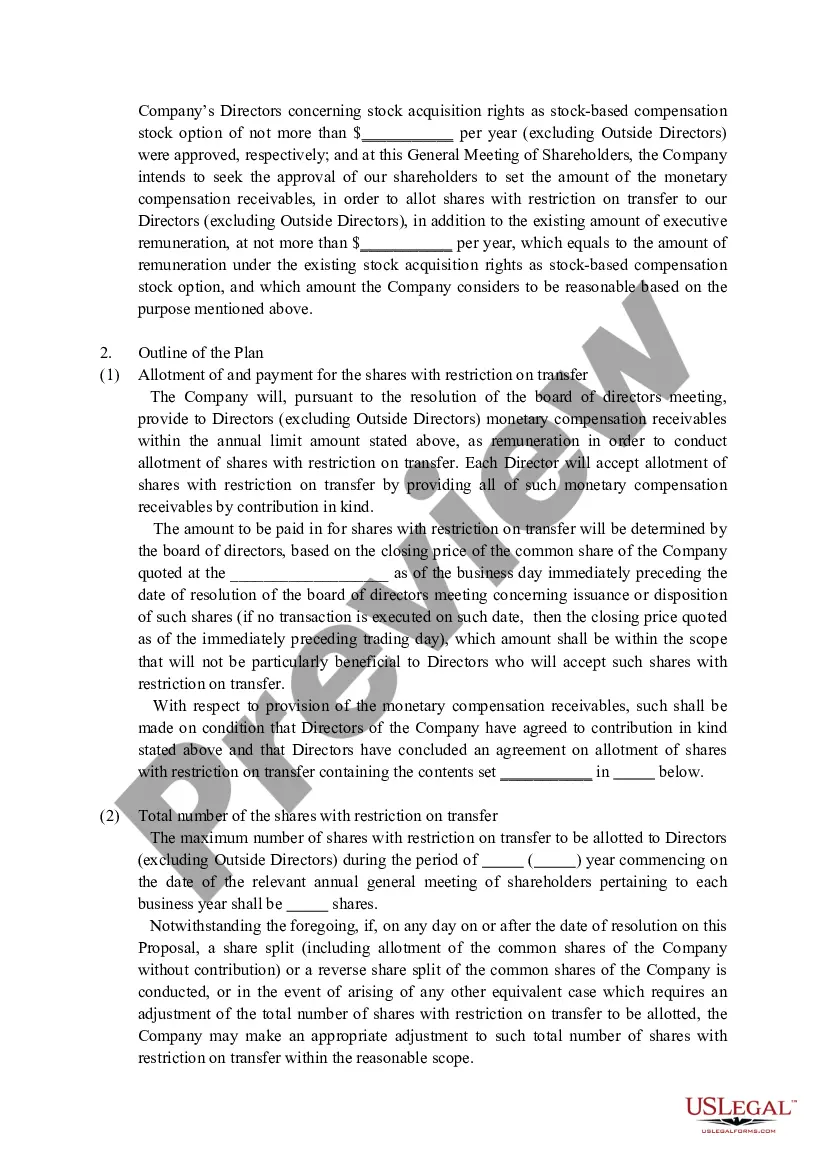

South Carolina Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

US Legal Forms - one of several greatest libraries of legitimate varieties in the United States - gives a wide range of legitimate papers web templates it is possible to acquire or printing. Using the site, you may get a large number of varieties for business and specific uses, categorized by categories, states, or key phrases.You will find the most recent types of varieties much like the South Carolina Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on in seconds.

If you have a registration, log in and acquire South Carolina Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on from your US Legal Forms local library. The Acquire switch can look on every single type you view. You have access to all previously acquired varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, allow me to share easy instructions to get you started off:

- Be sure you have chosen the right type for your personal city/county. Go through the Review switch to review the form`s content material. Read the type information to actually have chosen the right type.

- In the event the type doesn`t match your needs, utilize the Lookup area towards the top of the screen to get the the one that does.

- When you are pleased with the shape, affirm your decision by clicking on the Buy now switch. Then, choose the pricing prepare you favor and provide your qualifications to register to have an accounts.

- Procedure the deal. Make use of Visa or Mastercard or PayPal accounts to perform the deal.

- Select the format and acquire the shape in your device.

- Make adjustments. Complete, revise and printing and indication the acquired South Carolina Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Each and every design you included with your bank account does not have an expiry day and is also your own property for a long time. So, if you want to acquire or printing one more version, just proceed to the My Forms area and click on the type you want.

Get access to the South Carolina Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with US Legal Forms, by far the most substantial local library of legitimate papers web templates. Use a large number of expert and status-specific web templates that fulfill your company or specific requires and needs.

Form popularity

FAQ

There is no requirement under South Carolina law for an employer to provide employees with breaks or a lunch period. Q.

Under South Carolina law, employees are entitled to certain leaves or time off, including maternity leave, crime victim leave, volunteer emergency responder leave, quarantine/isolation leave and bone marrow donation leave. See Time Off and Leaves of Absence.

3. SC Code § 11-35-1560 permits the Chief Procurement Officer, the head of a purchasing agency, or a designee of either officer, above the level of the procurement officer, to authorize in writing a sole source procurement.

In South Carolina, if you buy a timeshare, you can cancel the contract within five days from the later of: the date you sign the contract, not including Sunday if that is the fifth day or. the date you receive the disclosure agreement pursuant to section 27-32-100 (see below). (S.C.

There are no state or federal laws regarding how many hours employees may work each week, unless they are under the age of 20.

The North Carolina Wage and Hour Act does not require mandatory rest breaks or meal breaks for employees 16 years of age or older. The WHA requires breaks only for youths under 16 years of age.

South Carolina Law: No Meal or Rest Breaks Required Employers in some states are required to provide a meal break, rest breaks, or both. South Carolina isn't one of them, however.

2. SC Code § 11-35-5240 requires each agency to develop an MBE Utilization Plan to emphasize the use of minority businesses and to submit quarterly and annual reports on the plan and its implementation.