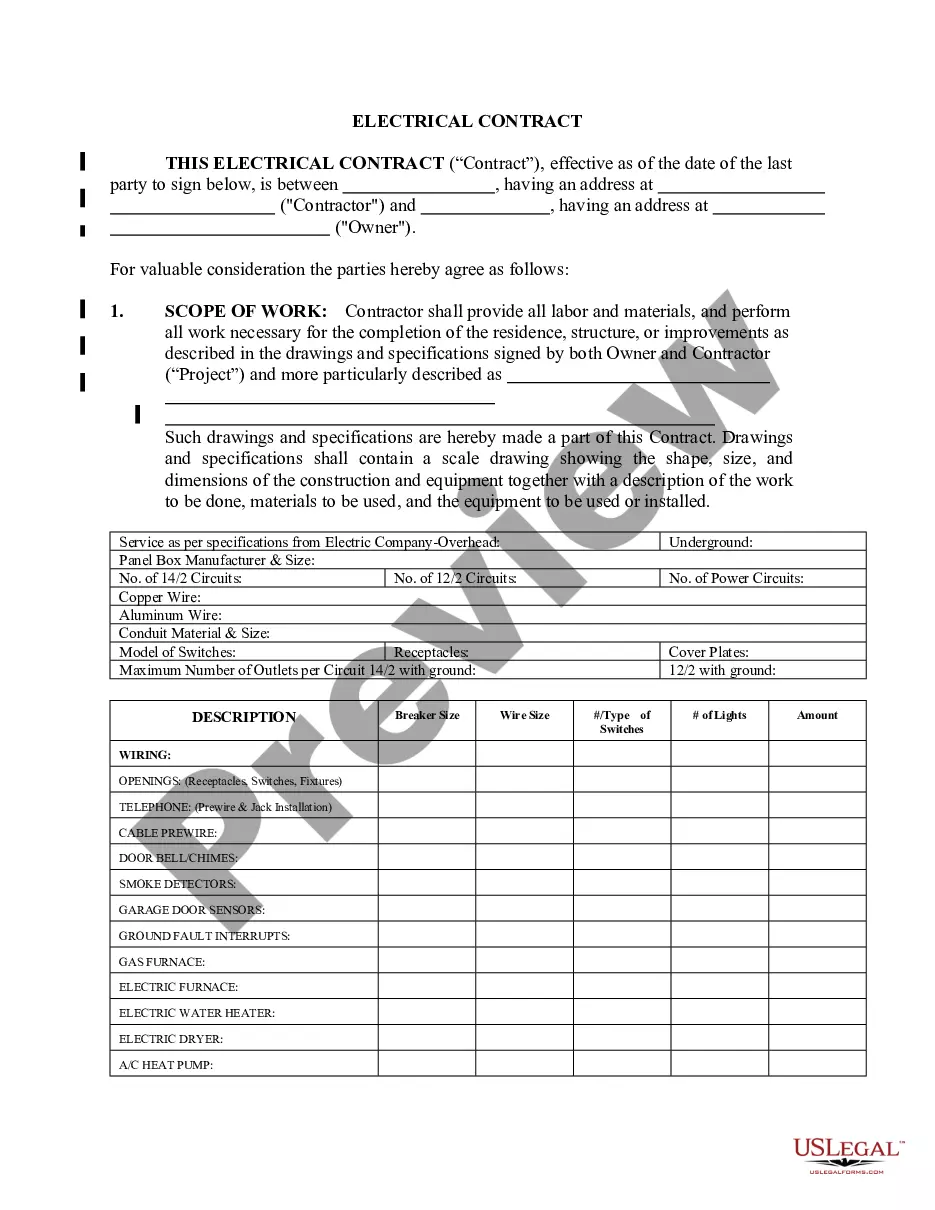

South Carolina Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund

Description

How to fill out Sample Purchase Agreement Between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund?

US Legal Forms - among the greatest libraries of authorized forms in the United States - provides an array of authorized file themes you are able to acquire or print out. While using internet site, you may get 1000s of forms for organization and person purposes, sorted by groups, states, or key phrases.You will find the most up-to-date models of forms much like the South Carolina Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund within minutes.

If you already have a registration, log in and acquire South Carolina Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund through the US Legal Forms collection. The Down load option will appear on each and every develop you look at. You have access to all earlier saved forms inside the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, allow me to share straightforward directions to get you started out:

- Be sure you have picked out the right develop to your town/area. Click the Review option to check the form`s information. Browse the develop description to actually have chosen the right develop.

- In case the develop does not fit your specifications, utilize the Lookup discipline towards the top of the monitor to find the one which does.

- Should you be content with the form, affirm your selection by visiting the Get now option. Then, choose the rates plan you want and give your qualifications to register to have an profile.

- Method the transaction. Utilize your bank card or PayPal profile to complete the transaction.

- Select the formatting and acquire the form on your own gadget.

- Make alterations. Load, edit and print out and sign the saved South Carolina Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund.

Each design you included with your account lacks an expiration date and is the one you have for a long time. So, if you would like acquire or print out yet another version, just check out the My Forms area and click about the develop you require.

Get access to the South Carolina Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund with US Legal Forms, by far the most extensive collection of authorized file themes. Use 1000s of specialist and state-certain themes that fulfill your organization or person requires and specifications.