If you need to complete, download, or printing authorized document layouts, use US Legal Forms, the largest selection of authorized forms, that can be found on the web. Make use of the site`s simple and easy convenient look for to get the paperwork you require. A variety of layouts for business and personal reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to get the South Carolina Guide to Complying with the Red Flags Rule under FCRA and FACTA with a number of click throughs.

If you are currently a US Legal Forms buyer, log in in your account and click on the Acquire option to get the South Carolina Guide to Complying with the Red Flags Rule under FCRA and FACTA. You may also access forms you formerly saved inside the My Forms tab of your respective account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct metropolis/country.

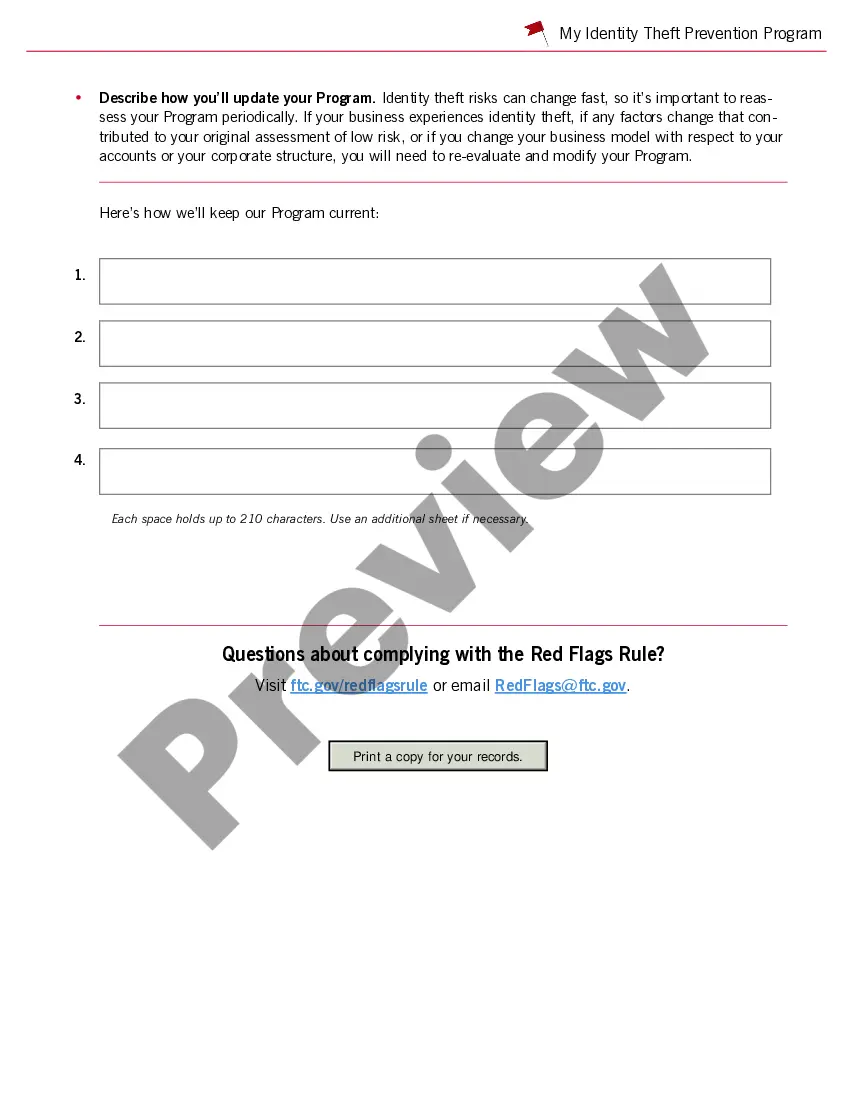

- Step 2. Utilize the Preview solution to look over the form`s content material. Do not forget about to read the explanation.

- Step 3. If you are not happy with all the type, take advantage of the Search industry on top of the screen to find other versions from the authorized type web template.

- Step 4. Once you have identified the shape you require, click on the Get now option. Pick the pricing program you like and put your credentials to register for the account.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Pick the structure from the authorized type and download it on your gadget.

- Step 7. Complete, edit and printing or signal the South Carolina Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Every single authorized document web template you purchase is your own eternally. You might have acces to every type you saved with your acccount. Select the My Forms section and decide on a type to printing or download once again.

Compete and download, and printing the South Carolina Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms. There are millions of expert and express-specific forms you may use for your business or personal needs.