South Carolina Employee Shareholder Escrow Agreement

Description

How to fill out Employee Shareholder Escrow Agreement?

Have you been in a placement the place you need files for sometimes organization or individual reasons virtually every day? There are a variety of lawful record themes available on the net, but discovering versions you can depend on isn`t easy. US Legal Forms gives a huge number of develop themes, just like the South Carolina Employee Shareholder Escrow Agreement, which are published to fulfill federal and state specifications.

Should you be currently knowledgeable about US Legal Forms website and get your account, basically log in. After that, you can download the South Carolina Employee Shareholder Escrow Agreement web template.

If you do not come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is to the correct city/area.

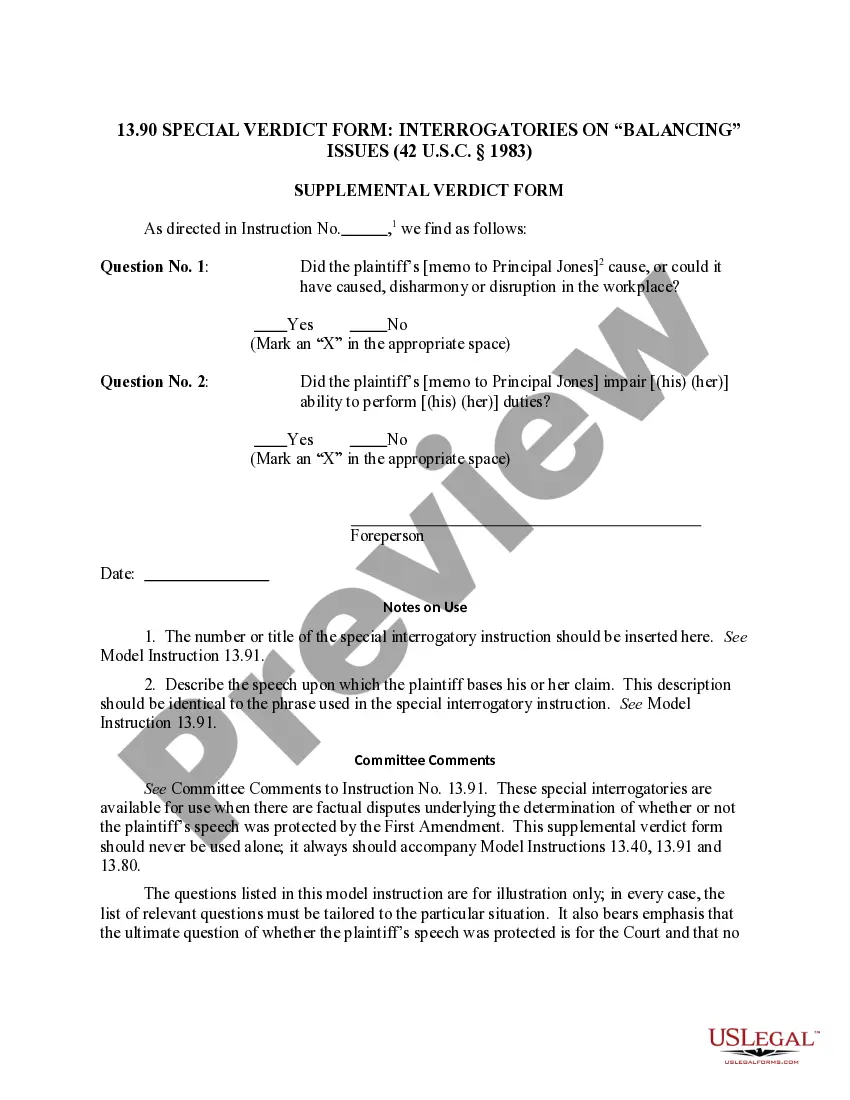

- Take advantage of the Review option to check the shape.

- Look at the information to ensure that you have selected the right develop.

- When the develop isn`t what you are trying to find, make use of the Research discipline to find the develop that fits your needs and specifications.

- If you get the correct develop, simply click Purchase now.

- Opt for the prices prepare you need, submit the desired information and facts to generate your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a practical document file format and download your duplicate.

Get all the record themes you may have bought in the My Forms food list. You can aquire a more duplicate of South Carolina Employee Shareholder Escrow Agreement at any time, if needed. Just go through the necessary develop to download or produce the record web template.

Use US Legal Forms, one of the most substantial collection of lawful forms, to save time as well as prevent blunders. The services gives expertly made lawful record themes which can be used for a range of reasons. Produce your account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

2022 South Carolina Code of Laws. Title 40 - Professions and Occupations. Chapter 57 - Real Estate Brokers, Salesmen, And Property Managers.

Joint Tenants with Rights of Survivorship: Created by SC Code §27-7-40. Upon the death of one owner, the death certificate is filed at the courthouse and that owner's interest automatically passes to the surviving owner(s). In other words, it does not pass through an estate.

SECTION 40-57-10. South Carolina Real Estate Commission created; purpose. There is created the South Carolina Real Estate Commission under the administration of the Department of Labor, Licensing and Regulation.

SECTION 40-57-20. Valid licensure requirement for real estate brokers, salesmen and property managers. It is unlawful for an individual to act as a real estate broker, real estate salesman, or real estate property manager or to advertise as such without a valid license issued by the department.

A buyer's agent, his company, and the broker-in-charge are not liable to a seller for providing the seller with false or misleading information if that information was provided to the licensee by his client and the licensee did not know or have reasonable cause to suspect the information was false or incomplete.

SECTION 37-22-120. Licensing requirements. (2) circulate or use advertising, including electronic means, make a representation or give information to a person which indicates or reasonably implies activity within the scope of this chapter.

SECTION 40-57-135. Duties of broker-in-charge and property manager-in-charge; associated licensees; office locations; policies and recordkeeping; management agreements; unlicensed employees. (8) notify the commission by mail within ten days of any change of office name, address, email address, or telephone number.

There is nothing illegal or wrong about double closings. There are perfectly legal and ethical.