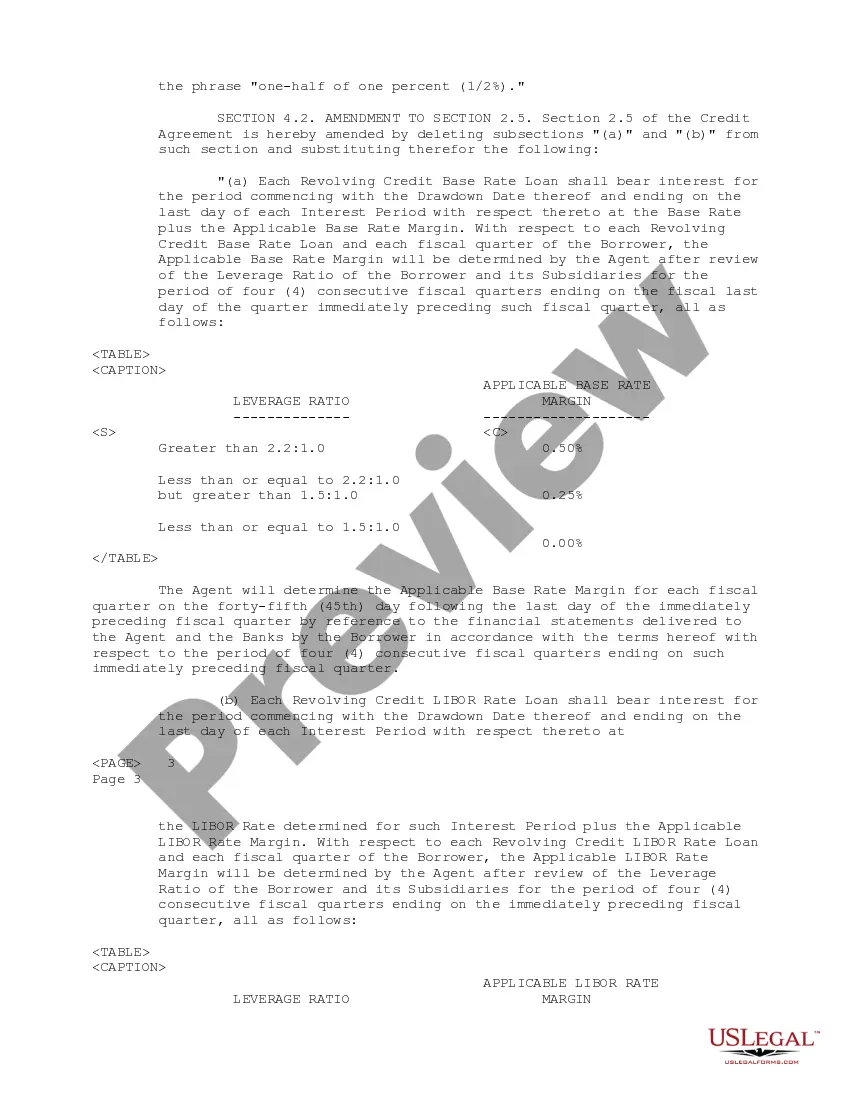

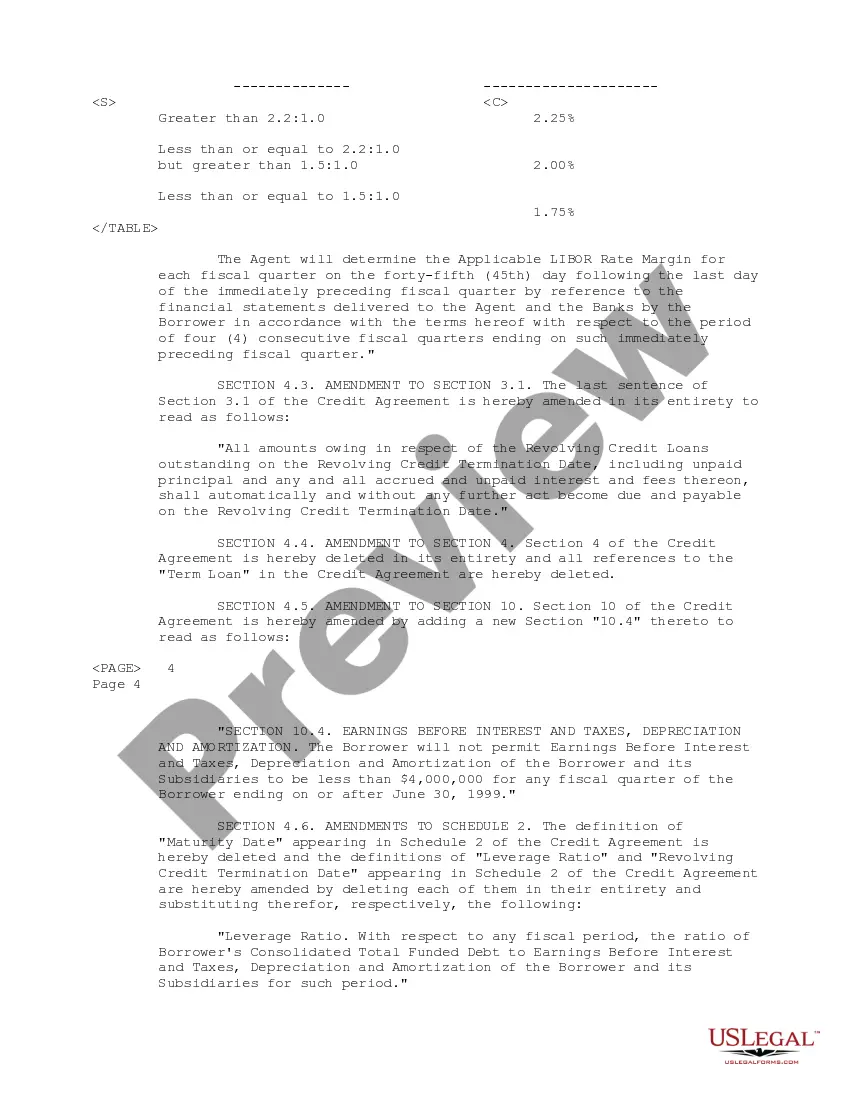

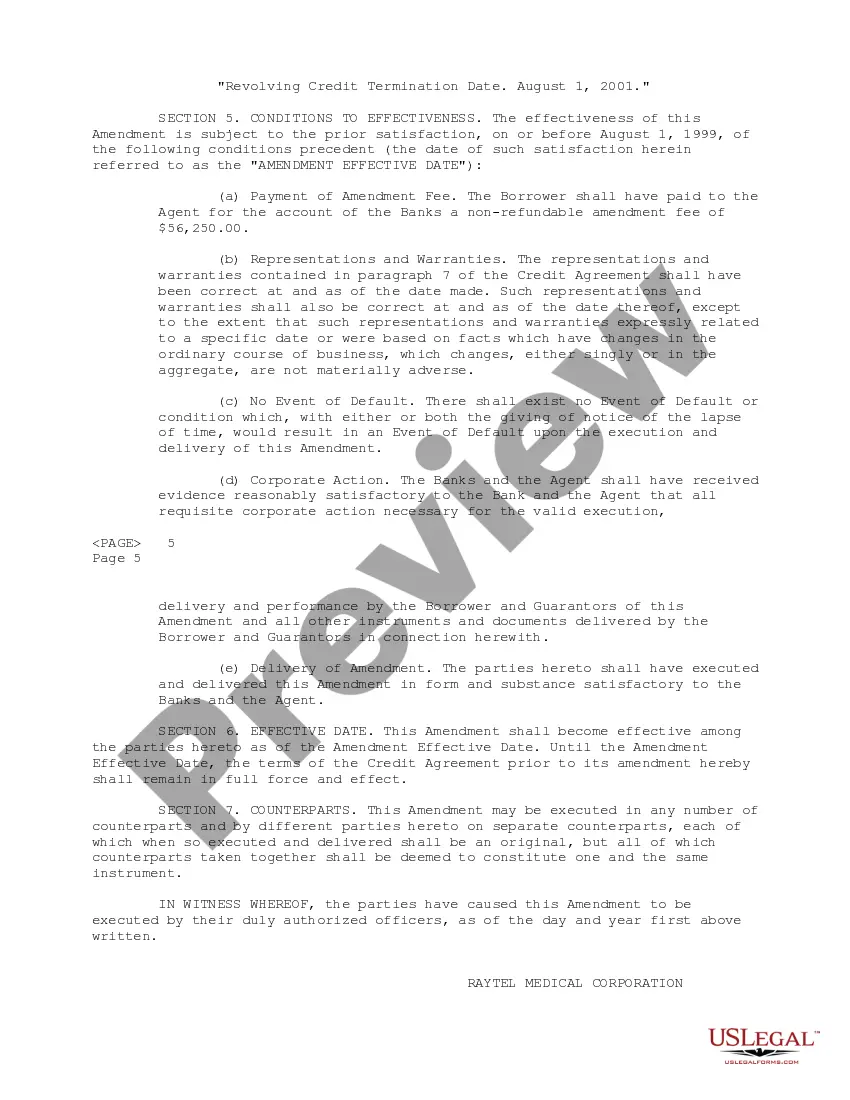

The South Carolina Fourth Amendment to Amended Restated Credit Agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus is a legally binding document that outlines the terms and conditions of the credit agreement between the mentioned parties. This agreement serves as a significant tool in managing the financial relationship between the borrower, Ray tel Medical Corp, and the lenders, Bank Boston, N.A., and Banquet Paribus. The Fourth Amendment refers to the specific modification made to the original agreement, indicating that there have been prior amendments. The purpose of the Fourth Amendment is to make necessary changes in the terms of the credit agreement to meet the evolving needs and circumstances of the borrower and lenders. The South Carolina Fourth Amendment to Amended Restated Credit Agreement is an essential document that provides detailed information about the following key aspects: 1. Parties involved: The agreement clearly identifies the parties to this credit agreement, namely Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. This section includes their legal names, addresses, and contact information. 