South Carolina Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

Choosing the best legitimate record format can be a struggle. Of course, there are a lot of templates accessible on the Internet, but how can you get the legitimate develop you need? Utilize the US Legal Forms site. The assistance offers a large number of templates, for example the South Carolina Term Sheet - Convertible Debt Financing, which can be used for organization and private needs. All of the varieties are checked by pros and meet federal and state needs.

When you are currently signed up, log in in your account and click the Acquire key to find the South Carolina Term Sheet - Convertible Debt Financing. Make use of your account to check throughout the legitimate varieties you might have acquired formerly. Proceed to the My Forms tab of your own account and obtain another duplicate of your record you need.

When you are a whole new user of US Legal Forms, listed below are easy recommendations that you can adhere to:

- First, make sure you have selected the proper develop to your area/area. You can look through the form while using Preview key and browse the form information to guarantee it will be the right one for you.

- If the develop does not meet your needs, use the Seach area to get the right develop.

- Once you are certain the form is suitable, click on the Purchase now key to find the develop.

- Pick the prices plan you want and enter the required info. Make your account and buy your order using your PayPal account or charge card.

- Select the submit format and acquire the legitimate record format in your gadget.

- Complete, revise and produce and indicator the obtained South Carolina Term Sheet - Convertible Debt Financing.

US Legal Forms will be the largest catalogue of legitimate varieties where you can discover different record templates. Utilize the service to acquire professionally-made paperwork that adhere to condition needs.

Form popularity

FAQ

Convertible Note - Reporting Requirements FIRC and KYC of the non-resident investor. Name and address of the investor and AD bank. Copy of MOA / AOA. Certificate of Incorporation. Startup Registration Certificate. Certificate from Practising Company Secretary.

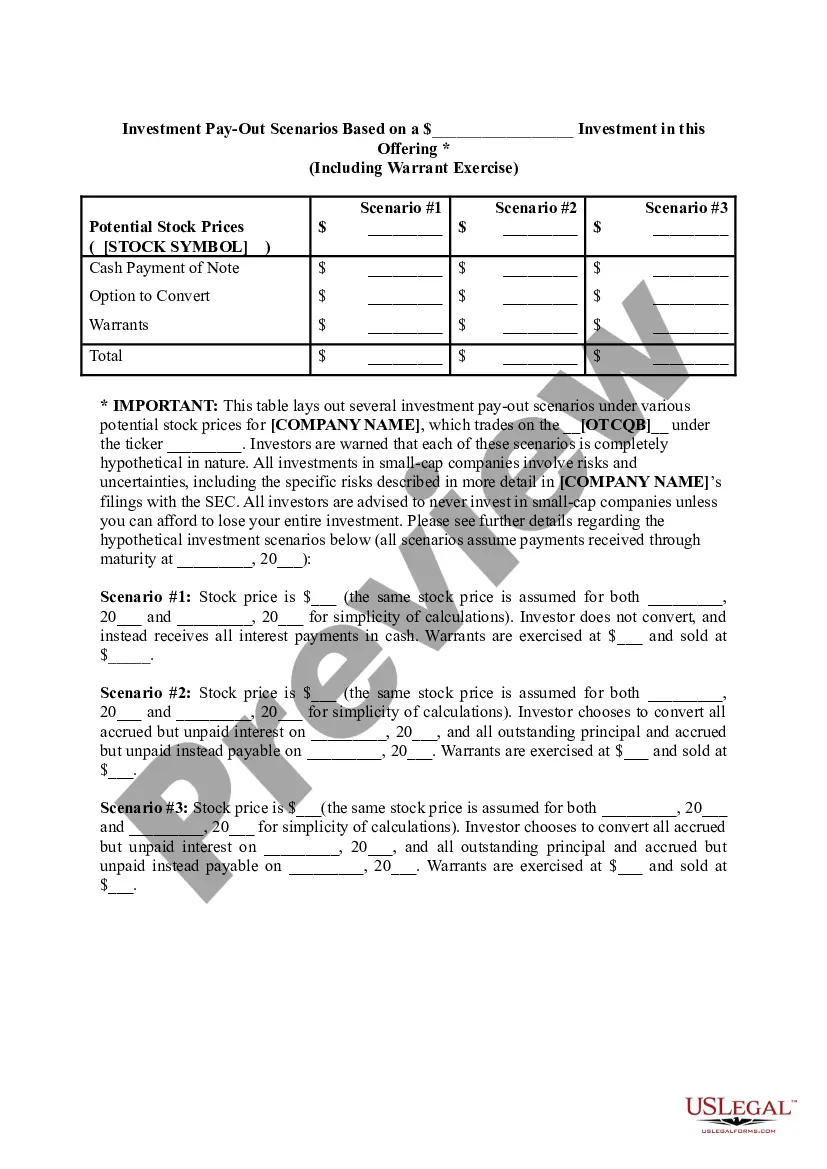

What is a Term Sheet? A term sheet is a nonbinding bullet-point document that outlines the material terms and conditions of a potential business agreement. The purpose of a term sheet is to outline the terms upon which the venture debt provider is willing to make the investment.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.