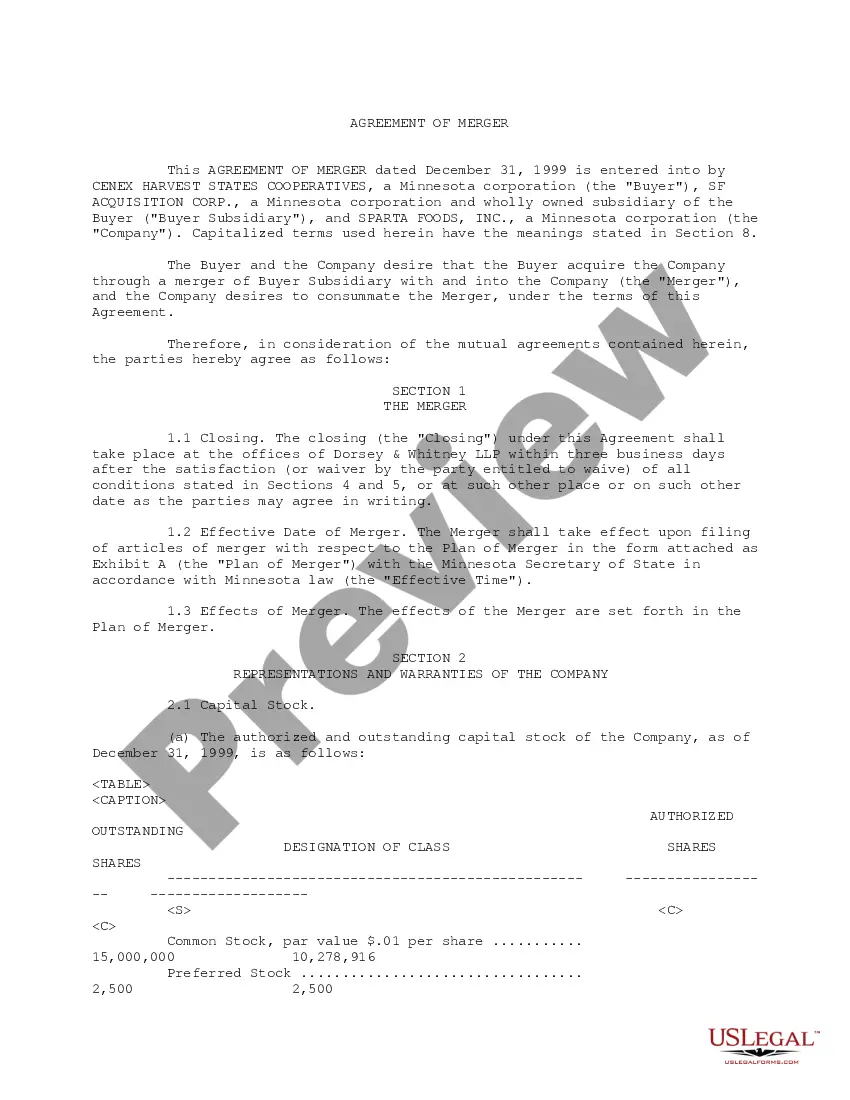

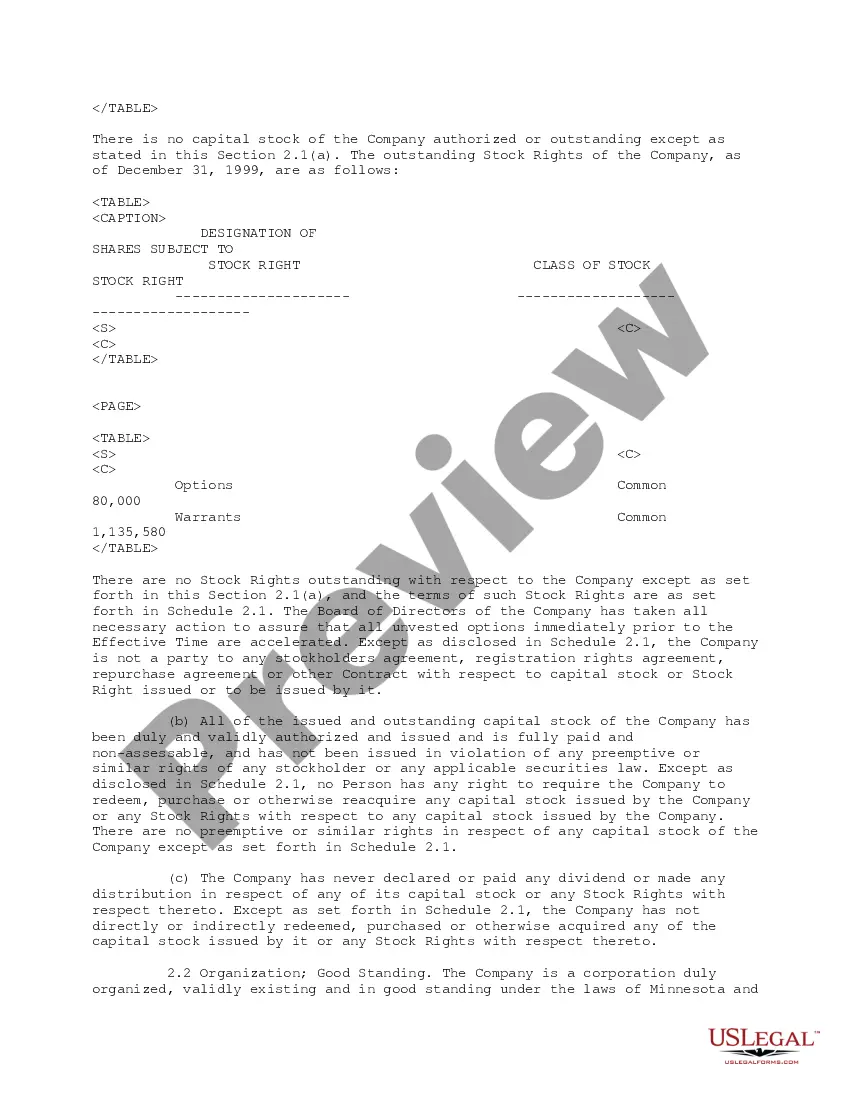

South Carolina Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

It is possible to commit several hours on the Internet attempting to find the lawful record web template that suits the federal and state needs you want. US Legal Forms supplies a large number of lawful types that happen to be examined by experts. It is possible to download or print the South Carolina Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. from the support.

If you already possess a US Legal Forms account, you may log in and then click the Download option. After that, you may comprehensive, change, print, or indication the South Carolina Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Every single lawful record web template you purchase is your own forever. To get yet another duplicate for any acquired kind, go to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms web site the very first time, follow the easy guidelines below:

- First, ensure that you have selected the correct record web template for your area/town that you pick. Look at the kind information to make sure you have picked out the proper kind. If readily available, take advantage of the Preview option to look through the record web template at the same time.

- If you want to discover yet another version in the kind, take advantage of the Look for area to discover the web template that suits you and needs.

- After you have found the web template you would like, click on Get now to carry on.

- Choose the pricing strategy you would like, enter your credentials, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your credit card or PayPal account to purchase the lawful kind.

- Choose the format in the record and download it in your device.

- Make changes in your record if needed. It is possible to comprehensive, change and indication and print South Carolina Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

Download and print a large number of record layouts while using US Legal Forms site, which provides the greatest assortment of lawful types. Use expert and status-distinct layouts to deal with your company or person needs.