2. Definitions and interpretations: This section elaborates on the terminology used in the agreement, ensuring that all parties have a common understanding of the terms and their meanings. 3. Amendment details: The Fourth Amendment outlines the specific changes made to the original credit agreement. These changes may include modifications to interest rates, repayment terms, collateral requirements, default provisions, or any other relevant terms. 4. Loan terms and conditions: This section provides an in-depth description of the overall terms and conditions of the loan, including the principal amount, interest rates, payment schedules, maturity dates, and any special provisions. 5. Fees and expenses: This clause outlines any fees or expenses associated with the credit agreement. It may include origination fees, legal fees, annual maintenance fees, or other charges. 6. Security and collateral: If applicable, this section defines the collateral pledged by the borrower to secure the loan. It explains the rights and obligations of the borrower and the lenders regarding the collateral. 7. Representations and warranties: The agreement may include representations and warranties made by the borrower. These are statements of fact concerning the borrower's financial condition, assets, liabilities, and other relevant information. 8. Covenants and undertakings: This section states the obligations and commitments of the borrower and the lenders, such as maintaining certain financial ratios, providing financial statements, or obtaining consent for extraordinary transactions. 9. Events of default and remedies: The agreement defines the circumstances under which a default occurs and outlines the remedies available to the lenders. It may include provisions for acceleration of the loan, termination of the agreement, or appointment of a receiver. Different variations of the South Carolina Fourth Amendment to Amended Restated Credit Agreement may exist depending on specific circumstances, such as variations in terms, eligible borrowers, or lenders involved. However, the core elements mentioned above generally remain consistent. It is crucial to consult legal counsel to fully understand the specific terms and implications outlined in the South Carolina Fourth Amendment to Amended Restated Credit Agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. This document plays a significant role in regulating the financial relationship between the borrower and lenders and provides the necessary protection and clarity for all parties involved.

