South Carolina Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit is a legal document that outlines the terms and conditions of a loan and security agreement between financial institutions in South Carolina. It is typically used when a company files for bankruptcy and requires access to additional funds to continue its operations during the bankruptcy process. This agreement provides the debtor company with a revolving line of credit, allowing them to borrow funds up to a specified limit. The loan is secured by collateral, which could be assets owned by the debtor company. This collateral acts as a security measure for the financial institutions, ensuring that they have some form of recourse in case the debtor fails to repay the loan. The South Carolina Post-Petition Loan and Security Agreement may include various types, depending on the specific terms and conditions agreed upon by all parties. Some common types of agreements include: 1. Secured Revolving Line of Credit Agreement: This type of agreement involves the debtor company providing collateral, such as inventory, accounts receivable, or equipment, to secure the revolving line of credit. The financial institutions have the right to seize and sell these assets in case of default. 2. Unsecured Revolving Line of Credit Agreement: In this type of agreement, no specific collateral is required. The financial institutions rely on the creditworthiness and reputation of the debtor company to provide the loan. However, the interest rates for an unsecured revolving line of credit may be higher to compensate for the increased risk. 3. Cross-Collateralized Revolving Line of Credit Agreement: This agreement involves multiple assets being pledged as collateral to secure the revolving line of credit. It provides the financial institutions with a higher level of security, as they have a claim on more than one asset. 4. Term Revolving Line of Credit Agreement: Unlike a typical revolving line of credit agreement, the term revolving line of credit has a specific maturity date. The debtor company has to repay the loan within a fixed term, usually in installments. These are just a few examples of the South Carolina Post-Petition Loan and Security Agreements that may be used by various financial institutions regarding revolving lines of credit. The specific terms and conditions can vary based on the negotiations and agreement reached between the debtor company and the financial institutions involved.

South Carolina Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

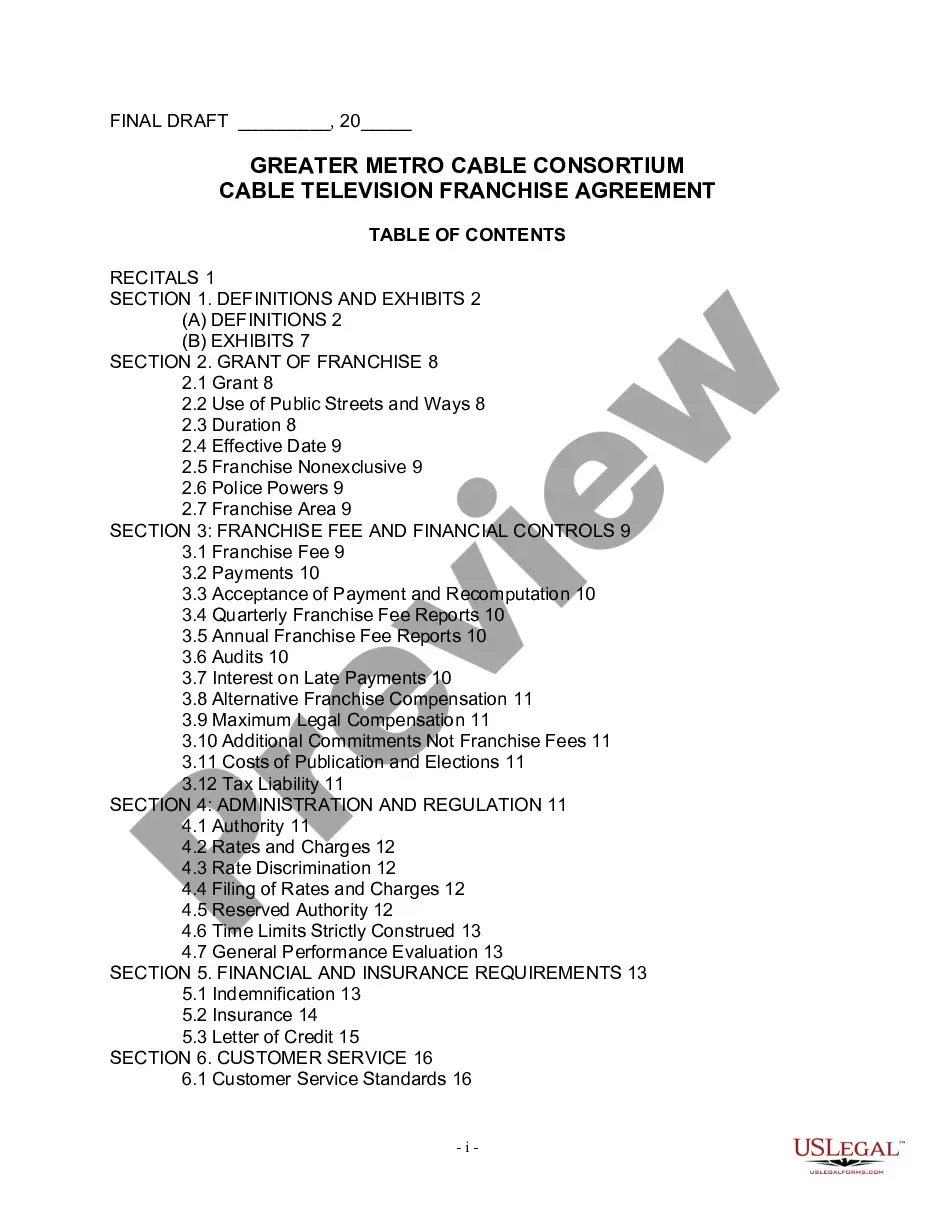

How to fill out South Carolina Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Are you in a place in which you need files for possibly company or specific uses just about every day time? There are plenty of authorized document themes available online, but discovering types you can depend on is not simple. US Legal Forms gives thousands of kind themes, just like the South Carolina Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, which are composed to satisfy federal and state specifications.

In case you are already knowledgeable about US Legal Forms website and possess your account, simply log in. Following that, you are able to down load the South Carolina Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit design.

Should you not provide an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you will need and make sure it is for your right area/county.

- Take advantage of the Review switch to review the shape.

- Browse the description to ensure that you have chosen the correct kind.

- When the kind is not what you are looking for, use the Search area to get the kind that meets your requirements and specifications.

- Whenever you obtain the right kind, click on Buy now.

- Opt for the prices plan you desire, complete the required info to make your bank account, and buy your order utilizing your PayPal or credit card.

- Decide on a hassle-free paper formatting and down load your version.

Locate each of the document themes you possess bought in the My Forms food selection. You can aquire a additional version of South Carolina Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit any time, if needed. Just click the essential kind to down load or printing the document design.

Use US Legal Forms, the most substantial variety of authorized forms, to save efforts and stay away from mistakes. The services gives expertly made authorized document themes which you can use for an array of uses. Produce your account on US Legal Forms and begin creating your lifestyle easier.