The South Carolina Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York is a legally binding document that establishes the terms and conditions of a trust relationship between the parties involved. This agreement outlines the roles and responsibilities of each party, as well as the specific details regarding the management, administration, and distribution of assets held within the trust. One type of South Carolina Trust Agreement between these entities is the Revocable Living Trust, which allows the granter (Van Kampen Foods, Inc.) to retain control over the assets within the trust while they are alive. This type of trust provides flexibility and allows for the amendment or revocation of the trust agreement as desired by the granter. Another type of trust agreement is the Irrevocable Trust, which permanently transfers ownership and control of assets from the granter to the trustee (The Bank of New York). Once an irrevocable trust is established, the granter can no longer modify or terminate the trust without the consent of the beneficiaries (American Portfolio Evaluation Services and Van Kampen Investment Advisory Corp.). This type of trust is often used for estate planning purposes, asset protection, or tax planning strategies. The South Carolina Trust Agreement includes details such as the purpose and objectives of the trust, the identification of the beneficiaries, the powers and duties of the trustee, the investment strategy, and the provisions for both income and principal distributions. Additionally, it may contain provisions for the appointment of successors or co-trustees, dispute resolution mechanisms, and instructions regarding the termination or dissolution of the trust. This South Carolina Trust Agreement is a critical document that ensures the smooth administration and management of assets held in trust, providing clear guidelines and instructions for all parties involved. It serves as a legal safeguard for the granter, beneficiaries, and trustee, protecting their interests and ensuring the proper execution of their responsibilities.

