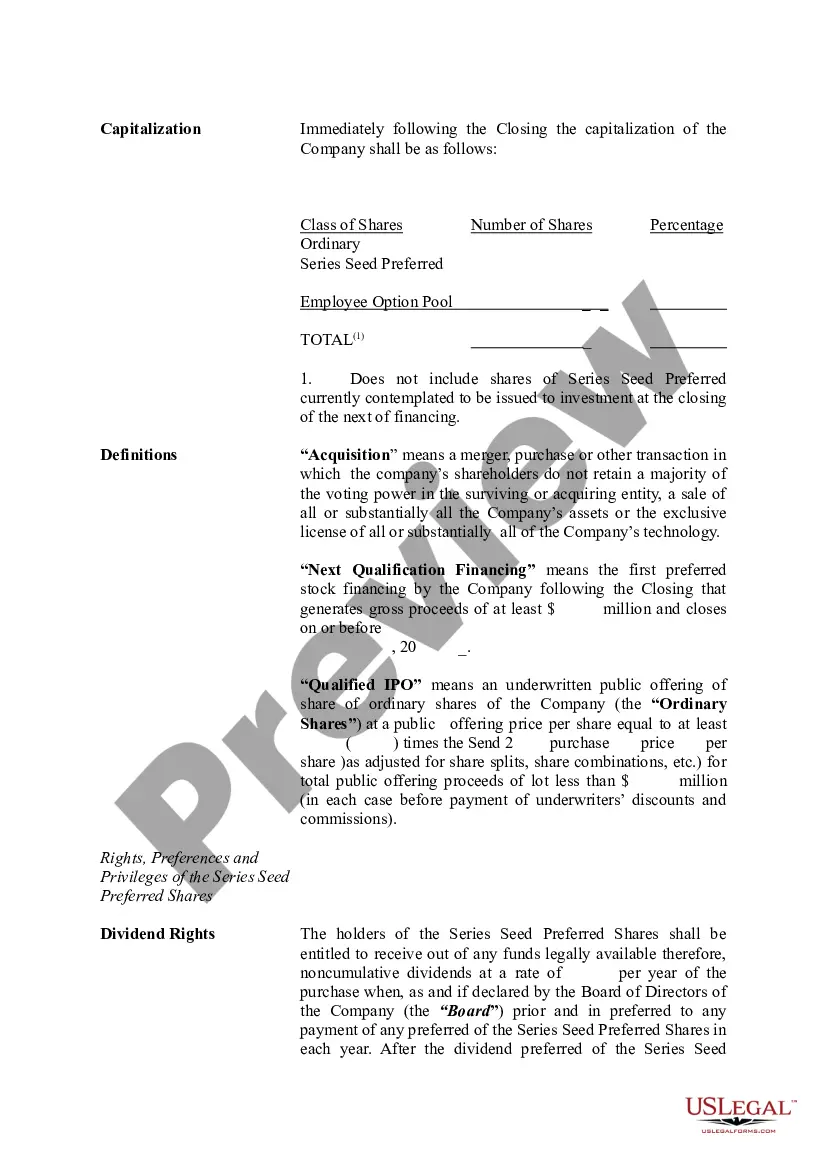

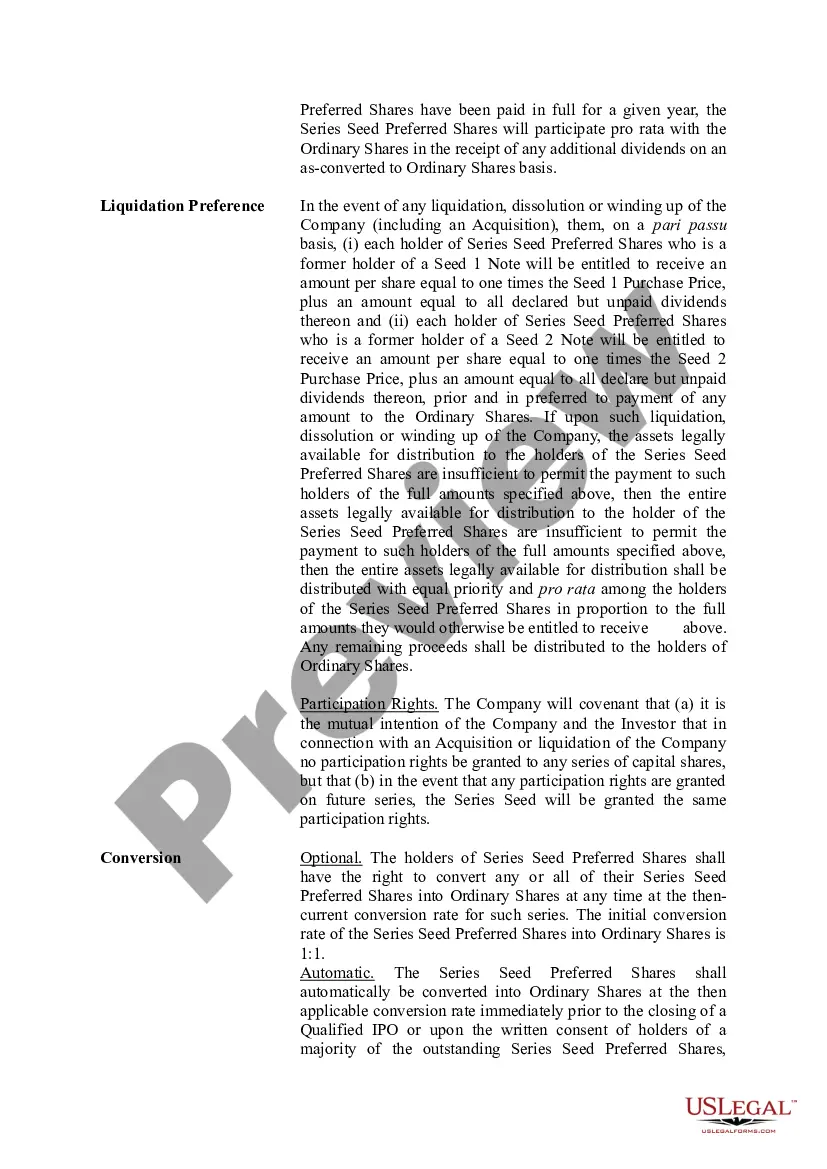

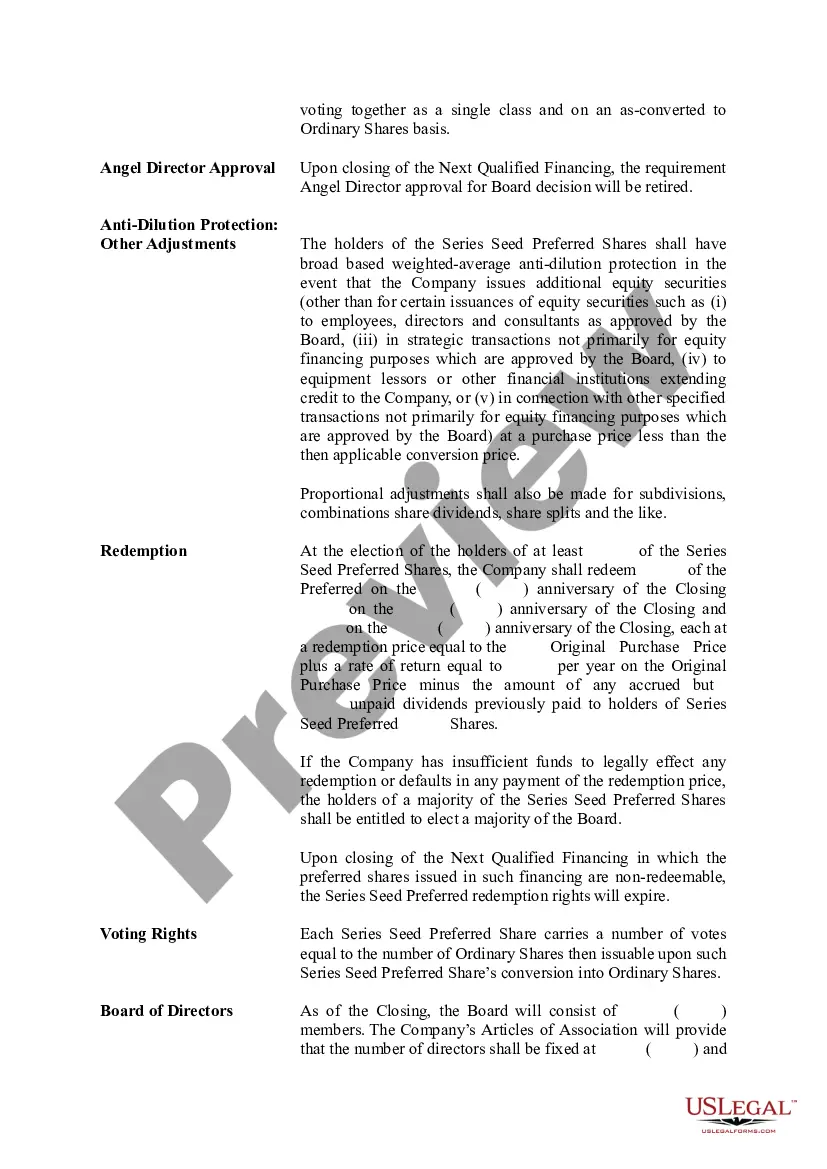

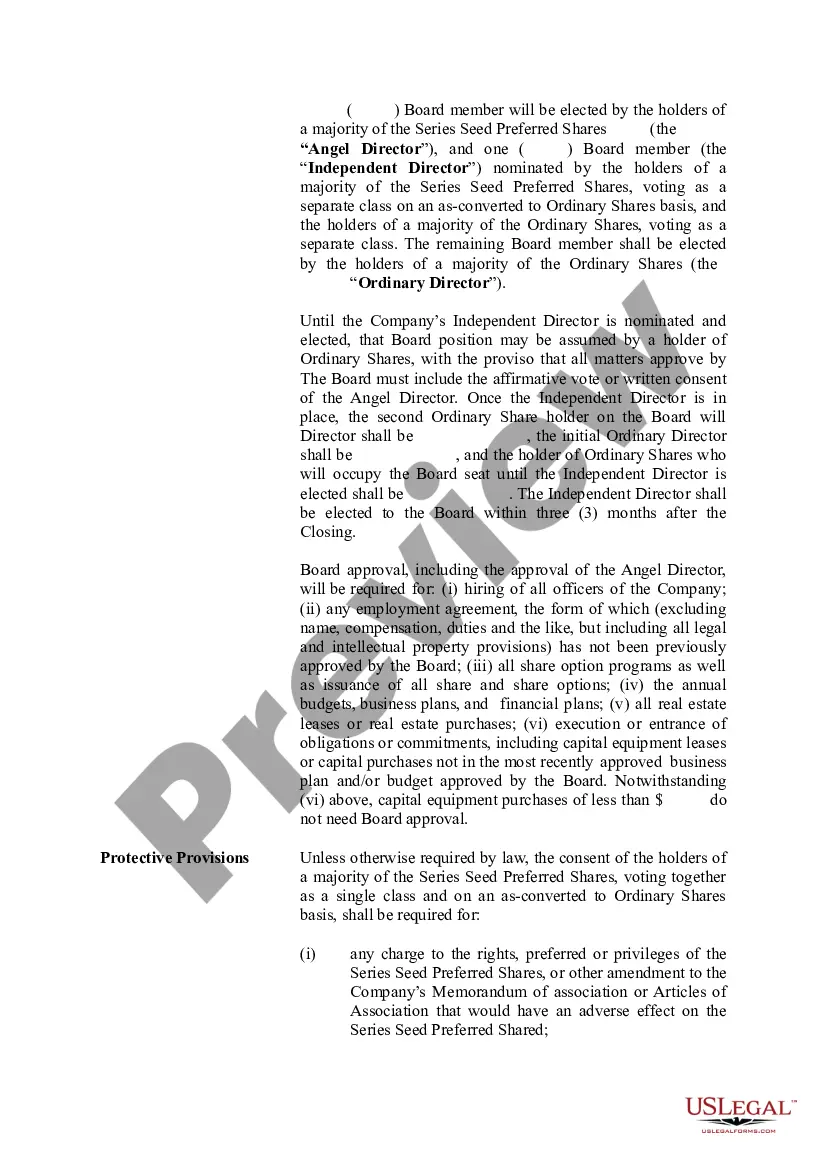

A South Carolina Term Sheet — Series Seed Preferred Share for Company is a legal document that outlines the terms and conditions of an investment agreement between a company and investors. It establishes the rights and obligations of both parties, specifically regarding the issuance of preferred shares and the investment process. Keywords: South Carolina, Term Sheet, Series Seed Preferred Share, Company, investment agreement, preferred shares, rights, obligations, investment process. In South Carolina, there are several types of Term Sheets for Series Seed Preferred Share agreements that may be used by companies and investors: 1. Basic Term Sheet: This outlines the fundamental terms and conditions of the investment, including the number of preferred shares to be issued, the price per share, and the total investment amount. 2. Liquidation Preferences: This type of Term Sheet specifies the order in which investors will receive their investment back in the event of liquidation or acquisition of the company. It may include elements such as multiple liquidation preferences, participation rights, and seniority preferences. 