South Carolina Tax Sharing and Disaffiliation Agreement is a legal document that outlines the terms and conditions related to the sharing of taxes and disaffiliation between different entities or municipalities within the state of South Carolina. This agreement is primarily designed to establish a fair and mutually beneficial arrangement for the distribution of tax revenues. The South Carolina Tax Sharing and Disaffiliation Agreement encompasses various types depending on the parties involved and the purpose of the agreement. Some commonly known types include: 1. Interlocal Agreement: This type of agreement is entered into between different local government entities within South Carolina, such as cities, towns, or counties. It establishes the terms for tax revenue sharing and disaffiliation between these local authorities, ensuring a coordinated and equitable distribution of tax burdens. 2. Multi-jurisdictional Agreement: This agreement involves multiple parties, including local governments, private enterprises, and other relevant stakeholders operating within different jurisdictions across South Carolina. It addresses tax sharing issues that arise due to the spatial distribution of business activities and aims to mitigate any potential conflicts. 3. Municipal Tax Sharing Agreement: This agreement is specific to municipalities within South Carolina. It defines the mechanisms through which tax revenues generated within a municipality are shared with other municipalities or government entities, promoting regional financial cooperation and economic development. 4. Intergovernmental Agreement: This broad type of agreement involves various South Carolina state agencies, state-owned enterprises, and local governments. It discusses the sharing and disaffiliation of taxes between different entities and facilitates cooperation in areas such as infrastructure development, service provision, and regional planning. Regardless of the specific type, a South Carolina Tax Sharing and Disaffiliation Agreement typically covers essential elements such as the formula for tax distribution, allocation of tax revenues, dispute resolution mechanisms, and governance structures. It aims to ensure transparency, fairness, and efficiency in the taxation system while fostering collaboration and economic growth across the state.

South Carolina Tax Sharing and Disaffiliation Agreement

Description

How to fill out Tax Sharing And Disaffiliation Agreement?

Have you been inside a situation where you require files for both enterprise or person functions almost every day? There are a variety of authorized file layouts available on the Internet, but discovering kinds you can trust isn`t easy. US Legal Forms gives a huge number of form layouts, like the South Carolina Tax Sharing and Disaffiliation Agreement, which are published to fulfill federal and state requirements.

If you are currently knowledgeable about US Legal Forms site and get your account, just log in. Next, it is possible to down load the South Carolina Tax Sharing and Disaffiliation Agreement format.

Unless you have an profile and wish to begin using US Legal Forms, abide by these steps:

- Find the form you need and ensure it is for that appropriate town/region.