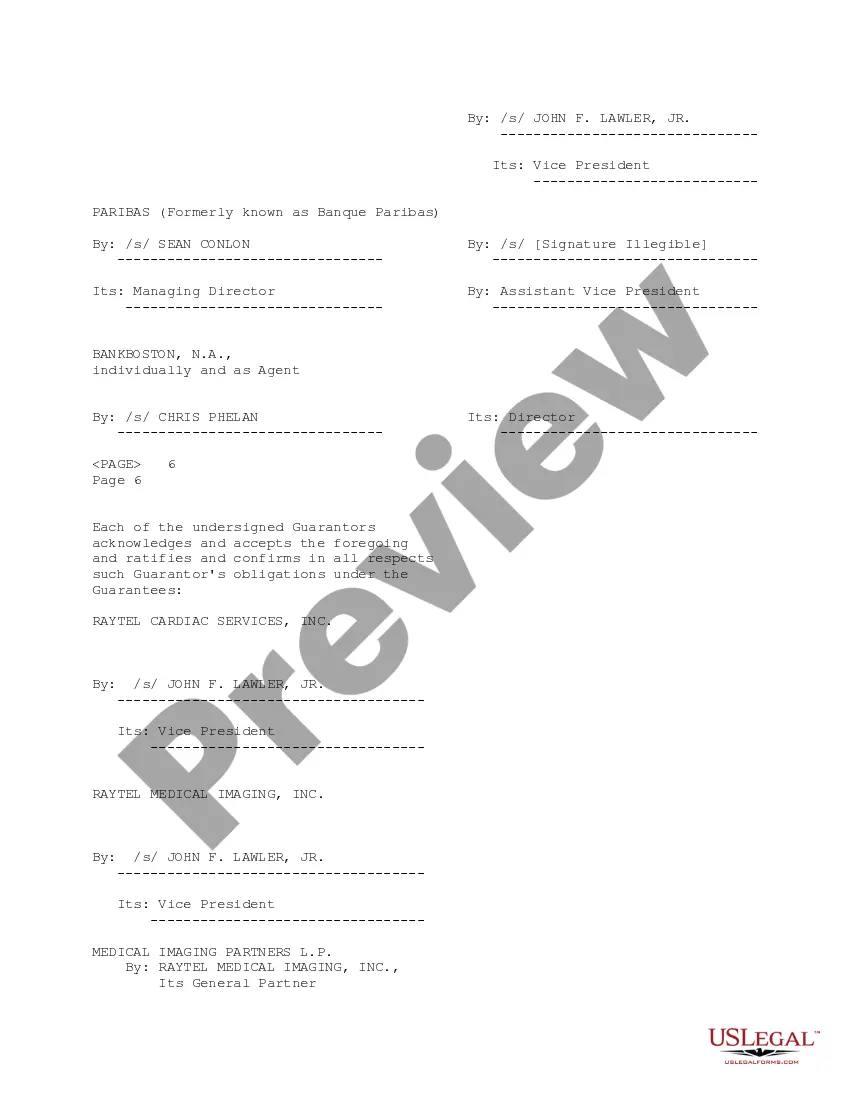

South Carolina Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out South Carolina Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

If you wish to complete, obtain, or printing legitimate papers themes, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on-line. Use the site`s simple and easy handy look for to obtain the papers you will need. Different themes for enterprise and personal uses are categorized by categories and says, or search phrases. Use US Legal Forms to obtain the South Carolina Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas with a handful of mouse clicks.

Should you be presently a US Legal Forms client, log in to your profile and then click the Download button to find the South Carolina Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas. You can also entry varieties you earlier delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your proper city/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s content material. Do not forget about to read through the outline.

- Step 3. Should you be unhappy with the kind, use the Research discipline towards the top of the display to discover other versions in the legitimate kind design.

- Step 4. Upon having located the form you will need, click the Acquire now button. Pick the pricing prepare you choose and include your references to register to have an profile.

- Step 5. Method the financial transaction. You can use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Pick the file format in the legitimate kind and obtain it on the gadget.

- Step 7. Full, change and printing or signal the South Carolina Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas.

Every legitimate papers design you acquire is the one you have for a long time. You might have acces to every kind you delivered electronically within your acccount. Click the My Forms portion and decide on a kind to printing or obtain again.

Be competitive and obtain, and printing the South Carolina Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas with US Legal Forms. There are many expert and state-specific varieties you can utilize to your enterprise or personal demands.