3. Anti-Dilution Provisions: These types of Term Sheets protect investors from future dilution of their ownership in the company. It establishes mechanisms to adjust the conversion price of the preferred shares in case of subsequent funding rounds or share issuance. 4. Dividend Provisions: This Term Sheet element outlines whether the preferred shares will be entitled to receive dividends and, if so, at what rate. It may also mention whether the dividends will be cumulative or non-cumulative. 5. Voting Rights: This part of the Term Sheet highlights the scope of voting rights attached to the preferred shares. It may define voting thresholds, protective provisions, and the level of control that the investors may exercise over company decisions. 6. Conversion Rights: This Term Sheet section specifies the conditions under which the preferred shares can be converted into common shares. It may include conversion ratios, conversion events (such as an IPO or a sale of the company), and any conversion price adjustments. 7. Board Seat and Observer Rights: If investors are granted a seat on the company's board of directors or observer rights, this Term Sheet will outline the specific terms regarding their involvement in corporate governance. 8. Information Rights: This part of the Term Sheet ensures that investors receive regular financial and operational information about the company. It typically defines the frequency and level of detail of these reports. 9. Founder Vesting: In some cases, the Term Sheet for Series Seed Preferred Share agreements may include vesting provisions for the founders' shares to align their interests with the long-term success of the company. 10. Redemption Rights: This element outlines whether the investors have the right to require the company to repurchase their preferred shares at a future date or under specific conditions. It is important to note that a South Carolina Term Sheet — Series Seed Preferred Share for Company can vary in its structure and content based on the specific needs and negotiations between the company and investors. Companies should seek legal advice to ensure compliance with applicable laws and properly protect their interests.

South Carolina Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out South Carolina Term Sheet - Series Seed Preferred Share For Company?

Choosing the right legitimate papers template can be quite a battle. Of course, there are plenty of layouts available on the Internet, but how would you obtain the legitimate develop you require? Utilize the US Legal Forms website. The service delivers a huge number of layouts, such as the South Carolina Term Sheet - Series Seed Preferred Share for Company, which can be used for business and private needs. All of the kinds are checked out by specialists and meet state and federal requirements.

When you are currently listed, log in in your accounts and click the Download switch to have the South Carolina Term Sheet - Series Seed Preferred Share for Company. Utilize your accounts to search with the legitimate kinds you may have acquired formerly. Go to the My Forms tab of your respective accounts and have another duplicate from the papers you require.

When you are a whole new user of US Legal Forms, listed below are basic recommendations that you can follow:

- Very first, make certain you have selected the proper develop for the metropolis/area. You can look over the form utilizing the Preview switch and study the form description to make sure this is basically the right one for you.

- If the develop fails to meet your requirements, make use of the Seach discipline to discover the right develop.

- When you are sure that the form is proper, go through the Purchase now switch to have the develop.

- Opt for the pricing program you would like and enter the needed info. Make your accounts and buy the order using your PayPal accounts or credit card.

- Pick the document structure and down load the legitimate papers template in your system.

- Full, modify and produce and indicator the obtained South Carolina Term Sheet - Series Seed Preferred Share for Company.

US Legal Forms will be the greatest library of legitimate kinds in which you can discover numerous papers layouts. Utilize the service to down load expertly-produced documents that follow state requirements.