South Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

How to fill out Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

You may invest hrs on-line searching for the authorized record template that suits the federal and state needs you need. US Legal Forms supplies a huge number of authorized forms which can be evaluated by experts. You can actually acquire or print the South Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions from my services.

If you already have a US Legal Forms profile, you are able to log in and then click the Download key. Afterward, you are able to comprehensive, modify, print, or signal the South Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Each and every authorized record template you acquire is your own for a long time. To have another copy of any purchased type, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms website for the first time, keep to the straightforward directions beneath:

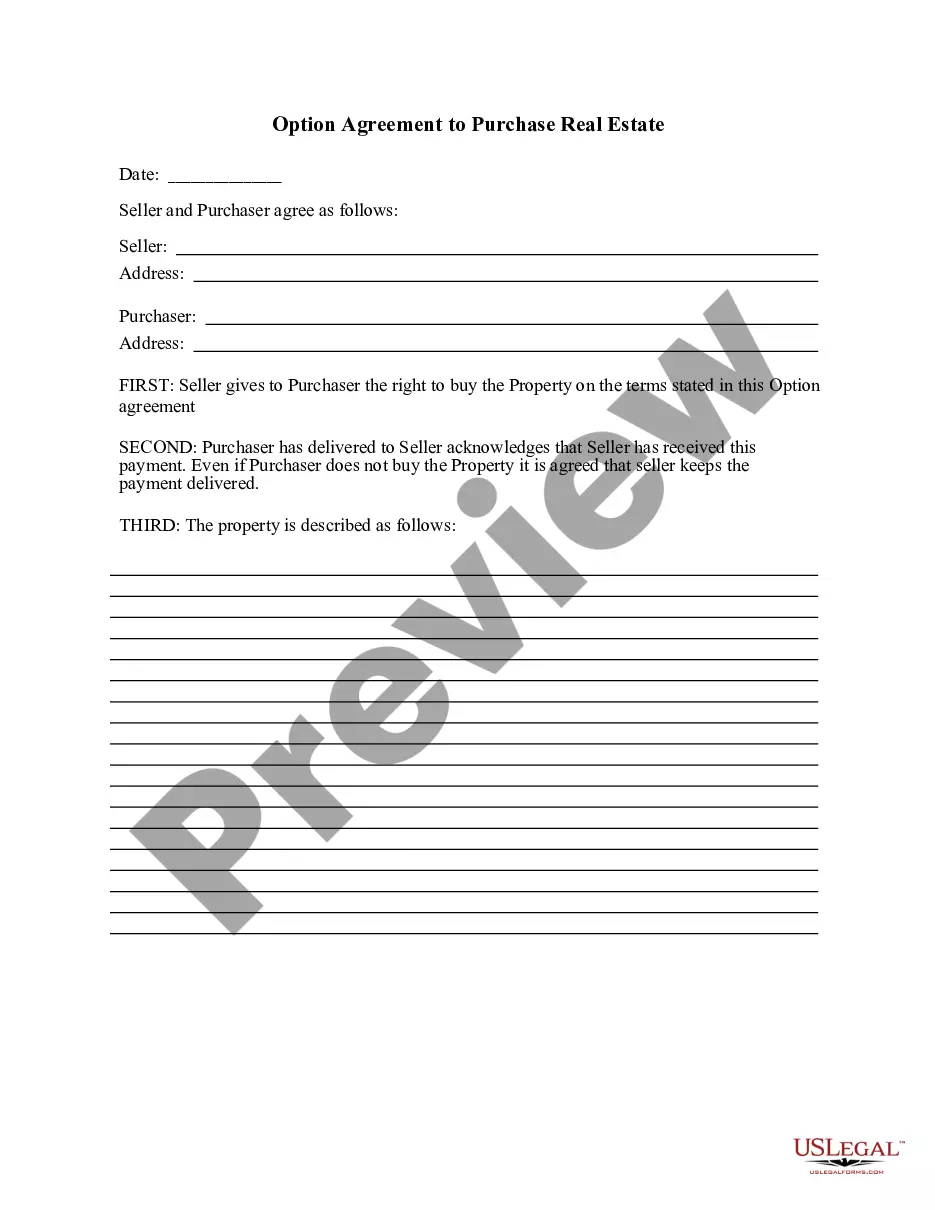

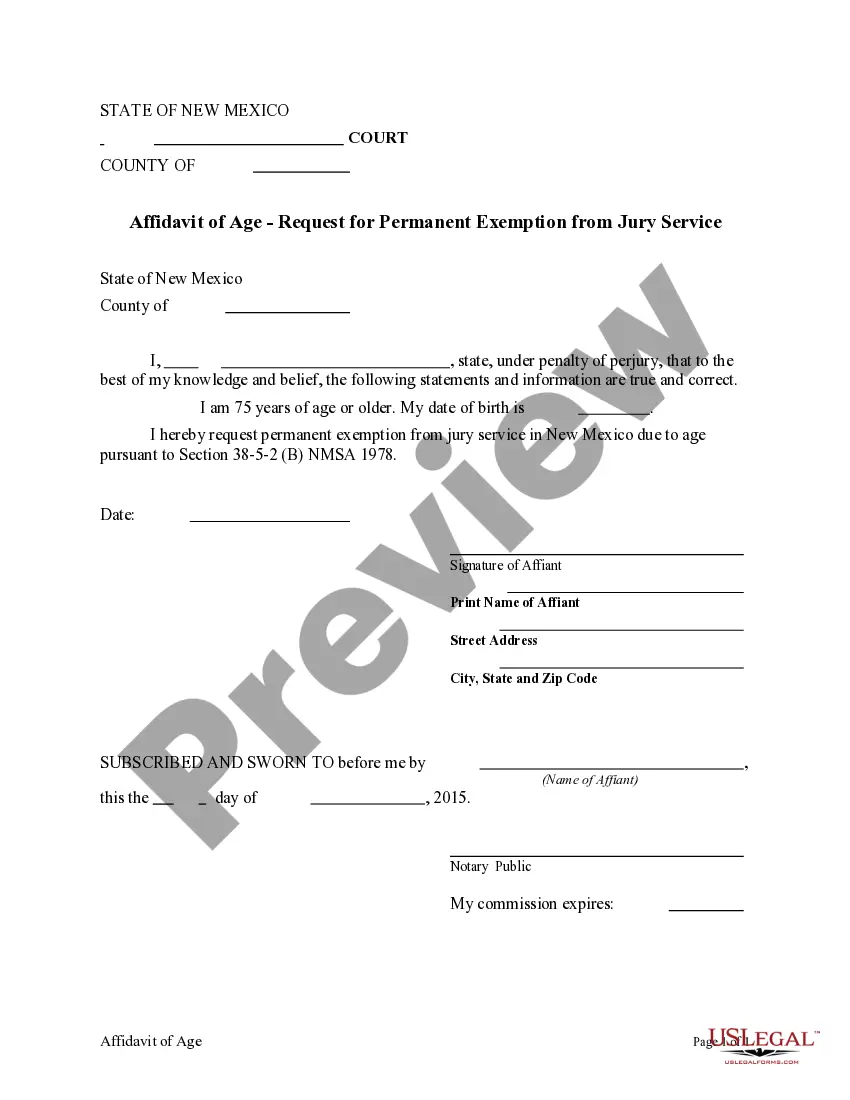

- First, ensure that you have selected the proper record template for the area/city of your choosing. See the type explanation to make sure you have picked out the correct type. If available, use the Preview key to look with the record template as well.

- If you wish to get another version in the type, use the Research industry to find the template that meets your needs and needs.

- When you have found the template you desire, simply click Acquire now to move forward.

- Pick the rates strategy you desire, type in your references, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your bank card or PayPal profile to purchase the authorized type.

- Pick the format in the record and acquire it to your product.

- Make changes to your record if necessary. You may comprehensive, modify and signal and print South Carolina Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Download and print a huge number of record layouts making use of the US Legal Forms Internet site, that provides the largest collection of authorized forms. Use skilled and state-particular layouts to deal with your company or specific requirements.