Title: Exploring the South Carolina Registration Rights Agreement for Object Soft Corp.'s 6% Series G Convertible Preferred Stocks Introduction: The South Carolina Registration Rights Agreement plays a crucial role in facilitating the sale and purchase of Object Soft Corp.'s 6% Series G convertible preferred stocks. This legal document establishes the rights and obligations between Object Soft Corp. and its investors regarding registration and the ability to sell or transfer these securities. Let's delve into the details of this agreement and explore its different types. Main content: 1. Understanding the South Carolina Registration Rights Agreement: The South Carolina Registration Rights Agreement serves as a contract between Object Soft Corp. and its investors to ensure the proper registration and compliance with state regulations governing the sale and purchase of 6% Series G convertible preferred stocks. It outlines the rights, duties, and obligations of both parties involved. 2. Key Provisions of the Agreement: a. Registration Statements: The agreement outlines the process for Object Soft to file necessary registration statements with the South Carolina regulatory authorities. This enables investors to freely trade the 6% Series G convertible preferred stocks on the open market. b. Demand Rights: Investors may have the right to request Object Soft to file a registration statement for their securities, subject to certain terms and conditions outlined in the agreement. c. Piggyback Rights: In case Object Soft decides to conduct a public offering, the agreement may grant investors the privilege to include their 6% Series G convertible preferred stocks in the registration statement alongside Object Soft's common stocks. d. S-3 Shelf Registration: If eligible, Object Soft may file an S-3 shelf registration statement, allowing investors to offer and sell their 6% Series G convertible preferred stocks at their discretion. 3. Types of South Carolina Registration Rights Agreements: a. Standard Registration Rights Agreement: This agreement primarily focuses on the registration process, ensuring compliance with South Carolina regulations for the sale and purchase of preferred stocks. b. Demand Registration Rights Agreement: A variant of the standard agreement, this type grants investors the right to demand registration of their 6% Series G convertible preferred stocks with Object Soft Corporation. c. Piggyback Registration Rights Agreement: This agreement allows investors to "piggyback" on Object Soft's registration statement for common stocks, ensuring simultaneous registration of their 6% Series G convertible preferred stocks. d. S-3 Shelf Registration Rights Agreement: This specific type of agreement is based on the eligibility criteria for filing an S-3 shelf registration statement. It permits investors to offer and sell their stocks in a streamlined manner. Conclusion: The South Carolina Registration Rights Agreement holds immense significance for Object Soft Corp. and its investors involved in the sale and purchase of 6% Series G convertible preferred stocks. Whether it's the standard registration rights, demand rights, piggyback rights, or S-3 shelf registration, understanding these key provisions and the different types of agreements helps ensure transparent and compliant transactions.

South Carolina Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

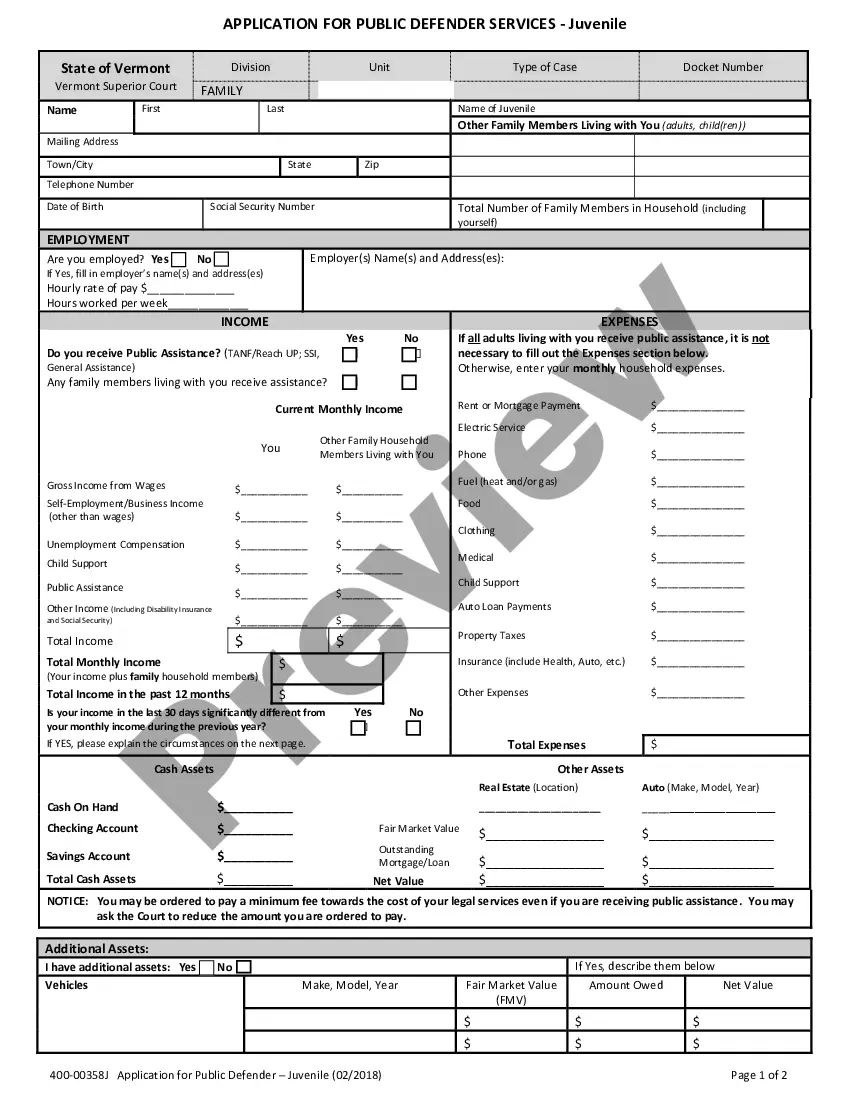

How to fill out South Carolina Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

