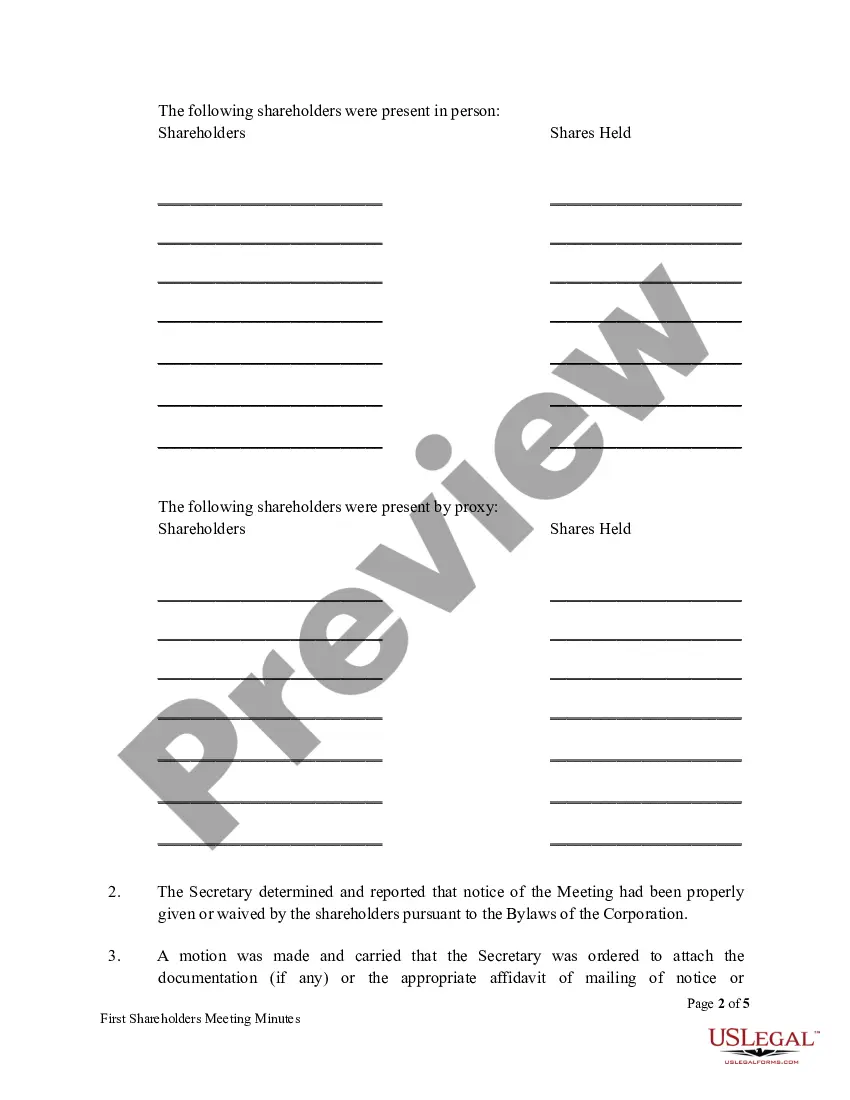

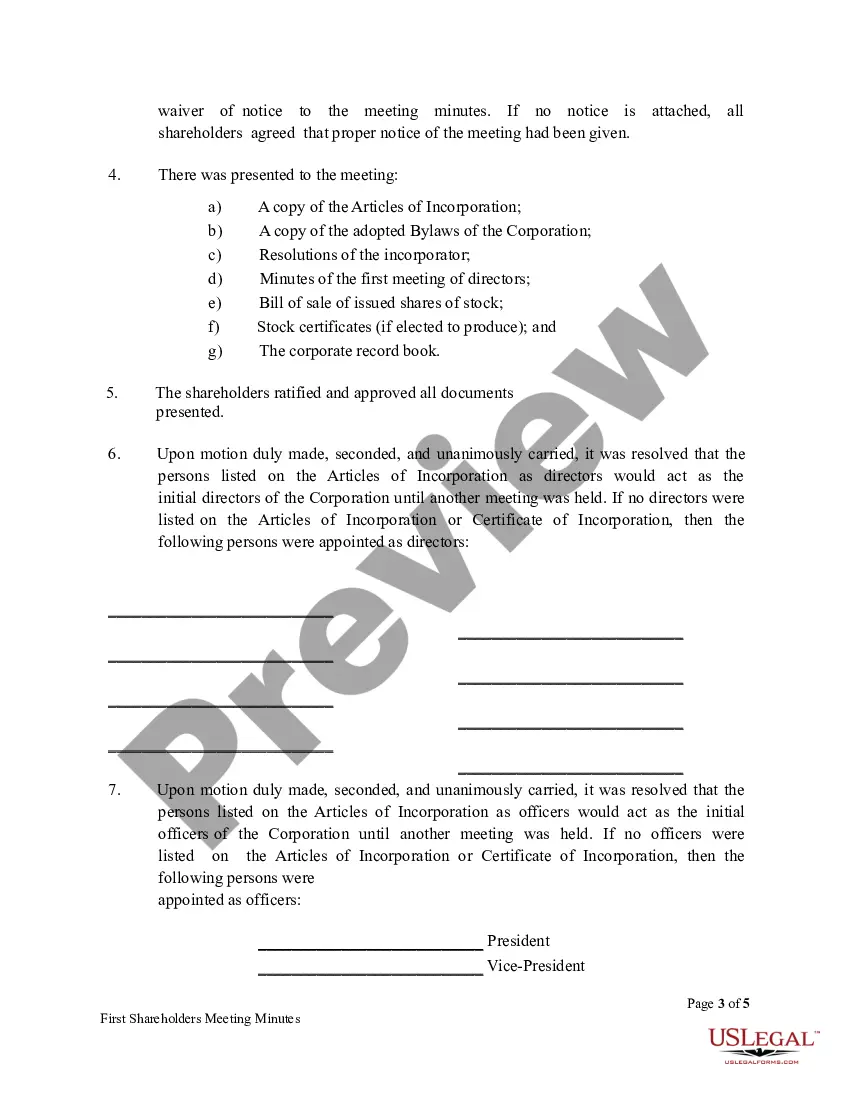

Title: South Carolina First Meeting Minutes of Shareholders: A Comprehensive Guide for Incorporation Introduction: South Carolina First Meeting Minutes of Shareholders serve as a crucial tool in documenting the initial proceedings and corporate governance decisions of a newly incorporated company in South Carolina. This comprehensive guide will outline the importance, key elements, and different types of South Carolina First Meeting Minutes of Shareholders, ensuring compliance with state regulations. Keywords: South Carolina, First Meeting Minutes of Shareholders, corporate governance, newly incorporated company, compliance, state regulations. I. Importance of South Carolina First Meeting Minutes of Shareholders: — Compliance: Documenting the first meeting minutes is a legal requirement under South Carolina corporate law. — Transparency: It establishes a transparent record of key decisions made by shareholders, ensuring accountability within the corporation. — Corporate Governance: The minutes provide guidelines for future actions, appointments, and decision-making processes. Keywords: Importance, South Carolina corporate law, legal requirement, transparency, accountability, corporate governance, guidelines. II. Key Elements of South Carolina First Meeting Minutes of Shareholders: 1. Date, Time, and Location: Start by recording the date, time, and physical location of the first shareholders' meeting. 2. Attendance: List all shareholders present, alongside their full names and number of shares held. 3. Appointment of Directors: Document the election/appointment of the board of directors, including their names, positions, and term of office. 4. Officer Appointments: Record the appointment of key officers, such as CEO, CFO, and Secretary, including their names and positions. 5. Approval of Bylaws: Officially adopt the company's bylaws, defining its internal regulations and governing principles. 6. Stock Issuance: Document the issuance of shares to shareholders, including the number of shares, stock certificates, and any associated consideration. 7. Financial Matters: Approve the opening of a corporate bank account and authorization of signatories. 8. Any Other Business: Include any additional decisions, resolutions, or discussions that occurred during the meeting. Keywords: Key elements, shareholders' meeting, directors, officers, bylaws, stock issuance, financial matters, decision-making. III. Types of South Carolina First Meeting Minutes of Shareholders: 1. Standard South Carolina First Meeting Minutes: Used to document general decisions taken during the initial shareholders' meeting, covering the key elements mentioned above. 