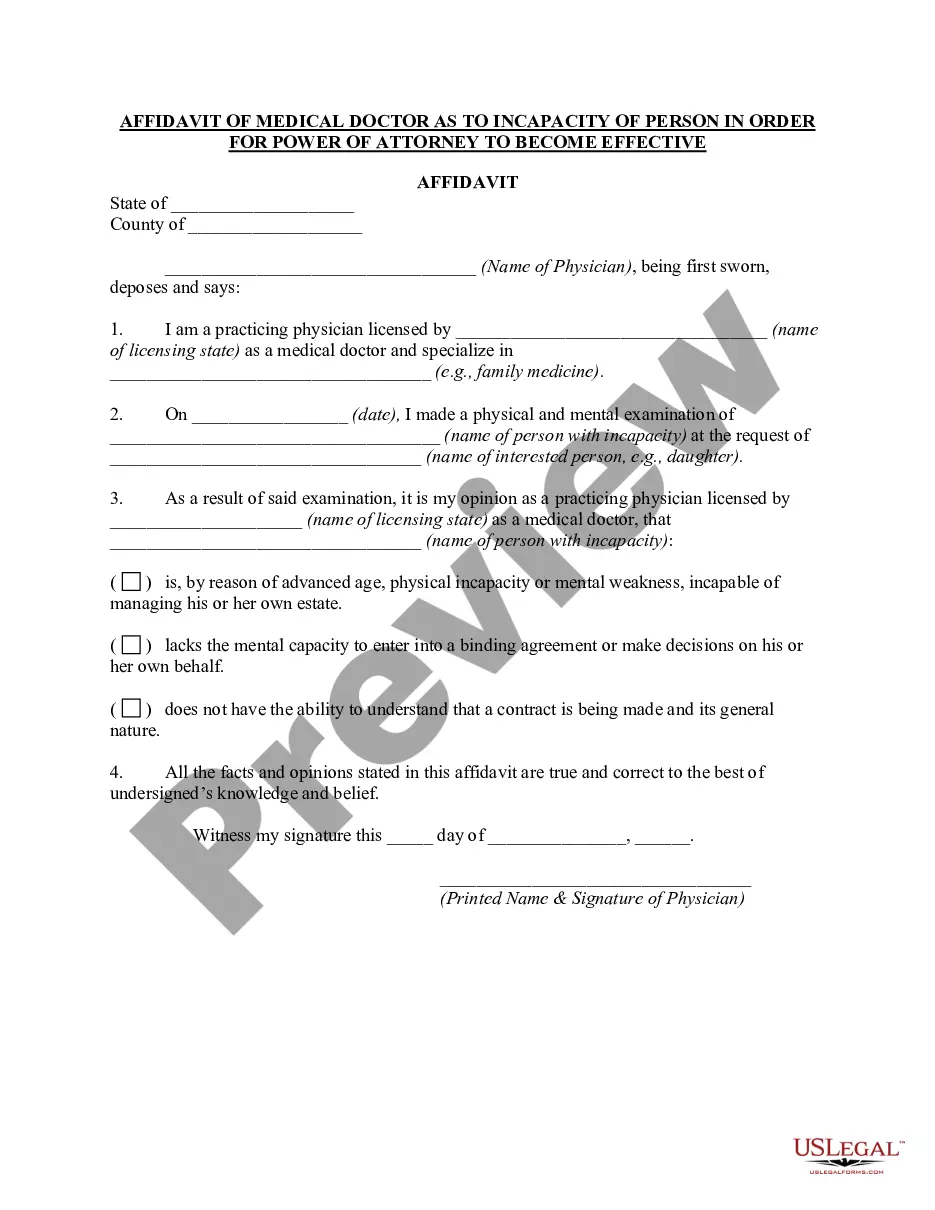

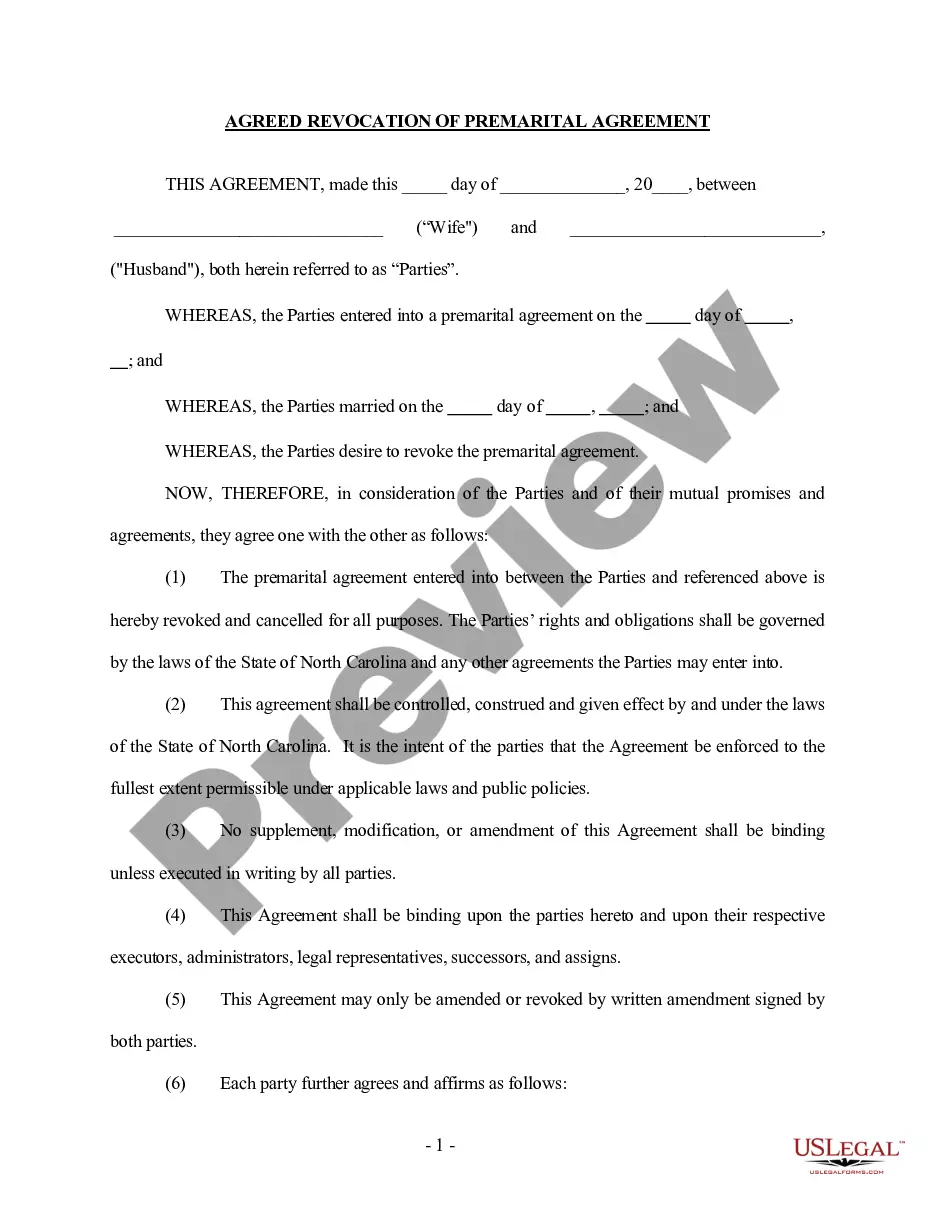

- Make use of the Review switch to review the shape.

- Browse the description to actually have selected the appropriate form.

- In case the form isn`t what you`re searching for, make use of the Look for industry to get the form that meets your requirements and requirements.

- Whenever you obtain the appropriate form, just click Get now.

- Opt for the prices program you would like, submit the specified details to create your money, and purchase the transaction utilizing your PayPal or credit card.

- Decide on a handy paper format and down load your backup.

Locate all the file layouts you might have bought in the My Forms menus. You can aquire a extra backup of South Carolina Tax Sharing and Disaffiliation Agreement whenever, if required. Just click on the essential form to down load or printing the file format.

Use US Legal Forms, one of the most substantial variety of authorized types, in order to save time as well as stay away from errors. The services gives professionally manufactured authorized file layouts that you can use for a selection of functions. Produce your account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.

Purpose of Affidavit The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

7% of the total of each payment made to a nonresident taxpayer who is not a corporation. 5% of the total of each payment made to a nonresident taxpayer that is a corporation.

S Corporations are required to withhold 5% of the South Carolina taxable income of shareholders who are nonresidents of South Carolina.

What are the withholding requirements on nonresident partners? ? Partnerships are required to withhold 5% of the South Carolina taxable income of partners who are nonresidents of South Carolina.

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain.

South Carolina Partnerships Must File Form 1065 Although a partnership is taxed as a pass-through entity, the business entity itself still has to file a tax return. If you own a general partnership in South Carolina, it is imperative that you file your business return before the relevant deadline.

South Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income. The state has some of the lowest property taxes in the country.