South Carolina Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

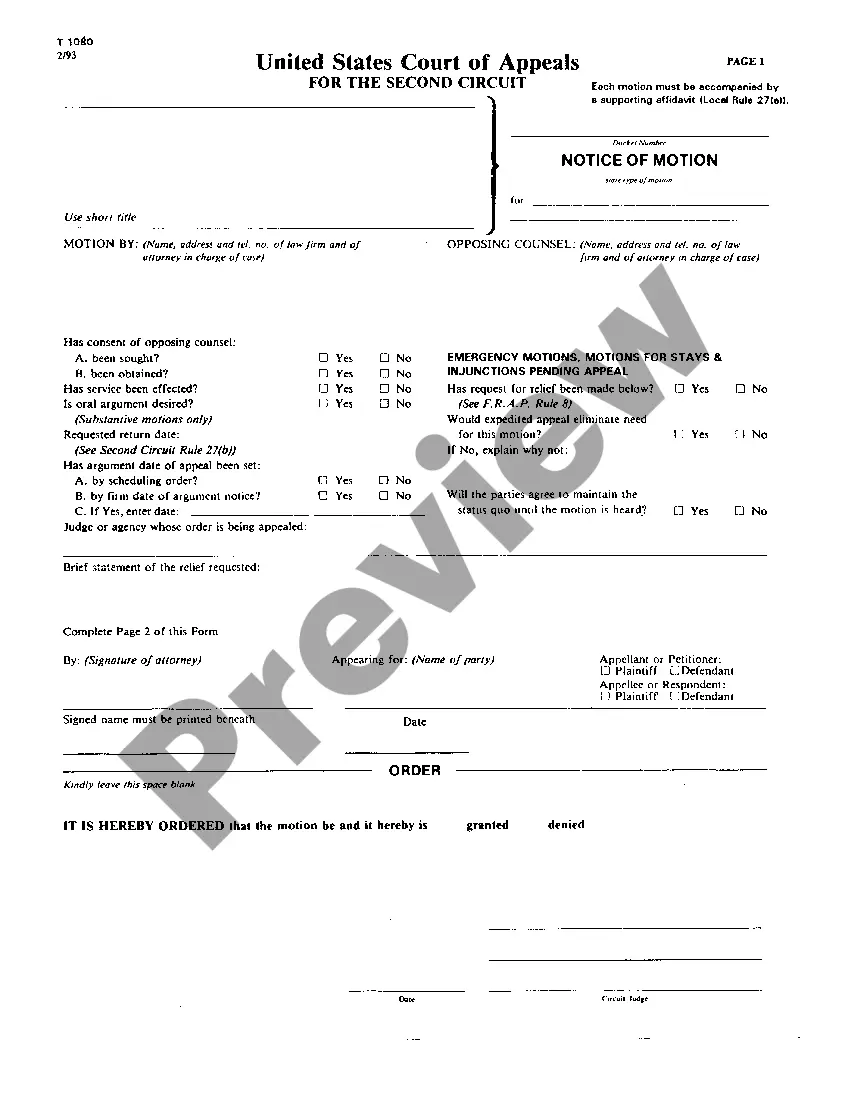

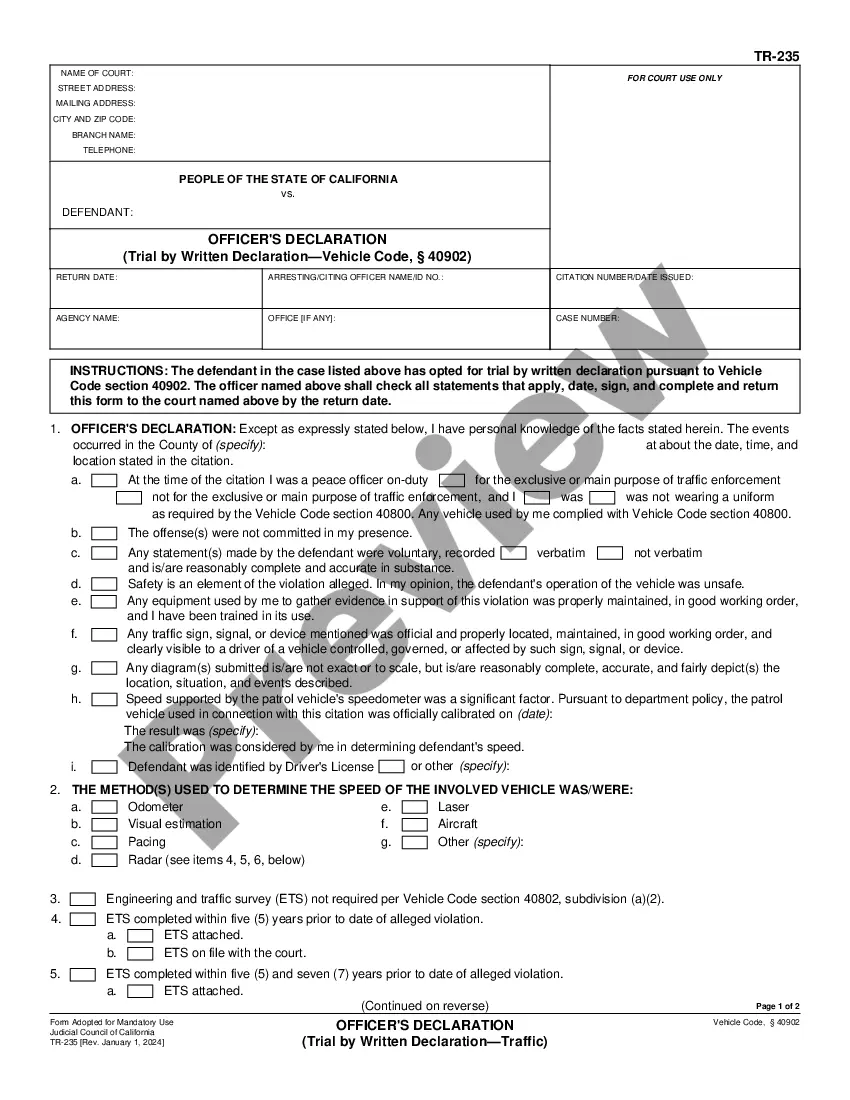

How to fill out South Carolina Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

You may devote time online trying to find the lawful document design which fits the state and federal specifications you want. US Legal Forms offers thousands of lawful forms that are reviewed by experts. It is possible to down load or print out the South Carolina Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York from the services.

If you currently have a US Legal Forms profile, you may log in and click on the Download key. Following that, you may total, modify, print out, or signal the South Carolina Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York. Each and every lawful document design you buy is your own eternally. To obtain one more version of any purchased form, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms website the first time, keep to the easy directions under:

- Initially, ensure that you have selected the best document design for that state/city of your choice. See the form information to make sure you have picked the proper form. If accessible, take advantage of the Preview key to look from the document design as well.

- If you would like get one more model of the form, take advantage of the Look for industry to obtain the design that meets your needs and specifications.

- When you have found the design you need, simply click Get now to carry on.

- Select the prices program you need, type in your accreditations, and register for a merchant account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal profile to pay for the lawful form.

- Select the structure of the document and down load it for your gadget.

- Make alterations for your document if possible. You may total, modify and signal and print out South Carolina Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York.

Download and print out thousands of document layouts using the US Legal Forms website, that offers the most important variety of lawful forms. Use specialist and status-specific layouts to handle your small business or person needs.