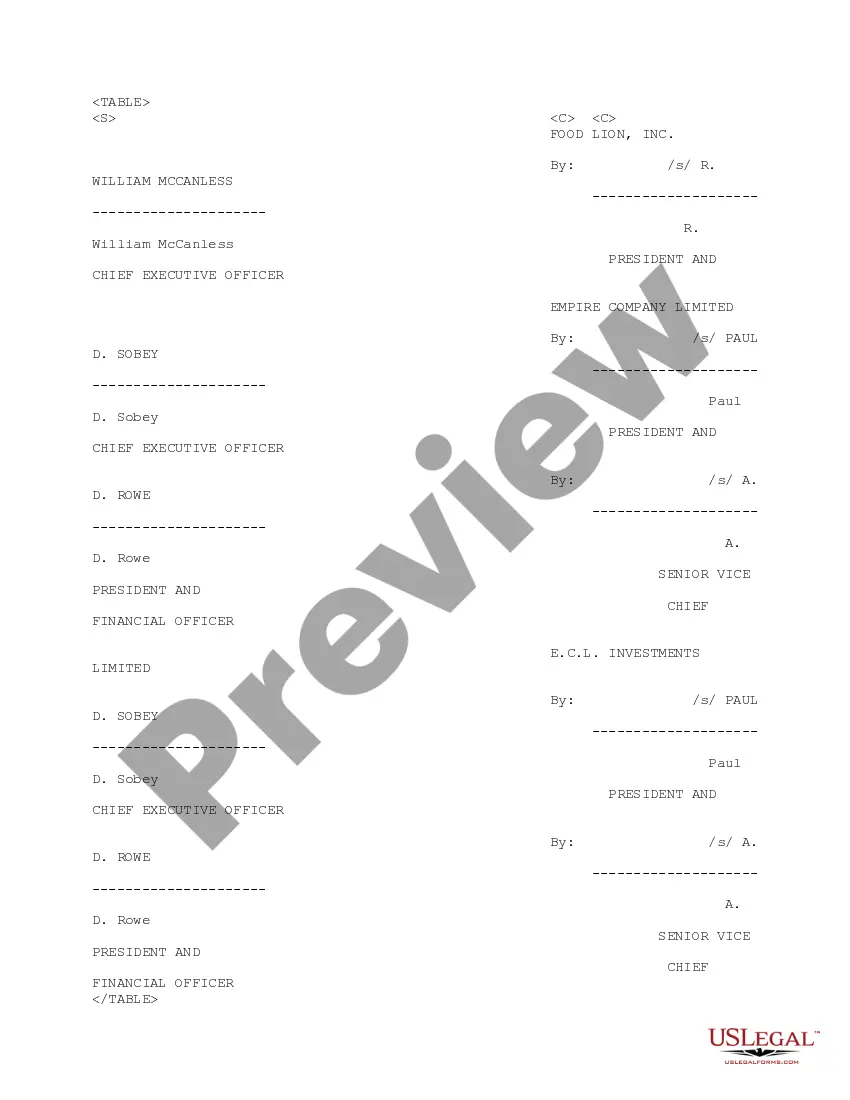

Title: South Carolina Voting Agreement: Food Lion, Inc. and ECL Investments Limited's Approval of Plan of Merger Keywords: South Carolina voting agreement, Food Lion, Inc., ECL Investments Limited, Plan of Merger, approval, detailed description Introduction: The South Carolina voting agreement between Food Lion, Inc. and ECL Investments Limited plays a crucial role in the approval process of the proposed merger plan. This detailed description highlights the significance, purpose, and potential types of voting agreements related to the approval of the Plan of Merger between these entities. 1. Voting Agreement Overview: The South Carolina voting agreement represents a legally binding document that outlines the terms and conditions agreed upon by Food Lion, Inc. and ECL Investments Limited. Its primary objective is to secure the necessary approvals from shareholders and corporate stakeholders to facilitate a successful merger between the two companies. 2. Purpose of the Voting Agreement: The voting agreement serves as a legally binding commitment by both Food Lion, Inc. and ECL Investments Limited to support the proposed Plan of Merger. It ensures consistent and collective decision-making among the shareholders, aiming to increase transparency and streamline the approval process. 3. Key Elements of South Carolina Voting Agreement: a. Shareholder Approval: The voting agreement elaborates on the requirement for Food Lion, Inc. and ECL Investments Limited to secure the majority or super majority of shareholder votes in favor of the merger. This agreement provides clarity on the voting process and required thresholds to validate the merger plan. b. Termination and Withdrawal: The voting agreement may contain provisions specifying the conditions under which either party may terminate or withdraw from the merger plan. These conditions may include breaches of contractual obligations, material changes in financials, legal issues, or unforeseen circumstances. c. Voter Commitments: The agreement establishes the commitment of Food Lion, Inc.'s and ECL Investments Limited's shareholders to vote in favor of the Plan of Merger. This commitment ensures alignment with the merger plan's objectives and aims to eliminate potential roadblocks during the approval process. 4. Potential Types of South Carolina Voting Agreements: a. Unanimous Shareholder Agreement: This type of voting agreement requires the unanimous consent of all shareholders involved. Every shareholder must vote in favor of the Plan of Merger, ensuring complete alignment. b. Super majority Voting Agreement: This type of agreement requires a specified percentage of shareholder vote in favor of the merger, which typically exceeds the majority standard. The exact threshold can be agreed upon by Food Lion, Inc. and ECL Investments Limited, depending on their respective circumstances. c. Majority Voting Agreement: This type of voting agreement necessitates a simple majority vote from shareholders to approve the merger plan. The agreement defines the specific voting threshold required to secure the majority vote. Conclusion: The South Carolina voting agreement between Food Lion, Inc. and ECL Investments Limited regarding the approval of the Plan of Merger is vital for ensuring the successful execution of the merger plan. By establishing clear guidelines for shareholder approvals, this agreement supports transparency, accountability, and the collective decision-making process. The types of voting agreements may vary based on specific circumstances, with unanimous, super majority, and majority voting agreements being potential options.

South Carolina Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger

Description

How to fill out South Carolina Voting Agreement Between Food Lion, Inc. And ECL Investments Limited Regarding Approval Of Plan Of Merger?

Finding the right authorized file web template can be quite a struggle. Naturally, there are a variety of layouts available on the Internet, but how do you find the authorized type you want? Utilize the US Legal Forms website. The service provides thousands of layouts, such as the South Carolina Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger, that can be used for enterprise and personal requirements. Each of the types are inspected by specialists and meet federal and state demands.

When you are currently authorized, log in to your account and click on the Download option to get the South Carolina Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger. Utilize your account to appear with the authorized types you might have bought formerly. Go to the My Forms tab of your own account and get one more duplicate of your file you want.

When you are a fresh consumer of US Legal Forms, allow me to share easy guidelines that you can adhere to:

- Very first, be sure you have chosen the right type for the metropolis/area. It is possible to check out the shape making use of the Preview option and browse the shape explanation to guarantee it is the best for you.

- When the type does not meet your requirements, use the Seach industry to obtain the correct type.

- When you are certain that the shape is acceptable, go through the Acquire now option to get the type.

- Choose the rates strategy you want and type in the essential information. Create your account and buy the order with your PayPal account or bank card.

- Opt for the submit file format and obtain the authorized file web template to your system.

- Complete, modify and printing and indicator the attained South Carolina Voting Agreement between Food Lion, Inc. and ECL Investments Limited regarding approval of Plan of Merger.

US Legal Forms will be the most significant library of authorized types for which you can discover different file layouts. Utilize the service to obtain skillfully-manufactured files that adhere to status demands.