South Carolina Investor Certification Form

Description

How to fill out Investor Certification Form?

Are you in a placement where you need to have papers for possibly business or personal purposes almost every day time? There are a variety of legal document themes available on the Internet, but locating kinds you can trust is not easy. US Legal Forms gives a large number of type themes, much like the South Carolina Investor Certification Form, that are created to fulfill federal and state specifications.

In case you are already informed about US Legal Forms web site and have your account, basically log in. Afterward, it is possible to obtain the South Carolina Investor Certification Form format.

Should you not provide an profile and want to begin to use US Legal Forms, follow these steps:

- Find the type you require and make sure it is for that proper area/state.

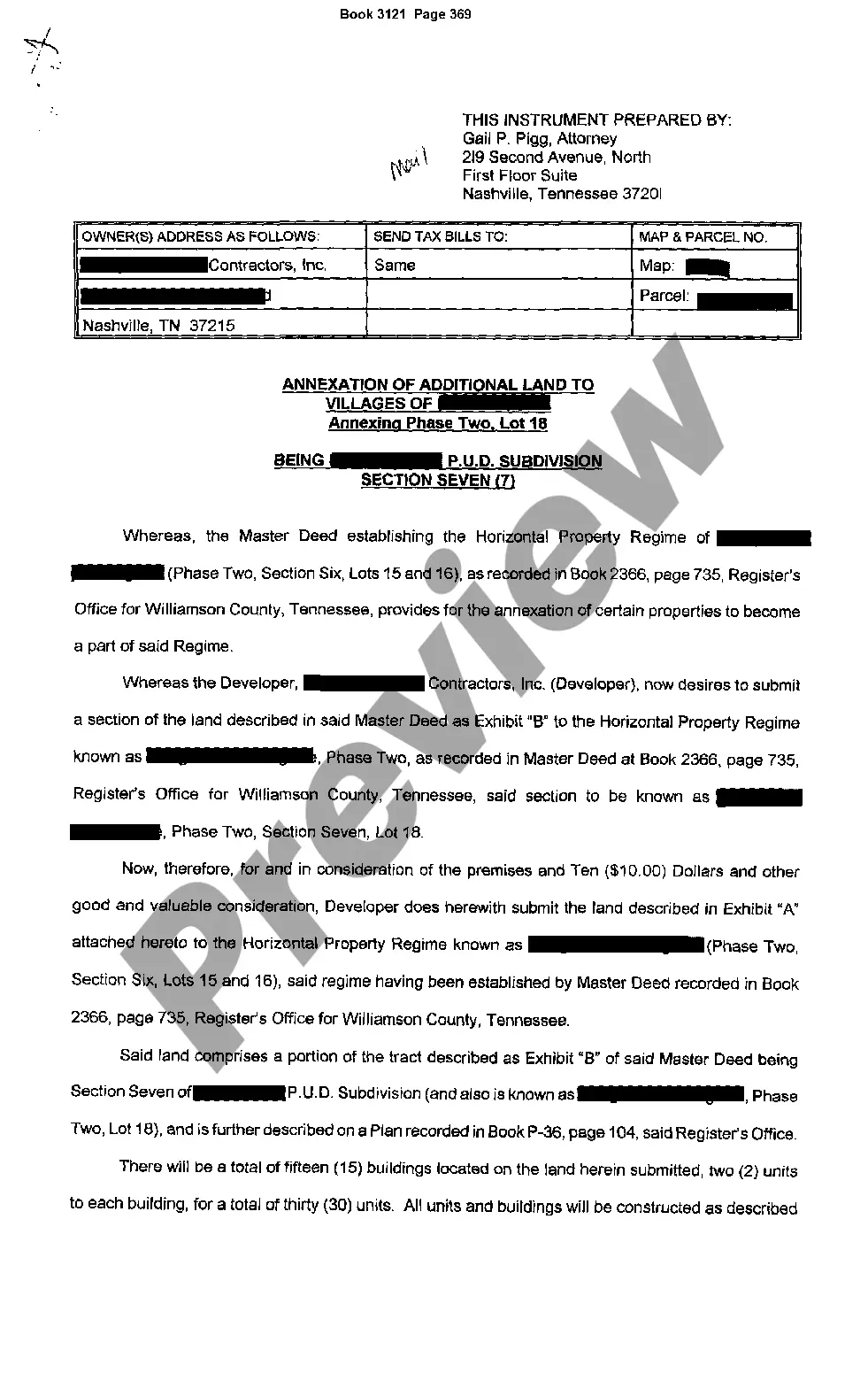

- Take advantage of the Review option to examine the shape.

- Browse the outline to actually have chosen the appropriate type.

- If the type is not what you are searching for, make use of the Lookup field to discover the type that suits you and specifications.

- When you find the proper type, simply click Acquire now.

- Pick the pricing strategy you need, fill in the desired info to make your bank account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Select a handy document file format and obtain your copy.

Locate every one of the document themes you might have purchased in the My Forms menus. You may get a extra copy of South Carolina Investor Certification Form any time, if possible. Just click the essential type to obtain or print out the document format.

Use US Legal Forms, the most extensive selection of legal types, to save efforts and steer clear of mistakes. The service gives professionally made legal document themes which can be used for a variety of purposes. Generate your account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

You can start angel investing with as little as $25,000. Of course, the more money you have to invest, the more potential there is for a return on investment. But if you're just starting, you don't need to break the bank. Just be sure to do your research and invest in a company that you believe in.

Angel investor FAQS Angel investors typically want to receive 20 to 25 percent of your profit. However, the amount you pay your angel investors depends on your initial contract. Hammer out these details before they give you any money, and have a lawyer draw up the agreement.

Angel Investors are entitled to a nonrefundable South Carolina Income Tax credit of 35% of their qualified investments.

The Angel Investor Tax Credit is: Equal to 25% of an investor's equity investment. Refundable to investors who file personal net income tax. Not refundable for investors filing corporate income tax, franchise tax, taxes on gross premiums or moneys and credits taxes.

Sources of Angel Funding Angel investors usually are using their own money, unlike venture capitalists who pool money from many investors. Though angel investors are usually individuals, the entity that actually provides the funds may be a limited liability company (LLC), a business, a trust, or an investment fund.

To qualify as an eligible angel investor, Indian investors need to meet 1 of the following requirements: An individual investor who has net tangible assets of at least INR 2 crore excluding value of the investor's principal residence, and who: has early stage investment experience, or.