South Carolina Term Sheet — Convertible Debt Financing is a legal document that outlines the terms and conditions of a financing arrangement in the state of South Carolina. This type of financing is commonly used by startups and early-stage companies looking to raise capital from investors. The term sheet serves as a preliminary agreement between the company seeking funding and potential investors. It includes details such as the principal amount of the loan, interest rate, maturity date, conversion price, conversion conditions, and other provisions that govern the relationship between the parties involved. A South Carolina Term Sheet — Convertible Debt Financing may come in various types, including: 1. Traditional Convertible Debt: This type of financing provides the investor with the option to convert their debt into equity at a later stage, typically during a future financing round or exit event. 2. Simple Agreement for Future Equity (SAFE): SAFE is a relatively new form of convertible debt financing that has gained popularity in the startup ecosystem. It offers similar benefits to traditional convertible debt but with fewer investor rights and a simpler structure. 3. Customized Term Sheets: Depending on the specific needs and preferences of the parties involved, term sheets can be customized to include unique provisions or variations. This allows for flexibility in tailoring the terms to suit the specific transaction. When drafting a South Carolina Term Sheet — Convertible Debt Financing, it is important to consider the applicable laws and regulations in the state. The term sheet should clearly outline the governing law, jurisdiction, and dispute resolution mechanism, ensuring the parties' legal rights and obligations are protected. In conclusion, a South Carolina Term Sheet — Convertible Debt Financing is a crucial legal document in raising capital for startups and early-stage companies. It provides a framework for the financing arrangement and outlines the terms and conditions of the investment. Understanding the different types and key elements of these term sheets is essential for both investors and companies seeking funding in South Carolina.

South Carolina Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - one of many greatest libraries of authorized forms in the States - offers a wide array of authorized papers themes you are able to down load or print out. Using the site, you will get a large number of forms for company and person reasons, sorted by groups, suggests, or key phrases.You will find the most up-to-date variations of forms like the South Carolina Term Sheet - Convertible Debt Financing within minutes.

If you already possess a subscription, log in and down load South Carolina Term Sheet - Convertible Debt Financing from the US Legal Forms catalogue. The Obtain switch will appear on every kind you see. You gain access to all previously delivered electronically forms inside the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are easy recommendations to help you started off:

- Ensure you have selected the proper kind for the area/region. Click the Review switch to check the form`s information. Browse the kind outline to actually have chosen the proper kind.

- In the event the kind doesn`t match your specifications, take advantage of the Lookup field on top of the display to obtain the the one that does.

- When you are satisfied with the form, affirm your selection by clicking the Get now switch. Then, choose the rates plan you favor and supply your credentials to sign up for the bank account.

- Approach the deal. Utilize your bank card or PayPal bank account to complete the deal.

- Choose the file format and down load the form on the system.

- Make adjustments. Load, edit and print out and indicator the delivered electronically South Carolina Term Sheet - Convertible Debt Financing.

Every single template you included in your account does not have an expiry date and is yours eternally. So, if you want to down load or print out yet another duplicate, just visit the My Forms segment and click on the kind you want.

Gain access to the South Carolina Term Sheet - Convertible Debt Financing with US Legal Forms, one of the most comprehensive catalogue of authorized papers themes. Use a large number of expert and status-distinct themes that meet your business or person requires and specifications.

Form popularity

FAQ

Usually 12?24 months. A mandatory conversion paragraph. Specifies the minimum size of the round that the company must close in the future (a qualified financing) to cause the debt to automatically convert into equity of the company. An optional conversion paragraph.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

Convertible bonds offer lower interest rates than comparable conventional bonds, so they're a cost-effective way for the company to raise money. Their conversion to shares also saves the company cash, although it risks diluting the share price.

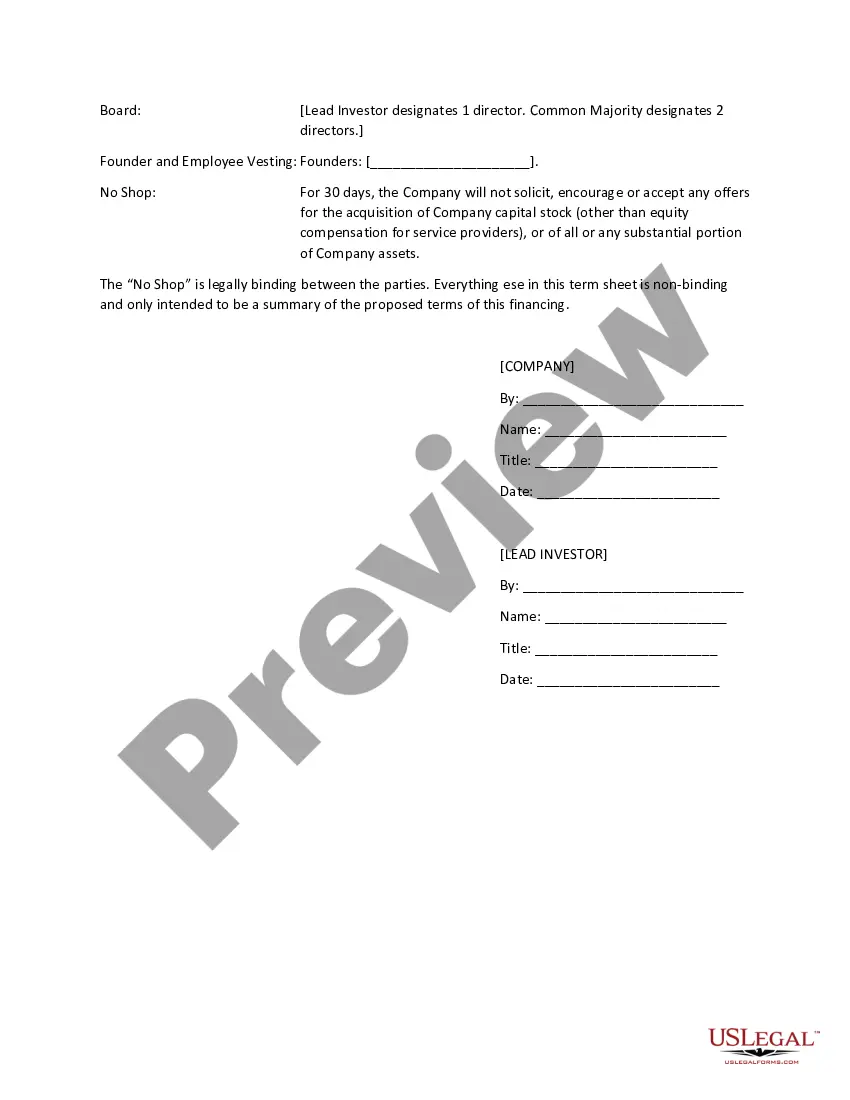

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

If a convertible debt instrument (where the conversion option was not bifurcated) is converted into a reporting entity's common or preferred stock pursuant to a conversion option in the instrument, it is not an extinguishment; the convertible debt is settled in exchange for equity and no gain or loss is recognized upon ...

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current.

Terms of Convertible Debt The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

The convertible debt that was listed as a non-current liability before the conversion now gets get treated as shareholder's equity.