South Carolina Pipeline Service Contract - Self-Employed

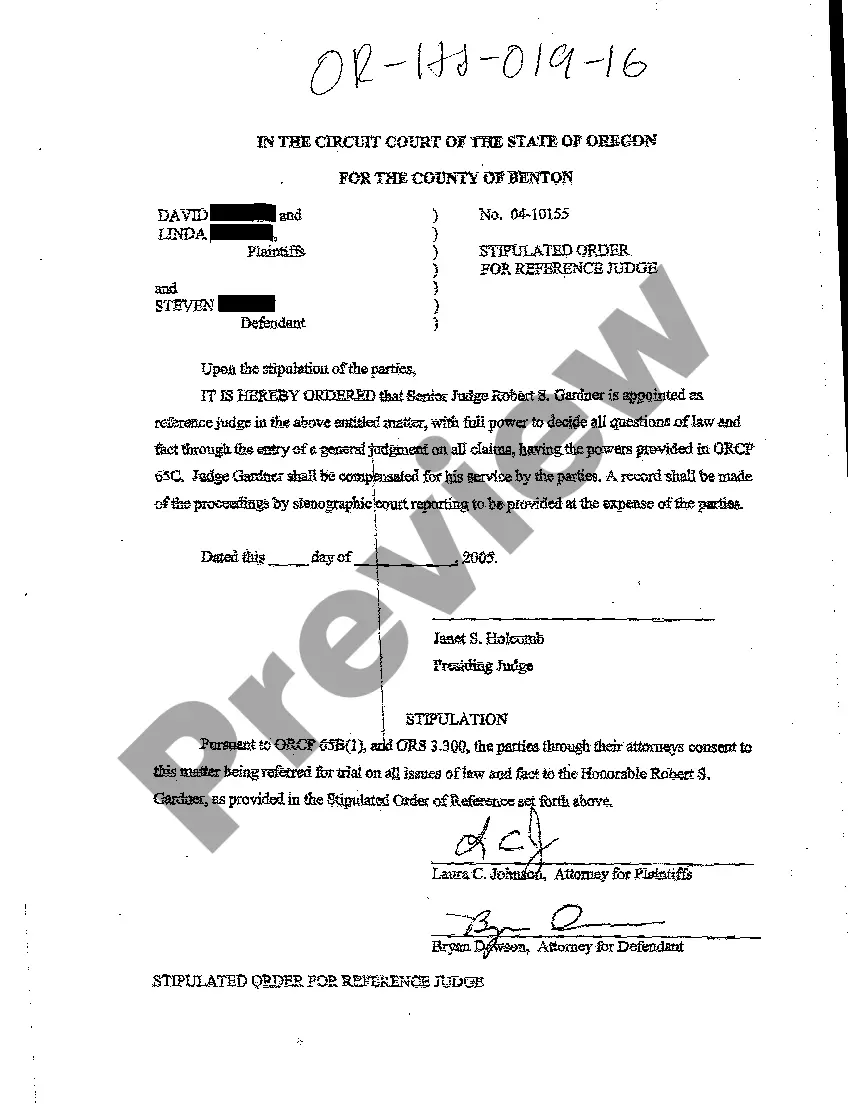

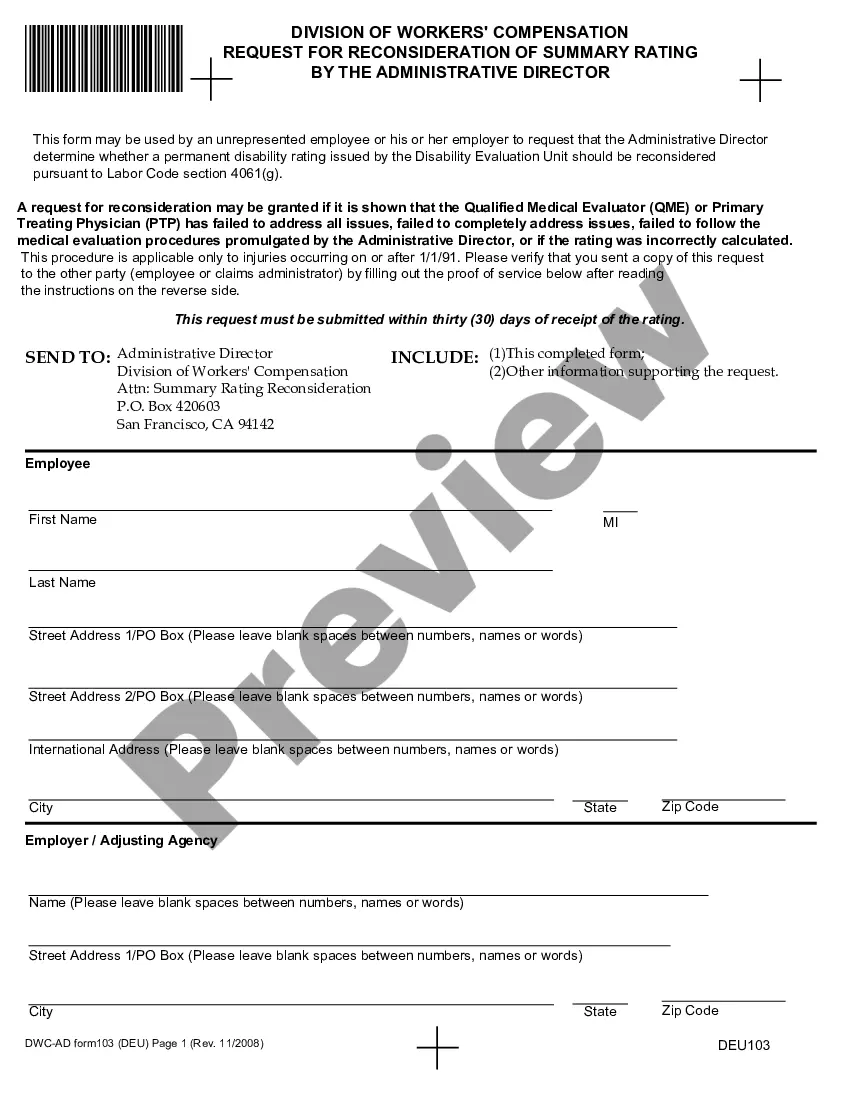

Description

How to fill out South Carolina Pipeline Service Contract - Self-Employed?

If you have to full, download, or printing lawful record web templates, use US Legal Forms, the greatest assortment of lawful kinds, that can be found on the Internet. Take advantage of the site`s easy and convenient lookup to find the documents you require. A variety of web templates for company and personal purposes are sorted by categories and states, or keywords and phrases. Use US Legal Forms to find the South Carolina Pipeline Service Contract - Self-Employed in a few clicks.

Should you be already a US Legal Forms client, log in to your bank account and click the Obtain switch to find the South Carolina Pipeline Service Contract - Self-Employed. You may also gain access to kinds you previously saved inside the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for your correct metropolis/nation.

- Step 2. Make use of the Preview method to check out the form`s content. Never neglect to learn the description.

- Step 3. Should you be not satisfied with all the type, use the Look for area at the top of the screen to locate other variations from the lawful type format.

- Step 4. When you have identified the form you require, go through the Get now switch. Pick the pricing prepare you favor and add your accreditations to sign up for the bank account.

- Step 5. Method the deal. You can use your charge card or PayPal bank account to perform the deal.

- Step 6. Find the formatting from the lawful type and download it on your product.

- Step 7. Comprehensive, edit and printing or indication the South Carolina Pipeline Service Contract - Self-Employed.

Each lawful record format you acquire is the one you have permanently. You might have acces to each type you saved in your acccount. Click on the My Forms portion and pick a type to printing or download again.

Remain competitive and download, and printing the South Carolina Pipeline Service Contract - Self-Employed with US Legal Forms. There are millions of professional and state-particular kinds you can utilize for your personal company or personal demands.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.

The definition of an independent contractor has been developed by case law in South Carolina as one who: Exercises independent employment. Contracts to do a piece of work according to his own methods. Is not subject to the control of his employer except for the result of the work.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...