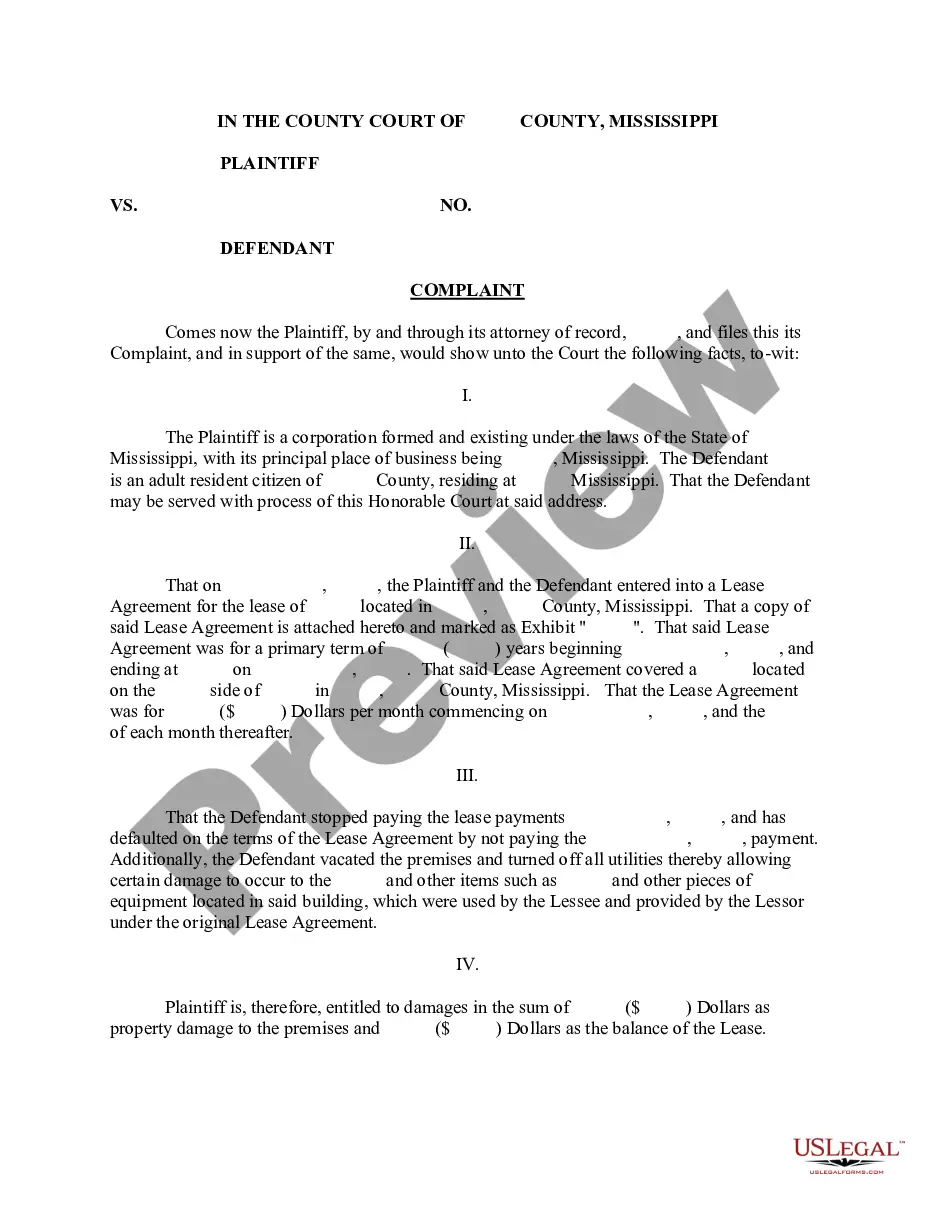

You can commit several hours on the web looking for the legal record web template which fits the federal and state demands you require. US Legal Forms gives 1000s of legal forms that are analyzed by specialists. It is simple to down load or produce the South Carolina Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks from our assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Acquire key. Next, it is possible to total, change, produce, or indicator the South Carolina Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks. Every legal record web template you get is your own for a long time. To acquire one more backup of the bought develop, visit the My Forms tab and then click the related key.

Should you use the US Legal Forms internet site the very first time, follow the basic guidelines below:

- Initial, make sure that you have selected the right record web template for that region/city of your choosing. See the develop information to make sure you have picked out the right develop. If offered, make use of the Preview key to check from the record web template too.

- If you wish to discover one more version of your develop, make use of the Lookup area to get the web template that meets your needs and demands.

- Once you have located the web template you would like, simply click Acquire now to proceed.

- Select the rates strategy you would like, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal bank account to pay for the legal develop.

- Select the structure of your record and down load it to your gadget.

- Make changes to your record if necessary. You can total, change and indicator and produce South Carolina Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Acquire and produce 1000s of record web templates making use of the US Legal Forms web site, that provides the biggest collection of legal forms. Use specialist and condition-distinct web templates to take on your organization or individual demands.