2. Specialized South Carolina First Meeting Minutes: Some companies may require more detailed minutes tailored to specific needs, such as unique provisions for privately held corporations or non-profit organizations. Keywords: Types, South Carolina First Meeting Minutes, general decisions, specialized minutes, privately held corporations, non-profit organizations. Conclusion: The South Carolina First Meeting Minutes of Shareholders serve as an essential legal document for companies seeking incorporation within the state. By accurately recording the key decisions, appointments, and governance-related matters, businesses can ensure compliance, transparency, and orderly corporate governance. Understanding the importance and following the key elements outlined in this guide will pave the way for successful incorporation and future operations. Keywords: South Carolina First Meeting Minutes, legal document, incorporation, compliance, transparency, governance, successful operations.

South Carolina First Meeting Minutes of Shareholders

Description

How to fill out South Carolina First Meeting Minutes Of Shareholders?

Are you currently in the position the place you need to have files for sometimes enterprise or person functions just about every day time? There are a variety of legitimate file themes accessible on the Internet, but locating types you can depend on is not straightforward. US Legal Forms gives a huge number of develop themes, like the South Carolina First Meeting Minutes of Shareholders, that happen to be written to meet state and federal needs.

In case you are previously informed about US Legal Forms internet site and have an account, simply log in. Afterward, you are able to obtain the South Carolina First Meeting Minutes of Shareholders web template.

Unless you offer an bank account and wish to start using US Legal Forms, follow these steps:

- Obtain the develop you need and ensure it is to the right metropolis/region.

- Utilize the Preview button to analyze the form.

- Browse the information to actually have chosen the correct develop.

- When the develop is not what you are seeking, use the Look for discipline to obtain the develop that suits you and needs.

- When you obtain the right develop, just click Buy now.

- Pick the rates prepare you desire, complete the necessary info to make your bank account, and buy the order making use of your PayPal or Visa or Mastercard.

- Pick a practical file structure and obtain your version.

Get every one of the file themes you might have bought in the My Forms food list. You may get a more version of South Carolina First Meeting Minutes of Shareholders whenever, if required. Just click the required develop to obtain or print the file web template.

Use US Legal Forms, one of the most extensive selection of legitimate varieties, to conserve time as well as prevent mistakes. The support gives appropriately made legitimate file themes which can be used for a range of functions. Create an account on US Legal Forms and initiate producing your lifestyle a little easier.